Market Definition

A Membrane Bioreactor (MBR) is a type of wastewater treatment system that combines a biological treatment process with membrane filtration. In an MBR, microorganisms break down organic matter in wastewater, while a membrane filter separates the treated water from the biomass. The membrane helps retain the suspended solids and microorganisms inside the reactor, while allowing treated water to pass through.

Membrane Bioreactor Market Overview

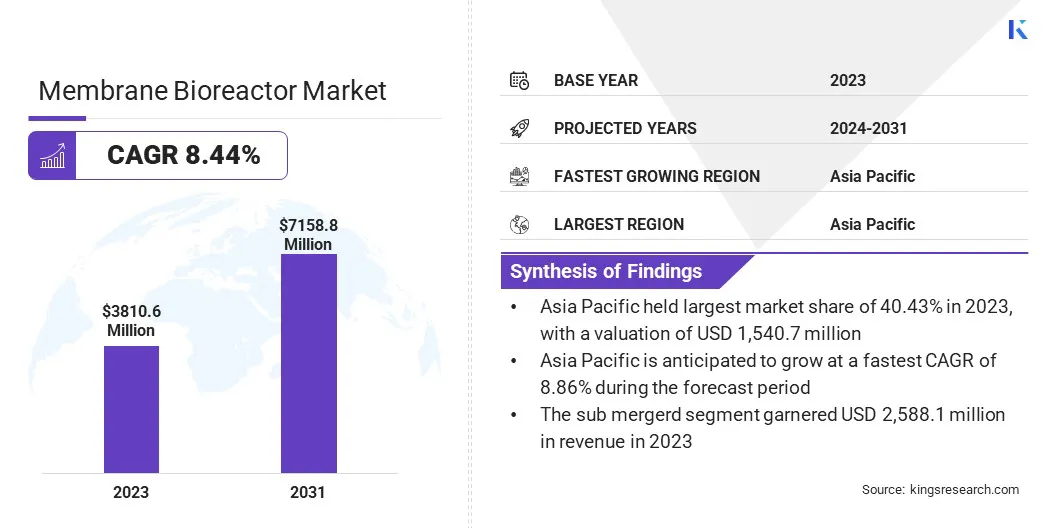

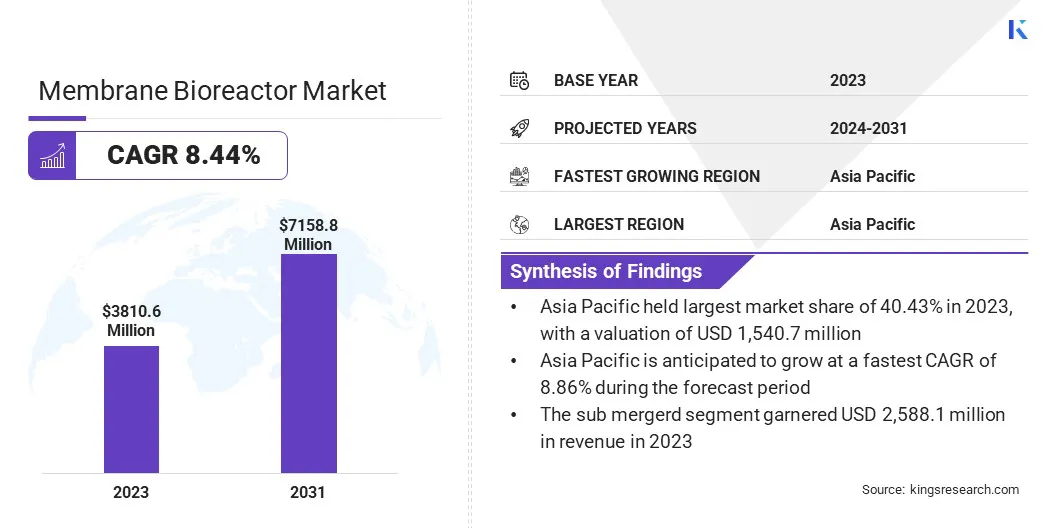

The global membrane bioreactor market size was valued at USD 3,810.6 million in 2023 and is projected to grow from USD 4,060.6 million in 2024 to USD 7,158.8 million by 2031, exhibiting a CAGR of 8.44% during the forecast period.

This market is registering significant growth, due to the increasing demand for efficient and sustainable wastewater treatment solutions for municipal, industrial, and agricultural applications.

The rising awareness of water scarcity, stringent environmental regulations, and the need for water reuse are driving the adoption of MBR systems, which offer superior effluent quality and reduced space requirements compared to traditional treatment methods.

Major companies operating in the membrane bioreactor industry are SUEZ SA, Kubota Corporation, Mitsubishi International Corporation, TORAY INDUSTRIES, INC., Xylem Inc., Veolia Water Technologies, Kovalus Separation Solutions, ALFA LAVAL, Aquatech, VA TECH WABAG LIMITED, Culligan International, Pentair, DuPont de Nemours, Inc., B&P Water Technologies s.r.l., and MANN+HUMMEL Group.

Technological advancements, such as improved membrane materials and automated monitoring systems, are fueling the market. The growing demand for modern infrastructure, including efficient wastewater treatment facilities, is also driving the adoption of MBR technology.

Furthermore, municipalities are seeking advanced water treatment solutions as population density increases and existing water resources become strained, with MBR systems offering an effective answer to these challenges.

- In July 2024, Osmoflo Water Management and CERAFILTEC Germany GmbH partnered to integrate advanced ceramic membranes into water and wastewater treatment systems across Australia and New Zealand. The collaboration focuses on upgrading MBRs, drinking water plants, and water reuse applications, offering a sustainable, energy-efficient alternative to polymeric membranes while supporting UN Sustainable Development Goal 6 for clean water.

Key Highlights:

- The membrane bioreactor industry size was valued at USD 3,810.6 million in 2023.

- The market is projected to grow at a CAGR of 8.44% from 2024 to 2031.

- Asia Pacific held a market share of 40.43% in 2023, with a valuation of USD 1,540.7 million.

- The hollow fiber segment garnered USD 1,916.8 million in revenue in 2023.

- The submerged segment is expected to reach USD 4,805.0 million by 2031.

- The municipal segment is expected to reach USD 4,453.5 million by 2031.

- The market in Europe is anticipated to grow at a CAGR of 8.24% during the forecast period.

Market Driver

"Water Reuse and Efficient Wastewater Treatment Driving the Membrane Bioreactor Market"

The increasing demand for water reuse solutions is a key driver of the membrane bioreactor market. MBR systems treat wastewater efficiently, making it suitable for reuse in various applications such as irrigation, industrial processes, and potable water. This reduces the strain on freshwater supplies as well.

Water scarcity in many regions is creating an urgent need for sustainable solutions that help manage and conserve water resources. MBRs support sustainable water management practices, which is critical in regions facing water shortages. The growing need for efficient wastewater treatment in urban and industrial settings further drives the market.

The volume of wastewater generated increases as urban populations grow and industries expand. Traditional treatment methods may struggle to meet the rising demand for effective, sustainable solutions.

MBR systems are well-suited for urban and industrial settings, as they offer high treatment efficiency, compact design, and the ability to handle large volumes of wastewater with reduced space requirements. This makes them ideal for areas where land is limited or expensive, offering a more scalable and space-efficient solution for wastewater treatment.

- In November 2023, QUA Group introduced the EnviQ RF, an advanced submerged ultrafiltration membrane designed to enhance MBR facility operations. It ensures high-quality effluent in wastewater treatment with its strong mechanical properties and resistance to chlorine and chemicals, making it an effective solution for challenging wastewater filtration.

Market Challenge

"Capital Costs and Membrane Fouling Management as Key Challenges in the Market"

High initial capital cost associated with the installation of MBR systems is a key challenge in the membrane bioreactor market. These advanced systems require significant investment in both infrastructure and technology, which can deter some potential users, especially in developing regions or smaller-scale operations.

However, this challenge can be mitigated by offering modular MBR solutions that allow for scalable investment. This approach enables businesses to start with smaller systems and gradually expand as needed, making it more cost-effective over time.

Membrane fouling is a significant challenge, as it occurs when organic and inorganic materials such as bacteria, sludge, and other particles build up on the membrane surface during the filtration process.

The accumulation forms a layer known as a foulant, which can obstruct the flow of water and reduce the membrane's filtration efficiency. The system requires more frequent cleaning or replacement of membranes as fouling increases, which leads to higher operational costs and longer downtimes.

Additionally, fouling can compromise the quality of treated water and reduce the system's ability to meet regulatory standards for effluent quality. The need to manage fouling effectively is critical for ensuring the continued efficiency and cost-effectiveness of MBR systems, especially in wastewater treatment facilities where high volumes of water are processed continuously.

Market Trend

"Smart Integration and Energy Efficiency Driving Advancements in Membrane Bioreactor Systems"

The integration of MBR technology with smart water management systems is becoming increasingly important. Real-time monitoring and optimization of wastewater treatment processes are now possible, due to the growing emphasis on improving operational efficiency and reducing costs.

Smart systems enable operators to track performance metrics like flow rates, energy consumption, and effluent quality, making it easier to identify potential issues early. This proactive approach helps avoid system downtime and improve overall treatment outcomes.

Additionally, the integration allows for the automation of certain processes, which enhances efficiency, reduces human error, and ensures that MBR systems operate at peak performance, leading to better resource management and cost savings.

The use of energy-efficient MBR systems is becoming increasingly prevalent, as manufacturers develop solutions that reduce operational costs and minimize environmental impact. Amid growing concerns about energy consumption in wastewater treatment, manufacturers are optimizing membrane technology to lower energy usage.

These energy-efficient MBR systems utilize advanced materials and process improvements, ensuring lower power requirements while maintaining high treatment efficiency. This innovation not only reduces overall operational costs but also helps meet stringent environmental regulations, making the systems more appealing for industries aiming to cut down their energy consumption and carbon footprint.

- In March 2023, DuPont launched DuPont Multibore PRO, an advanced PES In-Out Ultrafiltration (UF) membrane with a 19-capillary design, increasing filtration efficiency and reducing the number of required modules. Part of the DuPont IntegraTec UF portfolio, it enhances desalination, municipal, and industrial water treatment by lowering costs, saving space, and improving sustainability.

Membrane Bioreactor Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Hollow Fiber, Flat Sheet, Multi-tubular

|

|

By Configuration

|

Submerged, Side Stream

|

|

By Application

|

Municipal, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Hollow Fiber, Flat Sheet, Multi-tubular): The hollow fiber segment earned USD 1,916.8 million in 2023, due to its high filtration efficiency, compact design, and widespread use in wastewater treatment.

- By Configuration (Submerged, Side Stream): The submerged segment held 67.92% share of the market in 2023, due to its energy efficiency and the ability to handle higher solid loads in wastewater treatment applications.

- By Application (Municipal, Industrial): The municipal segment is projected to reach USD 2,398.3 million by 2031, owing to urban population growth and rising demand for sustainable water treatment solutions.

Membrane Bioreactor Market Regional Analysis

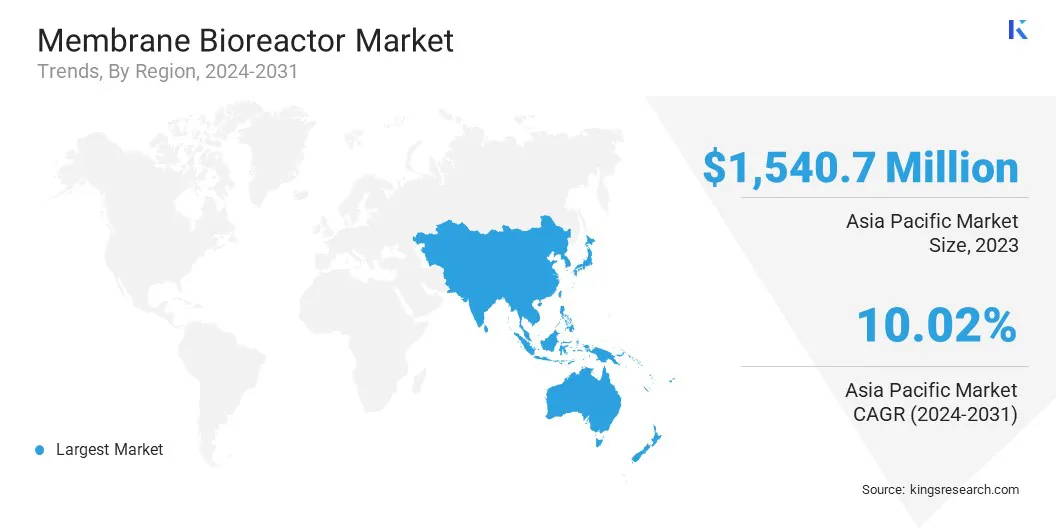

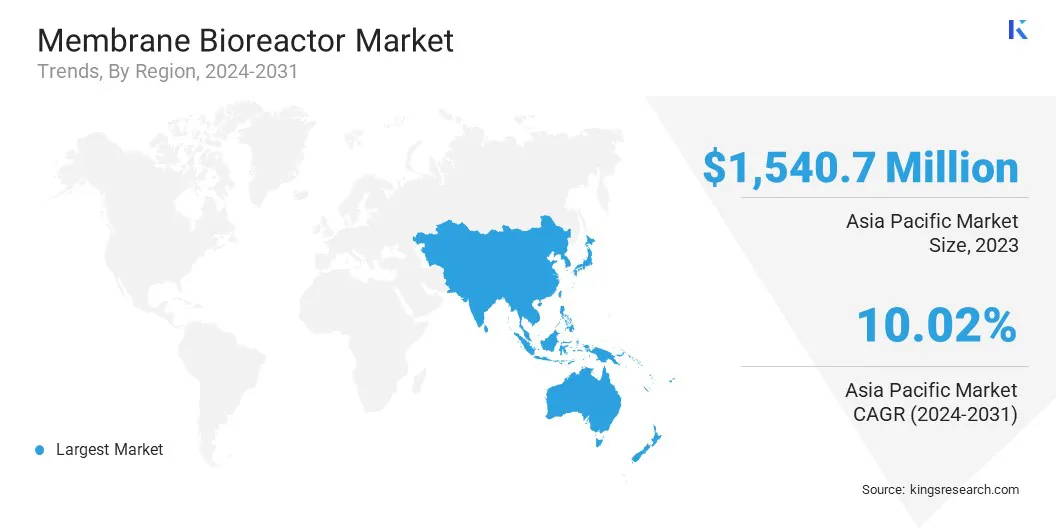

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Asia Pacific accounted for a substantial membrane bioreactor market share of 40.43% in 2023, with a valuation of USD 1,540.7 million. This expansion is attributed to rapid urbanization, industrialization, and increasing demand for advanced wastewater treatment solutions.

Countries like China, India, and Japan are investing heavily in infrastructure development and environmental sustainability, which drives the need for efficient water management systems such as membrane bioreactors.

Additionally, growing concerns over water scarcity, stringent environmental regulations, and the need for water reuse in industrial and municipal applications further contribute to the market growth in the region.

Continuous technological advancements in membrane materials and system design, along with government support for eco-friendly initiatives, are expected to bolster the adoption of membrane bioreactors, solidifying Asia Pacific’s dominance in the global market.

- In December 2024, Icon Water awarded a contract to Seymour Whyte and VINCI Construction Grands Projets to upgrade and extend the Lower Molonglo Water Quality Control Center in Canberra, Australia. The project includes the construction of a new membrane bioreactor with a treatment capacity of 97 Mega Litres of wastewater per day and is part of a 10-year program.

The membrane bioreactor industry in the Middle East & Africa is expected to register the fastest growth in the market, with a projected CAGR of 8.47% over the forecast period. This growth is attributed to several key factors, including the increasing demand for efficient water and wastewater treatment solutions, especially in water-scarce countries.

The growing focus on sustainable water management, combined with urbanization and industrial expansion, has spurred the need for advanced water treatment technologies like MBRs. In the Middle East, countries are actively investing in water treatment infrastructure to meet the rising demand for clean water and address wastewater management challenges.

Additionally, the key drivers for growth in this region include government initiatives for water sustainability, technological advancements in MBR systems, and the increasing awareness of the benefits of water reuse and resource conservation.

The shift toward green and sustainable solutions as well as stringent regulations on wastewater treatment and disposal further supports the expansion of MBR technology in this region.

Regulatory Frameworks Also Play a Significant Role in Shaping the Market

- In the U.S., the Environmental Protection Agency (EPA) regulates membrane bioreactors under the Clean Water State Revolving Fund (CWSRF) and the Safe Drinking Water Act (SDWA). The EPA sets water quality standards and guidelines for wastewater treatment technologies, ensuring that MBRs meet environmental and public health safety requirements.

- In Europe, MBRs are regulated by the European Commission (EC) through various directives, including the Water Framework Directive (WFD) and the Urban Wastewater Treatment Directive (UWWTD). The European Chemicals Agency (ECHA) also oversees the chemicals used in membrane materials to ensure compliance with environmental and safety standards.

- In China, the Ministry of Ecology and Environment (MEE) governs water treatment technologies, including MBR systems. The National Environmental Protection Agency (NEPA) sets regulations and standards for wastewater treatment, emphasizing the integration of advanced technologies like MBRs to improve water quality and environmental protection.

- In Japan, the Ministry of the Environment (MOE) and the Waterworks Bureau of the Ministry of Health, Labour and Welfare (MHLW) regulate the use of MBR systems in wastewater treatment. These authorities establish guidelines to ensure that MBRs comply with national water quality standards and contribute to sustainable water management practices.

Competitive Landscape:

The membrane bioreactor industry is characterized by a large number of participants, including established corporations and rising organizations. Top companies often capitalize on their extensive experience, robust distribution networks, and reputation for delivering reliable, large-scale projects.

These companies frequently focus on refining their existing technologies, expanding their product portfolios, and leveraging global reach to meet the growing demand in municipal, industrial, and agricultural wastewater treatment.

Strategic partnerships, joint ventures, and collaborations enable companies to combine resources, expand market penetration, and accelerate product development. Many participants are investing heavily in Research and Development (R&D) to ensure compliance with evolving environmental regulations and stay ahead of industry trends, particularly the growing emphasis on water reuse and sustainability.

Further consolidation within the market is expected as the demand for advanced wastewater treatment technologies continues to rise, with smaller entities potentially merging or being acquired to enhance capabilities and access broader markets.

- In April 2024, QUA inaugurated its new state-of-the-art membrane manufacturing facility in India, increasing production capacity by four times. The new facility enhances QUA’s ability to meet the growing demand for its diverse portfolio of advanced membrane technologies and reinforces its commitment to innovation and sustainability in water & wastewater treatment.

List of Key Companies in Membrane Bioreactor Market:

- SUEZ SA

- Kubota Corporation

- Mitsubishi International Corporation

- TORAY INDUSTRIES, INC.

- Xylem Inc.

- Veolia Water Technologies

- Kovalus Separation Solutions

- ALFA LAVAL

- Aquatech

- VA TECH WABAG LIMITED

- Culligan International

- Pentair

- DuPont de Nemours, Inc.

- B&P Water Technologies s.r.l.

- MANN+HUMMEL Group

Recent Developments (Acquisitions/Agreements)

- In February 2025, BluMetric Environmental Inc. secured a contract to supply an MBR wastewater treatment system for a private island in the Bahamas. The company also signed a lease for a 25,000-square-foot U.S. manufacturing facility in Gainesville, Florida, to expand capacity and support growth.

- In October 2024, H2O Innovation Inc. acquired NextEra Distributed Water, expanding its Water Infrastructure & Development business line. This acquisition enhances its WaterHub solutions, providing onsite wastewater treatment and reuse with no upfront cost, while strengthening its position in water infrastructure.

- In January 2023, Integrated Water Services Inc. acquired M|MBR Systems through Sciens Water Opportunities Management. The acquisition aims to advance MBR technologies for wastewater treatment and water reuse solutions.