Market Definition

The market involves the development, production, distribution, and sale of cochlear implant devices, which are advanced medical devices designed to restore or improve hearing in individuals with severe to profound sensorineural hearing loss.

It spans different age groups, including pediatric and adult patients, and addresses varying degrees of hearing impairment, from single-sided deafness to bilateral hearing loss. The report offers a thorough assessment of the main factors driving the market, along with detailed regional analysis and the competitive landscape influencing market dynamics.

Cochlear Implants Market Overview

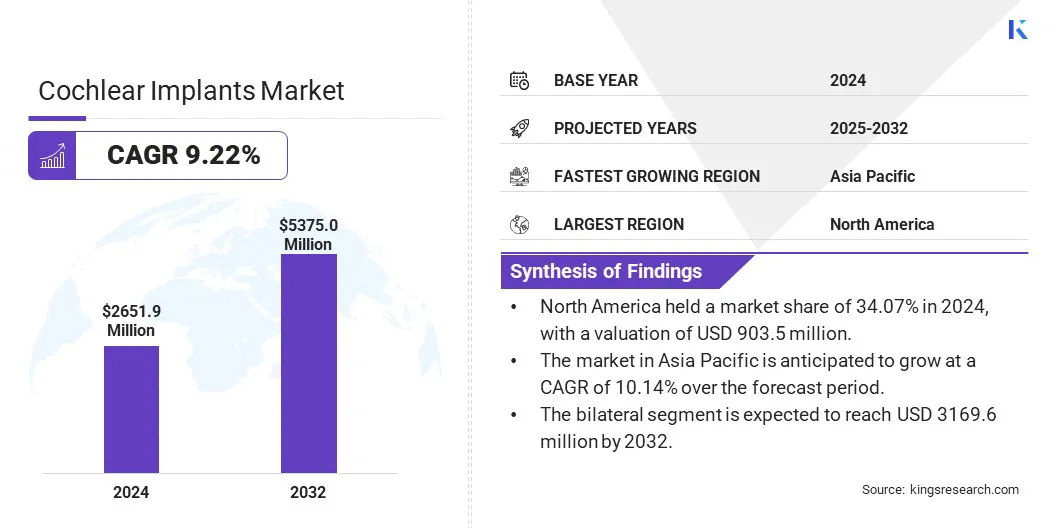

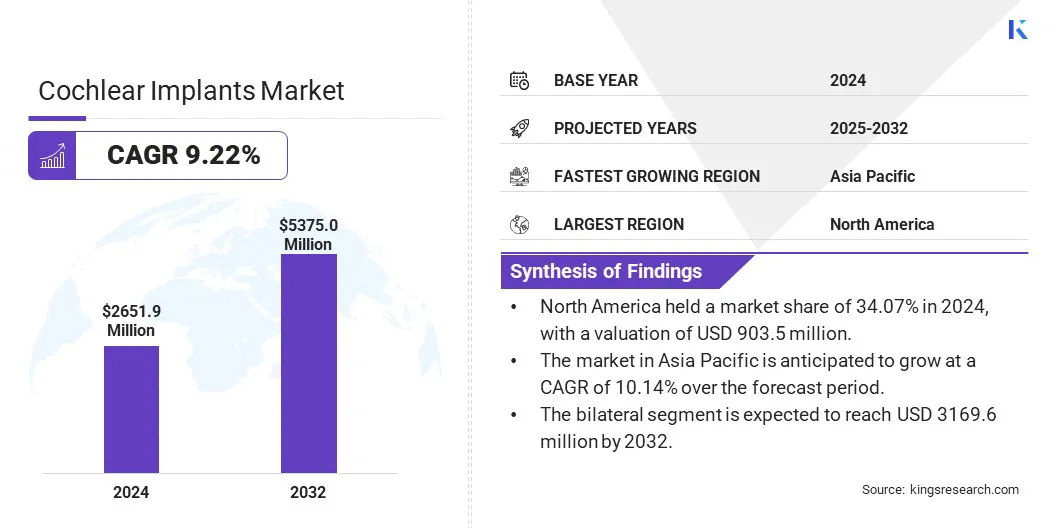

The global cochlear implants market size was valued at USD 2651.9 million in 2024 and is projected to grow from USD 2894.3 million in 2025 to USD 5375.0 million by 2032, exhibiting a CAGR of 9.22% during the forecast period.

The market is driven by the growing awareness of hearing loss & early diagnosis, increasing government support & funding for hearing healthcare, and expanding healthcare infrastructure in emerging regions. Additionally, the growing adoption of bilateral implants and integration with digital technologies are supporting the demand for cochlear implants and improving patient outcomes globally.

Major companies operating in the cochlear implants industry are Cochlear Ltd, Sonova, MED-EL Medical Electronics, Demant A/S, ZHEJIANG NUROTRON BIOTECHNOLOGY CO., LTD, Amplifon, Neubio AG, TODOC Co., Ltd., Shanghai Listent Medical TECH Co., Ltd, Medtronic, Advanced Bionics AG and affiliates, Envoy Medical Corporation, and iotaMotion, Inc.

Regulatory advancements are expanding the candidacy criteria for cochlear implants, allowing access to a wider group of patients with varying degrees of hearing loss. These changes are addressing long-standing concerns about hearing preservation, encouraging earlier intervention and broader adoption. The market is registering increased utilization and stronger demand for advanced implant solutions.

- In October 2024, the U.S. Food and Drug Administration (FDA) approved expanded indications for MED-EL cochlear implants, allowing access for more adults with residual hearing. This regulatory milestone bridges the gap between traditional cochlear implant and electric-acoustic stimulation (EAS) candidacy. The initiative supports broader utilization by addressing hearing preservation concerns, with data confirming that MED-EL’s FLEX electrode arrays can maintain residual hearing during implantation. The approval represents a step forward in improving treatment access and addressing underutilization among eligible adult cochlear implant candidates in the U.S.

Key Highlights:

- The cochlear implants market size was valued at USD 5375.0 million in 2024.

- The market is projected to grow at a CAGR of 9.22% from 2025 to 2032.

- North America held a market share of 34.07% in 2024, with a valuation of USD 903.5 million.

- The systems segment garnered USD 1445.5 million in revenue in 2024.

- The bilateral segment is expected to reach USD 3169.6 million by 2032.

- The pediatric segment is anticipated to register the fastest CAGR of 9.44% over the forecast period.

- The hospitals segment is projected to generate a revenue of USD 2242.6 million by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 10.14% over the forecast period.

Market Driver

Rising Prevalence of Hearing Loss

The increasing prevalence of hearing loss is fostering the growth of the cochlear implants market. Hearing loss is a widely recognized health concern, boosting the emphasis on early diagnosis and effective intervention. Cochlear implants are emerging as a reliable solution for individuals who do not benefit from conventional hearing aids, offering improved speech perception and quality of life.

This increasing prevalence of hearing loss is creating a strong demand for advanced cochlear implant technologies, early intervention, and comprehensive rehabilitation services.

- According to the World Health Organization in 2024, over 5% of the global population around 430 million people, including 34 million children are living with disabling hearing loss and require rehabilitation. By 2050, this number is projected to exceed 700 million, meaning 1 in every 10 people will be affected globally.

Market Challenge

Limited Awareness in Developing Countries

Limited awareness of cochlear implants in developing countries poses a major challenge to the market growth. Many people in developing countries are unaware of the availability and benefits of cochlear implantation as a treatment for severe hearing loss. This lack of knowledge leads to delayed diagnosis and treatment, reducing the chances of successful rehabilitation.

Additionally, cultural misconceptions and stigma around hearing impairment and medical devices further hinder acceptance. As a result, many patients remain untreated, restricting the overall adoption of cochlear implants in these markets.

Companies are implementing targeted education and awareness campaigns to enhance the understanding of cochlear implant benefits among patients and healthcare professionals. Partnerships with local healthcare providers are established to improve early diagnosis and referral rates.

Additionally, manufacturers are investing in training programs to build clinical expertise and expand service capabilities. These initiatives aim to increase market penetration and drive sustainable growth in emerging markets.

Market Trend

Advanced Precision Implant Technology

Advanced precision implant technology is transforming cochlear implant surgery by integrating real-time monitoring and AI-driven feedback systems. These innovations enable surgeons to accurately place electrodes within the cochlea, minimizing risks such as tissue damage and improper insertion.

Enhanced precision improves patient outcomes by ensuring optimal nerve stimulation and better hearing performance. Additionally, the elimination of traditional intraoperative imaging reduces surgery time and anesthesia exposure.

Continuous advancements in this technology are making procedures safer, more efficient, and more reliable, ultimately contributing to improved auditory rehabilitation and quality of life for individuals with severe hearing loss.

- In March 2025, CMRI Kolkata introduced SmartNav technology for cochlear implant surgery, becoming the first center in Eastern India to adopt this advanced system. This innovative technology enhances surgical precision by providing real-time feedback on electrode placement, eliminating the need for intraoperative X-rays, and reducing anesthesia time. The initiative aims to improve patient outcomes through AI-driven accuracy, continuous nerve response monitoring, and safer, more controlled electrode insertion, marking a significant advancement in cochlear implant procedures in the region.

Cochlear Implants Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Systems, Upgrades & Accessories

|

|

By Type

|

Unilateral, Bilateral

|

|

By Patient

|

Adult, Pediatric

|

|

By End User Industry

|

Hospitals, ENT Clinics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Systems, Upgrades & Accessories): The systems segment earned USD 1445.5 million in 2024, due to the increasing adoption of complete cochlear implant solutions.

- By Type (Unilateral, Bilateral): The bilateral held 59.85% share of the market in 2024, due to improved auditory outcomes and growing clinical preference.

- By Patient (Adult, Pediatric): The adult segment is projected to reach USD 3060.0 million by 2032, propelled by rising age-related hearing loss cases and greater awareness.

- By End User Industry (Hospitals, ENT Clinics, Others): The hospitals segment earned USD 1117.2 million in 2024, due to higher surgical volumes and access to specialized care.

Cochlear Implants Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 34.07% share of the cochlear implants market in 2024, with a valuation of USD 903.5 million. This dominance is driven by increasing innovation in hearing technology such as wireless connectivity and auditory integration. Key market players in the region are focusing on advancing user experience through seamless streaming capabilities and improved binaural hearing performance.

The market is also benefitting from a strong emphasis on collaborative research and development aimed at meeting evolving patient needs. Additionally, the presence of key industry conferences and thought leadership platforms in North America supports knowledge exchange and accelerates the adoption of next-generation cochlear implant solutions.

- In July 2024, MED-EL and Starkey announced a strategic collaboration to develop a new Bluetooth-enabled listening experience for users of MED-EL cochlear implants and Starkey hearing aids. Revealed at the CI2024 conference in Vancouver, the initiative aims to deliver seamless binaural hearing through advanced streaming capabilities. This partnership reflects a shared commitment to innovation and user-centric solutions, enabling integrated connectivity that enhances the auditory experience for implant users.

The cochlear implants industry in Asia Pacific is set to grow at a robust CAGR of 10.14% over the forecast period. This growth is attributed to the increasing government initiatives aimed at improving hearing healthcare and expanding access to advanced hearing technologies.

Rising awareness about hearing loss and early intervention are boosting the demand for cochlear implants, especially among pediatric populations. Additionally, significant investments in research and development by academic institutions and technology companies are fostering innovation in hearing solutions.

Collaborations between healthcare providers, research bodies, and technology firms are enhancing rehabilitation services and improving patient outcomes, further supporting market expansion throughout the region.

- In May 2024, the China Disabled Persons' Federation (CDPF) reported that nearly 90% of hearing-impaired children in China use cochlear implants, enabling better communication and education access. The federation is advancing key research projects in disability rehabilitation and assistive technology. Seven of these projects involve 25 universities, 16 research institutes, and 24 enterprises to support hearing-impaired individuals nationwide.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) is the regulatory authority for cochlear implants, ensuring that they are safe and effective before being marketed.

- In China, the China Food and Drug Administration (CFDA) is the primary regulatory body for medical devices in China, including cochlear implants. Manufacturers must obtain CFDA approval before their products can be sold in the Chinese market.

- In India, the Central Drugs Standard Control Organization (CDSCO) is the main regulatory body for pharmaceuticals and medical devices in India. They ensure the safety and efficacy of medical devices, including cochlear implants. CDSCO approval is required for the manufacturing and sale of cochlear implants in India.

- In Europe, the Medical Device Regulation (MDR) is the regulatory authority for cochlear implants. The MDR mandates a CE mark for approval, signifying that the device meets certain quality and safety standards.

Competitive Landscape

Market players are focusing on strategic acquisitions to expand their presence in the cochlear implants market. They are broadening their product portfolios and increasing their global footprint by acquiring established cochlear implant businesses.

Furthermore, they aim to integrate technologies and ensure continued support for existing users, enhancing patient outcomes and satisfaction. Additionally, players are committing to long-term service and support agreements to facilitate smooth transitions for customers and maintain brand loyalty, further strengthening their market position.

- In May 2024, Cochlear Limited acquired the Oticon cochlear implant business from Demant, marking a strategic move to expand its global footprint in implantable hearing solutions. The company aims to support the long-term hearing outcomes of over 20,000 existing Oticon cochlear implant users and gradually transition them to Cochlear’s technology.

List of Key Companies in Cochlear Implants Market:

- Cochlear Ltd

- Sonova

- MED-EL Medical Electronics

- Demant A/S

- ZHEJIANG NUROTRON BIOTECHNOLOGY CO., LTD

- Amplifon

- Neubio AG

- TODOC Co., Ltd.

- Shanghai Listent Medical TECH Co., Ltd

- Medtronic

- Advanced Bionics AG and affiliates.

- Envoy Medical Corporation

- iotaMotion, Inc.

Recent Developments (M&A/Partnerships/Product Launches)

- In May 2025, iotaMotion, Inc. marked the first international use of its iotaSOFT Insertion System as part of a pre-market clinical investigation at the University Hospital of Zurich, led by Professor Alexander Huber. This research-driven initiative aims to evaluate electrocochleographic signals during speed-controlled cochlear implant electrode array insertion and marks a significant advancement in robotic-assisted cochlear implant surgery. The project is focused on enhancing surgical precision, optimizing real-time intraoperative monitoring, and promoting global innovation in hearing restoration technologies.

- In March 2025, Cochlear and GN expanded their Smart Hearing Alliance to strengthen joint research and development efforts aimed at advancing integrated hearing solutions. The collaboration focuses on utilizing artificial intelligence and deep neural networks to enhance sound processing, connectivity, and user experience for cochlear implant and hearing aid users.

- In July 2024, MED-EL, a global provider of hearing implant solutions, acquired the Austrian company BHM-Tech, a specialist in bone conduction hearing systems. The strategic move aims to strengthen MED-EL’s position in the hearing solutions sector by expanding its product portfolio to include BHM-Tech’s advanced bone conduction technology. The acquisition enhances MED-EL’s ability to offer a broader range of hearing solutions for individuals with different types of hearing loss.

- In March 2024, Evercare Group and MED-EL partnered to improve access to advanced cochlear implant care in countries, Nigeria, Kenya, and Pakistan. This collaboration leverages Evercare’s expertise in private healthcare across Africa and South Asia along with MED-EL’s leadership in hearing implant technology.