Commercial Flooring Market Size

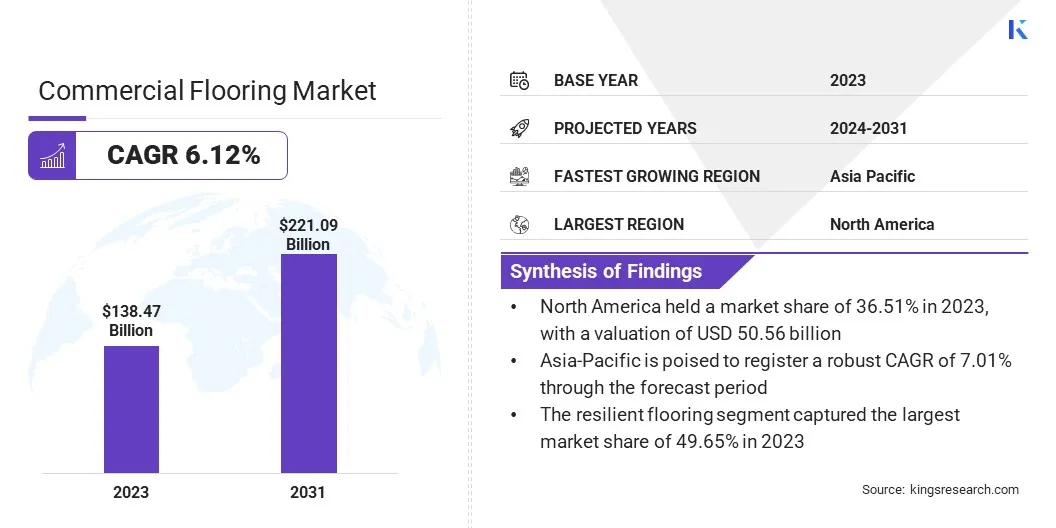

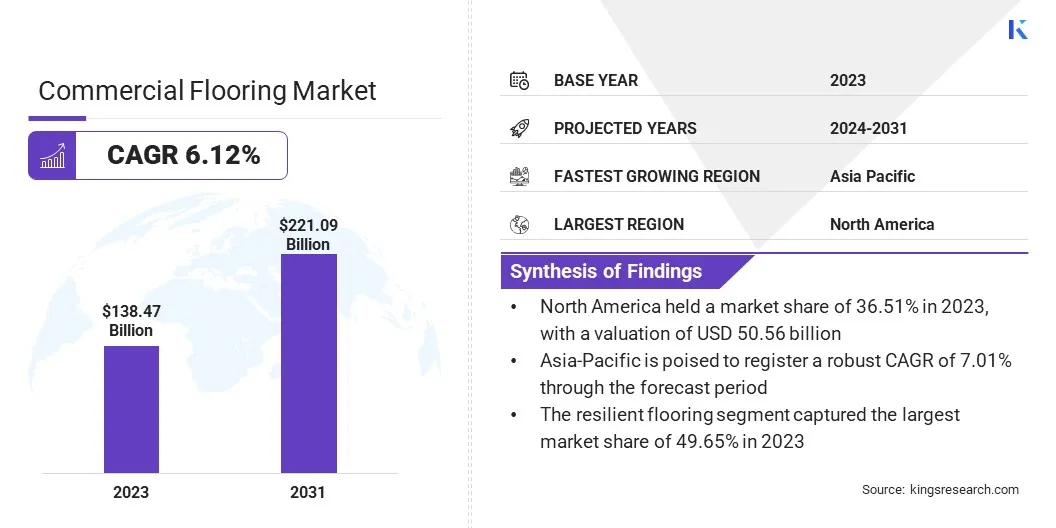

The global Commercial Flooring Market size was valued at USD 138.47 billion in 2023 and is projected to grow from USD 145.87 billion in 2024 to USD 221.09 billion by 2031, exhibiting a CAGR of 6.12% during the forecast period. The expansion of renovation and remodeling projects and rising demand for customizable flooring solutions presents significant opportunities for the development of the market.

In the scope of work, the report includes services offered by companies such as Amtico International, Congoleum, RPM International Inc., Forbo Flooring, Gerflor, Unilin, AB Gustaf Kähr, AHF Products, James Halstead PLC, NOX CORP., and others.

The surging adoption of smart flooring technologies is an emerging trend that is set to revolutionize the commercial flooring market. Smart flooring integrates advanced technologies such as sensors, Internet of Things (IoT) connectivity, and data analytics into traditional flooring systems. These innovations enable floors to monitor and respond to environmental changes, track foot traffic, and provide data-driven insights to optimize space utilization.

For instance, in retail environments, smart floors track customer movements to provide valuable data on shopping patterns, which assists in optimizing store layouts. In healthcare settings, these floors monitor patient movements to prevent falls or alert staff to emergency situations.

The increasing demand for smart buildings and the rise in IoT applications are creating potential growth opportunities. As businesses continue to prioritize safety, efficiency, and data-driven decision-making, the adoption of smart flooring is expected to increase. This trend presents a substantial growth opportunity for flooring manufacturers to innovate and differentiate their offerings in a competitive market.

Commercial flooring refers to the specialized flooring solutions designed to meet the demands of various commercial environments such as offices, retail stores, hospitals, hotels, and educational institutions.

Unlike residential flooring, which prioritizes comfort and aesthetics, commercial flooring is designed to withstand higher foot traffic, greater wear and tear, and more stringent safety and hygiene requirements. These floors are often made from durable materials such as vinyl, linoleum, ceramic tiles, carpet tiles, rubber, and engineered wood. Each material offers unique benefits.

For instance, vinyl and rubber flooring are highly regarded for their durability and ease of maintenance, while carpet tiles are often favored in offices due to their noise reduction and comfort. Applications of commercial flooring are diverse, ranging from slip-resistant surfaces in healthcare and hospitality sectors to high-durability options in retail and industrial spaces.

Selecting the appropriate flooring for commercial settings is critical, as it serves a functional purpose while also enhancing the overall aesthetic and reinforces the brand image of the space. This makes commercial flooring an integral component of interior design and facility management.

Analyst’s Review

The commercial flooring market is experiencing significant growth, fueled by the increasing demand for durable, sustainable, and aesthetically pleasing flooring solutions across various industries. Leading companies in the market are focusing on strategic initiatives such as mergers and acquisitions, partnerships, and investments in research and development to enhance their product portfolios and expand their market presence.

These strategies are aimed at addressing the evolving needs of customers, particularly the growing demand for eco-friendly and technologically advanced flooring options.

- For instance, in April 2023, Gerflor expanded its product line by introducing six new maple designs under the Taraflex brand. These designs were specifically engineered to meet the performance standards required by National Basketball Association (NBA) leagues.

The growth of the market is being supported by the expansion of commercial spaces in emerging markets, which presents new opportunities for key players to penetrate untapped regions. However, to maintain competitiveness, companies must navigate challenges such as fluctuating raw material prices and the high initial costs associated with premium flooring materials.

It is imperative for market leaders to continue innovating and to leverage digital technologies to offer smart and customized solutions that align with the future trends in commercial real estate and interior design.

Commercial Flooring Market Growth Factors

The market is witnessing a notable shift as businesses increasingly focus on aesthetic appeal and interior design. This trend is particularly prominent in various sectors such as retail, hospitality, and corporate offices, where the ambiance of a space directly impacts customer experience and brand perception. The growing emphasis on creating visually appealing environments is boosting the demand for a wider variety of flooring materials, textures, and designs.

This has led manufacturers to innovate with new designs, patterns, and materials that combine functionality with style. As the trend continues, the demand for aesthetically pleasing and high-quality flooring solutions is expected to rise, thereby further stimulating market growth.

Fluctuations in raw material prices pose a significant challenge to the progress of the commercial flooring market, impacting both manufacturers and consumers. The prices of key materials such as PVC, rubber, wood, and adhesives are subject to volatility due to factors such as supply chain disruptions, geopolitical tensions, and changes in global demand.

This volatility may lead to unpredictable cost structures for flooring manufacturers, potentially causing difficulties to maintain stable pricing for their products. Due to this, companies might face reduced profit margins, making it difficult to invest in research and development or to offer competitive pricing to customers.

Additionally, price fluctuations may result in delays in production schedules and affect the overall availability of certain flooring products. To mitigate this challenge, companies are increasingly implementing strategies such as long-term contracts with suppliers, diversification of material sources, and investment in alternative materials that are less susceptible to price volatility.

Effective supply chain management and cost control measures are critical for companies to navigate the uncertainties of raw material price fluctuations and maintain market competitiveness.

Commercial Flooring Market Trends

The rising popularity of sustainable and eco-friendly flooring materials is a major trend reshaping the landscape of the commercial flooring market. As businesses and consumers become more environmentally conscious, there is growing demand for flooring options that minimize their environmental impact.

This includes materials that are sustainably sourced, such as bamboo, cork, and reclaimed wood, as well as products made from recycled content, including recycled rubber or carpet tiles. In addition to their environmental benefits, these materials often contribute to healthier indoor environments by reducing volatile organic compounds (VOCs) and improving air quality.

- For instance, in July 2023, NOX Corporation signed a memorandum of understanding with Aekyung Chemical to enhance the use of eco-friendly plasticizers aimed at reducing carbon emissions in flooring construction. NOX introduced its new eco-friendly LVT to over 50 countries by leveraging Aekyung Chemical's recycled material-based plasticizers through its global distribution network.

The growing shift toward sustainable flooring is further propelled by stricter government regulations and green building standards, which promote the use of eco-friendly materials in construction and renovation projects. Moreover, companies that prioritize sustainability in their flooring choices enhance their corporate image and appeal to environmentally conscious customers.

As this trend continues to grow, manufacturers are likely to increase their investment in the development of innovative, sustainable flooring solutions that meet both aesthetic and environmental standards. This shift supports environmental goals and offers businesses a competitive advantage.

Segmentation Analysis

The global market is segmented based on type, application, and geography.

By Type

Based on type, the market is segmented into resilient, hard surface, and soft surface. The resilient flooring segment captured the largest commercial flooring market share of 49.65% in 2023. This considerable growth is predominantly driven by its exceptional durability, cost-effectiveness, and versatility across various commercial applications.

Resilient flooring, which includes materials such as vinyl, linoleum, and rubber, offers a unique combination of performance benefits that make it particularly attractive in high-traffic commercial environments. These materials are known for their ability to withstand heavy foot traffic, resist stains and moisture, and their provision of a comfortable underfoot experience, which makes them ideal for use in sectors such as healthcare, education, retail, and hospitality.

Additionally, advancements in design and manufacturing have enabled resilient flooring to mimic the appearance of more expensive materials such as wood and stone, offering businesses an affordable option. The ease of installation and maintenance further contributes to its popularity, as businesses seek flooring solutions that minimize downtime and reduce long-term maintenance costs.

The growth of the segment is further bolstered by the growing demand for eco-friendly options, with numerous resilient flooring products being made from recycled or sustainable materials.

By Application

Based on application, the market is classified into commercial buildings, industrial buildings, healthcare facilities, educational institutions, and public spaces. The commercial buildings segment is poised to record a staggering CAGR of 6.82% through the forecast period.

Rapid urbanization and economic expansion in emerging markets are leading to an increased demand for new commercial spaces, including offices, retail outlets, hotels, and healthcare facilities. This expansion is creating substantial growth opportunities for the commercial flooring market, as new constructions require durable, aesthetically appealing, and cost-effective flooring solutions.

Additionally, the growing trend toward modernization and renovation of existing commercial buildings in developed markets is contributing to this growth. An increasing number of businesses are investing heavily in upgrading their facilities to improve energy efficiency, comply with stricter building codes, and enhance the overall ambiance, leading to increased demand for high-quality flooring products.

Furthermore, the increasing adoption of sustainable building practices and the rising focus on creating healthier indoor environments are promoting the use of eco-friendly and innovative flooring materials in commercial buildings. This emphasis on sustainability aligns with global trends in green construction, thereby fueling the growth of the segment.

Moreover, the rise of smart buildings and the integration of advanced technologies into commercial spaces are expected to foster the demand for technologically advanced flooring solutions.

Commercial Flooring Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

North America commercial flooring market accounted for a substantial share of 36.51% and was valued at USD 50.56 billion in 2023. This dominance is largely attributed to the well-established commercial infrastructure across the United States and Canada, where sectors such as healthcare, retail, corporate offices, and hospitality generate substantial demand for high-quality, durable flooring solutions.

The region's major focus on renovation and modernization of existing commercial spaces plays a crucial role, as businesses actively seek to upgrade their interiors to enhance aesthetic appeal, improve energy efficiency, and meet evolving regulatory standards.

Moreover, the regional market is characterized by a strong preference for resilient flooring materials, such as vinyl and rubber, which are highly preferred due to their durability, ease of maintenance, and versatility in design. The growing trend toward sustainable building practices in the region further fuels the demand for eco-friendly flooring options, thereby contributing to the regional market growth.

Additionally, the presence of key market players and continuous technological advancements in flooring solutions bolster North America's leading position in the global market.

Asia-Pacific commercial flooring market is expected to grow at a robust CAGR of 7.01% in the forthcoming years, fueled by rapid urbanization, economic expansion, and increasing investment in commercial infrastructure. Countries such as China, India, and Southeast Asian nations are experiencing significant growth in commercial construction activities, particularly in the sectors of retail, healthcare, hospitality, and office spaces.

The rising middle-class population and increasing disposable incomes in these countries are leading to a strong demand for modern, aesthetically appealing, and durable commercial spaces, thereby fostering the demand for a wide range of flooring solutions.

Additionally, the region's growing emphasis on sustainability and green building practices is promoting the adoption of eco-friendly and innovative flooring materials, thereby supporting domestic market growth. The influx of foreign direct investment (FDI) in the commercial real estate sector, coupled with supportive government initiatives to develop smart cities and modernize infrastructure, is propelling regional market expansion.

Asia-Pacific market is poised to witness considerable growth in the foreseeable future, with Lucrative opportunities for both established players and new entrants to capitalize on the region's dynamic and rapidly evolving landscape.

Competitive Landscape

The global commercial flooring market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Commercial Flooring Market

- Amtico International

- Congoleum

- RPM International Inc.

- Forbo Flooring

- Gerflor

- Unilin

- AB Gustaf Kähr

- AHF Products

- James Halstead PLC

- NOX CORP.

Key Industry Development

- July 2024 (Partnership): AHF Products, a leading provider of commercial and residential hard surface flooring, announced that United Tile has been appointed to represent the Crossville brand in an expanded territory, including California and Hawaii. This strategic expansion offers AHF/Crossville enhanced growth opportunities in these key markets.

The global commercial flooring market is segmented as:

By Type

- Resilient

- Hard Surface

- Soft Surface

By Application

- Commercial Buildings

- Industrial Buildings

- Healthcare Facilities

- Educational Institutions

- Public Spaces

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America