Market Definition

Pharmaceutical contract manufacturing involves outsourcing the production of drugs to specialized providers offering comprehensive development and manufacturing services. It encompasses activities such as active pharmaceutical ingredient synthesis, formulation development, clinical trial material production, and commercial-scale manufacturing.

The scope of the market extends across small-molecule drugs, biologics, and complex dosage forms in response to the rising demand for flexible capacity and expertise. Pharmaceutical companies are engaging with contract manufacturers to streamline operations, ensure regulatory compliance, accelerate time‑to‑market, and optimize cost‑efficiency throughout the product lifecycle.

Pharmaceutical Contract Manufacturing Market Overview

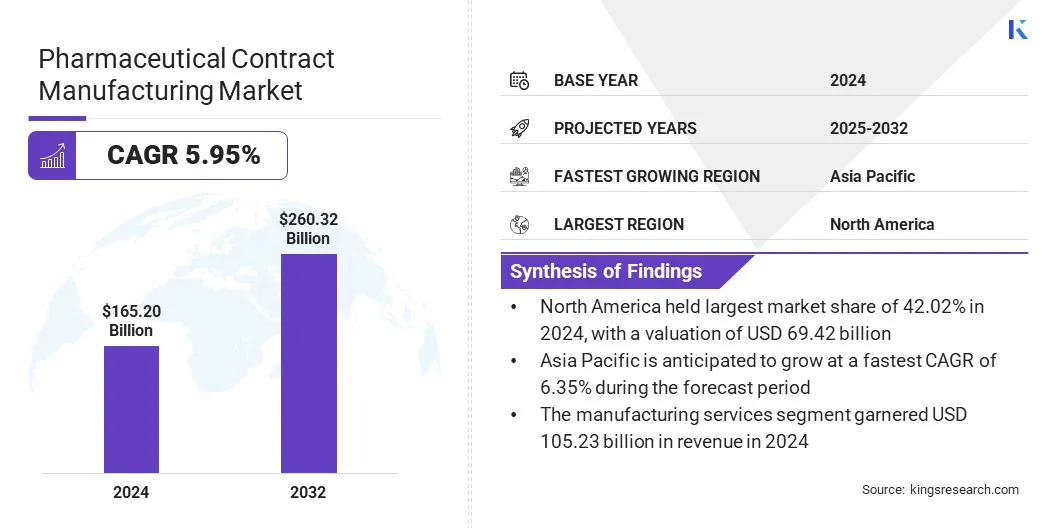

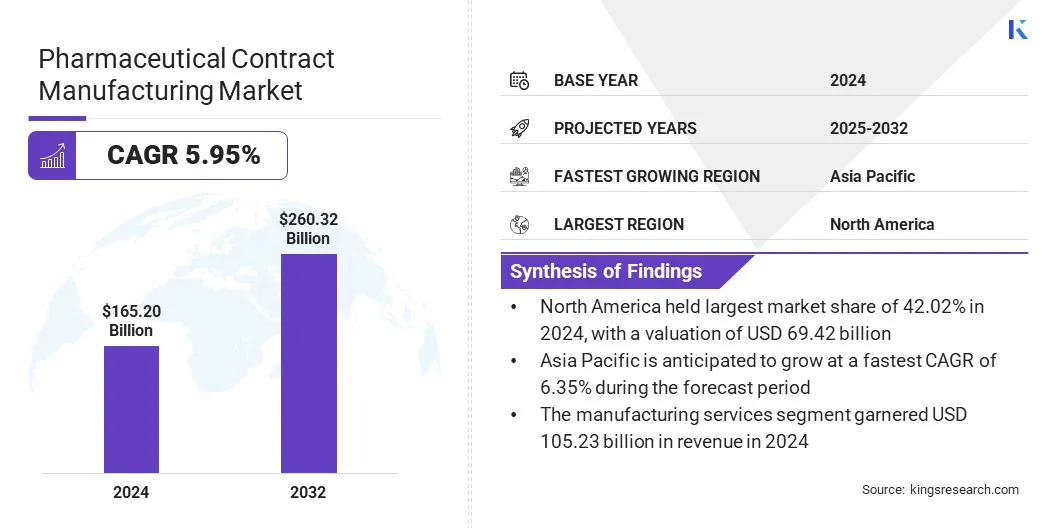

The global pharmaceutical contract manufacturing market size was valued at USD 165.20 billion in 2024 and is projected to grow from USD 173.76 billion in 2025 to USD 260.32 billion by 2032, exhibiting a CAGR of 5.95% during the forecast period.

This growth is driven by the rising demand for biologics and biosimilars, requiring specialized production capabilities that many drug developers outsource. Additionally, the integration of digital technologies and advanced analytics in manufacturing processes is improving efficiency, quality control, and scalability, making outsourcing more attractive to pharmaceutical companies.

Key Market Highlights

- The pharmaceutical contract manufacturing industry size was valued at USD 165.20 billion in 2024.

- The market is projected to grow at a CAGR of 5.95% from 2025 to 2032.

- North America held a market share of 42.02% in 2024, with a valuation of USD 69.42 billion.

- The manufacturing services segment garnered USD 105.23 billion in revenue in 2024.

- The branded drugs segment is expected to reach USD 127.27 billion by 2032.

- The oral solids segment secured the largest revenue share of 41.20% in 2024.

- The small & medium pharma is poised for a robust CAGR of 7.93% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 6.35% during the forecast period.

Major companies operating in the pharmaceutical contract manufacturing industry are Thermo Fisher Scientific, Inc., Ardena Holding NV., Lonza Group, WuXi AppTec, Merck KGaA, Siegfried Holding AG, Recipharm AB, Boehringer Ingelheim International GmbH, FUJIFILM Diosynth Biotechnologies, AGC Biologics, Almac Group, Cipla, Pfizer Inc., Rentschler Biopharma SE, and Akums Drugs and Pharmaceuticals Ltd.

Rising outsourcing in the pharmaceutical industry is fueling market growth as companies seek to reduce internal costs and improve operational efficiency. Drug developers are increasingly relying on contract development and manufacturing organizations (CDMOs) to accelerate production timelines and streamline market entry.

Outsourcing allows pharmaceutical firms to focus on core research and development activities while using external expertise for formulation, scale-up, and regulatory compliance. CDMOs offer flexible capacity and global infrastructure to meet evolving manufacturing needs.

- In February 2024, Samsung Biologics entered into an agreement with LegoChem Biosciences to support the development of antibody-drug conjugates (ADCs) and manufacture drug substances. As part of this collaboration, Samsung Biologics will contribute to LegoChem’s ADC program targeting solid tumors by providing antibody development and drug substance manufacturing services.

Market Driver

Surge in Demand for Biologics and Biosimilars

The surge in demand for biologics, biosimilars, and specialty medicines is enabling pharmaceutical companies to partner with contract development and manufacturing organizations (CDMOs). Producing complex biologics requires highly specialized facilities, strict quality controls, and advanced technical capabilities that CDMOs are well-equipped to deliver.

Biopharmaceutical firms are increasingly outsourcing manufacturing to gain expertise in handling large molecules, cell cultures, and sterile processes. Rising investment in biosimilars is further accelerating the need for scalable and compliant production infrastructure.

CDMOs are supporting rapid development and commercialization by offering end-to-end biologics manufacturing solutions, contributing to the expansion of the pharmaceutical contract manufacturing market.

- In July 2024, Just–Evotec Biologics extended its agreement with Sandoz to commercially manufacture multiple biosimilars using its new J.POD facility at Evotec’s Toulouse campus. The enhanced partnership secures long-term supply agreements and includes the expanded manufacturing of Sandoz’s biosimilar pipeline.

Market Challenge

Intellectual Property and Confidentiality Concerns

A key challenge limiting the expansion of the pharmaceutical contract manufacturing market is managing the risk of intellectual property leakage when proprietary formulations are shared with third-party manufacturers. These concerns are particularly critical for innovative and high-value drugs, where any breach can lead to competitive and legal consequences. Ensuring confidentiality throughout the production process is essential to foster trust and protect valuable assets.

To address this challenge, market players are implementing stringent contractual agreements, adopting secure data management systems, and maintaining compliance with global regulatory standards. Companies are also conducting regular audits and reinforcing internal protocols to safeguard client information and preserve IP integrity.

- In July 2023, Berkshire Sterile Manufacturing, a Massachusetts-based CDMO developing clinical and commercial drug products, implemented a new Mettler Toledo LabX data management system. It stores analytical results in a 21 CFR Part 11-compliant database to ensure traceability, permanence, and auditability of GMP data. It also features robust audit trails and user-level traceability to reinforce internal protocols and safeguard client information.

Market Trend

Integration of Digitalization & Advanced Analytics

A key trend in the pharmaceutical contract manufacturing market is the adoption of digital tools and advanced analytics to enhance operational performance. Contract manufacturers are integrating technologies such as artificial intelligence, Internet of Things (IoT), and predictive maintenance into their production environments.

These tools are helping streamline workflows, monitor equipment health, and reduce unplanned downtime. Advanced analytics are offering better visibility into process data and supporting faster decision-making and real-time adjustments. Digital platforms assist in maintaining regulatory compliance by ensuring consistent documentation and quality control.

- In February 2025, Parexel announced the piloting of an AI model designed to expedite the generation of drug safety reports. This AI-driven system aims to reduce the time taken to produce these reports by 30 to 45 minutes compared to manual processes. The integration of AI into this aspect of pharmaceutical contract manufacturing supports the trend of adopting digital tools and advanced analytics to enhance operational performance, streamline workflows, and improve decision-making processes.

Pharmaceutical Contract Manufacturing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Service Type

|

Manufacturing Services, Packaging Services, Other Services

|

|

By Drug Type

|

Branded Drugs, Generic Drugs

|

|

By Dosage Form

|

Oral Solids, Injectables, Others

|

|

By End User

|

Big Pharma, Small & Medium Pharma, Biotech Companies

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Service Type (Manufacturing Services, Packaging Services, and Other Services): The manufacturing services segment earned USD 105.23 billion in 2024, due to the high demand for large-scale production of complex drug formulations, including biologics and generics.

- By Drug Type (Branded Drugs and Generic Drugs): The branded drugs segment held a share of 54.30% in 2024, marked by a strong demand for specialized manufacturing capabilities, strict regulatory compliance, and greater profit margins.

- By Dosage Form (Oral Solids, Injectables, and Others): The oral solids segment is projected to reach USD 105.09 billion by 2032, owing to its high patient compliance, cost-effective production, and widespread use across therapeutic areas, making it the most commonly outsourced dosage form.

- By End User (Big Pharma, Small & Medium Pharma, and Biotech Companies): The small & medium pharma segment is set to grow at a CAGR of 7.93% through the forecast period, largely attributed to its limited in-house manufacturing capabilities and growing reliance on CDMOs to access advanced technologies, reduce costs, and accelerate product development timelines.

Pharmaceutical Contract Manufacturing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America pharmaceutical contract manufacturing market share stood at 42.02% in 2024, valued at USD 69.42 billion. This dominance is attributable to the region’s strong growth in biologics, biosimilars, cell and gene therapies, and mRNA-based drugs.

These products require highly specialized manufacturing environments, which require specialized manufacturing. In response, pharmaceutical companies are increasingly outsourcing to CDMOs with advanced technical capabilities.

- In March 2024, Lonza agreed to purchase Roche’s Genentech biologics facility in Vacaville, California, for USD 1.2 billion. Upgrade investments of CHF 500 million is planned to enhance large-molecule and monoclonal antibody CDMO capacity. Facility commissioning targets improved specialized manufacturing capabilities through 2024–2028.

The Asia-Pacific pharmaceutical contract manufacturing industry is set to grow at a CAGR of 6.35% over the forecast period. This growth is propelled by growing domestic pharmaceutical sectors, with increased investments in R&D and production capacity. Many local companies that are focused on generics and biosimilars often partner with CDMOs to meet the rising demand. This is creating new business opportunities for contract manufacturers across the region.

- In October 2024, Samsung Biologics signed a USD 1.24 billion contract with an Asia-based pharmaceutical company for production at its Songdo facility through December 2037. This marked the largest single-client CDMO agreement in Samsung’s history and raised its total CDMO contracts for 2024 to over USD 3.3 billion.

Regulatory Frameworks

- In the U.S., pharmaceutical contract manufacturing is regulated by the U.S. Food and Drug Administration (FDA) under Current Good Manufacturing Practice (CGMP) guidelines outlined in 21 CFR Parts 210 and 211. The FDA also enforces the Drug Supply Chain Security Act (DSCSA), which mandates serialization and traceability.

- The European Medicines Agency (EMA) enforces pharmaceutical GMP through Directives 2001/83/EC and 2003/94/EC. Manufacturers must hold valid manufacturing authorizations and comply with EudraLex Volume 4 GMP guidelines. Contract manufacturing requires written agreements defining roles in quality and compliance. Serialization is mandated under the Falsified Medicines Directive.

- China's National Medical Products Administration (NMPA) requires pharmaceutical manufacturers and Marketing Authorization Holders (MAHs) to obtain Category B licenses for outsourced drug production. Under the revised Drug Administration Law, MAHs are held accountable for contract manufacturer compliance. Manufacturers must pass NMPA GMP certification and conduct regular audits. High-risk drugs, such as vaccines and narcotics, face additional restrictions.

- Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) regulates contract manufacturing through the Ministry of Health, Labour and Welfare (MHLW) under the country’s GMP ordinance. Japan adheres to the International Council for Harmonisation (ICH) guidelines, including ICH Q7–Q13 for manufacturing practices and quality management. All manufacturers must obtain licensing and undergo regular inspections.

Competitive Landscape

Major players in the pharmaceutical contract manufacturing industry are adopting strategies such as acquisitions, capacity expansion, and the integration of specialized manufacturing capabilities. Companies are focusing on building end-to-end service offerings that cover early-stage development through commercial production.

Strategic investments in aseptic filling, lyophilization, and oral solid dosage capabilities, along with advanced engineering and supply chain solutions, are helping them meet growing client demand and maintain competitiveness. Partnerships and R&D-focused collaborations are also being used to enhance technical expertise and accelerate development timelines.

- In February 2025, Jabil acquired Pharmaceutics International, Inc. to expand its capabilities in early-stage and commercial-scale aseptic filling, lyophilization, and oral solid-dose manufacturing. The move integrates clinical and commercial CDMO services into Jabil’s engineering and supply chain portfolio.

Key Companies in Pharmaceutical Contract Manufacturing Market:

- Thermo Fisher Scientific, Inc.

- Ardena Holding NV.

- Lonza Group

- WuXi AppTec

- Merck KGaA

- Siegfried Holding AG

- Recipharm AB

- Boehringer Ingelheim International GmbH

- FUJIFILM Diosynth Biotechnologies

- AGC Biologics

- Almac Group

- Cipla

- Pfizer Inc.

- Rentschler Biopharma SE

- Akums Drugs and Pharmaceuticals Ltd.

Recent Developments (M&A/Expansion)

- In February 2025, Ardena acquired Catalent’s Somerset, a New Jersey drug product facility, adding over 50,000 ft² of cGMP manufacturing space, expanding its CDMO presence in North America. The transaction includes a new 2,500 ft² bioanalytical lab scheduled to open in Q3 2025.

- In September 2024, PCI Pharma Services initiated a USD 365 million expansion of drug-device combination packaging facilities. The investment includes a 545,000 ft² expansion in Rockford, Illinois, and upgrades to its Philadelphia Biotech Center for injectables and autoinjectors. The project enables scalable prefilled syringe, vial, and autoinjector assembly with ISO-compliant testing suites.

- In February 2024, Cambrex Corporation expanded its High Point API site in North Carolina, investing USD 38 million to add two clinical-scale production suites, a commercial-scale zone with 2,000 L reactors, and enhanced analytical and development labs. The expansion doubled the site’s production capacity and integrated Snapdragon Chemistry’s flow chemistry capabilities.