Market Definition

Protective gloves are hand-worn safety gear designed to prevent injury or contamination. They serve as a barrier against hazards such as chemicals, extreme temperatures, sharp objects, and infectious agents.

Made from materials such as rubber, leather, fabric, or synthetic polymers, these gloves are used in various fields, including medicine, construction, and industrial work, to enhance safety and performance.

Protective Gloves Market Overview

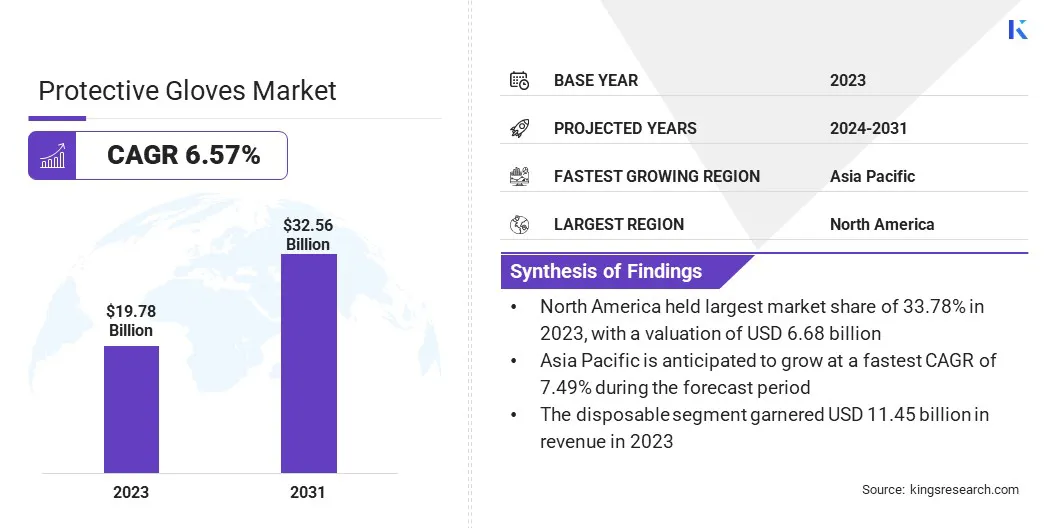

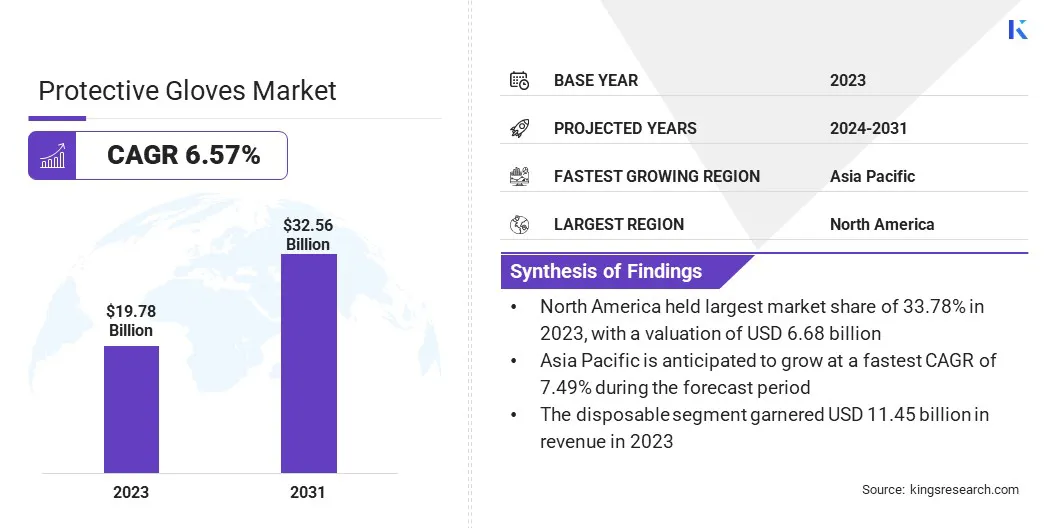

The global protective gloves market size was valued at USD 19.78 billion in 2023 and is projected to grow from USD 20.86 billion in 2024 to USD 32.56 billion by 2031, exhibiting a CAGR of 6.57% during the forecast period.

The market is experiencing significant growth, driven by increasing awareness of workplace safety, stringent regulations, and rising demand across industries such as healthcare, manufacturing, and construction.

The expansion of the healthcare sector, particularly in infection control and hygiene practices, has fueled demand for disposable gloves, while advancements in material technology have led to the development of more durable and comfortable protective gloves.

Additionally, the growing emphasis on personal protective equipment (PPE) in industries handling hazardous materials, along with the rise of automation and precision-based work, has boosted market expansion.

Major companies operating in the protective gloves market are 3M Company, ANSELL LTD., Honeywell International Inc., DuPont de Nemours, Inc., Top Glove Corporation Berhad, Acknit Industries Limited, Delta Plus Group, MCR Safety, Global Glove and Safety Manufacturing, Inc., Radians, Inc., Kimberly-Clark Professional, Cardinal Health, Lakeland Industries, Inc., Avon Protection, and MSA Worldwide, LLC.

The increasing adoption of eco-friendly and biodegradable gloves, coupled with technological innovations enhancing grip, dexterity, and cut resistance, creates new opportunities for market expansion.

- For instance, in September 2024, Mun Australia launched GloveOn COATS Biodegradable, a sustainable nitrile glove incorporating COATS (Colloidal Oatmeal System) technology for enhanced moisturization. These gloves biodegrade up to 90 times faster than traditional nitrile gloves in landfill conditions.

Key Highlights:

- The protective gloves industry size was valued at USD 19.78 billion in 2023.

- The market is projected to grow at a CAGR of 6.57% from 2024 to 2031.

- North America held a share of 33.78% in 2023, valued at USD 6.68 billion.

- The disposable segment garnered USD 11.45 billion in revenue in 2023.

- The latex segment is expected to reach USD 8.70 billion by 2031.

- The healthcare & medical segment is likely to generate a revenue of USD 9.09 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 7.49% over the forecast period.

Market Driver

"Growing Safety Regulations and Hygiene Awareness"

The protective gloves market is experiencing steady growth, primarily due to stringent occupational safety regulations and rising awareness of healthcare and hygiene.

Governments worldwide mandate the use of protective gloves in industries such as construction, manufacturing, oil & gas, and chemical handling to prevent injuries from sharp objects, hazardous substances, and extreme temperatures. As a result, businesses are prioritizing high-quality gloves that meet international safety standards, boosting demand.

Additionally, increased hygiene awareness, particularly in the healthcare sector, is leading to the widespread adoption of protective gloves.

The COVID-19 pandemic underscored the critical role of gloves in preventing contamination and the spread of infections, creating a strong demand across hospitals, laboratories, and food handling industries. Post-pandemic, the emphasis on hygiene and infection control remains high, sustaining demand for disposable gloves.

- In December 2024, Ergodyne introduced ProFlex work gloves, offering enhanced hand protection with high cut resistance, flexibility, and touchscreen capability. Available in nitrile-coated, fully coated, and PU-coated variants, these gloves comply with ANSI/ISEA safety standards while ensuring comfort and performance.

Market Challenge

"Raw Material Volatility and Automation"

The protective gloves market faces notable challenges, including fluctuating raw material prices and declining demand due to automation in certain industries. The costs of key materials such as nitrile, latex, and rubber fluctuate as a result of geopolitical issues, supply chain disruptions, and changing demand patterns.

Geopolitical tensions, such as trade restrictions or conflicts in major rubber-producing regions, can lead to supply shortages and increased tariffs, increasing raw material costs. Additionally, disruptions from natural disasters, labor shortages, or transportation delays affect material availability.

To mitigate these risks, companies are adopting diversified sourcing strategies, alternative materials, and efficient production techniques to reduce reliance on single supply sources and stabilize costs.

Automation and robotics are tranforming industries traditionally relied on manual labor, such as manufacturing, assembly lines, and material handling. As businesses prioritize efficiency, cost reduction, and improved productivity, they are investing heavily in robotic systems and automated machinery to replace human workers in repetitive and hazardous tasks.

This shift reduces the has led to a decline in demand for protective gloves in these industriesr. In response to this, glove manufacturers are diversifying their product offerings by expanding into high-growth sectors such as healthcare, biotechnology, and cleanroom applications, where human involvement remains critical.

Additionally, companies are innovating by developing specialized gloves with enhanced dexterity and sensor compatibility, allowing workers to operate touchscreens and advanced machinery while maintaining safety.

Market Trend

"Growing Focus on Sustainability and Ongoing Technological Advancements"

The protective gloves market is evolving with a focus on sustainability and technological advancements. A key trend is the growing adoption of eco-friendly and biodegradable gloves, supported by increasing environmental concerns and stricter plastic waste regulations.

Manufacturers are developing gloves made from biodegradable materials such as plant-based polymers and natural rubber to reduce ecological impact without compromising durability and protection.

This shift aligns with global sustainability initiatives and meets the rising consumer demand for environmentally responsible products, particularly in industries such as healthcare and food handling, where disposable gloves are extensively used.

Another significant trend is the integration of advanced materials and smart technology in protective gloves to enhance safety, comfort, and functionality. Companies are innovating with high-performance materials such as cut-resistant fibers, chemical-resistant coatings, and antimicrobial treatments to improve protection in hazardous work environments.

Additionally, smart gloves equipped with sensors are gaining traction in industrial applications, providing real-time data on hand movements, grip strength, and exposure to harmful substances. These technological advancements are enhancing worker safety while maintaining efficiency, fostering market growth.

- In July 2024, DEFILADE Protection Systems launched its Protective Deployment Gloves (PDG), designed to meet the demands of law enforcement. The gloves have undergone rigorous testing for flame resistance, as well as abrasion, tear, puncture, and impact protection, ensuring durability and high performance.

Protective Gloves Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Disposable, Reusable

|

|

By Material

|

Latex, Nitrile, Neoprene, Vinyl, Leather, Others

|

|

By End-Use Industry

|

Healthcare & Medical, Manufacturing, Construction, Food & Beverages, Mining, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Disposable and Reusable): The disposable segment earned USD 11.45 billion in 2023 due to its widespread use in healthcare, food processing, and industrial applications requiring single-use protection.

- By Material (Latex, Nitrile, Neoprene, Vinyl, Leather, and Others): The latex segment held a share of 26.86% of in 2023, propelled by its superior elasticity, comfort, and high tactile sensitivity preferred in medical and industrial sectors.

- By End-Use Industry (Healthcare & Medical, Manufacturing, Construction, Food & Beverages, Mining, and Others): The healthcare & medical segment is projected to reach USD 9.09 billion by 2031, fueled by increasing hygiene regulations, rising surgical procedures, and growing awareness of infection control.

Protective Gloves Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America protective gloves market accounted for a substantial share of 33.78% in 2023, valued at USD 6.68 billion. The rising demand from industries such as healthcare, manufacturing, and construction, coupled with the increasing awareness of hand protection in hazardous work environments, is stimulating this expansion.

The presence of leading players and advancements in glove materials, including nitrile and latex alternatives, further contribute to North America's stronghold in the market. Additionally, the region has witnessed an increase in government funding and investments aimed at improving workplace safety, boosting the adoption of high-quality protective gloves.

Furthermore, technological advancements, such as the development of biodegradable and antimicrobial gloves, are supporting regional market growth. The expansion of e-commerce platforms has made protective gloves more accessible, accelerating market penetration.

Asia Pacific protective gloves industry is expected to register the fastest CAGR of 7.49% over the forecast period. The growth is primarily attributed to the rapid industrialization, expanding healthcare sector, and rising worker safety awareness in countries such as China, India, and Japan.

Additionally, Asia Pacific is a major manufacturing hub for protective gloves, with key suppliers and manufacturers expanding production capacity to meet the growing global and regional demand. The rising prevalence of infectious diseases and the increasing adoption of stringent hygiene protocols in hospitals and laboratories are fueling the demand for high-quality protective gloves.

Moreover, the booming e-commerce industry is enhancing the accessibility of protective gloves, allowing businesses and consumers to purchase safety equipment with ease. The availability of cost-effective labor and raw materials further aid regional market expansion.

- In November 2024, DL Chemical commenced commercial operations at its newly completed Cariflex plant in Singapore. The facility is now the world’s largest polyisoprene latex plant, a key material for manufacturing surgical gloves.

Regulatory Framework

- In the U.S., the Occupational Safety and Health Administration (OSHA) regulates protective gloves under workplace safety standards, while the Food and Drug Administration (FDA) oversees thoses used in medical and food-handling applications.

- In Europe, the European Commission (EC) enforces protective glove regulations under the Personal Protective Equipment (PPE) Regulation, while the European Medicines Agency (EMA) ensures compliance with the Medical Device Regulation (MDR) for medical gloves.

- In China, the State Administration for Market Regulation (SAMR) sets quality standards for protective gloves used in industrial and healthcare applications. The National Medical Products Administration (NMPA) regulates medical gloves to meet national health and safety requirements.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) oversees protective gloves under occupational safety regulations, while the Pharmaceuticals and Medical Devices Agency (PMDA) oversees the approval and safety of medical gloves used in healthcare settings.

- In India, the Bureau of Indian Standards (BIS) establishes quality and safety standards for protective gloves across various industries, and the Central Drugs Standard Control Organization (CDSCO) regulates medical gloves for compliance with healthcare safety and performance standards.

Competitive Landscape

The protective gloves industry is characterized by a large number of participants, including both established corporations and emerging players. Companies are focusing on innovation in materials and design to enhance glove performance, durability, and comfort.

Research and development efforts are leading to the introduction of gloves with improved grip, chemical resistance, and touchscreen compatibility, catering to various industry needs.

Sustainability is becoming a key focus, with manufacturers investing in biodegradable and recyclable gloves to meet environmental standards and consumer preferences. The market is witnessing increased investments in quality certifications and regulatory compliance to ensure safety and reliability.

Expanding distribution networks, including e-commerce platforms and direct sales channels, are helping companies reach a broader customer base. Additionally, tailored product offerings for specific industries, including healthcare, food processing, and industrial safety, are propelling market expansion.

- In February 2024, Unigloves and KluraLabs partnered to launch CrossGuard, the first antimicrobial nitrile glove capable of eliminating 99.99% of selected bacteria within 60 seconds. The gloves utilize KluraLabs’ advanced antimicrobial technology without active ingredients, ensuring safety, durability, and sustainability.

List of Key Companies in Protective Gloves Market:

- 3M Company

- ANSELL LTD.

- Honeywell International Inc.

- DuPont de Nemours, Inc.

- Top Glove Corporation Berhad

- Acknit Industries Limited

- Delta Plus Group

- MCR Safety

- Global Glove and Safety Manufacturing, Inc.

- Radians, Inc.

- Kimberly-Clark Professional

- Cardinal Health

- Lakeland Industries, Inc.

- Avon Protection

- MSA Worldwide, LLC

Recent Developments (Acquisitions/Product Launch)

- In December 2024, MAPA Professional introduced the Solo 980, a thick disposable nitrile glove with enhanced protection and durability. The glove offers superior mechanical and chemical resistance, a long cuff for extra coverage, and a latex-free, powder-free composition for comfort and safety.

- In October 2024, Ansell launched AlphaTec 53-002 and 53-003, featuring advanced MICROCHEM technology for superior chemical resistance. AlphaTec 53-003 includes a nylon liner for added durability and heat resistance. Designed for industrial safety, both models are latex- and silicone-free, offering reliable protection against chemical hazards.

- In July 2024, Ansell Limited acquired Kimberly-Clark’s Personal Protective Equipment business, strengthening its position as a global leader in personal protection solutions. The acquisition aims to expand the company’s product portfolio and service capabilities.

- In May 2024, KARAM Safety acquired Midas Safety India, a leading player in hand protection safety products. This strategic move strengthens KARAM’s leadership in the Indian PPE industry by combining its expertise in fall protection with Midas Safety India's extensive hand protection portfolio.