Market Definition

Personalized nutrition is a customized approach to diet and health that takes into account an individual’s unique factors such as genetics, lifestyle, microbiome, health conditions, and dietary preferences to deliver tailored nutritional guidance.

This method focuses on improving health outcomes, preventing chronic diseases, and promoting overall well-being by going beyond traditional one-size-fits-all dietary recommendations. It serves diverse applications ranging from fitness and weight management to chronic disease prevention and clinical nutrition.

Personalized Nutrition Market Overview

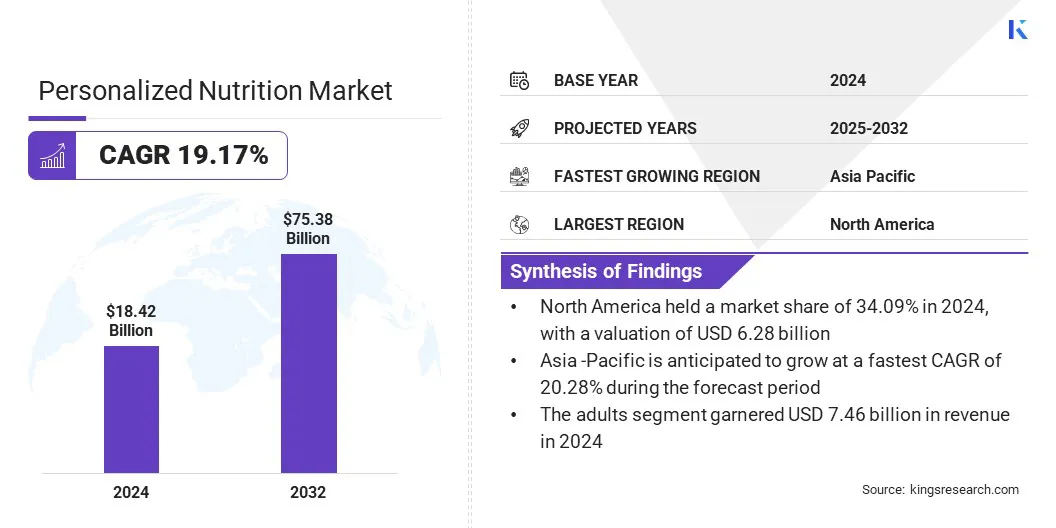

The global personalized nutrition market size was valued at USD 18.42 billion in 2024 and is projected to grow from USD 21.86 billion in 2025 to USD 75.38 billion by 2032, exhibiting a CAGR of 19.17% during the forecast period.

The market growth is attributed to the rising prevalence of lifestyle diseases, which is prompting consumers to seek preventive and targeted dietary solutions. The market is further driven by the adoption of advanced personalized nutrition trackers that integrate biometric and lifestyle data to deliver real-time and customized recommendations for improved health outcomes.

Key Highlights:

- The personalized nutrition industry size was valued at USD 18.42 billion in 2024.

- The market is projected to grow at a CAGR of 19.17% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 6.28 billion.

- The tablet segment garnered USD 5.17 billion in revenue in 2024.

- The active measurement segment is expected to reach USD 46.39 billion by 2032.

- The standard supplements segment is anticipated to register the fastest CAGR of 19.53% during the forecast period

- The adults segment garnered USD 7.46 billion in revenue in 2024

- The direct-to-consumers held a market share of 36.22% in 2024

- The market in Asia Pacific is anticipated to grow at a CAGR of 20.38% during the forecast period.

Major companies operating in the personalized nutrition market are Abbott, Amway, Herbalife International of America, Inc, Nestlé, dsm-firmenich, BASF, Glanbia plc, ADM, Danone, General Mills Inc, PepsiCo Inc, Viome Life Sciences, Inc, ZOE Limited, DayTwo Inc, and Nutrigenomix Inc.

Rising demand for customized nutrition and wellness products is driving the market. Consumers are increasingly seeking solutions tailored to their individual health goals, dietary preferences, and lifestyles. This shift is fueled by a desire for more effective and targeted outcomes, prompting brands to offer personalized supplements, meal plans, and wellness programs that align with specific needs and expectations.

- In April 2024, Vitamyna launched a personalized pack builder feature to meet the rising demand for customized nutrition and wellness products. The tool enables consumers to create tailored daily vitamin packs based on individual health needs, with convenient doorstep delivery through the brand’s online platform.

Market Driver

Rising Prevalence of Lifestyle Diseases

The rising prevalence of lifestyle diseases is driving the personalized nutrition market. Increasing incidences of conditions such as diabetes, obesity, and cardiovascular disorders are prompting individuals to seek proactive and preventive health solutions. Personalized nutrition offers tailored dietary plans that align with individual health goals, enabling better disease management and long-term wellness.

Moreover, the growing consumer interest in customized supplements, functional foods, and data-driven nutrition platforms is supporting the shift toward individualized approaches, further accelerating market expansion.

- According to the Centers for Disease Control and Prevention (CDC), approximately 6 in 10 Americans (60%) have at least one chronic disease, and 4 in 10 (40%) have two or more. This escalating prevalence is accelerating the demand for personalized nutrition solutions focused on prevention, targeted management, and long-term health optimization.

Market Challenge

High Cost of Personalized Nutrition Solutions

A key challenge in the personalized nutrition market is the high cost associated with customized health solutions. Products such as genetic testing kits, microbiome analyses, and personalized supplement regimens are often priced at a premium, making them inaccessible for a large segment of cost-conscious consumers.

This affordability gap is particularly evident in developing markets, where budget constraints limit adoption. Moreover, the added expense of subscription-based digital platforms and professional consultations raises the total cost, restricting mass-market penetration.

Market players are introducing tiered pricing models and budget-friendly subscription plans to make personalized nutrition more accessible. Companies are adopting AI to automate analysis and reduce operational costs, allowing them to offer affordable digital assessments.

Brands are offering free initial consultations or bundling services with wellness apps to add value in an increasingly competitive market. Additionally, partnerships with retailers and health insurers help subsidize costs and make personalized nutrition solutions available for a wider consumer base.

Market Trend

Advanced Personalized Nutrition Tracker

A key trend in the personalized nutrition market is the adoption of advanced nutrition trackers that integrate biometric and lifestyle data. Consumers are increasingly adopting platforms that combine inputs from blood biomarkers, DNA, and fitness trackers to generate tailored dietary recommendations.

This trend prompts companies to develop tools that offer real-time insights, meal timing guidance, and nutrient-specific feedback. These innovations enhance user engagement and support a shift toward precision-driven health management in both consumer and clinical settings.

- In September 2024, InsideTracker launched Nutrition DeepDive, a personalized nutrition tracking tool that analyzes the food and supplement intake of users in the context of their blood biomarkers, DNA, and fitness data. The platform delivers tailored nutritional insights and personalized recommendations linked to health goals such as sleep, stress, and performance.

Personalized Nutrition Market Report Snapshot

|

Segmentation

|

Details

|

|

By Form

|

Tablet, Capsule, Powder, Liquid, Others

|

|

By Product Type

|

Active Measurement, Standard Measurement

|

|

By Application

|

Standard Supplements, Disease-based

|

|

By End User

|

Adults, Pregnant Women, Geriatrics

|

|

By Distribution Channel

|

Direct-to-Consumers, Wellness & Fitness Centers, Hospitals, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Form (Tablet, Capsule, Powder, Liquid, and Others): The tablet segment earned USD 5.17 billion in 2024, due to its convenience, longer shelf life, and consumer preference for easy-to-consume supplement formats.

- By Product Type (Active Measurement, and Standard Measurement): The active measurement segment held 62.15% share of the market in 2024, due to the increasing demand for real-time, data-driven dietary recommendations based on biometric inputs.

- By Application (Standard Supplements, and Disease-based): The disease-based segment is projected to reach USD 44.45 billion by 2032, propelled by rising incidences of chronic illnesses and the need for targeted nutritional interventions.

- By End User (Adults, Pregnant Women, and Geriatrics): The adults segment earned USD 7.46 billion in 2024, owing to the growing awareness around preventive health and personalized wellness among working-age populations.

- By Distribution Channel (Direct-to-Consumers, Wellness & Fitness Centers, Hospitals, and Others): The hospitals segment is anticipated to register the fastest CAGR of 19.55% during the forecast period, due to increasing integration of personalized nutrition into clinical and therapeutic care pathways.

Personalized Nutrition Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

.webp)

North America personalized nutrition market share stood at around 34.09% in 2024, with a valuation of USD 6.28 billion. This market dominance is attributed to the increasing integration of personalized nutrition into mainstream healthcare and wellness routines across the region.

The region is registering the rising demand for tailored dietary solutions that support chronic disease management and preventive health. Consumers in the region are adopting data-driven platforms and personalized supplement plans that align with individual health goals, which is boosting the market in the region.

Moreover, the market is benefiting from the growing awareness of nutrition-sensitive conditions and the adoption of clinically validated digital tools that offer customized guidance. Brands in the region are launching solutions that emphasize convenience, precision, and holistic well-being, which is further supporting the market expansion in the region.

- In November 2024, NationsBenefits acquired Good Measures, a personalized nutrition and coaching platform, from Spencer Trask & Co. The integration combines Good Measures’ patented technology with NationsBenefits’ healthcare reach, creating the first national platform for personalized nutrition and food as medicine. The deal enables scalable, clinically-supported nutrition solutions across 100 health plans, advancing personalized care for chronic condition management.

The personalized nutrition industry in Asia Pacific is set to grow at a robust CAGR of 20.28% over the forecast period. This growth is attributed to the expanding health-conscious consumer base and the rapid adoption of personalized dietary solutions across the region. The market is registering increased demand for functional foods and tailored supplement plans as consumers actively seek preventive health measures.

The growing digital infrastructure is enabling the delivery of customized nutrition services, supported by rising urbanization and increasing disposable incomes that are expanding access to personalized wellness offerings across the region.

The market is also benefiting from the expansion of D2C business models that offer on-the-go nutrition products aligned with individual health needs. Key players in the region are integrating personalized plans with daily food consumption, which is supporting the adoption of personalized plans among younger demographics. The rapidly growing retail landscape and rising focus on personalized health outcomes are further accelerating the market growth in the region.

- In September 2024, Pluckk acquired D2C nutrition brand Upnourish for USD 1.4 million to expand its presence in the personalized nutrition space. The acquisition enables Pluckk to introduce a new vertical focused on nutrition, combining its farm-to-table model with Upnourish’s meal replacement products & personalized plans.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates personalized nutrition products under food, dietary supplement, and medical device categories. It oversees product labeling, health claims, genetic testing kits, and safety standards.

- In China, the National Medical Products Administration (NMPA) oversees the safety, labeling, and marketing of personalized nutrition products, especially those involving genetic testing or health food supplements. It regulates the approval process for new health foods and ensures that nutritional products do not make unsubstantiated health claims or violate consumer protection laws.

- In India, the Food Safety and Standards Authority of India (FSSAI) regulates personalized nutrition in India by overseeing food safety, labeling, and claims of functional foods and nutraceuticals. It ensures that products marketed with health benefits, including personalized dietary supplements, meet standards under the Food Safety and Standards Act and related nutraceutical regulations.

- In the UK, the Food Standards Agency (FSA) regulates the personalized nutrition space by overseeing food safety, novel foods, health claims, and genetic test-based dietary products. It ensures accurate labeling, enforces advertising standards, and monitors the safety of products such as DNA-based nutrition kits or bio-personalized supplements entering the UK market.

Competitive Landscape

Major players in the personalized nutrition industry are expanding their capabilities by integrating meal-planning technologies to deliver tailored dietary solutions. Players are introducing features such as automated grocery lists, personalized recipe recommendations, and ingredient ordering to simplify dietary planning for consumers. Additionally, market players are adopting digital tools to deliver convenience and align nutrition plans with individual health goals & preferences.

- In February 2025, MyFitnessPal acquired Intent, a personalized meal-planning app, to expand its nutrition offerings through tailored dietary solutions. The integration enables MyFitnessPal to deliver personalized meal plans, automated grocery lists, and ingredient ordering services via its Premium+ service. This move enhances user experience and supports the growing demand for digital, goal-based nutrition planning.

Key Companies in Personalized Nutrition Market:

Recent Developments (Product Launch)

- In December 2024, Bioniq launched Build Your Own, a hyper-personalized supplement solution designed for individuals with specific health needs, including allergies and nutrient intolerances. The platform allows consumers to create custom formulas based on unique health requirements, marking a significant expansion of Bioniq’s personalized offerings.

- In November 2024, Persona Nutrition launched a white label service to help other brands enter the market. The turnkey B2B solution includes a customized vitamin assessment, proprietary algorithm, drug-nutrient interaction checker, supplement supply, and full back-end subscription management.

.webp)