Market Definition

The market focuses on devices and systems designed to mitigate power quality issues, ensuring the stability and reliability of electrical power. Power quality issues, such as voltage sags, surges, harmonics, and transients, can undermine the efficiency and lifespan of electrical systems.

Key solutions include surge protectors, voltage regulators, uninterruptible power supplies (UPS), and power conditioners. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape influencing the market over the forecast period.

Power Quality Equipment Market Overview

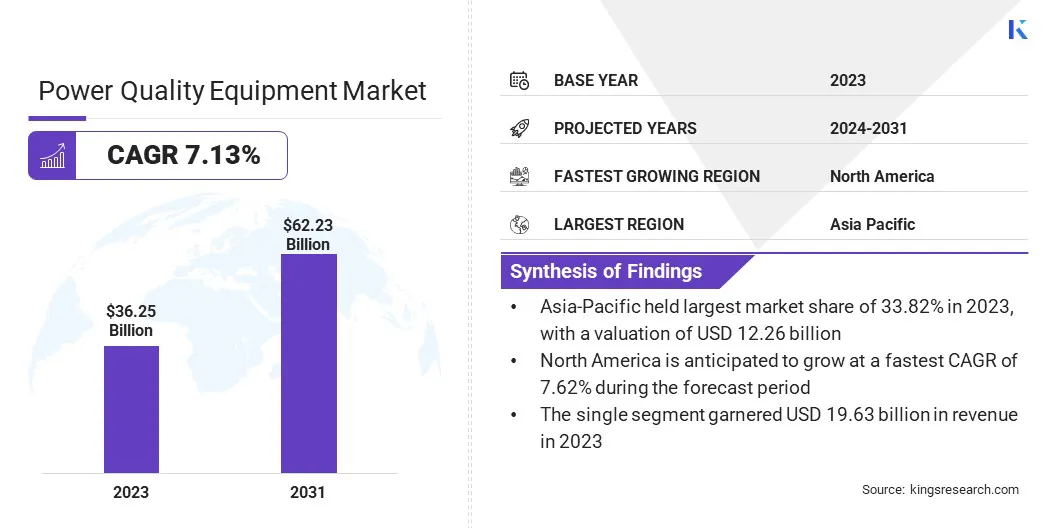

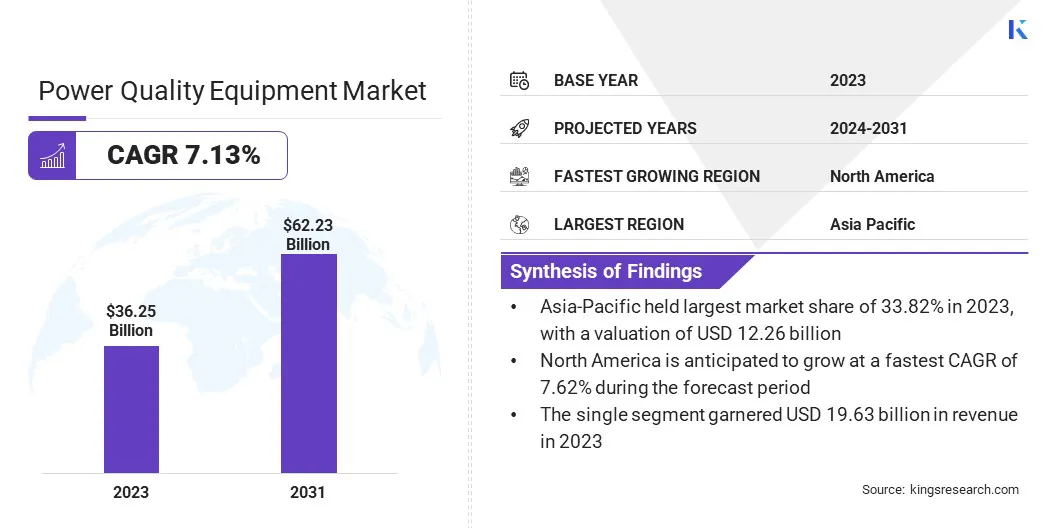

According to Kings Research, the global power quality equipment market size was valued at USD 36.25 billion in 2023 and is projected to grow from USD 38.43 billion in 2024 to USD 62.23 billion by 2031, exhibiting a CAGR of 7.13% during the forecast period.

The increasing demand for reliable and high-quality power supply is driving the adoption of power quality equipment across various industries. With the growing integration of automation and digital technologies, the reliance on sensitive electronic systems is rising, necessitating effective solutions to mitigate power disturbances.

Major companies operating in the power quality equipment industry are Schneider Electric, ABB, Toshiba International Corporation, Yokogawa Test & Measurement Corporation, Siemens, Hitachi Energy Ltd., Emerson Electric Co., Fluke Corporation, Vertiv Group Corp, Algodue Elettronica srl, MTE Corporation, Elspec LTD, GE Grid Solutions LLC, Langley Holdings plc, and Honeywell International Inc.

Key Market Highlights:

- The power quality equipment market size was valued at USD 36.25 billion in 2023.

- The market is projected to grow at a CAGR of 7.13% from 2024 to 2031.

- Asia-Pacific held a share of 33.82% in 2023, valued at USD 12.26 billion.

- The uninterruptable power supply (UPS) segment garnered USD 10.84 billion in revenue in 2023.

- The single segment is expected to reach USD 33.62 billion by 2031.

- The utilities segment is anticipated to witness the fastest CAGR of 7.92% over the forecast period

- North America is anticipated to grow at a CAGR of 7.62% through the projection period.

Industries such as manufacturing, healthcare, data centers, and telecommunications are becoming increasingly dependent on uninterrupted power for critical operations, making it essential to address issues such as voltage sags, surges, harmonics, and transients. The modernization of electrical infrastructure and the global shift toward smart grid technologies are further accelerating the deployment of advanced power quality solutions.

- In May 2023, Toshiba Electronic Devices & Storage Corporation launched the TCR1HF series - LDO regulators, offering output voltages of 1.8V, 3.3V, and 5.0V. Designed to reduce standby power consumption, the regulators support input voltages from 4V to 36V, making them suitable for USB PD and 24V systems in industrial and consumer electronics.

Rising Demand for Uninterrupted Power Supply

The growing need for uninterrupted power supply is fueling the expansion of the market. Frequent power disruptions can lead to operational downtime, equipment failure, and financial losses, particularly in sectors such as healthcare, manufacturing, IT, and telecommunications.

Organizations are increasingly investing in solutions such as uninterruptible power supplies (UPS), voltage regulators, and power conditioners to maintain stable and continuous power. Additionally, the major focus on operational reliability and system protection is accelerating the adoption of power quality equipment across both industrial and commercial environments.

- In July 2024, Vertiv Group Corp introduced its next-generation uninterruptible power supply (UPS) systems to address the high power and availability demands of AI workloads. The new UPS solutions support both in-room and prefabricated data center deployments across global regions, emphasizing efficiency, scalability, and resilience.

Complexity of Integration with Existing Infrastructure

The complexity of integration with existing infrastructure presents a significant challenge to the expansion of the power quality equipment market. Numerous industries rely on outdated electrical systems that may not be compatible with modern solutions such as uninterruptible power supplies (UPS) and voltage regulators, making installation and integration both technically challenging and costly.

To overcome this challenge, companies are focusing on developing adaptable power quality equipment that can be integrated into legacy systems with minimal disruption. Additionally, advancements in smart grid technologies and modular solutions are making it easier to upgrade existing infrastructure without extensive downtime. Enhanced system compatibility and tailored solutions are helping streamlining the integration process and improving overall efficiency.

Advancements in Power Electronics

Advancements in power electronics are emerging as a notable trend in the market, enabling the development of more efficient and compact solutions. Innovations in semiconductor materials such as silicon carbide (SiC) and gallium nitride (GaN) are allowing for smaller, more reliable power quality devices that can handle higher voltages and temperatures.

These advancements are enhancing the performance of systems such as uninterruptible power supplies (UPS), voltage regulators, and harmonic filters, making them more energy-efficient and cost-effective. Industries are increasingly adopting these next-generation solutions to improve operational reliability, reduce energy consumption, and lower overall equipment costs, fueling market growth.

- In May 2023, Semtech Corporation launched the RClamp0822B surge protection device, designed to safeguard sensitive electronics from electrical transients. The product enhances system reliability by protecting against surges commonly found in industrial and consumer electronics applications.

Power Quality Equipment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Uninterruptable Power Supply, Power Quality Meters, Surge Protection Devices, Harmonic Filters, Voltage Regulators

|

|

By Phase

|

Single, Three

|

|

By End Use

|

Residential, Commercial, Industrial & Manufacturing, Utilities

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Uninterruptable Power Supply, Power Quality Meters, Surge Protection Devices, Harmonic Filters, and Voltage Regulators): The uninterruptable power supply (UPS) segment earned USD 10.84 billion in 2023 due to its critical role in providing reliable backup power and preventing operational disruptions across industries.

- By Phase (Single and Three): The single segment held a share of 54.14% in 2023, fueled by its widespread use in residential and small commercial applications, where lower power requirements and cost-effectiveness are prioritized.

- By End Use (Residential, Commercial, Industrial & Manufacturing, and Utilities): The industrial segment is projected to reach USD 23.06 billion by 2031, propelled by the increasing adoption of automation, the need for uninterrupted power supply in critical manufacturing processes, and the growing demand for energy-efficient solutions in industrial operations.

Power Quality Equipment Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific power quality equipment market share stood at around 33.82% in 2023, valued at USD 12.26 billion. This dominance is reinforced by the region's rapid industrialization, infrastructure development, and growing adoption of renewable energy. Countries such as China, India, and Japan are expanding their manufacturing and commercial sectors, creating demand for reliable power quality solutions.

The region's strong focus on smart grid technologies, renewable energy integration, and the increasing number of data centers further supports this growth. Government initiatives aimed at modernizing energy infrastructure and promoting energy efficiency are aiding this upward trajectory.

- In September 2023, Vertiv launched the Liebert AF4 active harmonic filter in India, featuring artificial neural network technology to enhance power quality in industrial facilities. The solution aims to mitigate harmonic distortions, improve power factor, and support seamless operations in data centers and manufacturing environments.

North America power equipment market is set to grow at a CAGR of 7.62% over the forecast period. This growth is fostered by the region’s focus on upgrading aging electrical infrastructure and the growing demand for energy-efficient solutions. The expansion of industrial automation, increased reliance on renewable energy sources, and the adoption of smart grid technologies further support this growth.

Additionally, stringent regulations regarding energy efficiency and environmental sustainability are prompting industries to invest in reliable power solutions. The region's large manufacturing base, along with a notable shift toward renewable energy, contributes to the surging demand for power quality equipment.

- In May 2024, Accuenergy Inc. launched the Acuvim 3 Series Power Quality Meter, compliant with IEC 61000-4-30 Class A standards. This advanced meter offers enhanced power quality analysis, enabling precise monitoring of voltage, current, harmonics, and other electrical parameters critical for efficient energy management.

Regulatory Frameworks

- Globally, ISO 9001:2015 regulates quality management systems. It provides guidelines for establishing processes that ensure consistent quality, improve customer satisfaction, and comply with regulations.

- Globally, IEC 61000-4-30:2015 regulates power quality measurement methods. It defines standardized procedures for assessing electrical parameters such as voltage fluctuations, harmonics, and transients.

- In the U.S., IEEE 519-2022 regulates harmonic distortion in electrical systems with both linear and nonlinear loads. The standard aims to ensure minimal harmonic interference and improve power quality in installations containing harmonic-producing loads.

Competitive Landscape

The global power quality equipment market is highly competitive, featuring a diverse array of players that offer comprehensive solutions to address the growing demand for reliable power supply and efficient energy management. Leading market participants, including established companies specializing in uninterruptible power supplies (UPS), voltage regulators, surge protection devices, and harmonic filters, are increasingly prioritizing technological innovation and product advancement.

To gain a competitive edge, these companies are prioritizing strategic partnerships, leveraging cutting-edge smart technologies, IoT integration, and advanced monitoring systems. By enhancing the performance, efficiency, and intelligence of their power quality solutions, manufacturers are positioning themselves to meet the evolving needs of industries worldwide.

- In October 2023, Powerside introduced the PQ Edge Power Analyzer and PowerAct Hybrid Harmonic Filter to improve power quality by enabling real-time monitoring and correction of power system anomalies, reducing operational risks and ensuring stability.

Key Companies in Power Quality Equipment Market:

- Schneider Electric

- ABB

- Toshiba International Corporation

- Yokogawa Test & Measurement Corporation

- Siemens

- Hitachi Energy Ltd.

- Emerson Electric Co.

- Fluke Corporation

- Vertiv Group Corp

- Algodue Elettronica srl

- MTE Corporation

- Elspec LTD

- GE Grid Solutions LLC,

- Langley Holdings plc

- Honeywell International Inc.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In March 2025, Powerside acquired Electrotek Concepts from GMC Instruments Group to enhance its power quality solutions for utilities. This acquisition includes Electrotek's flagship software, PQView, which is used by over 80 utilities globally for power quality monitoring and analysis, reinforcing Powerside’s position in advancing utility power quality solutions.

- In March 2025, Kinetic Technologies introduced the KTB8375, a high-efficiency 6A synchronous buck regulator with I²C interface, targeting industrial, telecom, and computing applications. The regulator features fast transient response, a wide input range, and multiple protection features, offering enhanced performance for compact and power-sensitive systems.

- In May 2024, Eaton launched the 9395X UPS, an advanced power protection solution designed for large data centers and critical infrastructure. The UPS delivers higher efficiency, increased power density, and enhanced cybersecurity features, supporting organizations in achieving energy and operational resilience.