Market Definition

The market covers the production, distribution, and utilization of potassium formate across industries. It includes the use of potassium formate in de-icing, oil and gas drilling fluids, and as a heat transfer fluid in refrigeration systems.

The market involves various stakeholders, including manufacturers, suppliers, and end-users, and encompasses activities such as product development, packaging, and adherence to regulatory standards. The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the forecast period.

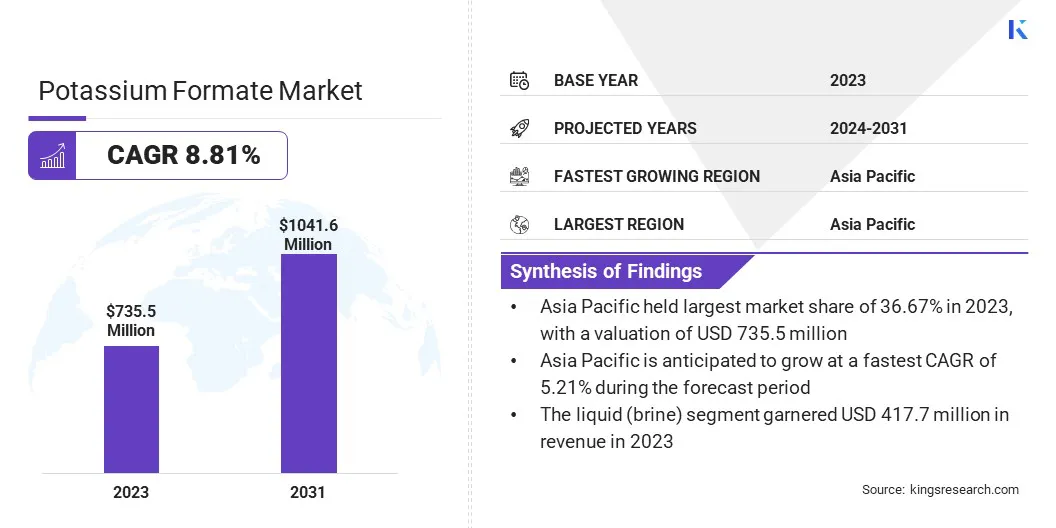

The global potassium formate market size was valued at USD 735.5 million in 2023 and is projected to grow from USD 765.2 million in 2024 to USD 1,041.6 million by 2031, exhibiting a CAGR of 4.50% during the forecast period.

This market is experiencing steady growth, driven by its increasing use as an environmentally friendly de-icing agent and its effectiveness in oil and gas drilling operations. Its low environmental impact and biodegradability make it an ideal alternative to conventional chloride-based solutions. In the oil and gas sector, potassium formate is valued for its superior density and thermal stability, which enhance drilling efficiency and safety.

Major companies operating in the potassium formate industry are Perstorp Holding AB, Clariant, Thermo Fisher Scientific Inc., Eastman Chemical Company, TETRA Technologies, Inc., ESSECO GROUP, Dynalene, Inc., Hawkins, American Elements, Hangzhou Focus Chemical Co., Ltd., Nachurs Alpine Solutions, BASF, DongyingShuntong Chemical (Group) Co., Ltd, SLB, and Kaz MI Swaco.

Additionally, its application as a heat transfer medium in HVAC systems and refrigeration equipment is expanding due to the growing demand for energy-efficient and sustainable cooling solutions. The market is further supported by technological advancements in formate-based fluids and a growing emphasis on reducing carbon footprints across industries.

Key Highlights:

- The potassium formate industry size was valued at USD 735.5 million in 2023.

- The market is projected to grow at a CAGR of 4.50% from 2024 to 2031.

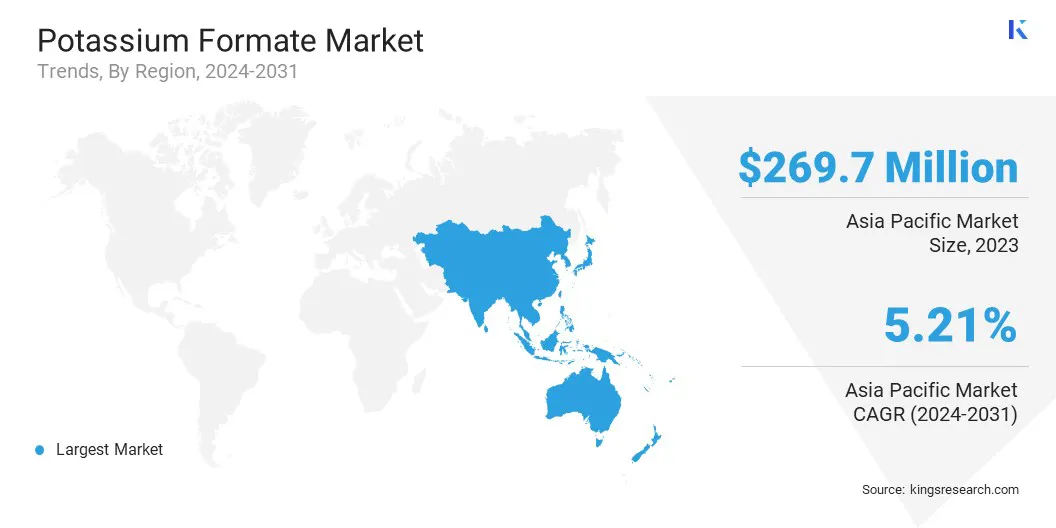

- Asia Pacific held a market share of 36.67% in 2023, with a valuation of USD 269.7 million.

- The liquid (brine) segment garnered USD 417.7 million in revenue in 2023.

- The drilling fluid segment is expected to reach USD 333.4 million by 2031.

- The market in North America is anticipated to grow at a CAGR of 4.44% during the forecast period.

Market Driver

"Growing Demand for Sustainable and Eco-Friendly Solutions"

The potassium formate market is experiencing robust growth, primarily driven by the increasing demands for sustainable de-icing solutions and the growing adoption of carbon capture and utilization (CCU) technologies.

As environmental concerns become more prominent, municipalities and industries are moving away from traditional chloride-based de-icing chemicals that cause soil corrosion, water contamination, and damage to infrastructure.

In contrast, potassium formate offers a safer and eco-friendly alternative, leading to increased adoption in cold regions for airport runways, roads, and commercial buildings.

- In April 2024, OMV Petrom began testing a carbon capture and utilization technology at the Petrobrazi refinery in Romania. The four-month trial, part of the EU-funded ConsenCUS project, converts captured CO₂ into potassium formate.

Market Challenge

"High Production Costs"

One of the major challenges facing the potassium formate market is its relatively high production cost compared to more widely used alternatives, such as chloride-based de-icing salts.

Potassium formate is typically produced through specialized processes, involving carbon capture and utilization technologies. These processes require sophisticated equipment and significant energy input, which contributes to higher manufacturing costs.

Furthermore, the raw materials used for manufacturing potassium formate are often more expensive or less readily available than those used in the production of traditional de-icing chemicals.

To address this challenge, manufacturers are investing in the development of more efficient production techniques and technologies that can lower the cost of production. This includes optimizing chemical synthesis pathways, utilizing renewable feedstocks, and adopting modular, energy-efficient production units.

Market Trend

"Technological Advancements and Expanding Market Applications"

The potassium formate market is evolving rapidly due to technological advancements and expanding applications across various industries. A key trend is the enhancement of production processes such as the utilization of CO₂ for synthesis.

These innovations are improving efficiency and lowering production costs, enabling larger-scale manufacturing and broader industry adoption. In addition, potassium formate is increasingly used in areas like synthetic fuel production and carbon capture.

As industries prioritize sustainability, the compound’s utility in supporting low-emission processes and cleaner energy solutions is becoming more prominent. This expansion into environmentally focused applications is strengthening market demand and reinforcing potassium formate’s value across multiple sectors.

- For instance, in December 2024, Adkins Energy, LLC announced a strategic partnership with a leading global CO₂ capture and conversion technology firm. This alliance aims to boost the profitability of Adkins' ethanol operations, extend facility longevity, and diversify its portfolio with innovative, high-margin, nonhydrocarbon “fuels of the future,” reinforcing its commitment to sustainable growth and long-term value creation.

|

Segmentation

|

Details

|

|

By Form

|

Solid, Liquid (Brine)

|

|

By Application

|

De-icing, Drilling Fluid, Heat Transfer Fluids, Agriculture Products, Anti-Freeze, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Form (Solid, Liquid (Brine)): The liquid (brine) segment earned USD 417.7 million in 2023 due to its superior solubility, ease of handling, and widespread use in de-icing and heat transfer applications.

- By Application (De-icing, Drilling Fluid, Heat Transfer Fluids, Agriculture Products, Anti-Freeze, Others): The drilling fluid segment held 30.66% of the market in 2023, due to potassium formate’s high density, thermal stability, and compatibility with sensitive reservoirs, making it ideal for high-performance drilling operations.

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific potassium formate market share stood around at 36.67% in 2023, with a valuation of USD 269.7 million. This dominance is primarily attributed to high demand from the oil and gas sectors in China and India, where potassium formate is extensively used in drilling operations due to the growing exploration activities in onshore and offshore fields.

Additionally, the large-scale industrial refrigeration sector in countries like South Korea and Japan is driving the demand for potassium formate-based heat transfer medium.

The rapid expansion of infrastructure in colder regions such as Northern China is also contributing to the increased consumption of de-icing applications, further boosting the market growth in this region.

Furthermore, the presence of key potassium formate manufacturers and the availability of low-cost raw materials in countries such as China have strengthened regional production capabilities, ensuring a steady and competitive supply across end-use industries.

The potassium formate industry in North America is expected to register the fastest growth in the market, with a projected CAGR of 4.44% over the forecast period. This growth is driven by the resurgence of shale gas and continuous oil extraction activities in the United States, where potassium formate is preferred for its efficiency in high-pressure drilling environments.

Moreover, the region’s advanced commercial HVAC systems have increased the adoption of potassium formate as a heat transfer medium due to its low environmental impact and thermal properties.

The rising need for sustainable de-icing alternatives in transportation hubs, including airports in colder regions, also plays a key role in the market’s expansion in North America.

In addition, the presence of several key players in the chemical and energy sectors, along with investments in R&D for high-performance fluids, has further accelerated the adoption of potassium formate across critical applications.

Regulatory Frameworks

- In the United States, potassium formate is regulated by the Environmental Protection Agency (EPA) under the Toxic Substances Control Act (TSCA), which mandates chemical reporting, recordkeeping, and testing requirements.

- In the European Union, potassium formate is regulated under the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) Regulation, which requires manufacturers and importers to assess and manage the risks posed by chemicals and provide safety information.

- In China, potassium formate is governed by the Measures on the Environmental Management of New Chemical Substances, administered by the Ministry of Ecology and Environment (MEE).

- In Japan, potassium formate falls under the Chemical Substances Control Law (CSCL), which classifies and regulates chemicals based on their environmental and health impacts. Manufacturers are required to notify the Ministry of Economy, Trade and Industry (METI) and conduct hazard assessments before commercial use.

- In India, the regulation of potassium formate is overseen by the Central Pollution Control Board (CPCB) and regulated under the Manufacture, Storage and Import of Hazardous Chemical Rules, 1989. Additionally, the Chemical Accidents Rules, 1996, ensure the safe handling and storage of potentially hazardous chemicals like potassium formate.

Competitive Landscape

The potassium formate industry is characterized by key players focusing on strategic initiatives to strengthen their market position and expand their global footprint. Companies are heavily investing in capacity expansion and modernization of production facilities to meet the growing demand across diverse end-use industries.

Strategic partnerships and long-term supply agreements with end-users in the oil and gas, de-icing, and HVAC sectors are common approaches to securing market share and ensuring consistent revenue streams.

In addition, market participants are emphasizing innovation in product formulation to improve the performance characteristics of potassium formate, particularly in high-pressure drilling and thermal management applications.

Efforts to optimize production costs and enhance supply chain efficiency through vertical integration are also evident. Key players are expanding their presence in high-growth regions through joint ventures and acquisitions while focusing on sustainability-driven product lines to align with the increasing preference for environmentally friendly solutions.

- In April 2024, OMV Petrom, Southeastern Europe's leading integrated energy producer, will pilot an advanced carbon capture and utilization (CCU) technology at its Petrobrazi refinery from June. Part of the EU-funded ConsenCUS innovation project across Denmark, Romania, and Greece, the system captures CO2 efficiently, purifies it, and converts it into potassium formate, a versatile chemical used in synthetic fuel production.

List of Key Companies in Potassium Formate Market:

- Perstorp Holding AB

- Clariant

- Thermo Fisher Scientific Inc.

- Eastman Chemical Company

- TETRA Technologies, Inc.

- ESSECO GROUP

- Dynalene, Inc.

- Hawkins

- American Elements

- Hangzhou Focus Chemical Co., Ltd.

- Nachurs Alpine Solutions

- BASF

- DongyingShuntong Chemical (Group) Co., Ltd

- SLB

- Kaz MI Swaco

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In January 2025, Electro Carbon delivered the first batch of its ECOWAY50 product, an environmentally friendly potassium formate formulation, to several Quebec airports for runway de-icing. The product is manufactured using an innovative electrochemical process involving the transformation of CO2 by electrolysis.