Market Definition

The market encompasses water-based and solvent-based formulations and a range of applications that include paints & coatings, adhesives & sealants, textile finishing, natural leather finishing, and synthetic leather finishing.

This market framework encompasses the entire supply chain, from the development of specialized formulations to their application across diverse industries, reflecting a balance between technological innovation and end-user performance requirements.

Polyurethane Dispersion Market Overview

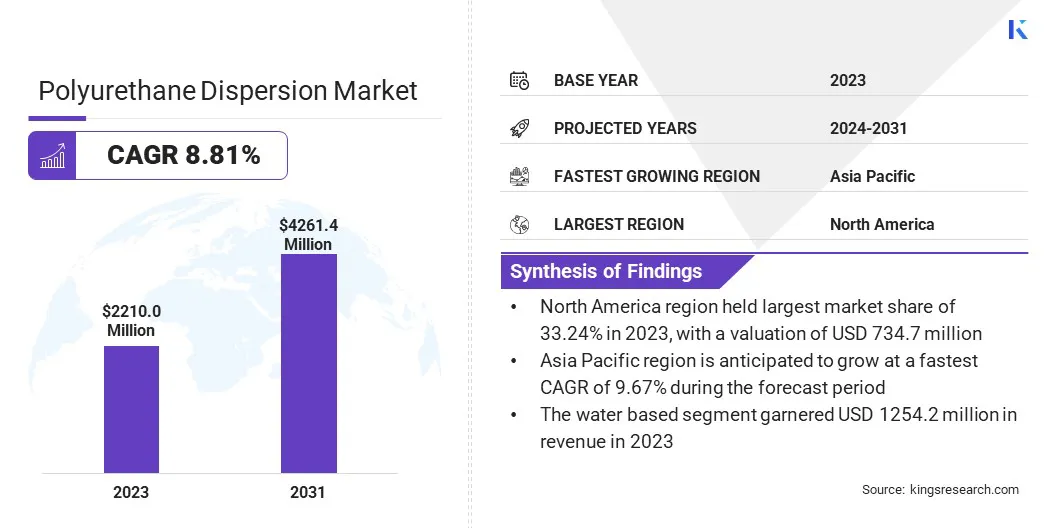

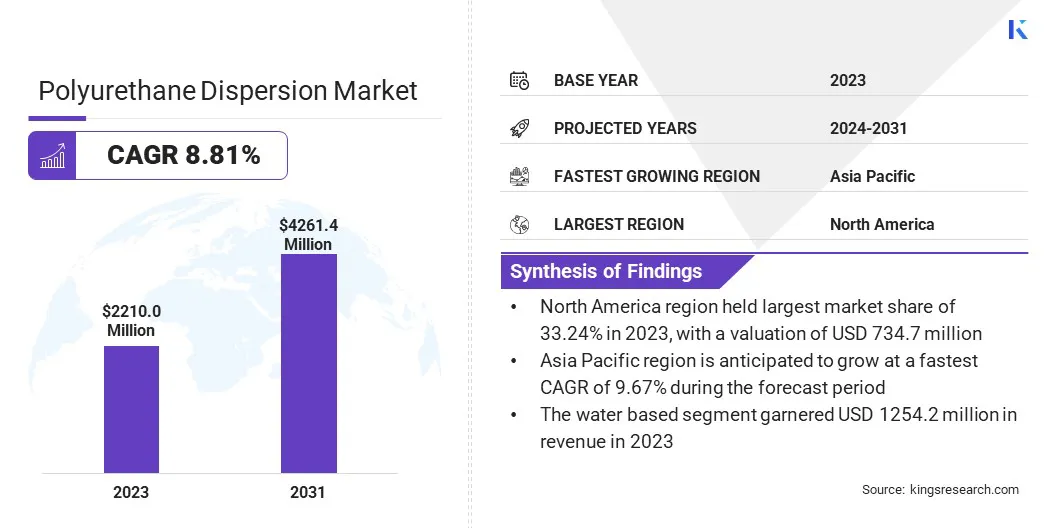

The global polyurethane dispersion market size was valued at USD 2210.0 million in 2023 and is projected to grow from USD 2360.4 million in 2024 to USD 4261.4 million by 2031, exhibiting a CAGR of 8.81% during the forecast period.

The market is driven by the increasing demand for eco-friendly and high-performance coating solutions across various industries. The shift toward water-based formulations, favored for their low VOC content and regulatory compliance, is a key factor supporting market expansion.

Major companies operating in the polyurethane dispersion industry are Asahi Kasei Corporation, LANXESS, Mitsui Chemicals, Inc., Stahl Holdings B.V., BASF, C. L. HAUTHAWAY & SONS CORP, Lamberti S.p.A., Perstorp, Cosmos Plastics & Chemicals, The Lubrizol Corporation, Huntsman International LLC, ALBERDINGK BOLEY GmbH, Dow, Wanhua, and Covestro AG.

The market is further supported by advancements in formulation technology, enhancing the durability, flexibility, and chemical resistance of Polyurethane Dispersion (PUD). Growing investments in the automotive, construction, furniture, and fashion industries are also contributing to the rising adoption of PUD globally.

Key Highlights:

- The polyurethane dispersion industry size was valued at USD 2210.0 million in 2023.

- The market is projected to grow at a CAGR of 8.81% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 734.7 million.

- The water based segment garnered USD 1254.2 million in revenue in 2023.

- The paints & coatings segment is expected to reach USD 1142.3 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 9.67% during the forecast period.

Market Driver

Rising Demand for Eco-friendly Solutions and Sustainable Packaging

The market is registering significant growth, driven by the increasing demand for eco-friendly coatings and adhesives as well as the expanding use of PUDs in sustainable packaging solutions.

The shift toward low-VOC, water-based formulations is gaining momentum, particularly in industries such as automotive, construction, textiles, and leather finishing, where regulatory policies and environmental concerns are pushing manufacturers to adopt greener alternatives.

Additionally, the growing emphasis on sustainable packaging, particularly mono-material food packaging, has fueled the need for PUD-based adhesives and coatings that enhance recyclability while maintaining strong barrier properties and durability. Major manufacturers are expanding their production capacities, further strengthening the market’s growth trajectory.

- In August 2023, Mitsui Chemicals, Inc. announced an expansion of its PUD production at the Shimizu Factory to meet the rising demand for mono-material food packaging. The move will double domestic capacity as sustainability drives the demand for PUD, especially in Europe. Takelac PUDs, known for heat resistance and barrier properties, are widely used in coatings, adhesives, and textiles, prompting Mitsui Chemicals to strengthen its supply network.

Market Challenge

High Production Costs

A major challenge in the polyurethane dispersion market is the high production cost associated with raw materials and advanced formulation technologies. The reliance on specialty polyols, isocyanates, and additives increases manufacturing expenses, making PUD-based products less cost-competitive compared to conventional solvent-based alternatives.

Market Trend

Advancements in High-performance Technologies

The market is evolving with rapid advancements in high-performance technologies, enhancing the durability, flexibility, and chemical resistance of PUD-based coatings and adhesives.

Crosslinking technology aids in improving adhesion strength, water resistance, and mechanical properties, making PUDs more suitable for demanding applications in automotive, construction, and industrial coatings. Additionally, hybrid PUDs that combine multiple polymer technologies are gaining traction, offering superior performance in textile finishing, synthetic leather, and protective coatings.

- In November 2024, Lubrizol introduced Sancure 20898 PUD, expanding its advanced resin technologies for coatings. Designed for packaging coatings and durable inks, it enhances Hot Stamp Foil (HSF) holographic packaging with an optimal balance of hardness and flexibility for high-quality finishes. Engineered to withstand embossing processes like holographic foils and metallic finishes, it ensures durability and maintains design integrity.

Polyurethane Dispersion Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Water based, Solvent based

|

|

By Application

|

Paints & Coatings, Adhesives & Sealants, Textile Finishing, Natural Leather Finishing, Synthetic Leather, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Water based, Solvent based): The water based segment earned USD 1254.2 million in 2023, due to its growing preference for low-VOC, environmentally friendly coatings and adhesives across industries.

- By Application (Paints & Coatings, Adhesives & Sealants, Textile Finishing, Natural Leather Finishing, Synthetic Leather, Others): The paints & coatings segment held 26.74% share of the market in 2023, due to the rising adoption of water-based PUDs in protective and decorative coatings for automotive, construction, and industrial applications.

Polyurethane Dispersion Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 33.24% share of the polyurethane dispersion market in 2023, with a valuation of USD 734.7 million. This is attributed to the strong demand for high-performance coatings, adhesives, and sealants in industries such as automotive, construction, and textiles.

Environmental regulations encouraging the adoption of low-VOC, water-based PUDs, along with technological advancements and the presence of key manufacturers, have contributed to the region's dominance. Additionally, the region benefits from a well-established industrial base and increasing investments in sustainable and advanced material solutions.

The market in Asia Pacific is poised to grow at a significant CAGR of 9.67% over the forecast period, driven by rapid industrialization, urbanization, and expanding manufacturing sectors in countries like China, India, and Japan.

The booming automotive, construction, and footwear industries, along with the rising demand for synthetic leather and textile finishing applications, are driving the consumption of PUDs. The presence of a large number of PUD manufacturers in the region, particularly in China and India, has strengthened supply chains and enhanced production capabilities.

Increasing environmental awareness and supportive government initiatives promoting eco-friendly coatings and adhesives further accelerate the market growth in this region.

- In November 2023, Covestro announced the launch of mass-balanced PUDs in Asia Pacific. Featuring up to 80% alternative raw materials, these low-carbon PUDs offer a drop-in solution for automotive, footwear, and electronics coatings, advancing sustainability and circular economy goals.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates PUDs under the Clean Air Act (CAA) by setting limits on volatile organic compound (VOC) emissions in coatings, adhesives, and other industrial applications.

- In India, the Bureau of Indian Standards (BIS) sets guidelines for PUDs in coatings, adhesives, and other applications to ensure quality, safety, and performance.

Competitive Landscape:

The polyurethane dispersion industry is marked by strong competition, with leading companies emphasizing technological advancements, industry collaborations, production enhancements, and eco-friendly initiatives to expand their market footprint.

Companies are investing in research and development to enhance the performance of PUDs, offering improved durability, flexibility, and environmental compliance. Mergers, acquisitions, and collaborations with raw material suppliers and end-use industries are common strategies aimed at expanding market reach and optimizing supply chains.

Additionally, manufacturers are increasing their production capacities, particularly in high-growth regions such as Asia Pacific, to meet the rising demand for water-based PUDs. A growing emphasis on sustainable and bio-based formulations has led to the development of low-VOC and solvent-free alternatives, aligning with global environmental regulations.

Companies are also leveraging advanced manufacturing technologies to enhance efficiency and cost-effectiveness while maintaining high product quality.

- In October 2024, Stahl announced the opening of a new state-of-the-art facility for the manufacturing of PUDs in Singapore. This strategic expansion aims to meet the growing demand in Asia and South Pacific, reinforcing Stahl’s commitment to sustainability and innovation. The new facility also aligns with the company’s environmental, social, and governance (ESG) goals, supporting its long-term growth strategy.

List of Key Companies in Polyurethane Dispersion Market:

- Asahi Kasei Corporation

- LANXESS

- Mitsui Chemicals, Inc.

- Stahl Holdings B.V.

- BASF

- C. L. HAUTHAWAY & SONS CORP

- Lamberti S.p.A.

- Perstorp

- Cosmos Plastics & Chemicals

- The Lubrizol Corporation

- Huntsman International LLC

- ALBERDINGK BOLEY GmbH

- Dow

- Wanhua

- Covestro AG

Recent Developments (Product Launch)

- In September 2023, Covestro launched its portfolio of PUDs and partially bio-based products. Covestro introduced its enhanced waterborne polyurethane adhesive solutions, Dispercoll U PLUS and Desmodur, specifically designed for the automotive interior market, offering low VOC emissions, improved environmental sustainability, and stable bonding performance in varying climate conditions.