Ultrafiltration Market Snapshot

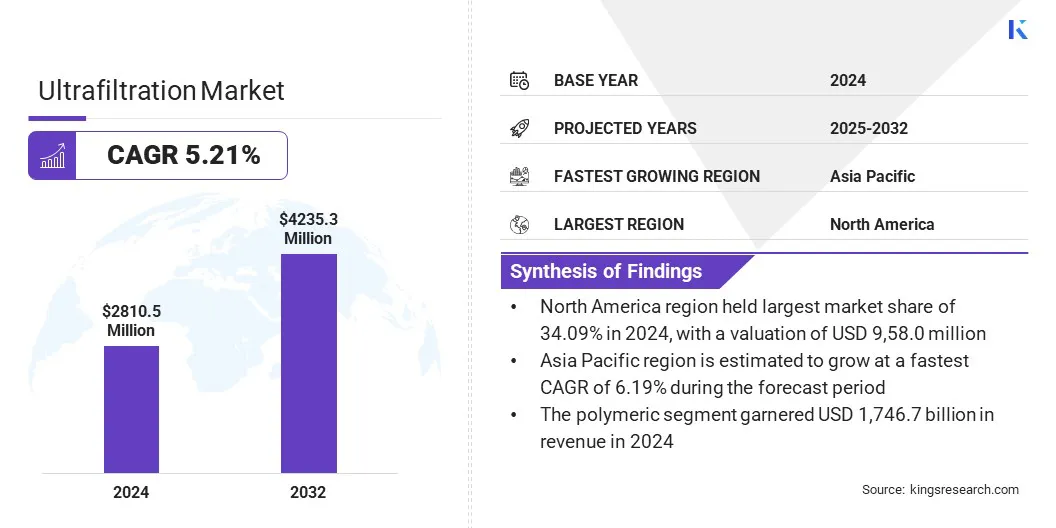

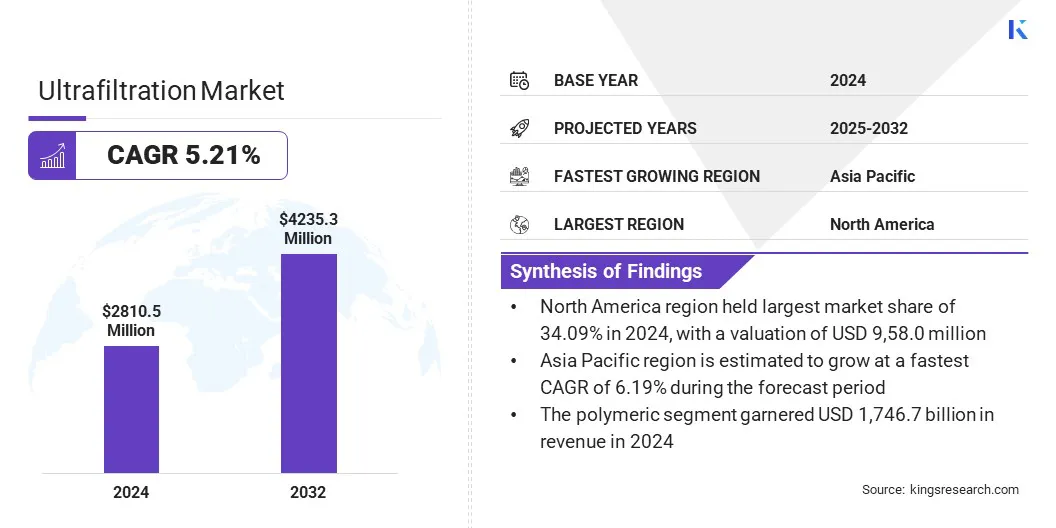

According to Kings Research, the global ultrafiltration market size was valued at USD 2,810.5 million in 2024 and is projected to grow from USD 2,950.5 million in 2025 to USD 4,235.3 million by 2032, exhibiting a CAGR of 5.21% during the forecast period. This growth is fueled by rising demand in the pharmaceutical and biotechnology sectors, supported by stringent quality standards requiring high-purity water and advanced filtration for sterility and contaminant removal.

Additionally, integrating ultrafiltration within zero liquid discharge systems enhances wastewater treatment, resource recovery, and sustainable water management.

Key Market Highlights:

- The global market size was recorded at USD 2,810.5 million in 2024.

- The market is projected to grow at a CAGR of 5.21% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 958.0 million.

- The polymeric segment garnered USD 1,746.7 million in revenue in 2024.

- The hollow fiber segment is expected to reach USD 1,767.1 million by 2032.

- The municipal treatment segment is anticipated to witness the fastest CAGR of 5.76% over the forecast period.

- Asia Pacific is estimated to grow at a CAGR of 6.19% through the projection period.

Major companies operating in the ultrafiltration industry are Berghof Group, APPLIED MEMBRANES, INC., Pall Corporation, 3M, AECOM, Trucent, DuPont, Genex Utility Management Pvt. Ltd., Pentair, Synder Filtration, Inc., Sterlitech Corporation, Kovalus Separation Solutions, ALFA LAVAL, BWT Holding GmbH, and Xylem.

Ultrafiltration Market Overview

Market expansion is fueled by the increasing adoption of membrane technologies for water reuse and recycling initiatives across industrial and municipal sectors. As global water demand rises, ultrafiltration systems are being integrated with reverse osmosis to treat wastewater and industrial effluent efficiently.

Advanced UF membranes with enhanced removal performance reduce the operational burden on RO systems, lower chemical usage, and support the production of high-quality recycled water, aligning with sustainability goals and reducing overall treatment costs and environmental impact.

- In February 2025, Toray Industries developed a high-removal ultrafiltration membrane that maintains water permeability while reducing the load on reverse osmosis membranes, thereby enhancing wastewater reuse. By analyzing nanopore formation using advanced radiation and simulations, Toray precisely controlled polymer materials to produce finer, more numerous nanopores. This innovation improves biopolymer removal, lowers cleaning frequency, reduces costs, and decreases carbon emissions in water recycling.

Surging Demand From Pharmaceutical and Biotech Industries

The progress of the market is propelled by the expansion of the pharmaceutical and biotechnology industries that demand high-purity water for manufacturing processes, including injection preparation and bioproduct filtration.

Increasingly stringent quality standards and regulatory requirements necessitate advanced filtration technologies to ensure sterility and contaminant removal.

Ultrafiltration membranes, particularly hollow-fiber types, provide reliable separation of microorganisms and endotoxins, supporting production efficiency and product safety. This rising need for ultrapure water significantly fuels the adoption of ultrafiltration solutions in these sectors.

- In April 2024, Asahi Kasei launched a membrane system for producing Water for Injection (WFI), offering an efficient alternative to traditional distillation. Utilizing its Microza hollow-fiber membrane, the system reduces steam generation, lowering CO2 emissions and production costs. Asahi Kasei’s Microza technology is well-regarded across pharmaceuticals, biotech, food processing, and water treatment for high filtration performance and technical support.

Membrane Fouling and Cleaning Requirements Impacting System Efficiency

The development of the ultrafiltration market is hindered by membrane fouling, which occurs when particles, microorganisms, and organic matter accumulate on membrane surfaces. This reduces water flux, increases operational pressure, and lowers system efficiency over time.

Frequent fouling leads to higher maintenance costs and shorter membrane lifespan, impacting overall profitability. Cleaning processes often require downtime and chemical use, further increasing operating expenses.

To address this challenge, companies are developing fouling-resistant membrane materials and advanced pretreatment methods. Innovations include surface-modified membranes and backwashable designs to minimize buildup.

Several players are integrating real-time monitoring to optimize cleaning cycles and focusing on low-fouling polymers and automated cleaning systems.

Increasing Integration of UF in Zero-Liquid Discharge (ZLD) System

The market is witnessing increasing adoption of UF membranes in zero liquid discharge (ZLD) systems to enhance wastewater treatment and resource recovery. This integration improves system efficiency, lowers chemical usage, and enables higher water recovery rates.

It supports sustainable water management by facilitating the recycling of wastewater and extraction of valuable minerals, aligning with stricter environmental regulations and the shift toward circular water solutions.

- In March 2025, Archroma, in partnership with Gradiant, implemented a membrane- and oxidation-based Zero Liquid Discharge (ZLD) solution at its Mahachai plant in Thailand, achieving 90–95% wastewater recovery and mineral extraction. The integration of ultrafiltration in this system enhances water circularity and operational efficiency, positioning the facility as a sustainable model for textile dye production in water-stressed regions.

Ultrafiltration Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Polymeric, Ceramic

|

|

By Module

|

Hollow Fiber, Plate and Frame, Tubular

|

|

By Application

|

Municipal Treatment, Industrial Treatment

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Polymeric and Ceramic): The polymeric segment earned USD 1,746.7 million in 2024 due to its cost-effectiveness, ease of manufacturing, and widespread adoption in municipal and industrial water treatment applications.

- By Module (Hollow Fiber, Plate and Frame, and Tubular): The hollow fiber segmentheld a share of 42.17% in 2024, attributed to its high surface area, compact design, and suitability for large-scale water and wastewater treatment.

- By Application (Municipal Treatment and Industrial Treatment): The industrial treatment segment is projected to reach USD 2,545.4 million by 2032, propelled by increasing regulatory pressure on effluent discharge and rising demand for water reuse across manufacturing sectors.

Ultrafiltration Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America ultrafiltration market share stood at 34.09% in 2024, valued at USD 958.0 million. This dominance is reinforced by the region's well-established pharmaceutical and biotechnology sectors, which demand advanced filtration technologies for high-purity water and bioproduct processing.

Additionally, stringent regulatory frameworks and robust environmental policies in the region boost the adoption of ultrafiltration systems for wastewater treatment and water recycling. These factors, combined with significant investments in research and development, foster technological innovation and foster regional market growth.

The Asia-Pacific ultrafiltration industry is set to grow at a CAGR of 6.19% over the forecast period. This growth is propelled by rapid industrialization and urbanization, which increase the demand for efficient water treatment solutions across municipal and industrial sectors.

Growing awareness of water scarcity and the need for sustainable water management promotes the adoption of advanced ultrafiltration technologies.

Additionally, supportive government initiatives and investments in infrastructure development further stimulate regional market expansion by enhancing access to clean water and promoting environmental compliance throughout the region.

Regulatory Frameworks

- In the U.S., ultrafiltration systems are primarily regulated by the Environmental Protection Agency (EPA), which sets water quality standards, and the Food and Drug Administration (FDA), which oversees ultrafiltration used in food and pharmaceutical applications to ensure safety and compliance.

- In India, ultrafiltration is monitored by the Bureau of Indian Standards (BIS), which sets quality and safety standards, and the Central Pollution Control Board (CPCB), which is responsible for environmental regulations and water treatment guidelines across industries.

Competitive Landscape

Key players in the ultrafiltration market are actively employing strategic initiatives, including mergers and acquisitions, to enhance their market presence and expand product portfolios. Companies are launching innovative ultrafiltration systems to meet diverse application requirements and strengthen competitive positioning.

Collaborations and partnerships are also prevalent, aiming to leverage technological expertise and geographic reach. These concerted efforts are shaping market dynamics, fostering consolidation, and accelerating new product introductions to address evolving customer demands across industries.

- In March 2025, DuPont Water Solutions launched WAVE PRO, an advanced online modeling tool for ultrafiltration applications. It enables precise water treatment system design by simulating process conditions, optimizing configurations, and incorporating project-specific economics, enhancing productivity and operational efficiency across drinking water, industrial, wastewater, and desalination projects.

Key Companies in Ultrafiltration Market:

- Berghof Group

- APPLIED MEMBRANES, INC.

- Pall Corporation

- 3M

- AECOM

- Trucent

- DuPont

- Genex Utility Management Pvt. Ltd.

- Pentair

- Synder Filtration, Inc.

- Sterlitech Corporation

- Kovalus Separation Solutions

- ALFA LAVAL

- BWT Holding GmbH

- Xylem

Recent Developments (Agreement /Product Launch)

- In February 2025, Veralto Corporation announced the acquisition of Austria-based AQUAFIDES, specializing in high-quality UV treatment systems for drinking water, wastewater reuse, and industrial applications. This acquisition complements its ultrafiltration technologies by enhancing integrated water treatment solutions, supporting the production of high-purity water across sectors such as food, beverage, and pharmaceuticals.

- In September 2023, PPG introduced a high-performance ultrafiltration membrane and filter elements for industrial process water and wastewater applications, enhancing water reuse and addressing scarcity. Featuring proprietary antifouling superhydrophilic technology, the membranes resist oil and grease buildup, extend service life, and reduce maintenance and replacement costs, improving operational efficiency and sustainability.