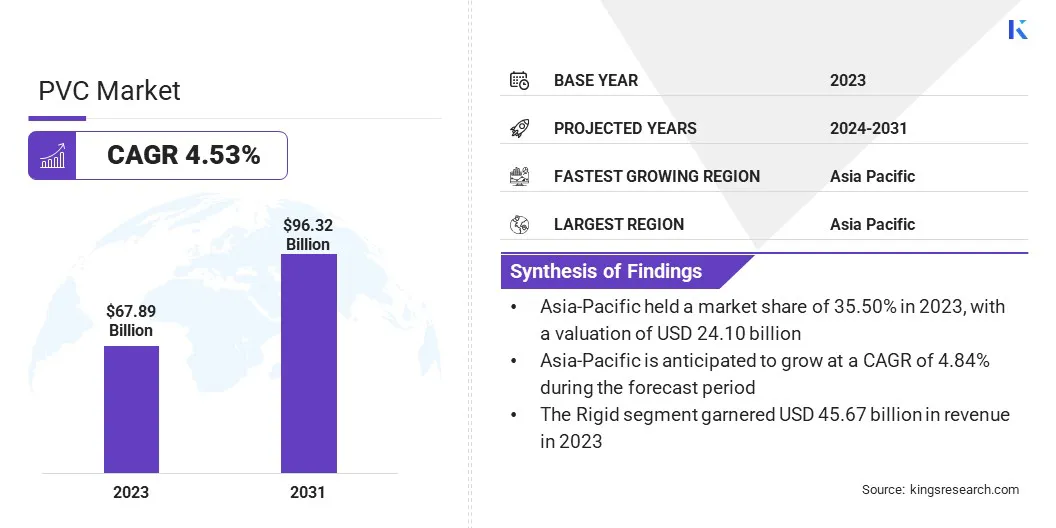

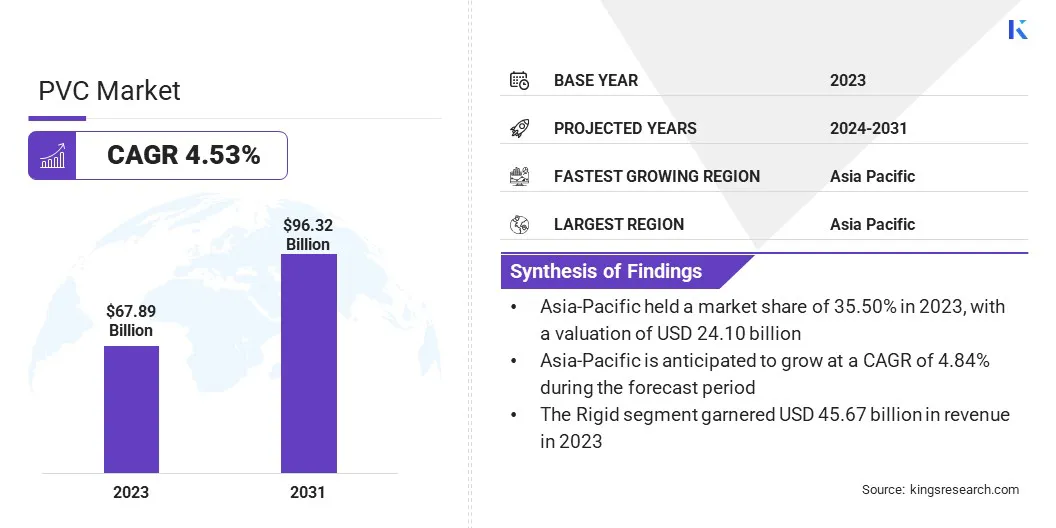

PVC Market Size

The Global PVC (Polyvinyl Chloride) Market size was valued at USD 67.89 billion in 2023 and is projected to grow from USD 70.63 billion in 2024 to USD 96.32 billion by 2031, growing at a CAGR of 4.53% during the forecast period.

The market is driven by its diverse applications across the construction, healthcare, automotive, packaging, electronics, and chemical processing industries, which continuously increase the demand for versatile, durable, and cost-effective PVC products.

In the scope of work, the report includes products offered by companies such as Ashirvad, Diamond Plastics Corporation, JM EAGLE, INC., OTECH CORPORATION, Westlake Corporation, INEOS AG, DCW Ltd., Occidental Petroleum Corporation, Shin-Etsu Chemical Co., Ltd, Ercros S.A, and others.

The PVC market is characterized by its wide-ranging applications across multiple industries, making it a versatile and essential material. It plays a crucial role in the construction, healthcare, automotive, and packaging sectors, offering benefits like durability, flexibility, and cost-effectiveness.

PVC products are known for their long-lasting performance and ability to meet diverse consumer needs. The market is marked by a constant demand for innovation, with manufacturers focusing on improving material properties, production processes, and sustainability to cater to evolving industry requirements.

The PVC market involves the production, distribution, and consumption of PVC, a widely used plastic polymer known for its versatility and durability. It is known for its adaptability for different needs, offering solutions that balance functionality, durability, and ease of production.

The market is segmented by type, application, and end use. The market continues to evolve as innovations in material formulations and production techniques emerge, contributing to PVC’s continued demand in both established and emerging sectors globally.

- In October 2024, Sika Corporation’s Roofing & Waterproofing team celebrated surpassing 100 million pounds of recycled PVC through its "Old Roof Take Back Program." Since 2008, the initiative has reduced landfill waste and conserved resources. Sika is the only PVC roofing manufacturer certified for incorporating 10% recycled vinyl into its products.

Analyst’s Review

The PVC market is currently experiencing a period of volatility, with fluctuating prices and shifting demand patterns across various industries. While the construction and automotive sectors continue to be significant consumers, the market faces pressure from rising production costs and environmental concerns surrounding PVC’s sustainability.

Increased competition from alternative players and growing regulatory scrutiny on plastic use are influencing the market's future trajectory. Despite these constraints, PVC remains integral in multiple applications, suggesting that while short-term disruptions may occur, the material is likely to maintain its relevance in the medium to long term, albeit under evolving market dynamics.

- In November 2024, the Directorate General of Trade Remedies (DGTR) recommended imposing anti-dumping duties on PVC resins imported from countries like China, the US, and Korea, citing price fluctuations that harm domestic producers. This move helps control fluctuating prices and protects local Indian PVC manufacturers, addressing short-term market disruptions.

PVC Market Growth Factors

The PVC market is driven by its affordability and versatility, particularly in the construction sector, where it is used for pipes, cables, and roofing materials. PVC’s resistance to chemical corrosion and degradation, along with its durability, makes it an ideal choice for long-lasting applications, further boosting its demand.

Additionally, the growing use of PVC in the telecommunications industry, for cables and infrastructure, contributes to its market growth. As industries continue to prioritize cost-effective and durable materials, PVC remains a key player in various sectors.

- In February 2024, Bharti Airtel, one of India’s leading telecommunications service providers, announced a partnership with IDEMIA Secure Transactions to transition from virgin plastic to recycled PVC SIM cards. This shift reflects Airtel's commitment to sustainability and reducing its environmental footprint, aligning with the growing demand for eco-friendly alternatives in the telecommunications industry.

Environmental concerns regarding PVC's recyclability and its contribution to plastic waste pose a significant challenge to the PVC market. PVC is often criticized for its recyclability issues and contribution to pollution when improperly disposed of. To address this, the industry is increasingly focusing on developing sustainable practices, such as promoting the use of recycled PVC.

Innovations can improve PVC's recyclability. Additionally, increased awareness and stricter regulations on plastic waste management are driving the companies to adopt eco-friendly and recycled alternatives, thereby mitigating environmental impacts.

- For instance, Coca-Cola has set a goal to incorporate 35% to 40% recycled materials in its primary packaging. This includes increasing the use of recycled plastic to between 30% and 35% by 2025.

PVC Industry Trends

Technological advancements in PVC formulations are driving improvements in both performance and sustainability. Innovations such as the development of more durable, flexible, and weather-resistant PVC are expanding its applications across industries. Additionally, new formulations are making PVC sustainable, addressing environmental concerns.

Enhanced manufacturing techniques help in reducing energy consumption and emissions during production. These advancements are positioning PVC as a sustainable material while maintaining its cost-effectiveness and versatility, enabling its continued use in various sectors.

- REHAU's RAU-FIPRO glass-fiber reinforced PVC exemplifies technological advancements in PVC formulations. This glass-fiber reinforced PVC is utilized in aerospace and automotive, offering superior durability, flexibility, and weather resistance. It addresses the growing demand for sustainable, high-performance materials, expanding PVC's applications while maintaining cost-effectiveness.

The growth of e-commerce and changing consumer lifestyles have significantly increased the demand for PVC packaging solutions. As online shopping continues to rise, there is a greater need for durable, lightweight, and protective packaging materials to ensure product safety during transit.

PVC's versatility and ability to be molded into various shapes make it an ideal choice for packaging in the electronics, food, and healthcare industries. This trend is expected to drive the demand for PVC packaging solutions as consumers seek more efficient and secure delivery options.

Segmentation Analysis

The global market is segmented based on type, application, end-use industry, and geography.

By Type

Based on type, the market is bifurcated into rigid and flexible. The rigid segment led the PVC market in 2023, reaching the valuation of USD 45.67 billion. The demand for rigid PVC is driving the market, due to its durability, versatility, and cost-effectiveness in a wide range of applications.

Rigid PVC is widely used in the construction, automotive, and packaging industries, where it provides reliable protection, structural strength, and resistance to environmental factors. Its ability to be molded into precise shapes for windows, doors, pipes, and other products makes it a preferred choice.

The demand for rigid PVC continues to grow as industries increasingly prioritize long-lasting, low-maintenance materials, fueling market expansion.

By Application

Based on application, the PVC market has been segmented into pipe & fittings, profiles, film & sheet, wire & cables, flooring, and others The pipe & fittings segment secured the largest revenue share of 25.43% in 2023.

PVC is widely used in pipes and fittings, due to its excellent durability, resistance to corrosion, and ease of installation. It is lightweight yet strong, making it ideal for transporting water, chemicals, and gases without the risk of rust or degradation.

PVC’s resistance to chemical corrosion and low maintenance requirements further enhance its appeal for long-term applications in plumbing and construction. These benefits, coupled with its cost-effectiveness, led to its increased adoption in various industries.

By End-use Industry

Based on end-use industry, the market has been classified into construction, packaging, automotive, electrical & electronics, and others. The construction segment is poised for significant growth at a CAGR of 4.92% through the forecast period.

PVC is widely used in the construction industry, due to its versatility, cost-effectiveness, and ease of maintenance. It is highly durable, resistant to weathering, and does not degrade easily, making it ideal for a variety of applications like roofing, flooring, windows, and doors. Its excellent insulation properties help improve energy efficiency in buildings.

Additionally, PVC is lightweight and easy to work with, reducing labor costs and installation time. These advantages have made PVC a popular choice, driving its use in construction projects.

PVC Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 35.50% share of the global PVC market in 2023, with a valuation of USD 24.10 billion. Asia Pacific is the largest and most dominant region for the market, due to its rapid industrialization, booming construction sector, and growing demand for infrastructure development.

Countries like China and India are major consumers of PVC, driven by large-scale housing projects, urbanization, and infrastructure expansion. Additionally, Asia’s robust manufacturing sector, especially in packaging, automotive, and electrical industries, fuels the demand for PVC.

The region's cost-effective production capabilities, along with increasing urban populations, further contribute to Asia's dominance in the global market.

The PVC market in Europe is poised for significant growth over the forecast period at a CAGR of 4.60%. Europe is expected to witness significant growth in the market, due to its focus on sustainability, infrastructure development, and technological advancements.

Increasing demand for eco-friendly and recyclable materials is driving innovation in PVC formulations, making it a preferred choice for construction, automotive, and packaging industries. The region's stringent environmental regulations are also encouraging the use of more sustainable PVC solutions.

Additionally, Europe's growing need for infrastructure upgrades, particularly in water and energy-efficient systems, supports the continued expansion of the PVC market.

Competitive Landscape

The global PVC market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create opportunities for market growth.

List of Key Companies in PVC Market

- Ashirvad

- Diamond Plastics Corporation

- JM EAGLE, INC.

- OTECH CORPORATION

- Westlake Corporation

- INEOS AG

- DCW Ltd.

- Occidental Petroleum Corporation

- Shin-Etsu Chemical Co., Ltd

- Ercros S.A

Key Industry Developments

- September 2024 (Launch): INEOS Inovyn's NEOVYNTM offers a 37% lower carbon footprint than the European industry average for suspension PVC, helping customers reduce their emissions. The first shipment was delivered to Freefoam for its sustainable PVC-UE cladding, known for its long lifespan and recyclability. Produced using renewable energy sources, NEOVYNTM aligns with INEOS Inovyn's commitment to sustainability and carbon reduction in the market, supporting industry goals for greenhouse gas (GHG) reductions by 2030.

The global PVC market is segmented as:

By Type

By Application

- Pipe & Fittings

- Profiles

- Film & Sheet

- Wire & Cables

- Flooring

- Others

By End-use Industry

- Construction

- Packaging

- Automotive

- Electrical & Electronics

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America