Market Definition

A prefabricated branch cable is a a pre-assembled electrical cable designed for power distribution systems. It includes connectors and terminations, streamlining installation and reducing on-site modifications.

Featuring a main cable with multiple pre-attached branch connections, it minimizes installation errors and enhances system reliability, making it particularly useful in industrial, commercial, and infrastructure projects.

Prefabricated Branch Cable Market Overview

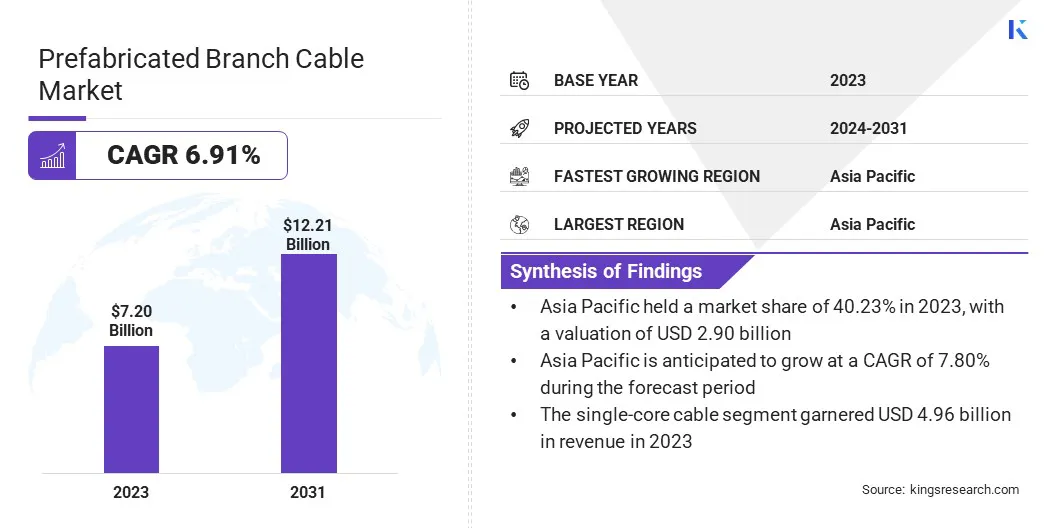

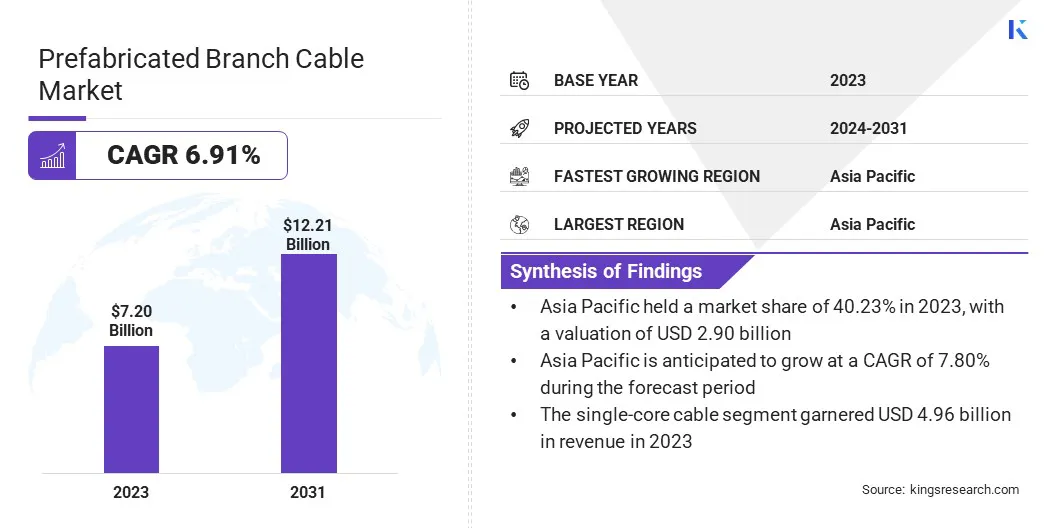

The global prefabricated branch cable market size was valued at USD 7.20 billion in 2023 and is projected to grow from USD 7.65 billion in 2024 to USD 12.21 billion by 2031, exhibiting a CAGR of 6.91% during the forecast period.

The growth of the market is driven by increasing investments in infrastructure development and rapid urbanization, particularly in emerging economies. Increasing commercial and residential construction projects are fueling the demand for efficient and cost-effective electrical distribution solutions.

Additionally, the growing adoption of smart building technologies and stringent safety regulations are promoting the use of prefabricated branch cables for enhanced reliability and streamlined installations.

Major companies operating in the global prefabricated branch cable Industry are Schneider Electric, ABB, Legrand, Furukawa Electric Co., Ltd., LS Cable & System Ltd., Sumitomo Electric Industries, Ltd., Eaton, Siemens AG, Nishi Nippon Electric Wire & Cable, Jiangsu Shangshang Cable Group Co., Ltd., Prysmian S.p.A, Wuxi Jiangnan Cable Co., Ltd., Southwire Company LLC, JIANGSU GUANGHUI CABLE CO., LTD., Tianjin Zhongqiang New Cable Co., Ltd., and others.

The rise of renewable energy projects is accelerating the growth of the market. The global shift toward sustainable energy sources such as solar and wind is highlighting the need for efficient, reliable electrical distribution systems.

Prefabricated branch cables are particularly well-suited for renewable energy installations, where quick deployment and consistent performance are essential. Their ease of use and adaptability make them ideal for large-scale projects, including solar farms and wind turbine installations. The increasing focus on renewable energy infrastructure is contributing to the growing demand for prefabricated branch cables in the energy sector.

- The Global Wind Energy Council's 2024 report highlights a record 117 GW of new wind energy capacity added in 2023, the highest to date. To meet COP28 targets, annual installations anticipated to rise to at least 320 GW by 2030.

Key Highlights:

- The global prefabricated branch cable market size was recorded at USD 7.20 billion in 2023.

- The market is projected to grow at a CAGR of 6.91% from 2024 to 2031.

- Asia Pacific held a share of 40.23% in 2023, valued at USD 2.90 billion.

- The single-core cable segment garnered USD 4.96 billion in revenue in 2023.

- The low voltage segment is expected to reach USD 5.28 billion by 2031.

- The residential is set to grow at a CAGR of 8.05% through the projection period.

- Europe is anticipated to grow at a CAGR of 7.26% over the forecast period.

Market Driver

"Expansion of Construction Activities in Emerging Economies"

The ongoing expansion in global construction activities is propelling the growth of the prefabricated branch cable market. The rising urbanization and infrastructure development are fueling demand for efficient electrical solutions.

Prefabricated branch cables are increasingly preferred in both residential and commercial building projects due to their ease of installation and cost-efficiency. Their ability to ensure quick, safe, and reliable electrical set ups makes them ideal for large-scale construction projects. Consequently, the growth of the market is closely linked to the global expansion of the construction industry.

- The 2023 National Action Plans (NAPs) on Business and Human Rights report projects that the global construction industry to grow by USD 4.5 trillion, reaching USD 15.2 trillion over the next ten years. China, India, the US, and Indonesia are anticipated to contribute to 58.3% of this growth.

Market Challenge

"Supply Chain Disruptions"

A significant challenge hindering the growth of the prefabricated branch cable market is the ongoing supply chain disruptions, particularly due to raw material shortages and logistical delays. These disruptions affect the timely availability of components needed for the production of prefabricated cables, leading to increased costs and delays in project timelines.

To address this challenge, companies are diversifying their supplier base, investing in local production facilities to reduce dependency on global supply chains, and adopting advanced inventory management systems to ensure better stock control. These strategies mitigate risks, maintain production continuity, and ensure timely delivery amid growing demand.

Market Trend

"Global Expansion of Data Centers"

The rapid global expansion of data centers is significantly boosting the growth of the prefabricated branch cable market. Data centers require highly reliable and efficient electrical systems to manage heavy data loads and ensure uninterrupted service.

Prefabricated branch cables, with their quick installation and high reliability, are ideal for meeting the electrical demands of these facilities. Their ability to streamline the setup process and minimize operational disruptions has made them an integral part of data center infrastructure. As the data center industry continues to grow worldwide, the demand for prefabricated branch cable is rising significantly.

- The International Energy Agency's 2024 report highlights a substantial rise in data center investments over the past two years, fueled by digitalization and AI adoption. The United States leads this trend, where annual data center construction spending doubling. Meanwhile, China and the European Union are also experiencing a rise in activity.

Prefabricated Branch Cable Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Single-core Cable, Multi-core Cable

|

|

By Voltage

|

Low Voltage, Medium Voltage, High Voltage

|

|

By End User

|

Residential, Commercial, Industrial, Telecommunication, Automotive

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Single-core Cable and Multi-core Cable): The single-core cable segment earned USD 4.96 billion in 2023 due to its superior flexibility, ease of installation, and high current-carrying capacity, making it the preferred choice for large-scale commercial and industrial applications requiring efficient power distribution.

- By Voltage (Low Voltage, Medium Voltage and High Voltage): The low voltage segment held a share of 43.23% in 2023, attributed to its widespread adoption in residential, commercial, and industrial construction projects, rapid urbanization, rising infrastructure investments, and the growing demand for efficient and cost-effective power distribution solutions.

- By End User (Residential, End User, Industrial, and Telecommunication): The commercial segment is projected to reach USD 4.45 billion by 2031, mainly fueled by the increasing demand for efficient and scalable electrical distribution systems in large-scale infrastructure projects, including office buildings, shopping malls, and industrial facilities.

Prefabricated Branch Cable Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

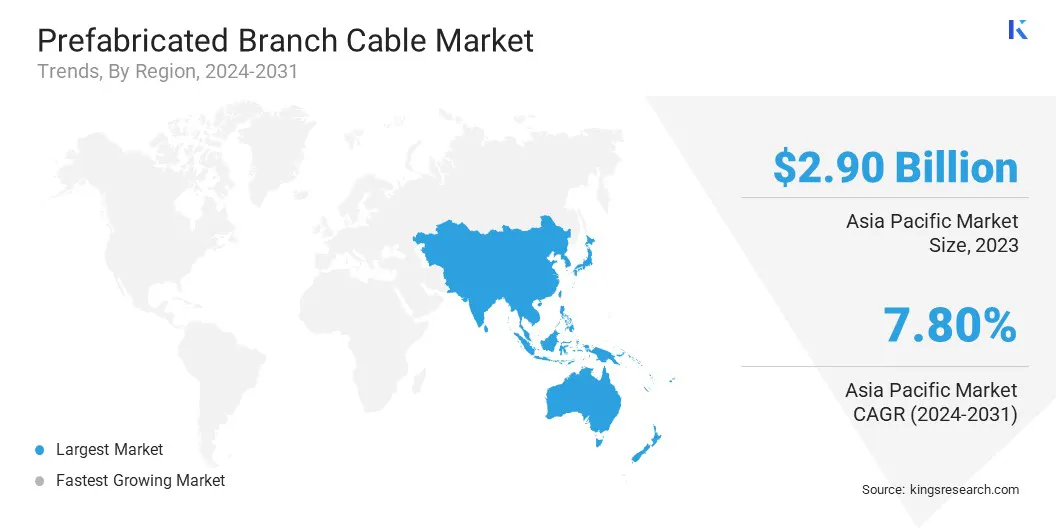

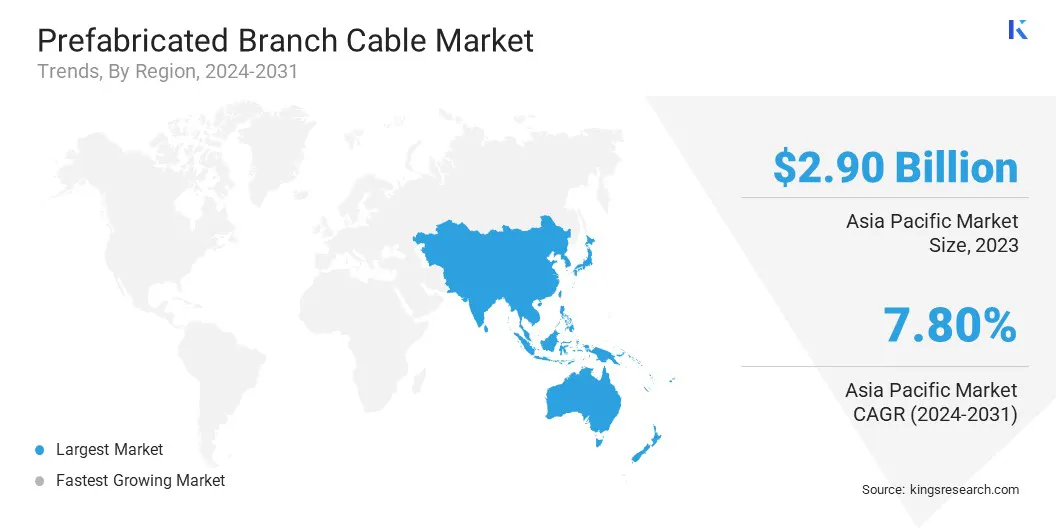

The Asia Pacific prefabricated branch cable market captured a share of around 40.23% in 2023, valued at USD 2.90 billion. The industrial sector in Asia-Pacific is witnessing significant growth, particularly in countries such as China, India, and Japan.

The increased demand for manufacturing facilities, energy plants, and industrial infrastructure is propelling the need for reliable and efficient electrical systems, further boosting the adoption of prefabricated branch cables. Their ease of installation and ability to meet complex industrial requirements contribute to their growing popularity.

Furthermore, rapid urbanization and large-scale infrastructure projects in the region are stimulating the demand for efficient electrical solutions. Prefabricated branch cables offer quick installation and reduced downtime, making them ideal for these large construction projects. The region's growing population and need for modern infrastructure in cities are key further propelling the expansion of the regional market.

- According to the United Nations Human Settlements Programme, Asia accounts for more than 54% of the global urban population, exceeding 2.2 billion people. By 2050, this figure is projected to rise by 1.2 billion, a 50% increase.

Europe prefabricated branch cable Industry is set to grow at a robust CAGR of 7.26% over the forecast period. Europe’s strong commitment to expanding renewable energy capacity, including wind, solar, and hydropower, is contributing to this notable growth.

Prefabricated branch cables are gaining traction in renewable energy projects due to their ease of installation and long-term reliability. With increasing investments in renewable energy across Germany, the UK, and France, demand for these cables is expected to rise.

Additionally, the growth of the digital economy in Europe is leading to a surge in data center investments. As data centers require advanced electrical systems for high-performance and uninterrupted operation, the demand for prefabricated branch cables is increasing. These cables offer quick installation, reduced downtime, and increased reliability, making them a preferred solution for data center construction across the continent.

- In 2023, the EU allocated substantial resources to support digital transformation, with USD 133.42 billion earmarked for digital-related reforms and investments within the national Recovery and Resilience Plans. On average, Member States have dedicated 26% of their Recovery and Resilience Facility (RRF) allocations to digital transformation, surpassing the mandatory 20% threshold.

Regulatory Frameworks

- In the U.S., the National Electrical Code (NEC), published by the National Fire Protection Association (NFPA), sets standards for electrical installations, including wiring methods and materials. It is updated every three years to reflect technological advancements and safety practices.

- In Europe, the Construction Products Regulation (CPR) (EU) No 305/2011 establishes harmonized conditions for the marketing of construction products, including cables. It requires that cables meet specific performance criteria, such as reaction to fire, to ensure safety in construction projects.

- In China, the Standardization Administration of China (SAC) oversees national standards for cables, including GB/T 19666-2005, which specifies the general requirements for power cables. Compliance with these standards is mandatory for manufacturers.

- In India, the Bureau of Indian Standards (BIS) publishes IS 694, specifying requirements for PVC-insulated cables to ensure product quality and safety.

- Internationally, the International Electrotechnical Commission (IEC) 60227 specifies the requirements for polyvinyl chloride (PVC) insulated cables up to and including 450/750 V and IEC 60502 for power cables with extruded insulation from 1 kV to 30 kV. Moreover, the International Organization for Standardization (ISO) 9001 outlines quality management system requirements for cable manufacturers to ensure consistent product quality.

Competitive Landscape

The global prefabricated branch cable market is characterized by a number of participants, including both established corporations and established players. Market paerticiapants are actively pursuing strategies such as mergers and acquisitions to enhance their market position and expand their footprint across various industries.

These strategic moves enable companies to strengthen their product portfolios, improve operational efficiencies, and gain access to new customer segments. By integrating advanced technologies and expertise from acquired firms, businesses can enhance their competitive edge and accelerate innovation.

Additionally, mergers and acquisitions facilitate geographic expansion, allowing companies to establish a stronger presence in high-growth regions.

- In March 2024, ABB acquired Solutions Industry & Building (SIB), a prominent manufacturer of building products and high-quality cable glands for industrial, railway, and hazardous environments. This acquisition enhances ABB’s presence in the rail, mining, OEM, and specialty markets across Europe, the Middle East, and North America.

List of Key Companies in Prefabricated Branch Cable Market:

- Schneider Electric

- ABB

- Legrand

- Furukawa Electric Co., Ltd.

- LS Cable & System Ltd.

- Sumitomo Electric Industries, Ltd.

- Eaton

- Siemens AG

- Nishi Nippon Electric Wire & Cable

- Jiangsu Shangshang Cable Group Co., Ltd.

- Prysmian S.p.A

- Wuxi Jiangnan Cable Co., Ltd.

- Southwire Company LLC

- JIANGSU GUANGHUI CABLE CO., LTD.

- Tianjin Zhongqiang New Cable Co., Ltd.

Recent Developments (M&A/Expansion/New Product Launch)

- In January 2025, LS Cable & System announced a merger with Gaon Cable, granting Gaon Cable full ownership of LSCUS. This strategic move aims to enhance localization capabilities and address the rising demand for global power infrastructure. Through collaboration with LS Cable & System, Gaon Cable plans to strengthen its ultra-high voltage cable business and expand into the submarine cable market.

- In November 2024, Prysmian Group introduced its new 16-fiber single-mode and multi-mode FlexRibbon 2.0 mm cables, set to be available in North America in Q1 2024. As infrastructure transmission speeds continue to advance with the rise of artificial intelligence, Prysmian’s 16-fiber FlexRibbon cable is designed to support hyperscale data centers, enabling speeds of 800Gbps, 1.6Tbps, and beyond.

- In October 2024, Furukawa Electric Co., Ltd. announced that its Board of Directors approved a reorganization plan aimed at optimizing its optical fiber and cable products business. This plan includes establishing a wholly-owned subsidiary, referred to as the "New Company," which will take over its optical fiber and cable operations through an absorption-type split and acquiring the shares of Shoden Seiwa Co., Ltd., strengthening its market position.

- In June 2024, Sumitomo Electric acquired a majority stake in Südkabel, a well-known German high-voltage cable manufacturer. The company is expanding its production capacity in Mannheim, Germany to locally manufacture advanced 525 kV HVDC cables. This expansion aligns with the German government's net-zero objectives, reinforcing Sumitomo Electric’s commitment to supporting sustainable energy infrastructure.