Market Definition

The market involves the creation and implementation of systems that analyze consumer behavior and preferences to deliver personalized product or content suggestions. It includes software and solutions utilized across various sectors, such as e-commerce, media, and entertainment, to improve user experiences.

The market includes technologies like collaborative filtering, content-based filtering, and hybrid models, helping businesses enhance engagement and sales. The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Recommendation Engine Market Overview

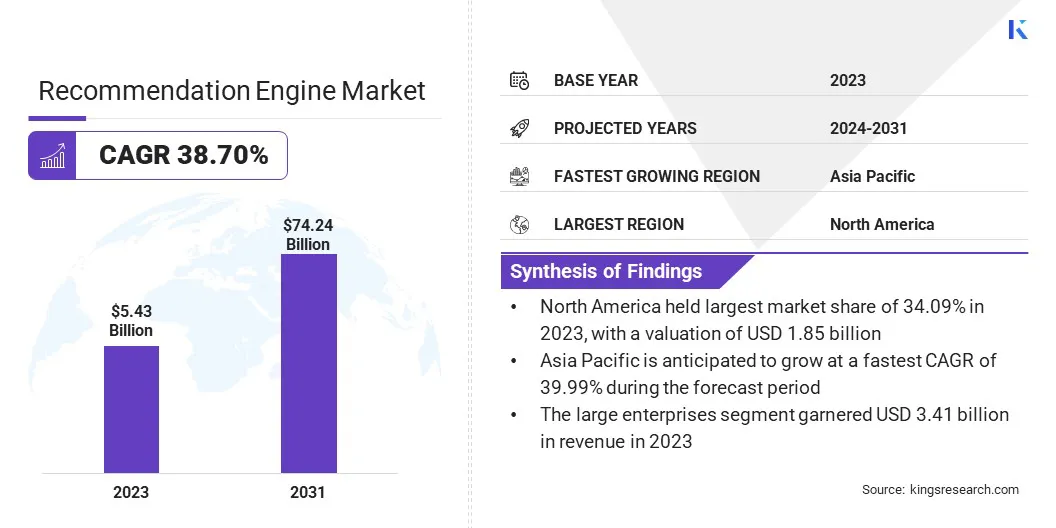

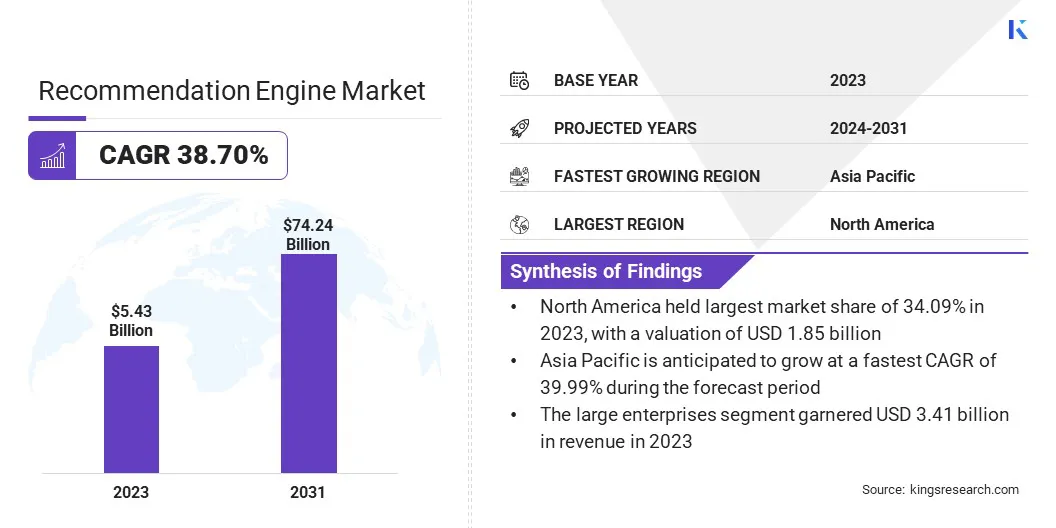

The global recommendation engine market size was valued at USD 5.43 billion in 2023 and is projected to grow from USD 7.52 billion in 2024 to USD 74.24 billion by 2031, exhibiting a CAGR of 38.70% during the forecast period.

The market is experiencing significant growth driven by increasing demand for personalized user experiences across industries like e-commerce, entertainment, and online services. The proliferation of big data and advanced analytics has enabled businesses to leverage consumer insights for tailored recommendations.

Major companies operating in the recommendation engine industry are Amazon.com, Inc., Alphabet Inc., Microsoft, Salesforce, Inc., Algolia, Stitch Fix, BigCommerce Pty. Ltd., Mastercard, Adobe, Coveo Solutions Inc., Intel Corporation, Oracle, SAP SE, Bloomreach, Inc., and Recombee.

Additionally, artificial intelligence (AI) and machine learning (ML) technologies are making recommendation systems more accurate and effective. As more people shop online and use digital platforms, businesses are using these systems to improve customer engagement, boost sales, and provide content that matches individual interests.

- In January 2024, Arthur introduced Recommender System Support, a new addition to its AI performance platform. The technology enhances the monitoring and management of AI-driven recommender systems, addressing data drift and performance issues, thus improving accuracy, relevance, and customer satisfaction for online businesses.

Key Highlights

- The recommendation engine market size was valued at USD 5.43 billion in 2023.

- The market is projected to grow at a CAGR of 38.70% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 1.85 billion.

- The cloud-based segment garnered USD 3.37 billion in revenue in 2023.

- The collaborative filtering segment is expected to reach USD 30.98 billion by 2031.

- The large enterprises segment is expected to reach USD 45.49 billion by 2031.

- The IT & Telecommunications segment is expected to reach USD 22.23 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 39.99% during the forecast period.

Market Driver

Growing Demand for AI Solutions to Improve Business Efficiency

The market is growing rapidly due to the increasing demand for AI-driven solutions that help businesses simplify their operations and improve efficiency. Companies are adopting these systems to automate tasks like delivering personalized content, suggesting products, and engaging with customers.

By leveraging AI, companies can improve decision-making, deliver more relevant recommendations, and enhance customer experiences. This growing reliance on AI is driven by the need to reduce operational costs, optimize workflows, and maintain competitiveness, is fueling the market growth.

- In September 2024, ezCater launched Smart Ordering, an AI-based order recommendation engine designed to simplify workplace food ordering. The feature uses over 17 years of proprietary data to provide tailored menu suggestions based on group size, budget, and preferences, helping customers save time and manage orders more efficiently.

Market Challenge

Managing Data Privacy Concerns in Recommendation Engines

A key challenge in the recommendation engine market is keeping user data private. These systems rely on collecting and analyzing large volumes of user data such as browsing behavior, purchase history, and preferences to generate personalized suggestions.

However, growing concerns over how this data is collected, stored, and used have raised privacy issues among consumers. Additionally, regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose strict compliance requirements on the use of personal data.

In response, companies are adopting privacy-preserving techniques, including data anonymization, differential privacy, and federated learning. These methods enable effective personalization while ensuring data protection and regulatory compliance.

Market Trend

Enhancing Recommendation Engines with Generative AI for Personalization

The market is witnessing a trend toward more personalized and data-driven recommendations powered by generative AI. Businesses are increasingly using this advanced technology to analyze large volumes of user data and generate highly tailored content, product suggestions, or services.

Generative AI can understand user preferences, behavior patterns, and context more accurately, allowing companies to deliver more relevant experiences. Unlike traditional models, generative AI can dynamically adjust recommendations in real time and interpret complex inputs such as user intent and visual signals.

This trend is being driven by rising consumer expectations for highly relevant and individualized interactions. As a result, generative AI is making recommendation engines more intelligent, responsive, and capable of delivering refined personalization at scale.

- In June 2024, AnyMind Group launched new generative AI (GenAI) functionality on its influencer marketing platform, AnyTag. The feature aims to enhance influencer search and recommendations by leveraging over 750,000 influencers' data, including audience demographics, content engagement, and past campaign performance, to optimize influencer selection for marketing campaigns.

Recommendation Engine Market Report Snapshot

|

Segmentation

|

Details

|

|

By Deployment

|

Cloud-based, On-premises

|

|

By Type

|

Collaborative Filtering, Content-based Filtering, Hybrid Recommendation Systems

|

|

By Organization

|

Small & Medium Enterprises, Large Enterprises

|

|

By End-user Industry

|

IT & Telecommunications, BFSI, Retail, Media & Entertainment, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Deployment (Cloud-based, On-premises): The cloud-based segment earned USD 3.37 billion in 2023 due to its flexibility, scalability, and cost-effectiveness for businesses of all sizes.

- By Type (Collaborative Filtering, Content-based Filtering, and Hybrid Recommendation Systems): The collaborative filtering segment held 42.17% of the market in 2023, due to its ability to provide personalized recommendations based on user behavior and preferences.

- By Organization (Small & Medium Enterprises, Large Enterprises): The large enterprises segment is projected to reach USD 45.49 billion by 2031, owing to their vast customer data and larger budgets for implementing advanced recommendation systems.

- By End-user Industry (IT & Telecommunications, BFSI, Retail, Media & Entertainment, Healthcare, Others): The IT & telecommunications segment is projected to reach USD 22.23 billion by 2031, owing to the growing demand for personalized services and customer engagement in the sector.

Recommendation Engine Market Regional Analysis

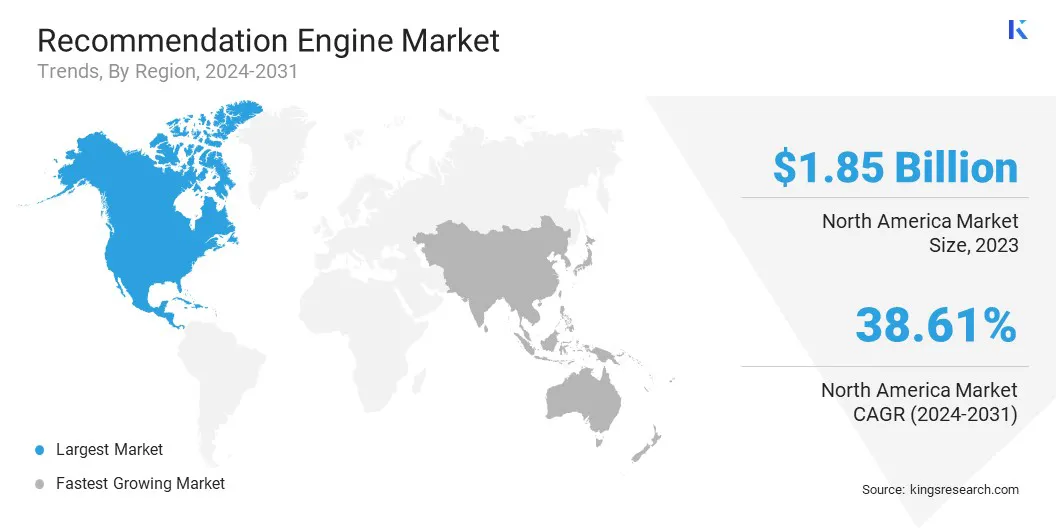

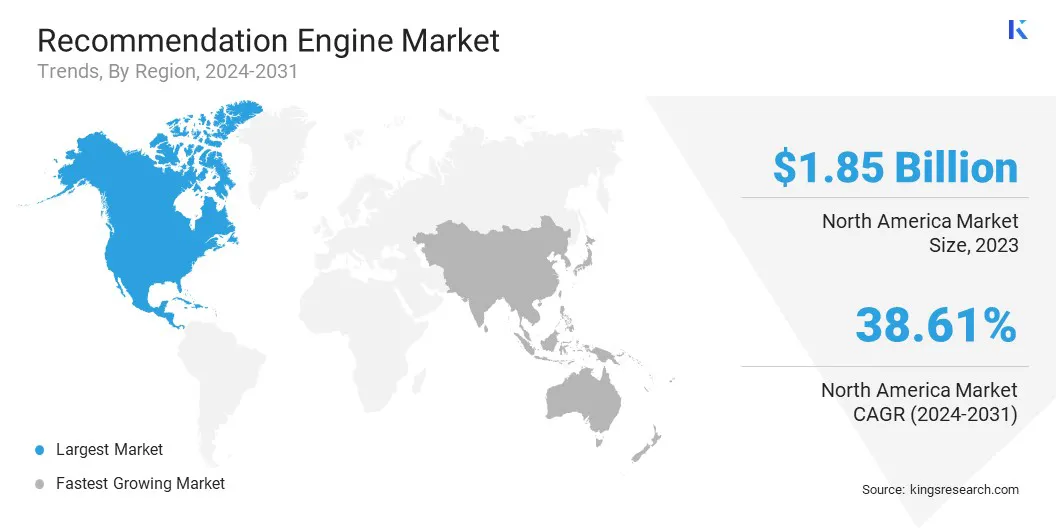

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 34.09% share of the recommendation engine market in 2023, with a valuation of USD 1.85 billion. This dominance is attributed to the region's strong presence of major tech companies, such as Google, Amazon, and Netflix, who have integrated advanced recommendation systems into their platforms to enhance user experience and engagement.

The region also benefits from a robust digital infrastructure, high internet penetration, and a well-established e-commerce industry, making it an ideal environment for the growth of recommendation engines. Additionally, businesses across the region are increasingly adopting AI and machine learning technologies in recommendation engines to deliver personalized content, strengthen customer engagement, and improve operational efficiency.

The recommendation engine industry in Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 39.99% over the forecast period. This growth is driven by the rapid expansion of digital platforms in countries like China, India, and Japan, and the rise of e-commerce and mobile app usage.

The growing demand for personalized shopping, entertainment, and content services is further propelling market expansion in Asia Pacific. Moreover, the region’s vast consumer base provides valuable data, enabling companies to fine-tune recommendation systems for a wide range of preferences, fueling rapid adoption across the region.

- In April 2025, CleverTap acquired rehook.ai, a Y Combinator-backed startup. The acquisition aimed to strengthen CleverTap’s AI-driven promotions and customer retention capabilities by integrating rehook.ai’s promotions automation solution with CleverTap’s engagement and analytics platform, expanding its reach and capabilities in Southeast Asia.

Regulatory Frameworks

- In U.S., recommendation engines are subject to data privacy regulations like the California Consumer Privacy Act (CCPA), which governs the collection, use, and sharing of personal data for residents of California.

- In Europe, recommendation engines must comply with the General Data Protection Regulation (GDPR), which sets guidelines for collecting, storing, and processing personal data. This regulation mandates that businesses obtain explicit consent from users before processing their data for personalized recommendations, and it ensures individuals' rights to access, correct, or delete their data.

Competitive Landscape

The recommendation engine market is characterized by key players employing various strategies to strengthen their market position. Leading companies focus on enhancing the accuracy and efficiency of their recommendation systems by incorporating advanced machine learning algorithms, improving data analytics capabilities, and utilizing deep learning techniques.

Strategic partnerships and acquisitions are also common as companies seek to expand their technological expertise and integrate cutting-edge solutions into their platforms. Companies are also increasingly investing in cloud-based solutions, offering scalability and flexibility to meet the growing demands of digital platforms and e-commerce sectors.

To further differentiate themselves, some players focus on providing industry-specific recommendation solutions, tailoring their technologies for sectors such as healthcare, retail, and entertainment.

- In August 2024, CleverTap partnered with Eatigo to implement its AI-based recommendation engine, enabling hyper-personalized user engagement and campaign automation. The collaboration helped Eatigo achieve 100% growth in reservations by delivering timely, relevant dining suggestions, improving conversion rates, and enhancing customer re-engagement through multi-channel strategies.

List of Key Companies in Recommendation Engine Market:

- Amazon.com, Inc.

- Alphabet Inc.

- Microsoft

- Salesforce, Inc.

- Algolia

- Stitch Fix

- BigCommerce Pty. Ltd.

- Mastercard

- Adobe

- Coveo Solutions Inc.

- Intel Corporation

- Oracle

- SAP SE

- Bloomreach, Inc.

- Recombee

Recent Developments (Product Launches)

- In January 2025, Sovrn launched AI Shopping Galleries, a new recommendation engine that uses AI and retrieval-augmented generation (RAG) technology to deliver contextually relevant product suggestions. The solution enables publishers to automate affiliate link generation, optimize product displays for engagement and revenue, and streamline content monetization with a simple integration process.

- In June 2024, Uber AI unveiled its out-of-app (OOA) recommendation system designed to scale personalized marketing through email, push, and SMS communications. The system leverages Uber’s knowledge graph, CEL-based rule engine, and learning-to-rank models to deliver localized, contextually relevant recommendations. Enhancements include machine learning-based user location prediction, cuisine-based user preference modeling, and efficient re-ranking strategies enabling Uber to send over 4 billion tailored messages annually across global markets while balancing cost, scalability, and engagement.

commerce-focused r