Market Definition

The market encompasses the sale, distribution, and utilization of pre-owned medical equipment restored to original manufacturer specifications. It includes diagnostic imaging systems, patient monitors, surgical instruments, and various other healthcare devices.

Serving hospitals, diagnostic centers, and clinics, the market offers cost-effective alternatives to new equipment while ensuring clinical reliability and regulatory compliance. The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Refurbished Medical Devices Market Overview

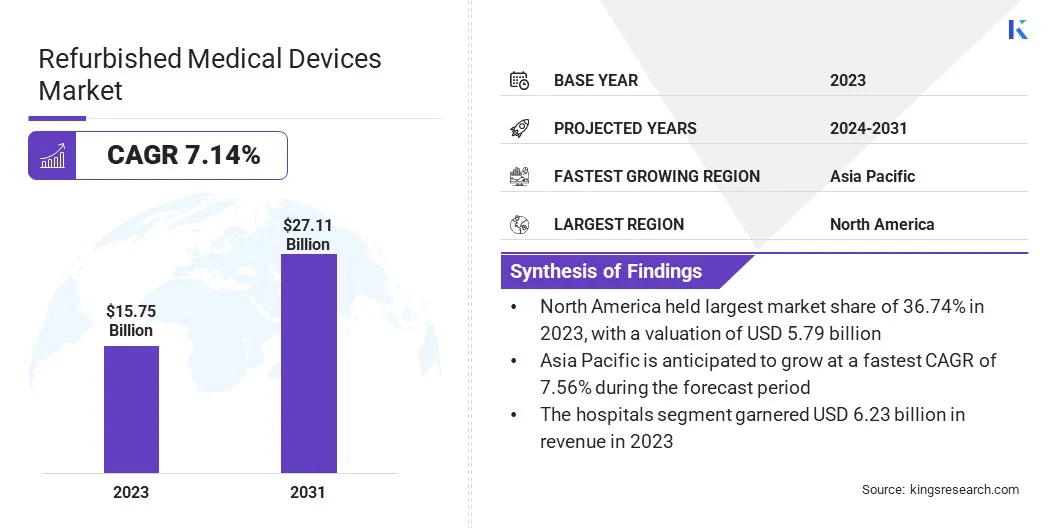

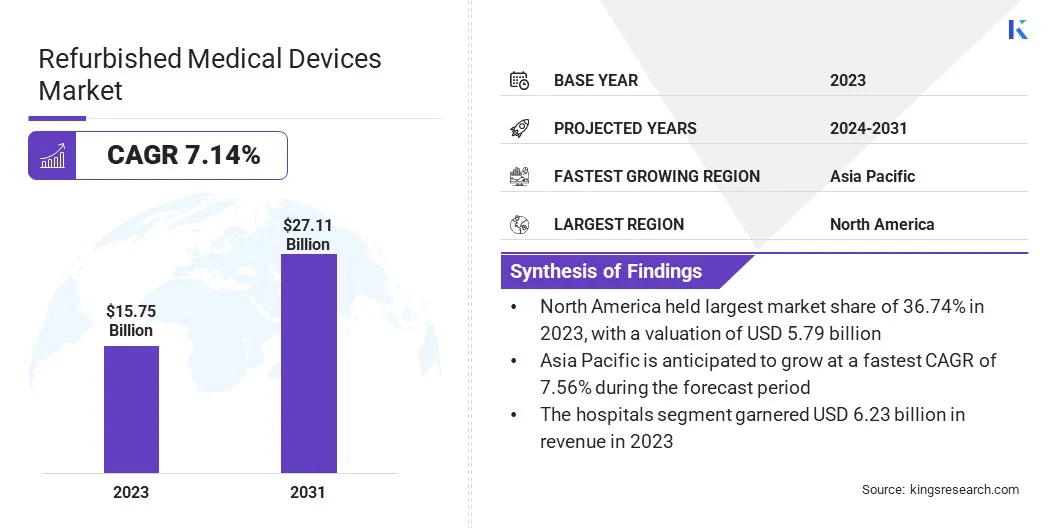

The global refurbished medical devices market size was valued at USD 15.75 billion in 2023 and is projected to grow from USD 16.73 billion in 2024 to USD 27.11 billion by 2031, exhibiting a CAGR of 7.14% during the forecast period.

The market is registering robust growth fueled by the rising cost of new medical equipment, prompting healthcare providers to seek more budget-friendly alternatives without compromising on performance. Increasing demand for diagnostic imaging and patient monitoring equipment, especially in low- to mid-income regions, is accelerating adoption.

Major companies operating in the refurbished medical devices ndustry are GE HealthCare, Koninklijke Philips N.V., Siemens, Canon Inc., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Block Imaging, Inc., Soma Tech Intl., Avante Health Solutions, AGITO Medical, Integrity Medical Systems, Inc., Hilditch Group, Master Medical Equipment, EVERX, Radiology Oncology Systems, and Probo Medical.

The market is also supported by the expansion of private healthcare facilities, the rising prevalence of chronic diseases requiring continuous monitoring, favorable regulatory policies that enable safe resale practices, and growing confidence in the quality and reliability of certified refurbished devices.

- In April 2024, the Centers for Disease Control and Prevention (CDC) reported chronic diseases as the leading cause of illness, disability, and death in the U.S., with six in ten Americans affected by at least one condition.

Key Highlights

- The refurbished medical devices industry size was valued at USD 15.75 billion in 2023.

- The market is projected to grow at a CAGR of 7.14% from 2024 to 2031.

- North America held a market share of 36.74% in 2023, with a valuation of USD 5.79 billion.

- The medical imaging systems segment garnered USD 5.92 billion in revenue in 2023.

- The hospitals segment is expected to reach USD 10.15 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.56% during the forecast period.

Market Driver

"Rising Demand for Cost-effective Solutions"

The refurbished medical devices market is registering significant growth driven by the rising demand for cost-effective medical equipment. Healthcare providers, particularly in emerging economies and underserved regions, are under pressure to expand patient access to advanced diagnostics and treatments while operating within tight budget constraints.

Refurbished devices present a compelling solution by offering high-quality, reliable technologies at substantially lower costs compared to new equipment. This affordability allows hospitals, diagnostic centers, and clinics to upgrade or expand their medical infrastructure without incurring the high capital expenditures typically associated with new devices.

Healthcare systems continue to look for affordable options that still deliver good results, thus driving the demand for refurbished devices in the market.

Market Challenge

A significant challenge in the refurbished medical devices market is navigating the complex regulatory landscape. Refurbished medical devices must meet the same stringent regulatory requirements as new devices to ensure patient safety and device performance.

Regulatory bodies set specific guidelines for the reprocessing, refurbishing, and certification of medical devices. However, differences in regulations across countries can complicate the certification process for refurbished devices, leading to delays and increased costs.

It is essential for refurbished device manufacturers to stay updated on the latest regulations and work closely with regulatory bodies to ensure compliance. Implementing robust quality control measures and obtaining certifications from accredited agencies can help establish trust in refurbished devices.

Market Trend

"Sustainability and Circular Economy"

The refurbished medical devices market is emphasizing sustainability and the circular economy. Healthcare providers strive to minimize waste and reduce their environmental impact, boosting the demand for refurbished devices.

Refurbished medical devices promote the reuse of existing equipment, which helps conserve resources and reduce e-waste, aligning with broader sustainability goals.

This trend is not only driven by environmental concerns but also by the growing pressure on healthcare organizations to cut costs while maintaining high-quality care. As a result, the market is benefiting from the rising shift toward circular economic practices that focus on reducing, reusing, and recycling medical equipment.

- In October 2023, GE HealthCare and reLink Medical collaborated to deliver asset management solutions aimed at reducing medical device waste for healthcare providers. The partnership focuses on the standardized disposition of end-of-life equipment through selling, recycling, or donation. This aids in enhancing operational efficiency, supporting sustainability, and enabling providers to optimize equipment utilization while generating potential revenue streams.

Refurbished Medical Devices Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Medical Imaging Systems, Operating Equipment and Surgical Devices, Patient Monitoring Equipment, Others

|

|

By End User

|

Hospitals, Clinics and Physician Offices, Diagnostic Centers, Clinical and Research Laboratories

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Medical Imaging Systems, Operating Equipment and Surgical Devices, Patient Monitoring Equipment, Others): The medical imaging systems segment earned USD 5.92 billion in 2023, due to the high demand for cost-effective diagnostic solutions and the widespread refurbishment of high-value imaging equipment such as MRI and CT scanners.

- By End User (Hospitals, Clinics and Physician Offices, Diagnostic Centers, and Clinical and Research Laboratories): The hospitals segment held 39.54% share of the market in 2023, due to their large equipment needs, budget limitations, and preference for reliable refurbished systems to enhance their diagnostic and surgical services.

Refurbished Medical Devices Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America .

North America refurbished medical devices market share stood at around 36.74% in 2023, with a valuation of USD 5.79 billion. The region holds the largest share of the market primarily due to the high demand for cost-effective medical solutions across hospitals, diagnostic centers, and private healthcare providers.

The high healthcare spending in the U.S. and Canada, along with the preference for premium-quality refurbished equipment in settings where budgets are a concern, significantly contributes to this dominance.

Additionally, North America's healthcare infrastructure, advanced medical technology needs, and strong healthcare sector, particularly in the U.S., drive the demand for refurbished diagnostic imaging and surgical equipment.

The widespread adoption of refurbished medical devices is also bolstered by the presence of established refurbishing companies offering quality assurance and reliable warranty options.

The refurbished medical devices industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 7.56% over the forecast period. This is attributed to the rising healthcare demand in emerging economies like China, India, and Southeast Asia.

Where medical equipment costs are often prohibitive for many healthcare providers. Healthcare infrastructure is expanding rapidly across the region. Refurbished devices offer an affordable solution without sacrificing quality.

Furthermore, the increasing prevalence of chronic diseases, growing awareness of the benefits of refurbished equipment, and the need for high-quality diagnostic and monitoring systems in both urban and rural areas are fueling demand.

The rapid development of private healthcare facilities and diagnostic centers in countries like India and China, where cost-efficiency is a key concern, is another significant factor driving the market.

- In April 2024, GE HealthCare launched a new refurbishing unit in Bangladesh for its A1-Sure ultrasound systems. The facility aims to improve healthcare access in Tier 2 and Tier 3 cities by offering high-quality, affordable refurbished ultrasound equipment, contributing to better diagnostic capabilities and local employment opportunities.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates the refurbishment of medical devices. The FDA ensures the safety and effectiveness of these devices, requiring refurbishes to follow specific guidelines and regulations. The FDA's Center for Devices and Radiological Health (CDRH) oversees medical device regulation, including remanufacturing and servicing.

- In the European Union (EU), the regulatory authority for refurbished medical devices is the European Medicines Agency (EMA) and the European Commission. The Medical Device Regulation (MDR) governs the regulation of both new and refurbished medical devices in the EU.

- In Japan, the Pharmaceutical and Medical Device Agency (PMDA) is the regulatory authority for medical devices. It works with the Ministry of Health, Labour and Welfare (MHLW). The MHLW is responsible for overseeing the Act on Securing Quality, Efficacy and Safety of Products Including Pharmaceuticals and Medical Devices (PMD Act), which includes regulations for medical devices, including refurbished ones.

Competitive Landscape

The refurbished medical devices industry is characterized by key players employing various strategies to enhance their market presence and differentiate themselves.

Many companies focus on expanding their product portfolios by offering a wide range of refurbished medical devices across multiple categories, such as diagnostic imaging systems, patient monitoring equipment, and surgical instruments.

Strategic partnerships with hospitals, diagnostic centers, and healthcare providers are common, allowing these players to secure long-term contracts and access larger customer bases. Additionally, companies are investing in advanced refurbishing technologies to ensure high-quality standards and reliable performance of refurbished devices.

This emphasis on quality helps establish trust with healthcare providers, who prioritize the reliability and effectiveness of refurbished products. Several companies prioritize regional expansion, particularly in emerging economies where the demand for affordable healthcare solutions is growing. This helps them strengthen their market position.

- In July 2024, AA Medical acquired Surgical Product Solutions (SPS), forming a strategic partnership aimed at enhancing the accessibility and affordability of premium medical products. The partnership allows AA Medical to expand its product portfolio to include SPS’s range of surgical consumables, solidifying its position as a comprehensive third-party provider of medical supplies.

List of Key Companies in Refurbished Medical Devices Market:

- GE HealthCare

- Koninklijke Philips N.V.

- Siemens

- Canon Inc.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Block Imaging, Inc.

- Soma Tech Intl.

- Avante Health Solutions

- AGITO Medical

- Integrity Medical Systems, Inc.

- Hilditch Group

- Master Medical Equipment

- EVERX

- Radiology Oncology Systems

- Probo Medical