Market Definition

The market encompasses the extraction, refinement, and distribution of rare earth elements (REEs), comprising the 15 lanthanides, along with scandium and yttrium. These elements are crucial for advanced technologies due to their unique properties, such as high magnetic strength, luminescence, and catalytic efficiency that make them indispensable in a wide array of advanced technologies.

The report presents an overview of the primary growth drivers, supported by regional analysis and regulatory frameworks expected to impact market development over the forecast period.

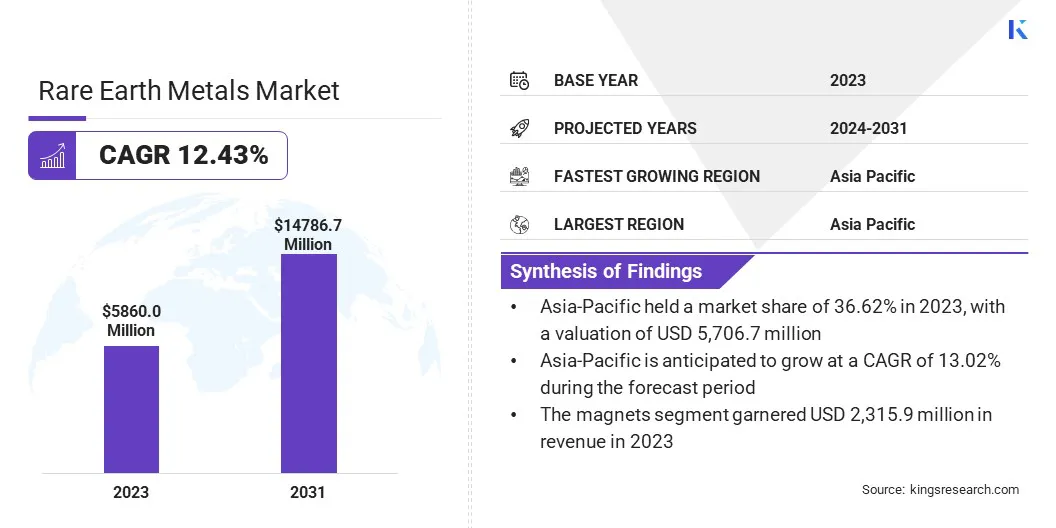

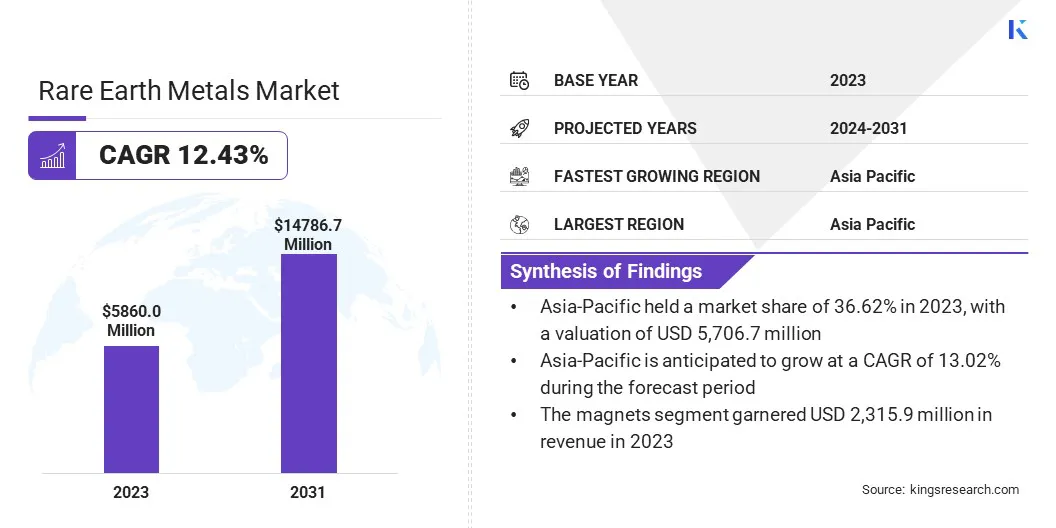

The global rare earth metals market size was valued at USD 5,860.0 million in 2023 and is projected to grow from USD 6,512.2 million in 2024 to USD 14,786.7 million by 2031, exhibiting a CAGR of 12.43% during the forecast period.

Market growth is driven by the increasing adoption of electric vehicles and renewable energy technologies, both of which rely heavily on rare earth elements for components such as permanent magnets and high-efficiency motors.

Major companies operating in the rare earth metals industry are Shenghe Resources Holding Co., Ltd., Canada Rare Earth Corporation, Lynas Rare Earths Ltd, IREL Limited, Rare Element Resources Ltd, Arafura Rare Earths, Ucore Rare Metals Inc., Northern Minerals, Alkane Resources Ltd, MP Materials, NEO, Shin-Etsu Chemical Co., Ltd, Iluka Resources Limited, Energy Transition Minerals Ltd, and Australian Strategic Materials Ltd.

Additionally, ongoing innovation in magnet technology and materials processing is improving the performance and efficiency of rare earth applications, accelerating market growth.

Manufacturers are also investing in integrated supply chains and advanced separation technologies to enhance production capabilities and ensure material security. These strategic efforts are vital to meeting the growing global demand and minimizing reliance on concentrated sources of rare earth supply.

- In December 2024, BMW i Ventures invested in Phoenix Tailings to support the expansion of U.S.-based rare earth processing. The funding aims to scale production to 200 tons annually using a zero-waste, zero-emission process, strengthening the domestic supply chain and reducing reliance on foreign sources.

Key Highlights

- The rare earth metals market size was valued at USD 5,860.0 million in 2023.

- The market is projected to grow at a CAGR of 12.43% from 2024 to 2031.

- Asia-Pacific held a market share of 36.62% in 2023, with a valuation of USD 2,145.9 million.

- The dysprosium segment garnered USD 2,252.6 million in revenue in 2023.

- The magnets segment is expected to reach USD 6,457.8 million by 2031.

- North America is anticipated to grow at a CAGR of 12.67% over the forecast period.

Market Driver

Strategic Importance in Defense and Aerospace

The strategic importance of rare earth metals in defense and aerospace applications is fueling market growth. These metals are essential for high-strength magnets, precision-guided weapons, radar systems, and satellite communications, boosting the expansion of the market.

Defense agencies and aerospace manufacturers are increasingly prioritizing secure access to these critical materials, prompting investments in domestic mining and processing infrastructure. This strategic shift, supported by national security concerns and supply chain resilience, significantly contributes to market expansion.

- In March 2024, the U.S. Department of Defense announced progress in developing a domestic “mine-to-magnet” rare earth supply chain. Since 2020, over USD 439 million has been invested to reduce reliance on foreign sources and ensure access to critical materials for defense systems such as the F-35, submarines, and missiles.

Market Challenge

Geopolitical Concentration of Supply Chain

A major challenge hampering the growth of the rare earth metals market is the geopolitical concentration of the supply chain, with China dominating both the mining and processing of rare earth elements. This dependence creates significant vulnerability to trade restrictions, export controls, and geopolitical tensions that can disrupt global supply and trigger market volatility.

As the strategic importance of rare earths intensifies across sectors such as defense, renewable energy, and advanced electronics, governments and industries are seeking to reduce this reliance through diversification of supply sources and investment in domestic processing capabilities. These efforts are crucial for enhancing supply chain resilience and mitigating national security risks.

- In September 2024, the Saskatchewan Research Council (SRC) announced that its Rare Earth Processing Facility in Saskatoon became the first in North America to produce rare earth metals. Sourcing materials globally, the facility aims to produce 40 tonnes of rare earth metals monthly, reducing reliance on China and supporting industries such as electric vehicles.

To address this challenge, countries are forming international alliances, advancing recycling technologies, and supporting research into material substitutes. These initiatives collectively aim to build a more stable, self-sufficient rare earth ecosystem that can support long-term industrial growth and innovation.

Market Trend

Surge in Demand from Renewable Energy and Electric Vehicles

The growing adoption of renewable energy and electric vehicles is boosting the demand for rare earth metals, particularly for high-performance permanent magnets. Elements such as neodymium and praseodymium are critical for manufacturing efficient wind turbine generators and electric vehicle motors, where durability, strength, and thermal stability are paramount.

This trend is prompting strategic investments and technological advancements across the rare earth metals value chain. As manufacturers align with clean energy and mobility requirements, the market is experiencing accelerated growth, supported by global sustainability goals and expanding renewable infrastructure.

- In April 2025, Solvay launched a new rare earths production line at its La Rochelle site in France, marking a key advancement in strengthening Europe’s supply of essential materials for permanent magnets. This expansion allows commercial production of rare earth elements critical for electric vehicles, renewable energy, and advanced electronics, supporting the European Union’s objective to fulfill 30% of its permanent magnet demand by 2030.

|

Segmentation

|

Details

|

|

By Type

|

Cerium, Dysprosium, Lanthanum, Others (Gadolinium, Holmium, Europium, Lutetium etc.)

|

|

By Application

|

Magnets, Catalysts, Phosphors, Others (Polishing Powders, Alloys)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Cerium, Dysprosium, Lanthanum, and Others (Gadolinium, Holmium, Europium, and Lutetium)): The dysprosium segment earned USD 2,252.6 million in 2023 due to its critical application in enhancing the efficiency and performance of permanent magnets used in motors and electronic devices.

- By Application (Magnets, Catalysts, Phosphors, and Others (Polishing Powders, and Alloys)): The magnets segment held a share of 39.52% in 2023, fueled by the increasing demand for high-performance magnets in electric vehicles, wind turbines, and consumer electronics.

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific rare earth metals market share stood at around 36.62% in 2023, valued at USD 2,145.9 million. This dominance is fueled by China's leadership in production and processing, along with rising regional demand from rapid industrialization and technological advancements.

Countries such as India and Japan are witnessing increased consumption of rare earth metals for applications in electric vehicles, electronics, and renewable energy. Investments in clean energy infrastructure and the region's position as a key hub for wind turbine and EV production further increase the need for high-performance magnets dependent on rare earth elements.

North America rare earth metals industry is estimated to grow at a robust CAGR of 12.67% over the forecast period. This growth is propelled by rising demand from the electric vehicle, renewable energy, and defense sectors. Strategic investments in domestic mining and processing facilities are strengthening the region's production capabilities and reducing dependency on foreign imports.

Additionally, government-led initiatives and public-private partnerships are facilitating the development of a robust local supply chain. As suppliers increasingly comply with regulatory standards and optimize production processes, the regional market is set to witness sustained expansion, supporting the region's transition to sustainable energy and advanced technological applications.

- In July 2023, American Rare Earths announced progress in developing Halleck Creek deposit in Wyoming, the largest known rare earth resource in the U.S., containing 1.46 billion tons of minerals such as neodymium and praseodymium. The company is collaborating with U.S. universities and Lawrence Livermore Labs to create a more cost-effective and sustainable extraction process.

Regulatory Frameworks

- In the EU, the Critical Raw Materials Act aims to secure critical raw material supply chains across the green, digital, and defense sectors. It focuses on boosting domestic production, processing, and recycling capacities, with 2030 targets to reduce dependence on single-source imports.

- In China, the Rare Earth Management Regulations establishes a framework for the protection and regulation of rare earth resources in China, covering mining, smelting, separation, metal production, utilization, and international trade.

- In the U.S., the Environmental Protection Agency (EPA’s) standards for promoting the reuse of rare earth materials promote the recycling and reuse of rare earth elements. The NSF/ANSI 426-2018 standard supports the evaluation of sustainability in processes involving rare earth materials.

Competitive Landscape

Companies in the rare earth metals market are heavily investing in R&D to innovate more efficient and sustainable mining and processing technologies, including advanced extraction methods and recycling solutions to reduce environmental impact.

Strategic collaborations and partnerships with industry stakeholders are being employed to secure long-term supply agreements and expand access to critical resources, particularly in regions with high demand for clean energy and advanced technologies.

Mergers and acquisitions are enabling companies to diversify their portfolios, gain access to proprietary technologies, and strengthen their global supply chains, particularly in response to geopolitical and market challenges. Numerous players are focusing on the development of integrated solutions that combine efficient extraction, processing, and recycling techniques to meet evolving industrial demands and environmental standards.

- In September 2024, American Rare Earths secured a USD 456 million Letter of Interest from EXIM Bank to support the development of its Halleck Creek deposit in Wyoming. This strengthens its position as a strategic domestic source of critical rare earth elements.

List of Key Companies in Rare Earth Metals Market:

- Shenghe Resources Holding Co., Ltd.

- Canada Rare Earth Corporation

- Lynas Rare Earths Ltd

- IREL Limited

- Rare Element Resources Ltd

- Arafura Rare Earths

- Ucore Rare Metals Inc.

- Northern Minerals

- Alkane Resources Ltd

- MP Materials

- NEO

- Shin-Etsu Chemical Co., Ltd

- Iluka Resources Limited

- Energy Transition Minerals Ltd

- Australian Strategic Materials Ltd.

Recent Developments (Partnerships/Agreements/Expansion)

- In April 2025, USA Rare Earth signed a memorandum of understanding with The StudBuddy to supply U.S.-made neodymium magnets. The partnership underscores a shared commitment to strengthening the domestic rare earth magnet supply chain and supporting U.S. manufacturing, with plans to deliver approximately 20 metric tons of finished magnets annually under a forthcoming multi-year agreement.

- In April 2025, GreenMet partnered with Tanbreez to strengthen critical rare earth supply chains in North America and Europe. The Tanbreez Project in Greenland, with over 27% heavy rare earth element content, is one of the largest untapped deposits outside China, valued at USD 3.04 billion in a 2025 Preliminary Economic Assessment. This collaboration aims to support defense and high-tech industries by securing a steady supply of rare earth elements.

- In March 2024, Solvay and Carester entered into an MOU to establish a strategic partnership aimed at building a rare earth permanent magnet supply chain in Europe. This collaboration combines Solvay's industrial assets with Carester's recycling expertise, supporting Europe's shift to electrification, wind energy, and digitalization.

- In April 2023, Solvay joined the Rare Earth Industry Association (REIA) to strengthen Europe’s rare earth supply chain. This partnership supports Solvay’s efforts to expand its rare earth operations in La Rochelle, France, and meet the growing demand for critical materials in electric vehicles, wind energy, and electronics.