Market Definition

The market encompasses genetic screening services and technologies applied during in vitro fertilization (IVF) procedures to assess embryos for genetic abnormalities prior to implantation.

It includesdiagnostic solutions, laboratory infrastructure, specialized equipment, and associated services that facilitate the detection of chromosomal aneuploidies (PGT-A), single-gene mutations (PGT-M), and structural chromosomal rearrangements (PGT-SR).

The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Preimplantation Genetic Testing Market Overview

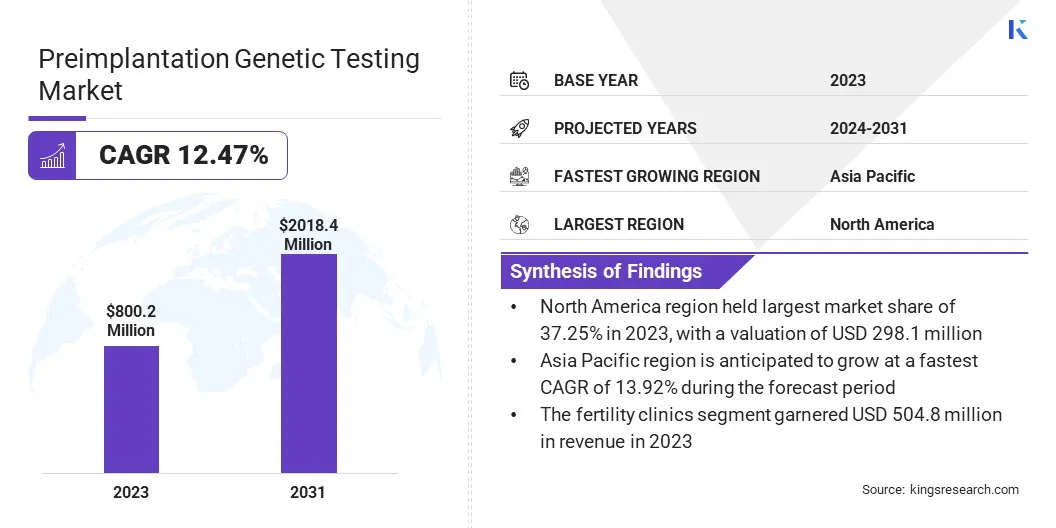

The global preimplantation genetic testing market size was valued at USD 800.2 million in 2023 and is projected to grow from USD 886.9 million in 2024 to USD 2,018.4 million by 2031, exhibiting a CAGR of 12.47% during the forecast period.

This growth is driven by the rising incidence of genetic disorders and chromosomal abnormalities, leading to a greater emphasis on early detection through embryo screening to enhance pregnancy outcomes and reduce inherited conditions.

Major companies operating in the preimplantation genetic testing industry are Illumina, Inc., Thermo Fisher Scientific Inc., CooperSurgical Inc., Natera, Inc., Invitae Corporation., Igenomix, Vitrolife, Quest, Bioarray S.L., Genea BIOMEDX, Revvity, Orchid, Progenesis, Fulgent Genetics, Anderson Diagnostics & Labs, and others.

Moreover, the integration of next-generation sequencing (NGS) in PGT protocols has revolutionized the testing landscape by offering high-resolution genomic analysis, improved detection rates, and the ability to screen for multiple genetic conditions simultaneously. This advancement has improved clinical accuracy, increased efficiency, and expanded accessibility, propelling market expansion.

- In November 2023, Complete Genomics partnered with Basepair, Inc. to enhance preimplantation genetic testing workflows by integrating cloud-based bioinformatics tools. This collaboration enables faster, cost-effective analysis of NGS data, supporting improved genomic interpretation and scalability across fertility and reproductive health applications.

Key Highlights:

- The preimplantation genetic testing industry size was recorded at USD 800.2 million in 2023.

- The market is projected to grow at a CAGR of 12.47% from 2024 to 2031.

- North America held a share of 37.25% in 2023, valued at USD 298.1 million.

- The PGT for Aneuploidy (PGT-A) segment garnered USD 456.8 million in revenue in 2023.

- The next-generation sequencing (NGS) segment is expected to reach USD 884.2 million by 2031.

- The IVF failure segment is expected to reach USD 678.2 million by 2031.

- The fertility clinics segment is projected to generate a valuation of USD 1,244.3 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 13.92% over the forecast period.

Market Driver

"Rising Incidence of Genetic Disorders and Chromosomal Abnormalities"

The growth of the preimplantation genetic testing (PGT) market is propelled by the rising incidence of genetic disorders and chromosomal abnormalities worldwide.

With growing awareness about the risk of inherited conditions such as cystic fibrosis, Tay-Sachs disease, and Down syndrome, more couples are opting for genetic screening during the IVF process to ensure the health of their future offspring.

Preimplantation genetic testing allows early identification of embryos carrying genetic defects, thereby reducing the likelihood of implanting embryos with abnormalities that could lead to failed pregnancies, miscarriages, or severe health complications in newborns.

This increasing demand for preventive reproductive solutions is accelerating the adoption of PGT, particularly among high-risk couples, those with a family history of genetic diseases, or individuals undergoing IVF at an advanced maternal age.

- In February 2023, the World Health Organization (WHO) reported that congenital disorders are responsible for the deaths of approximately 240,000 newborns globally within the first 28 days of life each year. Additionally, these conditions account for 170,000 deaths among children aged between 1 month and 5 years. Beyond mortality, congenital disorders often lead to long-term disabilities, significnatly impacting individuals, families, healthcare systems, and society.

Market Challenge

"High Cost Associated with Procedures"

A major challenge restraining the growth of the preimplantation genetic testing (PGT) market is the high cost associated with the procedures, which can limit accessibility, especially in low- and middle-income regions. PGT is typically offered as an additional service alongside in vitro fertilization (IVF), increasing the cost of fertility treatment.

This financial barrier often prevents many couples from opting for genetic screening, even when medically necessary. This challenge can be addressed through the development of cost-effective testing platforms and broader integration of automated technologies, such as AI-driven embryo analysis and streamlined NGS workflows.

Additionally, expanding insurance coverage and implementing government-supported fertility programs could help make PGT more accessible and affordable to a wider patient population.

Market Trend

"Integration of Next-Generation Sequencing (NGS) in PGT Protocols"

The preimplantation genetic testing (PGT) market is witnessing a notable growth due to the increasing integration of next-generation sequencing (NGS) technologies into genetic screening protocols. NGS has become a preferred method for PGT due to its ability to deliver high-throughput, precise, and comprehensive analysis of embryonic genetic material.

Compared to traditional techniques such as FISH or PCR, NGS provides a broader scope for detecting chromosomal aneuploidies, single-gene disorders, and structural rearrangements in a single workflow.

This improves diagnostic accuracy and enhances the selection of genetically viable embryos, increasing the likelihood of successful implantation and healthy pregnancies. As fertility clinics and diagnostic laboratories seek to improve clinical outcomes, the adoption of NGS-based PGT solutions is rising.

- In July 2023, Thermo Fisher Scientific launched two new next-generation sequencing based reproductive health assays, the Ion ReproSeq PGT-A Kit and the Ion AmpliSeq Polyploidy Kit, designed for use with the Ion Torrent Genexus Integrated Sequencer. These assays support aneuploidy analysis in preimplantation genetic testing (PGT-A) and aim to advance IVF and ICSI research by enabling labs to generate valuable genomic insights that may improve pregnancy success rates and future reproductive outcomes.

Preimplantation Genetic Testing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

PGT for Aneuploidy (PGT-A), PGT for Monogenic Disorders (PGT-M), PGT for Structural Rearrangements (PGT-SR)

|

|

By Technology

|

Next-Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), Fluorescence In Situ Hybridization (FISH), Comparative Genomic Hybridization (aCGH)

|

|

By Application

|

Embryo HLA Typing, IVF Failure, Recurrent Miscarriage, Late Maternal Age

|

|

By End User

|

Fertility Clinics, Hospitals, Diagnostic Laboratories

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (PGT for Aneuploidy (PGT-A), PGT for Monogenic Disorders (PGT-M), and PGT for Structural Rearrangements (PGT-SR)): The PGT for aneuploidy (PGT-A) segment earned USD 456.8 million in 2023 due to its widespread use in detecting chromosomal abnormalities that can lead to implantation failure or miscarriage.

- By Technology (Next-Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), Fluorescence In Situ Hybridization (FISH), and Comparative Genomic Hybridization (aCGH)): The next-generation sequencing (NGS) held a share of 47.11% in 2023, attributed to its high accuracy, scalability, and ability to simultaneously analyze multiple genetic markers.

- By Application (Embryo HLA Typing, IVF Failure, Recurrent Miscarriage, and Late Maternal Age): The IVF failure segment is projected to reach USD 678.2 million by 2031, fueled by the increasing prevalence of infertility cases and the growing reliance on PGT to improve success rates.

- By End User (Fertility Clinics, Hospitals, Diagnostic Laboratories): The fertility clinics segment is projected to reach USD 1,244.3 million by 2031, propelled by the rising number of IVF procedures and the integration of advanced genetic screening in fertility treatment protocols.

Preimplantation Genetic Testing Market Regional Analysis

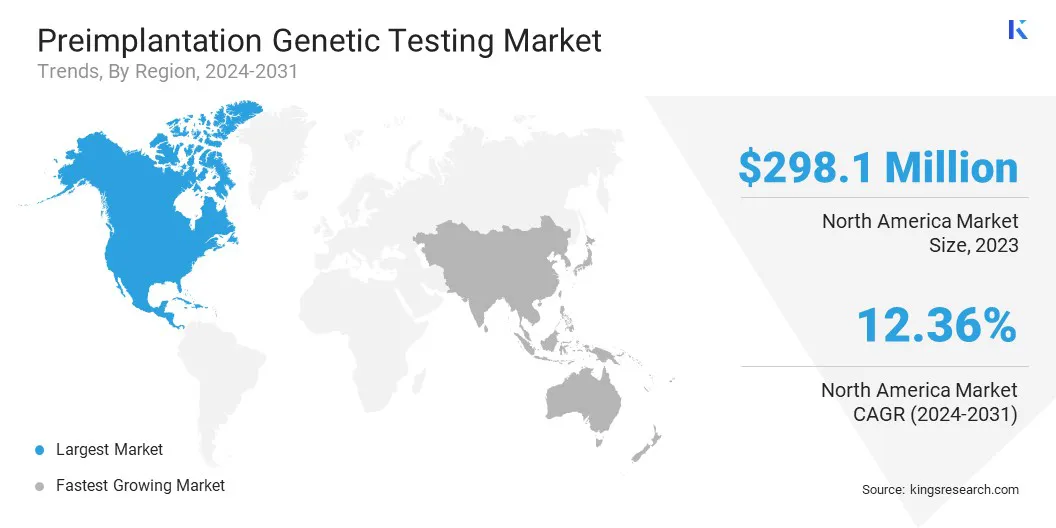

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America preimplantation genetic testing market share stood at around 37.25% in 2023, valued at USD 298.1 million. This dominance is primarily reinforced by the region’s advanced healthcare infrastructure, widespread adoption of in vitro fertilization (IVF) technologies, and strong presence of leading genetic testing companies.

Additionally, supportive regulatory frameworks, high awareness about genetic disorders, and the availability of insurance coverage for fertility treatments in certain parts of the U.S. and Canada have significantly contributed to domestic market growth. The regional market further benefits from ongoing research and innovation in genomic diagnostics, reinforcing its leading position.

- In February 2025, the President of the United States signed an Executive Order focused on expanding access to in vitro fertilization for Americans. The Order mandates the development of comprehensive policy recommendations designed to safeguard IVF availability while substantially lowering both out-of-pocket expenses and health insurance costs related to these treatments.

Asia Pacific preimplantation genetic testing industry is poised to grow at a robust CAGR of 13.92% over the forecast period. This rapid growth is attributed to rising infertility rates, increasing awareness of reproductive health, and improving access to assisted reproductive technologies across countries such as China, India, Japan, and South Korea.

Government initiatives to expand fertility care, growing investments in healthcare infrastructure, and the entry of global PGT providers into emerging markets are further accelerating regional market expansion. Additionally, the increasing affordability of IVF procedures and genetic testing is encouraging more couples in the region to opt for PGT services.

Regulatory Frameworks

- In the U.S., the Clinical Laboratory Improvement Amendments (CLIA) regulate all clinical laboratory testing, including preimplantation genetic testing (PGT), to ensure the accuracy, reliability, and timeliness of patient test results regardless of where the test is performed.

- In Japan, the Japan Society of Obstetrics and Gynecology (JSOG) regulates the clinical use of PGT. As of recent updates, PGT is permitted for couples with a history of recurrent pregnancy loss or serious genetic disorders, but requires ethical review and approval by designated committees before implementation.

Competitive Landscape

The preimplantation genetic testing (PGT) industry is characterized by intense competition, with key players focusing on strategic collaborations, product innovation, and geographic expansion to strengthen their market presence.

Companies are actively investing in advanced genomic technologies such as next-generation sequencing (NGS) and developing integrated PGT platforms that offer faster, more accurate, and cost-effective testing solutions.

They are entering strategic partnerships with fertility clinics and diagnostic laboratories to enhance service accessibility and streamline workflows. Additionally, there is a strong emphasis on expanding regulatory approvals across different regions to gain a competitive edge in emerging markets.

Several players are adopting mergers and acquisitions to consolidate their market position and broaden their technological capabilities. Continuous investment in research and development, along with the introduction of AI-based embryo analysis and automated genetic screening systems, further reflects competitiveness in the market.

- In February 2025, Roche introduced its novel sequencing by expansion (SBX) technology, establishing a new class of next-generation sequencing. SBX leverages synthetic molecules and a high-throughput sensor to enable ultra-fast, accurate, and scalable DNA sequencing. By drastically reducing sequencing time, SBX is poised to accelerate research and clinical applications in areas such as cancer, immune disorders, and neurodegenerative diseases.

List of Key Companies in Preimplantation Genetic Testing Market:

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- CooperSurgical Inc.

- Natera, Inc.

- Invitae Corporation.

- Igenomix

- Vitrolife

- Quest

- Bioarray S.L.

- Genea BIOMEDX

- Revvity

- Orchid

- Progenesis

- Fulgent Genetics

- Anderson Diagnostics & Labs

Recent Developments (Product Launch)

- In June 2023, Kindbody launched Kindlabs, its in-house genetic testing division, to integrate genomics into its end-to-end fertility care model. Operating a CLIA-certified and CAP-enrolled lab in Secaucus, NJ, Kindlabs offers comprehensive, medical-grade genetic testing, including preimplantation genetic testing (PGT). The initiative aims to enhance clinical outcomes and broaden access to genomic information through a verticalized platform combining advanced lab chemistry, software, and bioinformatics.