Procurement Outsourcing Market Size

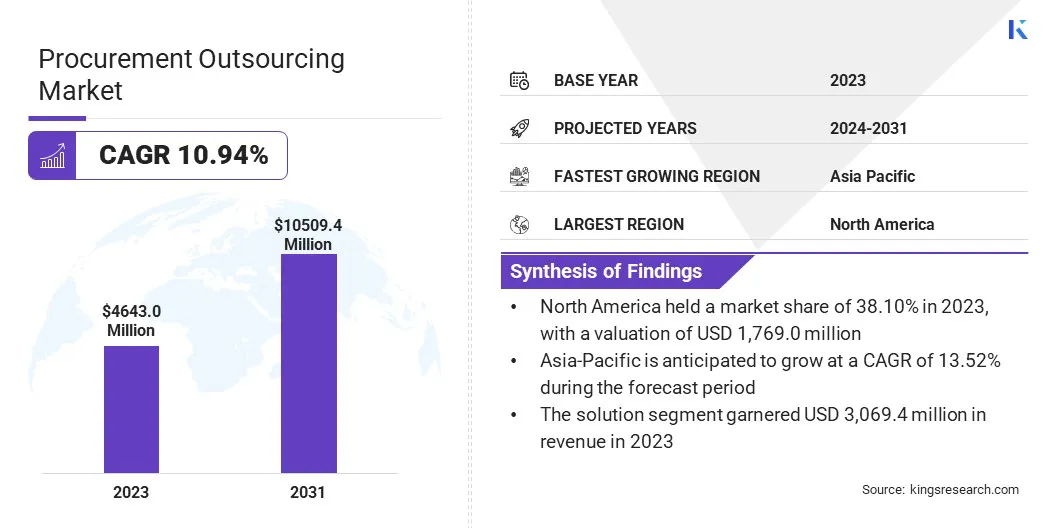

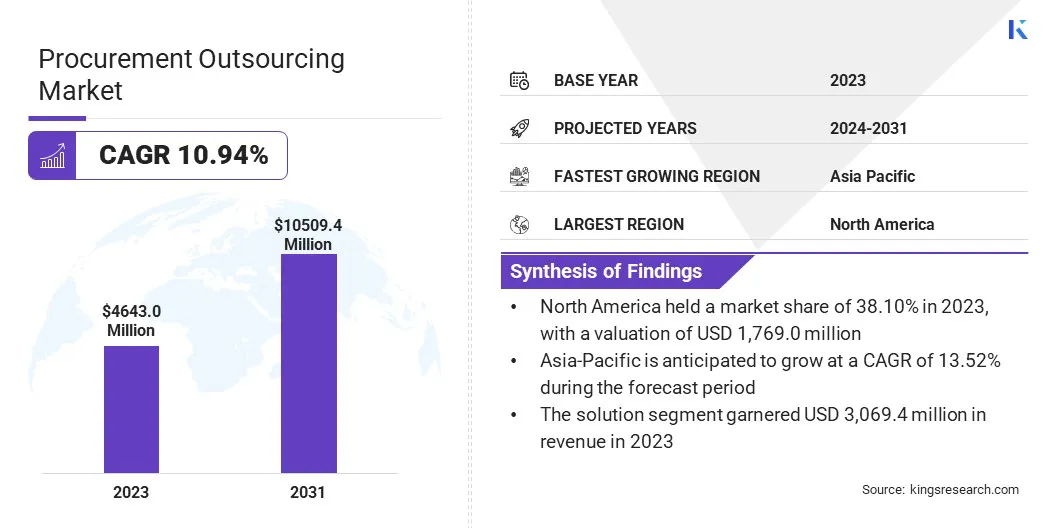

The global Procurement Outsourcing Market size was valued at USD 4,643.0 million in 2023 and is projected to grow from USD 5,081.4 million in 2024 to USD 10,509.4 million by 2031, exhibiting a CAGR of 10.94% during the forecast period. The market is expanding as businesses seek greater agility and innovation.

Companies are increasingly turning to outsourcing to concentrate on core functions and leverage specialized vendor expertise. This shift is driven by the need for scalable solutions and enhanced operational flexibility. Ongoing technological advancements and evolving business requirements are continuously shaping the procurement outsourcing landscape.

In the scope of work, the report includes solutions offered by companies such as Infosys Limited, TATA Consultancy Services Limited, WNS Procurement, Wipro, Genpact, IBM, HCL Technologies Limited, GEP, Accenture, Capgemini, and others.

The procurement outsourcing market is experiencing rapid growth, mainly due to the increasing demand for cost efficiency, operational optimization, and access to specialized expertise. Organizations are partnering with third-party providers to streamline procurement functions, reduce overhead costs, and leverage advanced technologies such as AI and automation.

The rise of strategic sourcing outsourcing, coupled with innovations such as GEP's AI-driven platform, is enhancing procurement operations and improving supplier management.

- In October 2023, the UK government announced a USD 6.09 billion investment framework aimed at enabling public sector organizations to procure outsourced contact center and business process services over the next four years. This initiative reflects the growing trend of governments utilizing outsourcing to enhance service delivery and operational efficiency.

Furthermore, businesses are focusing on long-term goals such as sustainability and spend management, thereby fueling market expansion.

Procurement outsourcing involves delegating specific procurement functions or the entire procurement process to an external service provider. This strategic approach allows organizations to benefit from the expertise and resources of specialized vendors for supplier sourcing, contract negotiation, and order fulfillment.

By outsourcing procurement, companies can achieve cost savings through economies of scale, improve efficiency with advanced technologies, and focus on their core business activities. Additionally, procurement outsourcing enhances operational flexibility and access to industry best practices, enabling organizations to streamline their supply chain management and respond more effectively to market changes.

Analyst’s Review

Government initiatives, such as significant investment frameworks, along with technological advancements by key players, are poised to propel procurement outsourcing market growth. These initiatives promote the adoption of outsourced services, while innovations such as AI and automation enhance procurement efficiency.

- In February 2024, the UK government issued two tenders for cloud services, collectively valued at USD 9.5 billion, to be managed under framework agreements. Additionally, a separate procurement initiative sought a technology firm to assist public sector organizations in transitioning to cloud-based software or hosting services.

- In October 2023, Olive Technologies, known for its AI-driven solutions, partnered with Procurify, a provider of cloud-based procure-to-pay software. This collaboration is designed to enhance and streamline vendor sourcing, selection, and procurement processes for organizations globally.

By leveraging substantial government investments and cutting-edge technological collaborations, the industry is set to witness significant advancements. This progress is expected to redefine procurement practices, enhance efficiency, and expand opportunities for organizations worldwide.

Procurement Outsourcing Market Growth Factors

The surge in procurement outsourcing is substantially fueling market growth as organizations increasingly seek to optimize their procurement functions. Engaging specialized service providers enables companies to achieve cost efficiencies through economies of scale, advanced technologies, and streamlined processes. This shift leads to notable reductions in procurement costs, including labor and operational expenses.

The resultant cost savings and enhanced operational effectiveness are compelling businesses to adopt outsourcing solutions, thereby supporting market growth. This growing adoption incentivizes service providers to innovate and deliver advanced offerings, thus stimulating procurement outsourcing market expansion.

Market development is expected to be hindered by the complexities of managing diverse supplier networks and ensuring compliance with varying regulatory requirements across different regions. Additionally, data security concerns and integration issues with existing systems pose significant challenges. To address these challenges, key players are investing in advanced technologies such as AI and blockchain to enhance supply chain visibility and ensure data security.

Furthermore, they are developing comprehensive compliance frameworks and offering integrated solutions that seamlessly align with clients' existing systems. By focusing on these areas, providers are improving the efficiency and reliability of procurement outsourcing services, effectibely overcoming regional and operational hurdles.

Procurement Outsourcing Industry Trends

The growing trend of outsourcing strategic sourcing functions is stimulating market growth, with companies increasingly seeking to enhance their procurement strategies. Partnering with service providers allows organizations to gain valuable insights into market trends, supplier capabilities, and cost-saving opportunities.

Leveraging their expertise, these providers offer data-driven recommendations for informed and strategic decision-making. This approach helps businesses concentrate on long-term procurement goals, including improving supplier relationships and optimizing spend management.

The demand for outsourcing strategic sourcing functions is growing, fueling market expansion as companies increasingly recognize the value of these specialized services.

The surging adoption of AI and automation technologies in procurement outsourcing is expected to augment procurement outsourcing market growth. These technologies streamline procurement processes, encompassing supplier selection to contract management, thereby reducing manual tasks and minimizing errors.

Enhanced data analysis capabilities provide deeper insights into procurement trends, supplier performance, and cost-saving opportunities, leading to more informed decision-making. Automation improves efficiency by accelerating transaction cycles and ensuring compliance with procurement policies.

- In October 2023, GEP launched GEP Quantum, an AI-driven, low-code platform for procurement and supply chain management, enabling non-technical users to leverage sophisticated tools such as GEP Smart, GEP Nexxe, and GEP Green.

With the growing recognition of AI-driven procurement solutions, the demand for outsourcing services integrated with these technologies is rapidly increasing, fueling significant market expansion.

Segmentation Analysis

The global market has been segmented based on component, organization size, industry vertical, and geography.

By Component

Based on component, the market has been categorized into solution and services. The solution segment led the procurement outsourcing market in 2023, reaching a valuation of 3,069.4 million, due to its critical role in enhancing operational efficiency and effectiveness. Key solutions, such as cloud-based procurement platforms, AI-driven analytics, and automation tools, are transforming traditional procurement processes.

The adoption of these solutions is supported by their ability to streamline procurement activities, improve data accuracy, and accelerate decision-making. Cloud-based platforms provide scalability and flexibility, enabling organizations to manage procurement functions more efficiently.

Additionally, AI and automation technologies offer advanced insights and reduce manual tasks, thereby fostering segmental growth. With businesses increasingly focused on optimizing procurement operations and leveraging technological advancements, the solution segment is projected to experience robust expansion.

By Organization Size

Based on organization size, the procurement outsourcing market has been categorized into SMEs and large enterprises. The large enterprises segment captured the largest share of 69.47% in 2023. Large enterprises are increasingly outsourcing procurement functions to manage their extensive and diverse supply needs more effectively.

This segment benefits from sophisticated solutions such as integrated procurement platforms, strategic sourcing tools, and advanced analytics, which help optimize supplier management and procurement strategies. The growing emphasis on cost reduction, operational efficiency, and risk management is further boosting the adoption of these services.

Additionally, large enterprises are leveraging procurement outsourcing to focus on core business activities while ensuring compliance and achieving economies of scale, thereby bolstering segmental expansion.

By Industry Vertical

Based on industry vertical, the market has been categorized into BFSI, healthcare, IT & telecom, and others. The BFSI segment is expected to garner the highest revenue of USD 3,538.5 million by 2031. This expansion is largely attributed to the sector's increasing need for streamlined procurement processes to manage complex financial products and services effectively.

- In February 2024, Genpact partnered with Tropicana Brands Group to overhaul its global business services and supply chain operations. Genpact plans to apply its expertise and digital business platform to introduce standardized processes, advanced data analytics, and innovative digital solutions, aiming to transform Tropicana Brands Group’s finance and accounting (F&A) functions.

BFSI organizations are turning to outsourcing to enhance their procurement functions, such as vendor management, contract administration, and risk assessment. Advanced solutions such as cloud-based platforms, AI-driven analytics, and automated workflows are being adopted to handle large volumes of transactions, ensure regulatory compliance, and mitigate risks. The growing focus on cost efficiency, compliance, and operational agility within the BFSI sector is propelling the demand for procurement outsourcing services.

Procurement Outsourcing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America procurement outsourcing market accounted for the largest share of 38.10% in 2023, with a valuation of USD 1,769.0 million. The region’s significant investment in advanced technologies, including AI and automation, is enhancing procurement efficiency across various sectors.

Additionally, a strong emphasis on cost reduction and operational excellence is fueling the demand for outsourced procurement services. The presence of leading global vendors and innovative solutions further supports regional market growth. Moreover, regulatory compliance and the need for strategic supplier management are contributing to regional market expansion.

Asia-Pacific is anticipated to witness notable growth, recording a fastest CAGR of 13.52% over the forecast period. The region is witnessing significant advancements in digital infrastructure, enabling the adoption of sophisticated procurement technologies.

Moreover, the rise of e-commerce and retail sectors is highlighting the growing need for effective procurement management. Furthermore, local companies are increasingly seeking to enhance supply chain visibility and optimize sourcing strategies to compete in both domestic and international markets.

- In January 2023, the Japanese government revealed plans to implement a new scheme for IT procurement for government agencies and to facilitate online procurement of IT software beginning in 2024.

These factors are expected to fuel regional market growth by fostering the adoption of outsourcing services.

Competitive Landscape

The global procurement outsourcing market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Procurement Outsourcing Market

- Infosys Limited

- TATA Consultancy Services Limited

- WNS Procurement

- Wipro

- Genpact

- IBM

- HCL Technologies Limited

- GEP

- Accenture

- Capgemini

Key Industry Developments

- February 2024 (Acquisition): Accenture acquired Insight Sourcing, a firm specializing in strategic sourcing and procurement services. This acquisition is anticipated to enhance Accenture’s capabilities in sourcing and procurement across private equity and various industries, including consumer goods, retail, technology, and industrial sectors.

The global procurement outsourcing market is segmented as:

By Component

By Organization Size

By Industry Vertical

- BFSI

- Healthcare

- IT & Telecom

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America