Market Definition

The market involves the production, distribution, and application of fluids used in drilling operations for oil, gas, and other subsurface resources. It includes water-based, oil-based, and synthetic-based fluids, each selected based on specific geological conditions and environmental factors.

The report explores key factors of market development, offering detailed regional analysis and a comprehensive overview of the competitive landscape shaping future opportunities.

Drilling Fluids Market Overview

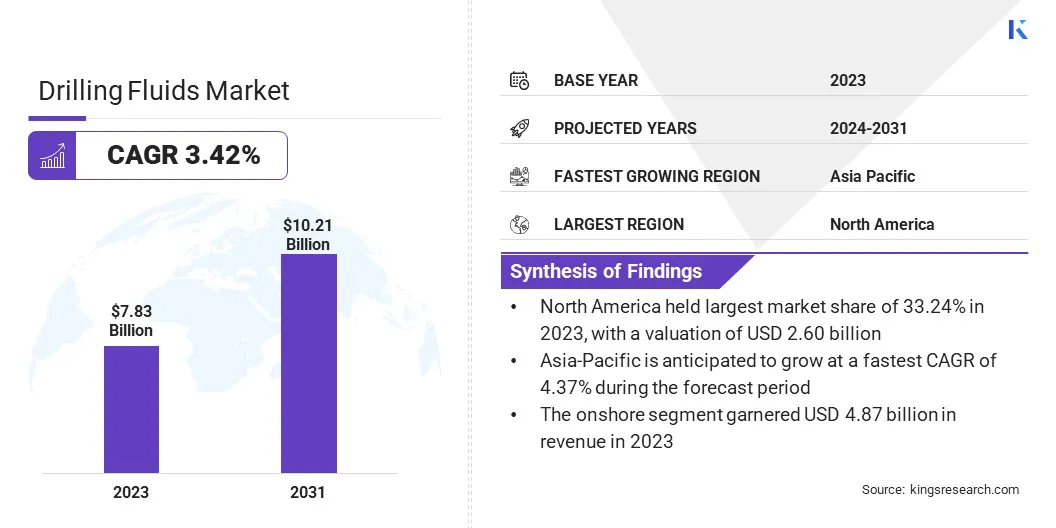

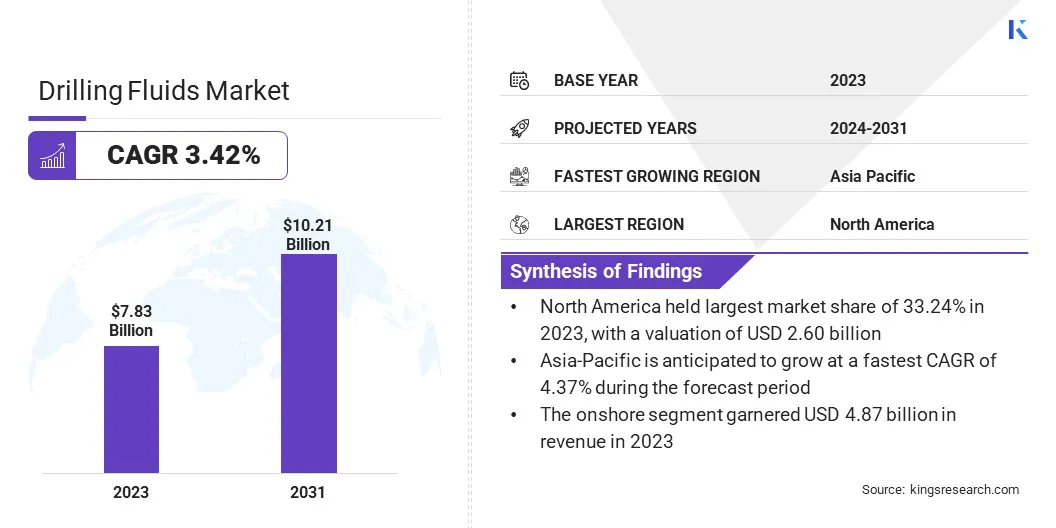

The global drilling fluids market size was valued at USD 7.83 billion in 2023 and is projected to grow from USD 8.07 billion in 2024 to USD 10.21 billion by 2031, exhibiting a CAGR of 3.42% during the forecast period.

Market growth is attributed to the rising globSal energy demand, which continues to drive exploration and production (E&P) activities, particularly in both conventional and unconventional hydrocarbon reserves.

Major companies operating in the drilling fluids industry are Halliburton Energy Services, Inc., Newpark Resources Inc, Baker Hughes Company, Flotek Industries, Inc., oil-drilling-fluids.com. , CES Energy Solutions Corp., Catalyst, Universal Performance Chemicals Pvt. Ltd, SLB, Ashahi Chemical Industries (P) Ltd, Weatherford, Imperial Oilfield Chemicals Pvt. Ltd, TETRA Technologies, Inc., Core Drilling Chemicals, and Scomi Group Bhd.

Technological advancements in drilling methodologies, such as horizontal and deepwater drilling, are highlighting the need for efficient and high-performance drilling fluids.

Moreover, growing emphasis on optimizing wellbore stability, enhancing drilling efficiency, and adhering to stringent environmental regulations is expected to propel market growth through the forecast period.

- In March 2025, SLB secured a major drilling contract by Woodside Energy for the ultra-deepwater Trion development project offshore Mexico. The contract encompasses digital directional drilling, logging while drilling (LWD), cementing, surface logging, drilling and completion fluids, completions, and wireline services.

Key Highlights

- The drilling fluids industry size was valued at USD 7.83 billion in 2023.

- The market is projected to grow at a CAGR of 3.42% from 2024 to 2031.

- North America held a share of 33.24% in 2023, valued at USD 2.60 billion.

- The water-based segment garnered USD 2.90 billion in revenue in 2023.

- The onshore segment is expected to reach USD 6.28 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 4.37% over the forecast period.

Market Driver

"Increased Offshore Drilling Activities"

Increased offshore drilling activities are contributing significantly to the expansion of the drilling fluids market, as energy companies expand exploration into deepwater and ultra-deepwater reserves.

These offshore operations necessitate specialized drilling fluids to address the unique challenges of high-pressure environments, ensure wellbore stability, and mitigate fluid loss.

The complexity of offshore drilling, coupled with stringent environmental regulations and the need for enhanced operational safety, accelerates the demand for advanced and environmentally sustainable drilling fluid solutions.

- In January 2025, Halliburton Energy Services, Inc. secured a major contract with Petrobras to provide integrated drilling services across multiple offshore fields in Brazil for a three-year period. This contract marks Halliburton's largest service agreement with Petrobras, significantly enhancing its presence in both pre-salt and post-salt offshore regions.

Market Challenge

"High Cost of Advanced Drilling Fluids"

The high cost of advanced drilling fluids presents a key challenge to the expansion of the drilling fluids market. As exploration increasingly extends into geologically complex and high-risk environments, such as high-pressure, high-temperature (HPHT) formations and deepwater reservoirs, the need for technically sophisticated fluid systems has grown.

These fluids, essential for complex operations such as HPHT and deepwater drilling, require premium materials and specialized additives, leading to significantly higher production costs.

While they offer superior performance, their high expense limits adoption in cost-sensitive operations, particularly during periods of low oil prices. Smaller operators and marginal fields often find it difficult to justify the investment, making cost-effectiveness a critical barrier to broader market penetration.

To mitigate this challenge, operators can focus on optimizing fluid formulations by utilizing cost-effective materials without compromising performance. Implementing fluid recycling technologies can reduce waste and lower disposal costs, while real-time monitoring and precision fluid management can enhance operational efficiency.

Collaboration between fluid suppliers and operators enales tailored, cost-effective solutions. Furthermore, economies of scale in large-scale projects can reduce per-unit costs, enhancing the affordability of advanced drilling fluids.

Market Trend

"Advancements in Drilling Technologies"

Advancements in drilling technologies, such as deepwater, horizontal, and extended reach drilling, are propelling the expansion of the drilling fluids market. These techniques target challenging environments, requiring fluids with superior thermal stability, pressure resistance, and wellbore stability.

Moreover, the integration of automation and real-time data analytics allows for precise fluid management, improving efficiency while reducing costs and environmental impact. These innovations are shaping the development of new fluid formulations to meet the evolving needs of modern drilling operations.

Drilling Fluids Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Oil-Based, Synthetic Based, Water-Based, Others

|

|

By Application

|

Onshore, Offshore

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Oil-Based, Synthetic Based, Water-Based, and Others): The water-based segment earned USD 2.90 billion in 2023 due to its cost-effectiveness, environmental benefits, and widespread use in conventional drilling operations.

- By Application (Onshore and Offshore): The onshore segment held a share of 62.15% in 2023, fueled by higher drilling activity and lower operational costs compared to offshore.

Drilling Fluids Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America drilling fluids market share stood at around 33.24% in 2023, valued at USD 2.60 billion. This dominance is reinforced by the region's extensive oil and gas production, particularly in U.S. shale plays and offshore Gulf of Mexico fields.

The presence of major oilfield service companies, coupled with ongoing advancements in drilling technologies, further supports this expansion. Moreover, favorable regulatory frameworks and significant investments in exploration and production activities boost the demand for drilling fluids.

- According to the Bureau of Ocean Energy Management, the Gulf of America remains the primary offshore source of U.S. oil and gas, accounting for about 97% of the nation's OCS production. Offshore activities generate significant revenues from lease sales, royalties, and rental fees, with the largest portion allocated to the U.S. Treasury's General Fund, supporting federal operations. In FY2024, revenues from OCS oil and gas activities totaled USD 7 billion.

The Asia-Pacific drilling fluids industry is estimated to grow at a CAGR of 4.37% over the forecast period. This growth is fostered by the rising exploration and production activities in emerging oil and gas fields across countries, along with the region's increasing energy demand.

Furthermore, substantial investments in both conventional and unconventional hydrocarbon resources, coupled with the adoption of advanced drilling technologies and efficient fluid management systems, are expected to stimulate regional market expansion.

Regulatory Frameworks

- In the United States, the Oil and Gas Extraction Effluent Guidelines (40 CFR Part 435) regulate wastewater discharges from oil and gas extraction. These guidelines aim to minimize environmental impact by controlling pollutants such as oil and grease, particularly in coastal areas.

- In Canada, the Offshore Waste Treatment Guidelines (NE23-59/2010) regulate waste management in offshore oil and gas operations, ensuring responsible waste treatment and disposal to protect the marine environment during drilling activities.

- In the United States, the Oil and Gas Industry Wastewater Effluent Guidelines (EPA 503925) regulate wastewater discharges from oil and gas extraction, with a focus on limiting pollutants to protect water quality and ecosystems.

Competitive Landscape

The drilling fluids industry is highly competitive, with numerous key players operating across various regions. Prominent oilfield services companies, along with specialized fluid manufacturers, are competing for market share through technological advancements, product differentiation, and strategic partnerships.

Leading industry participants are focusing on the development of environmentally sustainable fluid solutions to comply with stringent regulatory standards and meet the growing demand for high-performance drilling fluids.

Furthermore, the market is marked by consolidation through mergers and acquisitions, as well as increased investments in R&D to enhance product offerings and secure a competitive advantage.

- In September 2024, Newpark Resources, Inc. announced the successful completion of the sale of its Fluids Systems segment to SCF Partners, a private equity firm focused on the global energy industry. The transaction, valued at USD 127.5 million, enables Newpark to concentrate on growing its specialty rental and services business within worksite access and critical infrastructure markets.

List of Key Companies in Drilling Fluids Market:

- Halliburton Energy Services, Inc.

- Newpark Resources Inc

- Baker Hughes Company

- Flotek Industries, Inc.

- oil-drilling-fluids.com.

- CES Energy Solutions Corp.

- Catalyst

- Universal Performance Chemicals Pvt. Ltd

- SLB

- Ashahi Chemical Industries (P) Ltd

- Weatherford

- Imperial Oilfield Chemicals Pvt. Ltd

- TETRA Technologies, Inc.

- Core Drilling Chemicals

- Scomi Group Bhd

Recent Developments (M&A)

- In August 2024, AES Drilling Fluids announced the acquisition of HydroLite Operating LLC, a completion services firm located in Midland, TX. HydroLite will now function under the name AES Completion Services, specializing in fluid systems for well drill-outs and cleanouts across a range of reservoir pressure environments.

- In November 2023, Wyo-Ben, Inc. acquired the bentonite operation from M-I Swaco, a Schlumberger division, strengthening its position in the industry. This acquisition, based in Greybull, WY, aims to expand their portfolio of drilling fluid products and services for global customers by combining their expertise.