Market Definition

The rare earth metals recycling market focuses on recovering and reprocessing rare earth elements (REEs) from discarded electronic devices, industrial equipment, and other waste. Key elements such as neodymium, dysprosium, and lanthanum are essential in the production of high-tech products such as smartphones, electric vehicles, wind turbines, and advanced military equipment.

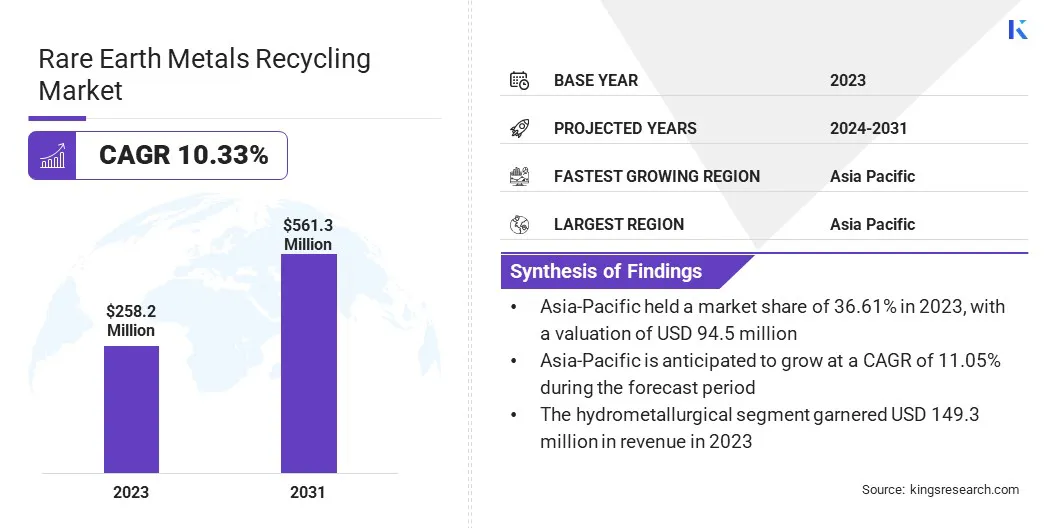

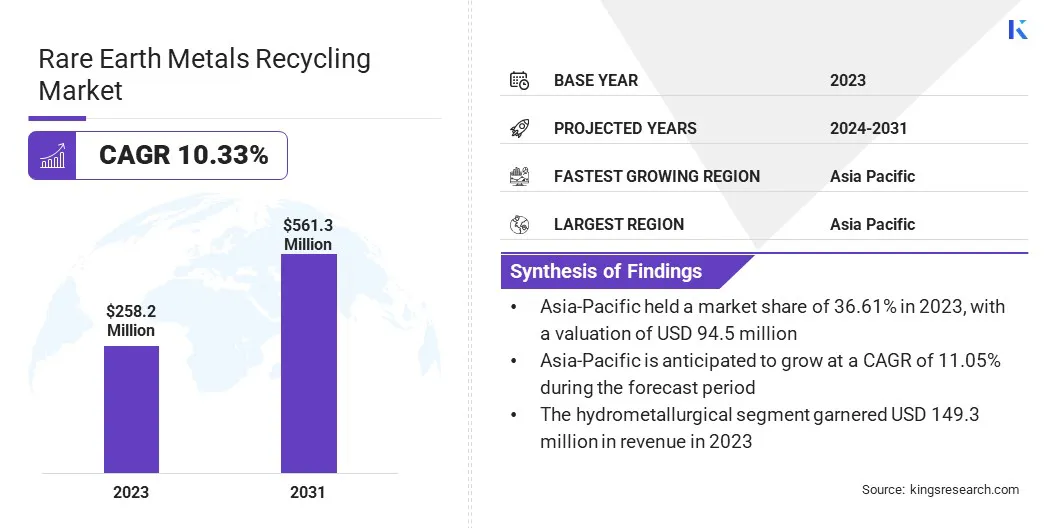

The global rare earth metals recycling market size was valued at USD 258.2 million in 2023 and is projected to grow from USD 282.2 million in 2024 to USD 561.3 million by 2031, exhibiting a CAGR of 10.33% during the forecast period.

Market growth is attributed to the increasing demand for rare earth metals in industries such as electronics, renewable energy, and electric vehicles. Governments and industries are implementing stricter regulations on waste management and recycling, leading to the widespread adoption of advanced recycling technologies.

Key Market Highlights:

- The rare earth metals recycling market size was recorded at USD 258.2 million in 2023.

- The market is projected to grow at a CAGR of 10.33% from 2024 to 2031.

- Asia-Pacific held a share of 36.61% in 2023, valued at USD 94.5 million.

- The hydrometallurgical segment garnered USD 149.3 million in revenue in 2023.

- The magnets segment is expected to reach USD 254.3 million by 2031.

- The permanent magnets segment is anticipated to witness the fastest CAGR of 11.92% over the forecast period

- Asia Pacific is anticipated to grow at a CAGR of 11.05% over the forecast period.

Major companies operating in the global rare earth metals recycling industry are Solvay, Hitachi, Ltd, Umicore, Lynas Rare Earths Ltd, Geomega Resources Inc., Shenghe Resources Holding Co., Ltd., Geomega Resources Inc., Nissan Motor Co., Ltd., Mitsubishi Electric Corporation, Avalon Advanced Materials Inc., MP Materials., OSRAM SYLVANIA Inc., REEcycle, ENERGY FUELS INC., and American Rare Earths.

The shift toward sustainable technologies is highlighting the need for efficient recycling to reduce dependence on mining and minimize environmental impact. The volatility of rare earth metal prices and the geopolitical risks associated with their supply are prompting companies to seek secondary sources, further fueling market growth.

- In June 2024, Solvay and Cyclic Materials signed an agreement for the supply of recycled mixed rare earth oxide (rMREO) from Cyclic Materials to Solvay, with shipments set to begin. This agreement follows extensive collaboration, confirming the technical and commercial viability of Cyclic Materials’ product with a leading rare earth chemicals producer.

Advancements in Recycling Technologies

Advancements in recycling technologies have significantly improved rare earth metal recovery. Hydrometallurgy, utilizing aqueous solutions for metal seperation, and pyrometallurgy, employing high temperatures for refining, have increased efficiency and purity, propelling the growth of the rare earth metals recycling market.

Additionally, innovations in solvent extraction, bioleaching, and ion-exchange processes enable more precision recovery from complex waste.

- In October 2024, NioCorp Developments Ltd. successful tested its proposed hydrometallurgical process for producing critical minerals at the proposed Elk Creek Critical Minerals Project in southeast Nebraska, aimed at recycling post-consumer rare earth magnets.

Concerns Pertaining to Difficulty in Recycling Techniques

Rare earth elements are widely used in electronic devices, batteries, magnets, and fluorescent lights, often in small quantities and complex alloys. T Their integration through advanced manufacturing complicates separation and extraction during recycling, impeding the progress of the rare earth metals recycling market.

The need for specialized equipment, such as automated sorting systems or chemical leaching processes, further increases the difficulty and cost of recycling. Additionally, the low concentration of rare earth metals in products necessitates processing large waste volumes to recover minimal amounts, reducing efficiency.

This challenge can be addressed through significant advancements in technology and process optimization. Key strategies include developing efficient and selective separation methods, such as advanced chemical leaching, hydrometallurgical processes, and solvent extraction, to isolate specific rare earth elements.

Standardizing product structures and using fewer easily separable materials can streamline recycling. Additionally, cross-industry collaboration and closed-loop recycling systems can enhance efficiency by improving e-waste and scrap collection infrastructure.

Increased Focus on Circular Economy

As industries and governments adopt sustainable practices, the circular economy model promotes material reuse, refurbishment, and recycling to extend their life cycle and reduce waste.

This highlights the shift away from the traditional take-make-dispose approach toward recovering rare earth metals from end-of-life products such as electronics, wind turbines, and EV batteries for integration into the supply chain. This approach minimizes environmental impact and reduces reliance on resource-intensive primary mining.

- In December 2024, Cyclic Materials Inc. partnered with Circulor, a leading supply chain traceability provider, to establish the first end-to-end traceability for rare earth elements (REEs). This partnership sets a new standard for transparent REE recycling, promoting responsible, sustainable, and secure sourcing.

|

Segmentation

|

Details

|

|

By Technology

|

Hydrometallurgical, Pyrometallurgical

|

|

By Source

|

Fluorescent lamps, Magnets, Batteries, Others (Industrial process, Permanent Magnet Scrap)

|

|

By Application

|

Alloy, Catalyst, Permanent Magnets, Ceramics, Others (Phosphor, Polishing materials, Glass)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (Hydrometallurgical and Pyrometallurgical): The hydrometallurgical segment earned USD 149.3 million in 2023 due to its efficient and environmentally friendly extraction of rare earth metals from electronic waste and other sources.

- By Source (Fluorescent lamps, Magnets, Batteries, and Others (Industrial process, Permanent Magnet Scrap)): The magnets segment held a share of 46.63% in 2023, attributed to strong demand for rare earth metals in producing high-performance permanent magnets for electric motors, wind turbines, and other high-tech applications.

- By Application (Alloy, Catalyst, Permanent Magnets, Ceramics, and Others (Phosphor, Polishing materials, Glass)): The permanent magnets segment is projected to reach USD 244.8 million by 2031, owing to the growing demand for rare earth metals in energy-efficient motors, electric vehicles, and renewable energy technologies such as wind turbines.

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific rare earth metals recycling market share stood at around 36.61% in 2023,valued at USD 94.5 million. This dominance is attributed to the region's strong manufacturing base, particularly in electronics, automotive, and renewable energy sectors.

China, Japan, and South Korea are at the forefront of rare earth metal production and recycling, supported by technological advancements and large-scale recycling facilities. The growing emphasis on circular economy practices and government incentives are further stimulating regional market growth.

North America rare earth metals recycling industry is estimated to grow at a robust CAGR of 10.63% over the forecast period. This growth is bolstered by increasing government support for sustainability initiatives and the need for secure domestic supply chains.

The U.S., in particular, is prioritizing reduced reliance on foreign sources for critical raw materials, such as rare earth metals, essential to electronics, defense, and clean energy.

The rising demand for electric vehicles (EVs) and renewable energy systems, which require rare earth metals for batteries, motors, and magnets, is further fueling the need for recycling solutions. Private sector investment is increasing as companies recognize the economic and environmental benefits of rare earth metal recycling.

- In December 2024, Greenwave Technology Solutions, Inc. a leading metal recycler in Virginia, North Carolina, and Ohio, announced an accelerated recovery of rare-earth metals from appliances, equipment, heavy machinery, and vehicles, fueled by surging global demand and geopolitical tensions.

Regulatory Frameworks

- The U.S. Environmental Protection Agency (EPA) has established standards to promote the reuse of rare earth materials as part of its broader efforts to encourage sustainable practices and reduce environmental impacts.

- India's Ministry of Mines regulates the use of rare earth metals under the National Mineral Policy, 2019, emphasizing efficient extraction and recycling.

- The U.S. Nuclear Regulatory Commission (NRC) enforces regulations for the safe handling, recycling, and disposal of radioactive materials.

Competitive Landscape

The competitive landscape of the rare earth metals recycling market is marked by a mix of established players, emerging innovators, and new entrants focused on advancing recycling technologies and securing sustainable supply chains.

Companies are leveraging hydrometallurgy, pyrometallurgy, and chemical leaching to improve the efficiency and cost-effectiveness of rare earth metal recovery. There is a strong emphasis on developing environmentally friendly and energy-efficient processes to reduce environmental impact.

Companies are forming strategic partnerships and collaborations to enhance their capabilities and ensure a stable supply of rare earth elements.

- In April 2023, Apple Inc announced plans to accelerate the use of recycled materials across its products. By 2025, the company aims to use 100% recycled cobalt in all Apple-designed batteries, fully recycled rare earth elements in device magnets, and 100% recycled tin soldering and gold plating in printed circuit boards.

Key Companies in Rare Earth Metals Recycling Market:

- Solvay

- Hitachi, Ltd

- Umicore

- Lynas Rare Earths Ltd

- Geomega Resources Inc.

- Shenghe Resources Holding Co., Ltd.

- Geomega Resources Inc.

- Nissan Motor Co., Ltd.

- Mitsubishi Electric Corporation

- Avalon Advanced Materials Inc.

- MP Materials.

- OSRAM SYLVANIA Inc.

- REEcycle

- ENERGY FUELS INC.

- American Rare Earths

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In August 2024, Cyclic Materials partnered with SYNETIQ to recycle electric motors containing rare earths. This colaboration enhances circularity by recovering rare earth elements from end-of-life vehicle motors, enhancing resource efficiency and reducing environmental impact

- In May 2024, Heraeus Group commenced operations at Europe's largest recycling plant in Bitterfeld , with an initial capacity of up to 600 tons per year, scalable to 1,200 tons.

- In August 2023, Maginito Limited announced the completion of its acquisition of HyProMag Limited.This strengthens Maginito's position in the rare earth supply chain and supports sustainable solutions for magnet production through advanced recycling technologies.

- In February 2023, Mkango Resources raised USD 4.5 million through a placement and subscription of 28,000,000 new common shares at 12.5 pence per share.