Market Definition

Recycled Terephthalic Acid (rTPA) refers to terephthalic acid that has been recovered from post-consumer or post-industrial polyethylene terephthalate (PET) plastic waste through chemical recycling processes.

It is used as a raw material in the production of new PET products, polyester fibers, and other applications, reducing reliance on virgin petrochemical-based terephthalic acid.

Recycled Terephthalic Acid Market Overview

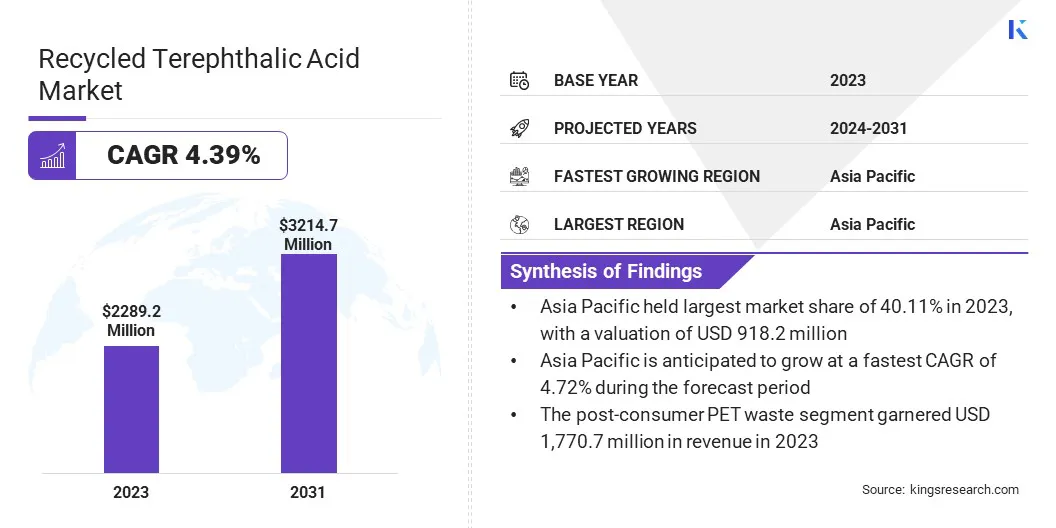

The global recycled terephthalic acid market size was valued at USD 2,289.2 million in 2023 and is projected to grow from USD 2,379.7 million in 2024 to USD 3,214.7 million by 2031, exhibiting a CAGR of 4.39% during the forecast period. This market is registering steady growth, driven by the increasing demand for sustainable and circular economy solutions in the plastics and textile industries.

With rising environmental concerns and stringent regulations on plastic waste management, industries are shifting toward chemically recycled PET to reduce reliance on virgin resources. The market is fueled by advancements in chemical recycling technologies, improving the efficiency and cost-effectiveness of rTPA production.

Major companies operating in the global recycled terephthalic acid Industry are Indorama Ventures Public Company Limited, Alpek S.A.B. de C.V., Far Eastern New Century Corporation, Lotte Corporation, Saudi Basic Industries Corporation, Loop Industries, Inc., Biffa, Plastipak Holdings, Inc., CARBIOS, GreenMantra Technologies, Hengli Group Co., Ltd., Grupo IMG, Reliance Industries Limited, SK chemicals, and Krones AG.

Additionally, growing consumer preference for eco-friendly products and brands committed to sustainability is further boosting the demand for rTPA-based materials. Key end-use sectors include packaging, textiles, and automotive, where rTPA serves as a sustainable alternative to traditional terephthalic acid.

- In January 2025, DePoly announced a collaboration with Plastic Technologies Inc. to develop a closed-loop recycled PET bottle using DePoly’s advanced recycling technology. The project successfully demonstrated the feasibility of creating food-grade recycled PET bottles from diverse waste streams.

Key Highlights:

- The global recycled terephthalic acid market size was valued at USD 2,289.2 million in 2023.

- The market is projected to grow at a CAGR of 4.39% from 2024 to 2031.

- Asia Pacific held a market share of 40.11% in 2023, with a valuation of USD 918.2 million.

- The mechanical recycling-based RTA segment garnered USD 1,508.6 million in revenue in 2023.

- The post-consumer PET waste segment is expected to reach USD 1,770.7 million by 2031.

- The glycolysis segment is expected to reach USD 1,380.3 million by 2031.

- The polyester segment is expected to reach USD 1,529.4 million by 2031.

- The textile & apparel segment is expected to reach USD 1,409.2 million by 2031.

- The market in Europe is anticipated to grow at a CAGR of 4.42% during the forecast period.

Market Driver

How does changing regulations in plastic recycling affect the market?

The market is registering significant growth, due to the increasing demand for sustainable packaging and enforcement of stringent government regulations promoting plastic recycling.

Industries such as food & beverage, textiles, and consumer goods are shifting to recycled PET bottles and containers that use rTPA as a key raw material, due to rising environmental awareness and consumer preference for eco-friendly products. This growing adoption is further reinforced by global sustainability commitments from major corporations aiming to reduce plastic waste.

- For instance in September 2024, Schneider Electric partnered with GR3N to develop the first open automation system for advanced plastic recycling. The collaboration integrates Schneider Electric’s EcoStruxure Automation Expert with GR3N’s Microwave Assisted Depolymerization (MADE) process to address hard-to-recycle PET waste.

Additionally, governments across various regions are implementing strict plastic waste management policies, including extended producer responsibility (EPR) programs, mandatory recycling targets, and tax incentives for companies utilizing recycled materials.

These regulatory measures encourage industries to incorporate rTPA into their manufacturing processes, ultimately driving the market and strengthening the transition to a circular economy.

Market Challenge

What are the negative implications of high production cost on the market?

The recycled terephthalic acid market faces significant challenges that hinder its large-scale adoption. One of the biggest hurdles in the rTPA market is the inefficient collection and sorting of PET waste, which serves as the primary raw material for rTPA production. Many regions lack well-developed recycling systems, leading to low recovery rates of PET bottles and polyester waste.

Additionally, improper disposal and mixing of PET with non-recyclable plastics or contaminants degrade the quality of the collected material, making recycling less efficient and more expensive. Investments in advanced sorting technologies like AI-powered optical sorting and chemical markers can help separate PET waste more accurately.

The production of rTPA remains costlier than virgin TPA, primarily due to the complex recycling processes involved. Mechanical recycling has limitations in maintaining material integrity, while chemical recycling methods-such as enzymatic or solvent-based depolymerization-require significant energy inputs and advanced processing technologies, increasing operational expenses.

Additionally, fluctuating oil prices affect the cost competitiveness of virgin PTA, sometimes making it cheaper than recycled alternatives. Scaling up recycling operations to achieve economies of scale can help lower costs.

Market Trend

What technological advancements can be seen in this market?

The recycled terephthalic acid market is evolving with emerging trends that emphasize technological advancements and expanding applications beyond traditional industries. One key trend is the continuous improvement in chemical recycling technologies, which enhance the efficiency and quality of rTPA production.

Innovations such as depolymerization and enzymatic recycling are allowing manufacturers to produce high-purity rTPA that meets the standards of virgin PET, making it more suitable for food-grade packaging and high-performance applications. Another significant trend is the increasing utilization of rTPA in diverse industries beyond packaging, such as textiles, automotive, and construction.

Companies are leveraging recycled polyester fibers derived from rTPA to develop sustainable clothing, while the automotive sector is incorporating rTPA-based composites for lightweight and eco-friendly vehicle components. The demand for rTPA is expected to grow as industries explore new applications, reinforcing its role in advancing circular economy initiatives.

- In January 2025, Oerlikon Barmag and Evonik announced a partnership to advance the chemical recycling of PET waste. The collaboration aims to develop efficient depolymerization, purification, and repolymerization processes, integrating them into existing PET production. This initiative will support a circular economy and provide sustainable solutions for global PET producers and processors.

Recycled Terephthalic Acid Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Mechanical Recycling-Based RTA, Chemical Recycling-Based RTA

|

|

By Source

|

Post-Consumer PET Waste, Post-Industrial PET Waste

|

|

By Process

|

Glycolysis, Methanolysis, Hydrolysis, Enzymatic Depolymerization

|

|

By Application

|

Polyester, Polyester Films, PET Resin, Others (Adhesives, Coatings, Specialty Chemicals

|

|

By End Use Industry

|

Textile & Apparel, Food & Beverage Packaging, Automotive & Transportation, Electrical & Electronics, Construction & Building Materials, Others (Adhesives, Industrial Applications)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Mechanical Recycling-Based RTA, Chemical Recycling-Based RTA): The mechanical recycling-based RTA segment earned USD 1,508.6 million in 2023, due to its cost-effectiveness and established recycling infrastructure.

- By Source (Post-Consumer PET Waste, Post-Industrial PET Waste): The post-consumer PET waste segment held 77.35% share of the market in 2023, due to increasing government regulations and consumer awareness about plastic waste recycling.

- By Process (Glycolysis, Methanolysis, Hydrolysis, Enzymatic Depolymerization): The glycolysis segment is projected to reach USD 1,380.3 million by 2031, owing to its efficiency in breaking down PET waste into reusable monomers for various applications.

- By Application (Polyester, Polyester Films, PET Resin, Others (Adhesives, Coatings, Specialty Chemicals)): The polyester segment is projected to reach USD 1,529.4 million by 2031, owing to its high demand in the textile industry and increasing adoption of sustainable materials.

- By End Use Industry (Textile & Apparel, Food & Beverage Packaging, Automotive & Transportation, Electrical & Electronics, Construction & Building Materials, Others (Adhesives, Industrial Applications)): The textile & apparel segment is projected to reach USD 1,409.2 million by 2031, owing to the growing preference for recycled polyester in fashion and sportswear industries.

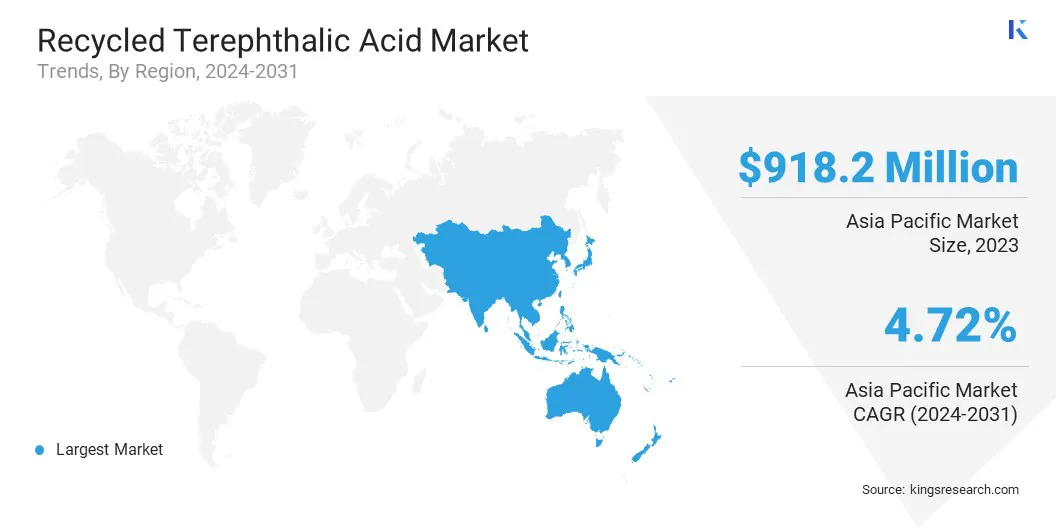

What is the market scenario in Asia-Pacific Europe region?

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a substantial recycled terephthalic acid market share of 40.11% in 2023, with a valuation of USD 918.2 million. The region’s dominance is driven by the presence of textile and packaging industries, increasing government regulations on plastic waste management, and growing adoption of sustainable materials in countries like China, India, and Japan.

The availability of large volumes of post-consumer PET waste, coupled with rising investments in advanced recycling technologies, is further fueling the market. Additionally, the surging demand for recycled polyester in the apparel sector and the presence of major rTPA producers contribute to the market dominance of the region.

The market in Asia Pacific is expected to register the highest growth rate over the forecast period, due to continuous advancements in chemical recycling processes and favorable policies promoting circular economy initiatives.

- In June 2024, CARBIOS and Zhink Group entered official discussions for a long-term partnership to build PET biorecycling industrial capacities in China. The agreement aims to establish a biorecycling plant using CARBIOS’ enzymatic depolymerization technology to process a minimum of 50,000 tons of PET waste per year, supporting the global packaging and textile markets.

The recycled terephthalic acid Industry in Europe is expected to register the fastest growth, with a projected CAGR of 4.42% over the forecast period. Stringent regulations on plastic waste management, such as the European Union’s Single-use Plastics Directive and increased recycling targets, are key factors driving the market.

The growing focus on sustainability, circular economy initiatives, and strong consumer demand for eco-friendly products are pushing industries like textiles, packaging, and automotive toward greater adoption of rTPA. Countries are investing in innovative recycling technologies, particularly chemical recycling methods such as glycolysis and methanolysis, to enhance rTPA production efficiency.

Additionally, collaborations between major corporations and recycling firms to develop closed-loop systems are further supporting market growth in the region.

Regulatory Frameworks Also Plays a Significant Role in Shaping the Market

- In the U.S., rTPA is regulated by the Environmental Protection Agency (EPA) under the Resource Conservation and Recovery Act and the Toxic Substances Control Act. Additionally, for applications in food-grade plastics, the Food and Drug Administration (FDA) oversees the safety and compliance of rTPA ensuring it meets strict purity and contamination control standards.

- In Europe, the European Chemicals Agency (ECHA) and the European Food Safety Authority (EFSA) regulate rTPA. ECHA, under the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) Regulation, ensures the safe use of rTPA in industrial applications, while EFSA assesses its safety for food-contact applications.

- In China, rTPA is regulated by the Ministry of Ecology and Environment (MEE) under the Solid Waste Pollution Prevention and Control Law. Additionally, the National Medical Products Administration (NMPA) and National Health Commission (NHC) oversee the safety of recycled plastics, including rTPA, for food contact applications.

- In Japan, the Ministry of Economy, Trade and Industry (METI) and the Ministry of the Environment (MOE) regulate the production and use of rTPA under the Act on the Promotion of Effective Utilization of Resources.

- In India, the Central Pollution Control Board (CPCB) and the Ministry of Environment, Forest and Climate Change regulate rTPA under the Plastic Waste Management Rules.

Competitive Landscape:

The global recycled terephthalic acid market is characterized by a large number of participants, including both established corporations and rising organizations.

Companies are focusing on technological advancements in chemical recycling processes to improve efficiency, reduce costs, and enhance product quality. Strategic collaborations, mergers, and acquisitions are common as firms seek to expand their market presence and secure a steady supply of raw materials.

Market players are also investing in R&D to optimize depolymerization and purification techniques, making rTPA more viable for high-performance applications such as food-grade packaging and high-quality textiles. Additionally, partnerships with brands and manufacturers looking to incorporate recycled materials into their products provide a competitive edge.

Companies that can offer scalable and cost-effective rTPA production while maintaining quality and consistency are likely to gain a stronger foothold in the market as the demand for eco-friendly solutions increases.

- In May 2024, Dow and SCG Chemicals announced a partnership to transform 200KTA of plastic waste into circular products by 2030 in Asia Pacific. The collaboration focuses on enhancing the plastic recycling value chain using mechanical and advanced recycling technologies.

List of Key Companies in Recycled Terephthalic Acid Market:

Recent Developments (Partnerships/New Product Launch)

- In November 2024, Axens, IFPEN, and JEPLAN announced the commercial launch of the Rewind PET chemical recycling process. The partnership enables Axens to license the technology globally, providing a complete package including process design, performance guarantees, proprietary equipment, and technical support.

- In August 2024, CARBIOS and SASA signed a Letter of Intent to establish a 100,000-ton/year PET biorecycling facility in Turkey. The partnership aims to leverage CARBIOS' enzymatic depolymerization technology to produce recycled polyester fibers and textiles, supporting SASA’s goal of becoming a leading supplier of sustainable polyester in Europe.