Market Definition

The market involves the production and application of semiconductor nanocrystals that emit light when exposed to energy. These dots are formulated using materials such as cadmium selenide, indium phosphide, or perovskites and are synthesized through colloidal, plasma, or lithographic techniques.

Quantum dots are widely used in display technologies, solar cells, bio-imaging, and quantum computing due to their tunable emission and high brightness. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Quantum Dots Market Overview

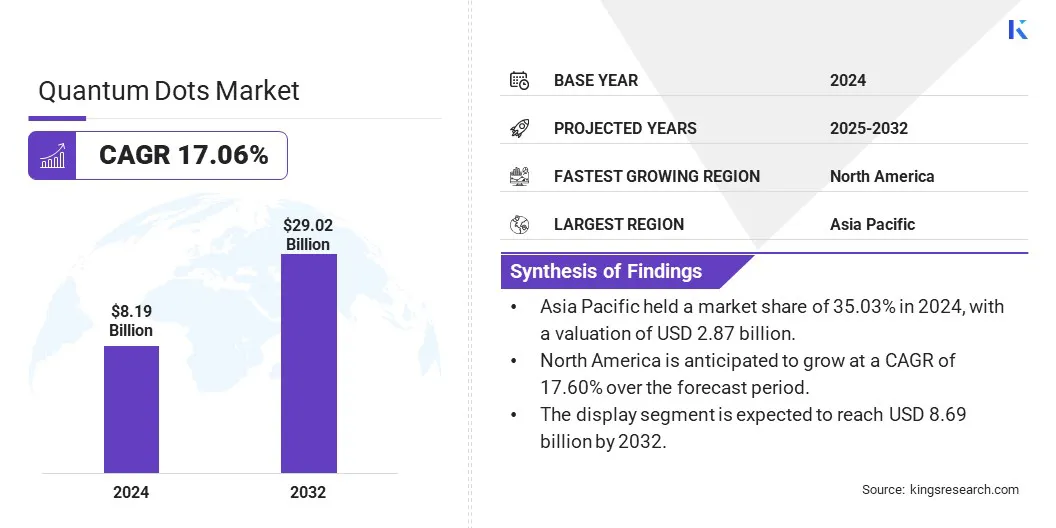

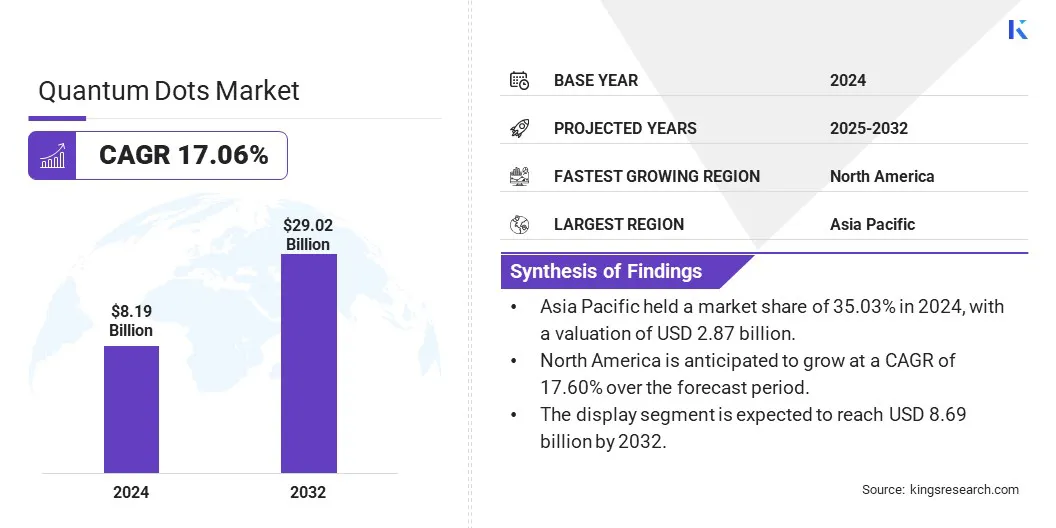

The global quantum dots market size was valued at USD 8.19 billion in 2024 and is projected to grow from USD 9.56 billion in 2025 to USD 29.02 billion by 2032, exhibiting a CAGR of 17.06% during the forecast period.

Market growth is driven by rising demand for high-performance displays, where quantum dots enhance brightness and color precision. Additionally, advancements in quantum computing research are expanding the applications of quantum dot, strengthening their role in next-generation computing technologies and contributing to sustained market expansion.

Major companies operating in the quantum dots industry are SAMSUNG, LG Electronics, BOE Technology Group Co., Ltd., AUO Corporation, Nanoco Group plc, Shoei Electronic Materials, Inc., TCL, Ocean NanoTech, QD Laser, Avantama AG, Merck KGaA, UbiQD, NNCrystal US Corporation, Thermo Fisher Scientific Inc., and Dotz Nano.

Market expansion is mainly fueled by rising application of quantum dots in biomedical imaging and diagnostic tools. Quantum dots provide stronger and more stable fluorescence signals than traditional dyes, allowing for better contrast and longer imaging times. This property is crucial in cancer detection, cellular tagging, and real-time imaging.

With growing investments in medical research and the need for more precise diagnostic tools, healthcare institutions are increasingly adopting quantum dot-based imaging technologies.

- In May 2025, researchers at the Indian Institute of Technology Indore unveiled a Quantum AI nanotechnology that integrates quantum transport with explainable AI. This innovation enables early and accurate detection of genetic mutations, including cancer-related, by decoding raw electric signals, offering a cost-effective and high-resolution DNA sequencing solution.

Key Highlights

- The quantum dots market size was valued at USD 8.19 billion in 2024.

- The market is projected to grow at a CAGR of 17.06% from 2025 to 2032.

- Asia Pacific held a market share of 35.03% in 2024, with a valuation of USD 2.87 billion.

- The cadmium-free segment garnered USD 4.91 billion in revenue in 2024.

- The display segment is expected to reach USD 8.69 billion by 2032.

- The consumer segment secured the largest revenue share of 28.08% in 2024.

- North America is anticipated to grow at a CAGR of 17.60% over the forecast period.

Market Driver

Rising Demand for High-Performance Displays

The shift toward advanced display technologies in televisions, monitors, and smartphones is fueling the growth of the market. Quantum dots offer improved brightness, color precision, and energy efficiency, which makes them ideal for ultra-high-definition and next-generation displays.

Manufacturers are increasingly integrating these materials into QLED and QD-OLED products, creating consistent demand across consumer electronics. The expansion of premium display segments has positioned quantum dots as a critical component in maintaining competitive advantage in the display industry.

- In May 2025, Samsung Display showcased its enhanced Electroluminescent Quantum Dot (EL-QD) prototypes at SID 2025, including a 400-nit high-brightness model and a 264 PPI high-resolution version. These developments mark significant progress toward next-generation self-emissive QD displays.

Market Challenge

Use of Heavy Metal-Based Quantum Dots

A significant challenge restraining the growth of the quantum dots market is the use of heavy metals such as cadmium, which raises environmental and health concerns. These materials face strict regulations in many countries, limiting their adoption, especially in consumer electronics and medical applications.

To address this, key players are developing cadmium-free quantum dots using safer alternatives such as indium phosphide and carbon-based materials. Firms are also investing in eco-friendly synthesis processes and recycling technologies to minimize waste. These approaches help ensure regulatory compliance while maintaining performance, supporting sustainable market growth.

Market Trend

Advancements in Quantum Computing Research

Quantum dots are being explored as building blocks for qubits in quantum computing systems due to their ability to confine single electrons and control spin states. This makes them a strong candidate for scalable quantum architectures.

With increasing investments in quantum technologies by both private and public institutions, the market is benefitting from growing R&D and prototyping activity in this emerging field. Their applicability in quantum logic operations enhances their long-term market potential.

- In February 2025, an international team from QuTech and the University of Copenhagen developed a superconductor-semiconductor hybrid device containing a quantum dot in germanium proximized by a superconductor. This integration enables the potential development of new hybrid quantum processors, combining the advantages of both superconducting and semiconducting qubits.

Quantum Dots Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Cadmium-based, Cadmium-free

|

|

By Product

|

Display, Laser, Solar cells/Modules, Medical Devices, Sensors, Others

|

|

By Vertical

|

Consumer, Healthcare, Automotive, Energy & Utilities, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (Cadmium-based and Cadmium-free): The cadmium-free segment earned USD 4.91 billion in 2024, mainly due to rising regulatory restrictions on toxic substances and growing demand for environmentally safe materials in consumer electronics and healthcare applications.

- By Product (Display, Laser, Solar cells/Modules, Medical Devices, Sensors, and Others): The display segment held a share of 29.90% in 2024, propelled by its widespread integration in high-end televisions and monitors, where enhanced color accuracy and brightness offer a competitive advantage.

- By Vertical (Consumer, Healthcare, Automotive, Energy & Utilities, and Others): The consumer segment is projected to reach USD 8.16 billion by 2032, owing to high demand for advanced display technologies in televisions, monitors, and smartphones that require superior color accuracy and brightness.

Quantum Dots Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific quantum dots market share stood at around 35.03% in 2024, valued at USD 2.87 billion. Asia Pacific houses major display panel producers that are actively integrating quantum dot technology into their products.

Companies in the region are investing in quantum dot-based QLED and QD-OLED displays to meet demand for higher resolution and wider color ranges. This demand for advanced screen technology, particularly in consumer electronics and televisions, is boosting regional market expansion.

Moreover, the region's strong semiconductor production and R&D capabilities boost this growth. The region’s emphasis on miniaturization and performance enhancement has created demand for quantum dot-based components in photonics and microelectronics. Local companies are increasingly incorporating quantum dots in sensors, lasers, and photodetectors where precision and optical clarity are critical.

- In May 2025, at Display Week 2025, Nanosys showcased several quantum dot innovations, including a QD-LCD for automotive applications with over 110% NTSC color gamut under high ambient light conditions. They also demonstrated advancements in QD-OLED and QD-MiniLED displays, highlighting the integration of quantum dots in various display technologies.

The North America quantum dots industry is estimated to grow at a robust CAGR of 17.60% over the forecast period. The regional market benefits from a well-established research ecosystem comprising universities, national labs, and private research centers.

Substantial government and private funding directed toward nanotechnology, including quantum dot development accelerates innovation, optimizes formulations, and scales production. This facilitates the rapid commercialization of quantum dot applications across electronics, healthcare, and energy sectors.

- In February 2025, U.S. Senators introduced the bipartisan DOE Quantum Leadership Act of 2025, proposing over USD 2.5 billion in funding to advance quantum research and development through 2030. The bill aims to strengthen the Department of Energy's quantum initiatives by addressing supply chain challenges, workforce development, and commercialization.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates quantum dots under the Toxic Substances Control Act (TSCA), requiring pre-manufacture notifications, particularly for cadmium-containing materials. The Food and Drug Administration (FDA) oversees medical quantum dot applications, classifying them as combination products subject to both device and drug regulations. Additionally, states such as California enforce Proposition 65, mandating warnings for products containing hazardous substances like cadmium, adding another compliance layer.

- In the European Union, quantum dots regulated primarily under the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation, which mandates safety data, particularly for cadmium-based dots. The Restriction of Hazardous Substances Directive (RoHS) limits cadmium use in electronic equipment. For medical applications, the Medical Device Regulation (MDR) requires thorough environmental risk assessments of nanomaterials, ensuring strict safety and sustainability compliance across member states.

- In China, the National Medical Products Administration (NMPA) regulates quantum dot-based diagnostics, granting conditional approvals with ongoing safety monitoring. The country’s GB standards support industrial scalability, accelerating commercialization, particularly in displays. These regulations balance innovation with safety, allowing quicker market entry for quantum dot products while maintaining oversight on material safety and manufacturing standards.

- In Japan, Pharmaceuticals and Medical Devices Agency (PMDA) offers accelerated approval pathways for innovative quantum dot medical devices through programs such as Sakigake. The Home Appliance Recycling Law classifies quantum dot displays as recyclable, mandating manufacturers to ensure high material recovery rates.

Competitive Landscape

Major players in the quantum dots market are adopting strategies such as launching advanced quantum dot display solutions with enhanced color accuracy and stability. These innovations address the demand for ultra-precise color performance in specialized applications such as virtual production and premium retail displays.

These developments contribute to the higher adoption quantum dots by expanding product capabilities and meeting the needs of high-end technology sectors.

- In March 2025, Saphlux introduced the QD-COB Pro, a professional-grade quantum dot Micro-LED display solution. This technology offers full-angle color accuracy without color shift, making it ideal for applications that require ultra-precise color performance, including virtual production and premium retail displays.

List of Key Companies in Quantum Dots Market:

- SAMSUNG

- LG Electronics

- BOE Technology Group Co., Ltd.

- AUO Corporation

- Nanoco Group plc

- Shoei Electronic Materials, Inc.

- TCL

- Ocean NanoTech

- QD Laser

- Avantama AG

- Merck KGaA

- UbiQD

- NNCrystal US Corporation

- Thermo Fisher Scientific Inc.

- Dotz Nano

Recent Developments (M&A/Expansion/Product Launch)

- In May 2025, TCL launched its new lineup of QD Mini-LED and QLED televisions in India, including models such as the C6K and C6KS QD Mini-LED TVs. These TVs aim to offer enhanced viewing quality with improved brightness, contrast, and color accuracy, catering to the growing demand for advanced display technologies in the region.

- In March 2025, Nvidia announced plans to establish the Nvidia Accelerated Quantum Research Center (NVAQC) in Boston, collaborating with Harvard and MIT. The center will focus on advancing quantum computing research, including quantum dot applications, and will partner with companies such as Quantinuum and QuEra Computing.

- In October 2024, Samsung Display launched a quantum dot ink recycling technology that recovers 80% of used QD ink. This breakthrough method is projected to generate annual savings of around USD 7.3 million.

- In September 2023, Shoei Electronic Materials acquired the quantum dot business from Nanosys, including its research and development team and assets. This strategic move enhances Shoei's foothold in advanced materials, while Nanosys remains focused on innovating and providing high-quality quantum dot technology worldwide.