Market Definition

Polyvinylidene fluoride (PVDF) membranes are advanced filtration materials that provide high chemical resistance and thermal stability. They are widely known for their ability to deliver precise separation performance in both hydrophobic and hydrophilic forms. The scope of this market spans technologies such as microfiltration, ultrafiltration, and nanofiltration, supporting applications in filtration, sample preparation, purification, and bead-based assays.

PVDF Membrane Market Overview

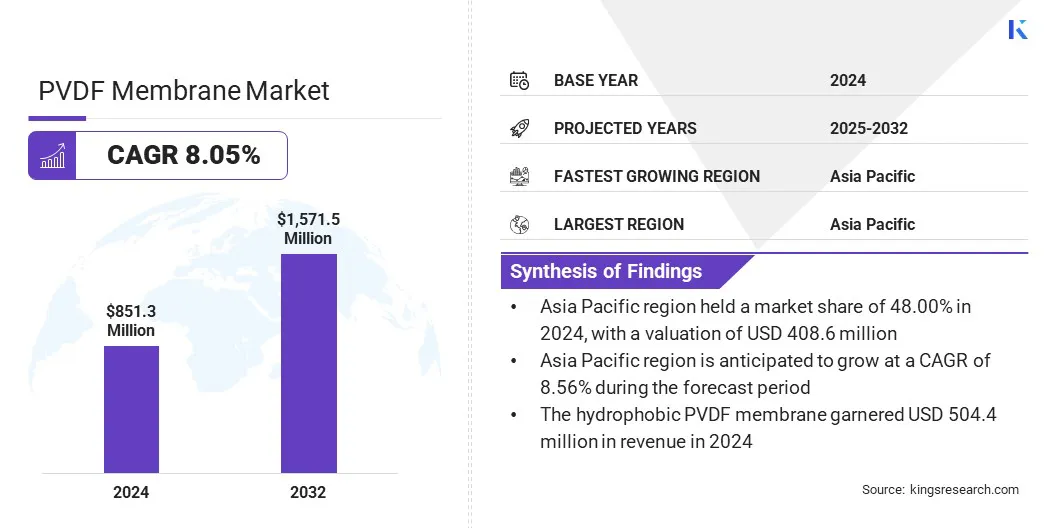

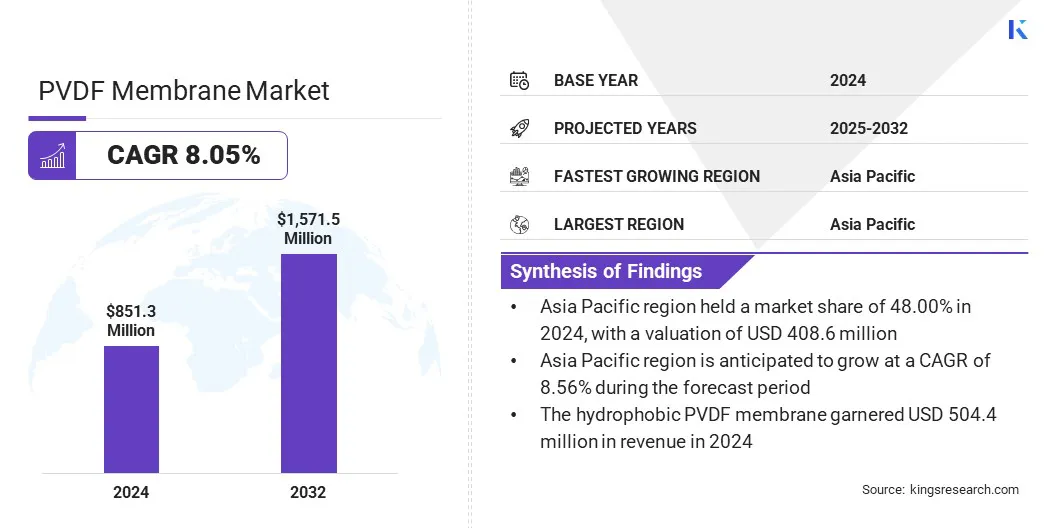

The global PVDF membrane market size was valued at USD 851.3 million in 2024 and is projected to grow from USD 914.0 million in 2025 to USD 1,571.5 million by 2032, exhibiting a CAGR of 8.05% during the forecast period.

This growth is fueled by the increasing demand for membrane solutions in water and wastewater treatment, supported by the need for efficient purification and compliance with quality standards. Research and development efforts are focused on the production of green PVDF membranes, with companies exploring eco-friendly solvents and sustainable manufacturing processes.

Key Highlights:

- The PVDF membrane industry size was recorded at USD 851.3 million in 2024.

- The market is projected to grow at a CAGR of 8.05% from 2025 to 2032.

- Asia Pacific held a share of 48.00% in 2024, valued at USD 408.6 million.

- The hydrophobic PVDF membrane segment garnered USD 504.4 million in revenue in 2024.

- The microfiltration segment is expected to reach USD 650.7 million by 2032.

- The filtration segment is projected to generate USD 598.9 million by 2032.

- The biopharmaceutical & biotechnology segment is estimated to reach USD 728.4 million by 2032.

- North America is anticipated to grow at a CAGR of 7.47% over the forecast period.

Major companies operating in the PVDF membrane market are Pall Corporation, Thermo Fisher Scientific Inc., TORAY INDUSTRIES, INC., GVS S.p.A., Synder Filtration, Inc., Membrane Solutions, LLC, Meissner Corporation, Cobetter Filtration Equipment Co., Ltd, Asahi Kasei Corporation, LG Chem, Ltd., Sterlitech Corporation, RisingSun Membrane Technology Co., Ltd, Hongtek Filtration Co., Ltd., Elabscience, and ALWSCI.

Companies are developing virus removal filters that provide high-purity separation and effective pathogen clearance for biotherapeutics manufacturing. These filters address the growing demand for reliable filtration technologies in biopharmaceutical production.

They offer consistent performance, reduce processing time, and enhance operational efficiency in complex manufacturing processes. Adoption of these advanced filtration solutions supports compliance with regulatory standards and facilitates safe and efficient production of biotherapeutic products.

- In October 2024, Asahi Kasei Medical launched the Planova FG1 next-generation virus removal filter for biotherapeutic manufacturing. The filter features higher flux and improved filtration speed, providing robust virus removal while maintaining high protein recovery. It is compatible with standard CIP and SIP processes and can be integrated with existing biopharmaceutical equipment.

Market Driver

Growing Demand for Membrane Solutions in Water and Wastewater Treatment

The expansion of the PVDF membrane market is fueled by the growing demand for membrane solutions in water and wastewater treatment. Rapid urbanization and industrial expansion have increased the need for effective filtration systems to ensure safe and clean water supply.

PVDF membranes are widely adopted as they provide high chemical resistance, thermal stability, and long service life, making them suitable for removing impurities, bacteria, and suspended solids. This rising demand for advanced water treatment solutions supports market growth through increased adoption of PVDF membranes across municipal and industrial applications.

- In December 2024, LG Water Solutions launched two new product lines for water treatment such as QuantumFlux UF/MBR membranes and QuantumPure IX resins. QuantumFlux membranes use advanced PVDF chemistry through the TIPS process, providing chemical and mechanical durability for ultrafiltration and membrane bioreactor applications in water and wastewater treatment.

Market Challenge

Stringent Regulatory Requirements

A major challenge hindering the progress of the PVDF membrane market is the strict regulatory requirements for chemical safety, environmental compliance, and material certifications across different regions.

Compliance with standards such as FDA regulations and REACH in Europe increases production complexity and operational costs for manufacturers. This regulatory burden can slow product launches and limit market expansion. To address this challenge, companies are implementing robust quality management systems, adopting environmentally compliant production methods, and ensuring thorough documentation to meet global regulatory standards efficiently.

Market Trend

Development of Green PVDF Membranes

The PVDF membrane market is experiencing a notable trend toward the development of green PVDF membranes to enhance sustainability in manufacturing processes. Industry players and research institutions are prioritizing the use of eco-friendly solvents and optimizing production methods to reduce environmental impact. This approach addresses evolving regulatory standards and growing demand for environmentally responsible technologies across sectors.

Companies are integrating these green membranes into existing production lines and exploring new applications in water treatment, pharmaceuticals, and food processing. Continuous research in sustainable PVDF materials improves process efficiency and broadens the application scope of membrane technologies.

- In November 2024, researchers at Nanjing Tech University and Sichuan University developed a green PVDF membrane for membrane distillation in water treatment. The membrane achieved a water vapor flux of 18.49 kg·m−2·h−1 and over 99.97% salt rejection during 24 hours of continuous operation.

PVDF Membrane Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Hydrophobic PVDF Membrane, Hydrophilic PVDF Membrane

|

|

By Technology

|

Microfiltration, Ultrafiltration, Nanofiltration

|

|

By Application

|

Filtration, Sample Preparation, Bead-based Assays, Others

|

|

By End Use Industry

|

Biopharmaceutical & Biotechnology, Water and Wastewater Treatment, Food & Beverage, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Hydrophobic PVDF Membrane, and Hydrophilic PVDF Membrane): The hydrophobic PVDF membrane segment earned USD 504.4 million in 2024, primarily due to its widespread use in sterilizing filtration of gases and aggressive solvents.

- By Technology (Microfiltration, Ultrafiltration, and Nanofiltration): The microfiltration segment held a share of 41.68% in 2024, propelled by its effectiveness in removing bacteria and fine particulates in bioprocessing and water treatment.

- By Application (Filtration, Sample Preparation, Bead-based Assays, and Others): The filtration segment is projected to reach USD 598.9 million by 2032, owing to increasing demand for high-performance membranes in critical liquid purification processes.

- By End Use Industry (Biopharmaceutical & Biotechnology, Water and Wastewater Treatment, Food & Beverage, and Others): The biopharmaceutical & biotechnology segment is estimated to reach USD 728.4 million by 2032, owing to rising use of PVDF membranes in drug development, protein purification, and cell culture applications.

PVDF Membrane Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific PVDF membrane market share stood at 48.00% in 2024, valued at USD 408.6 million. This dominance is reinforced by rapid industrial growth in chemical and semiconductor manufacturing across countries such as China, Japan, and South Korea.

The expansion of chemical plants and semiconductor fabrication units is increasing demand for high-performance filtration solutions, including PVDF membranes, to ensure product purity and process efficiency. This regional industrial expansion supports growth by increasing the adoption of PVDF membranes across critical manufacturing processes.

The North America PVDF membrane industry is poised to grow at a significant CAGR of 7.47% over the forecast period. This growth is fostered by increased investments by private companies in new PVDF production facilities, ensuring a stable supply of raw materials for membrane manufacturing.

These investments enhance production capacity and reduce dependency on imports, enabling manufacturers to meet rising demand in water treatment, pharmaceuticals, and industrial filtration. The strategic expansion of production capabilities aids regional market growth.

- In February 2025, Arkema announced a 15% expansion of its PVDF production capacity at the Calvert City, Kentucky, facility, investing approximately USD 20 million. The expansion targets innovative PVDF grades for electric vehicle and energy storage applications, as well as semiconductor and cable manufacturing.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates PVDF membranes under Title 21, Code of Federal Regulations, Section 177.2510, permitting their use in direct food contact applications.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA), under the Ministry of Health, Labor and Welfare (MHLW), regulates medical devices, including PVDF-based components, through the Pharmaceuticals and Medical Devices Act (PMD Act).

- In Europe, the European Chemicals Agency (ECHA) oversees PVDF membranes under the REACH regulation, ensuring compliance with chemical safety standards.

Competitive Landscape

Key players in the PVDF membrane industry are focusing on innovations and product launches featuring larger membrane surface area. These designs enhance filtration efficiency and improve throughput in critical processes. Companies are introducing PVDF membranes that optimize packing and operational performance in filtration systems.

Continuous innovation in membrane surface area allows firms to strengthen their competitive position and expand applications across water treatment, biopharmaceuticals, and food and beverage processing, meeting growing demands.

- In November 2024, Veolia Water Technologies & Solutions launched the ZW1500 XT model for the South Asia market during IFAT 2024. The upgraded membrane offers a 120-square-meter surface area with new-generation PVDF hollow fibers, improved fouling resistance, and enhanced hydrophilicity. It delivers high-quality treated water while minimizing land footprint and maximizing filtration efficiency.

Top Key Companies in PVDF Membrane Market:

- Pall Corporation

- Thermo Fisher Scientific Inc.

- TORAY INDUSTRIES, INC.

- GVS S.p.A.

- Synder Filtration, Inc.

- Membrane Solutions,LLC

- Meissner Corporation

- Cobetter Filtration Equipment Co.,Ltd

- Asahi Kasei Corporation

- LG Chem, Ltd.

- Sterlitech Corporation

- RisingSun Membrane Technology Co., Ltd

- Hongtek Filtration Co., Ltd.

- Elabscience

- ALWSCI

Recent Developments

- In May 2024, Asahi Kasei Medical inaugurated a new assembly plant in Nobeoka, Miyazaki, Japan, to produce Planova virus removal filters. The facility manufactures cellulose and hydrophilic PVDF hollow-fiber membrane filters for biotherapeutic manufacturing, including monoclonal antibodies and plasma derivatives.