Market Definition

The market refers to the industry focused on diagnosing, treating, and managing injuries to the peripheral nervous system, which includes nerves outside the brain and spinal cord.

It involves products like surgical instruments, therapies, and medical devices aimed at nerve repair. Demand for these products is growing, due to rising incidences of trauma and neurological disorders.

Peripheral Nerve Injury Market Overview

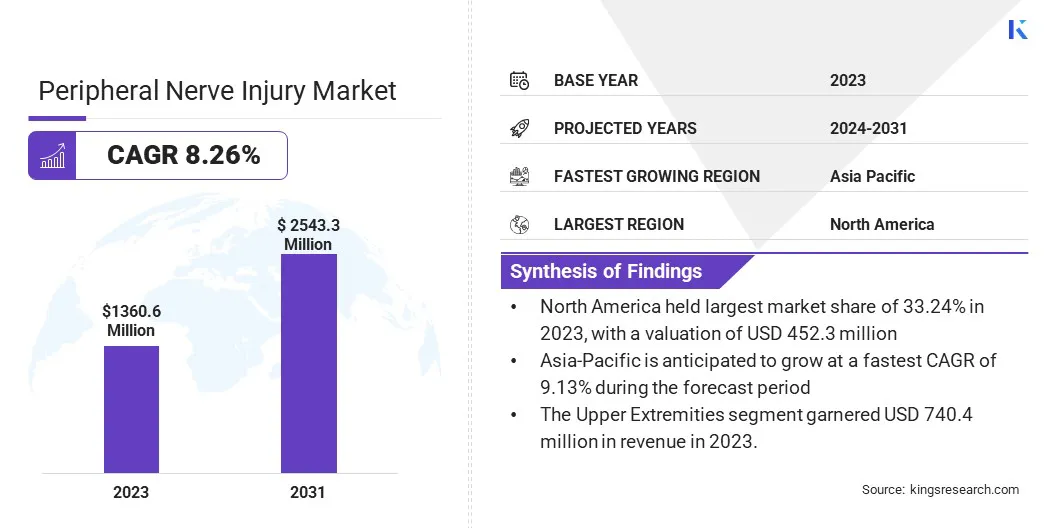

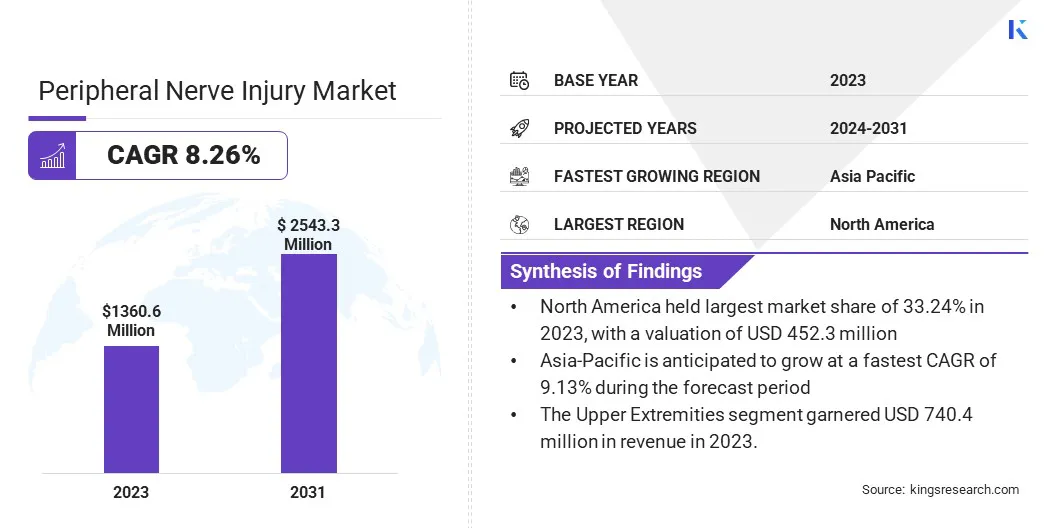

The global peripheral nerve injury market size was valued at USD 1360.6 million in 2023, which is estimated to be USD 1458.8 million in 2024 and reach USD 2543.3 million by 2031, growing at a CAGR of 8.26% from 2024 to 2031.

The rising geriatric population, which is susceptible to nerve injuries due to age-related factors like reduced mobility and frailty, is a significant driver of growth in the peripheral nerve injury market, increasing the demand for treatments and therapies.

Major companies operating in the peripheral nerve injury industry are Axogen Corporation, Stryker, BAXTER INTERNATIONAL INC., Polyganics, Integra LifeSciences Corporation, Renerva, TOYOBO CO., LTD, Newrotex, Orthocell Ltd., BioCircuit Technologies, Neuraptive Therapeutics, Inc., Boston Scientific Corporation, Abbott, NervGen Pharma Corp., and Epineuron Technologies Inc.

The market is evolving rapidly, driven by technological advancements that offer less invasive, more efficient treatment options. The rise of innovative solutions, such as sutureless repair devices, is transforming nerve repair procedures by enhancing precision, reducing surgical time, and improving patient recovery.

These advancements are addressing the growing need for effective treatments, due to an increasing incidence of nerve injuries caused by trauma, surgery, and age-related conditions. As a result, the market is poised for continued growth, with more accessible and reliable therapies shaping its future.

- In June 2024, BioCircuit Technologies announced the first human implantations of Nerve Tape, a sutureless device designed to enhance peripheral nerve repair. This innovation is poised to revolutionize nerve surgery by providing faster, more precise, and less invasive treatment options.

Key Highlights:

- The peripheral nerve injury industry size was valued at USD 1360.6 million in 2023.

- The market is projected to grow at a CAGR of 8.26% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 452.3 million.

- The nerve conduit segment garnered USD 433.4 million in revenue in 2023.

- The direct nerve repair segment is expected to reach USD 1051.7 million by 2031.

- The upper extremities segment is anticipated to register the fastest CAGR of 8.51% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 9.13% during the forecast period.

Market Driver

Rising Geriatric Population

The global aging population is a major driver of the peripheral nerve injury market, as older individuals are more prone to nerve injuries on account of decreased bone density, reduced muscle mass, and slower healing processes.

- According to the WHO, 1 in 6 people will be aged 60 or older by 2030. By 2050, it will double to 2.1 billion, including 426 million people aged 80+ years.

The risk of falls, fractures, and conditions such as diabetes or neuropathy increases as people age, which often leads to peripheral nerve damage. This growing demographic demands more specialized treatments, including surgical interventions, neurostimulation therapies, and rehabilitation services, fueling the market.

- In June 2024, Axogen announced the full launch of Avive+ Soft Tissue Matrix, a resorbable amniotic membrane allograft designed to enhance nerve protection. This innovation supports the increasing demand for effective treatments driven by the growing geriatric population prone to nerve injuries.

Market Challenge

Variability in Treatment Outcomes

A key challenge in the peripheral nerve injury market is the variability in treatment outcomes, primarily due to the complexity of nerve injuries. The diverse nature of nerve damage, ranging from mild to severe, makes it difficult to achieve consistent results.

However, research and advancements in personalized treatment approaches, offer solutions to improve outcomes. Additionally, tailoring treatments to specific injury types and patient needs helps in overcoming this challenge.

- In April 2024, the Miami Project to Cure Paralysis at the University of Miami, in collaboration with Gel4Med, received a USD 1.75 million Department of Defense grant to study Schwann cell transplantation combined with biomimetic matrices. This novel approach aims to improve nerve repair outcomes by enhancing cell survival and integration, offering promising advancements in treating complex spinal cord and peripheral nerve injuries.

Market Trend

Advancements in Bioelectronic Therapy

The market is registering a notable shift toward bioelectronic therapies. These innovative, non-invasive treatments focus on enhancing nerve regeneration by using electrical stimulation to promote healing. Advancements in bioelectronic devices have shifted the focus from traditional surgical interventions to more accessible & efficient approaches.

This trend reflects a growing interest in developing therapies that minimize patient recovery time, reduce surgical complexities, and improve long-term outcomes, offering a promising alternative to conventional methods in nerve repair.

- In August 2023, Epineuron announced the enrollment of its first patient in the REGAIN pivotal trial. This multicenter, double-blinded study evaluates the PeriPulse bioelectronic device for treating peripheral nerve injuries, aiming to improve recovery through advanced nerve regeneration techniques.

Peripheral Nerve Injury Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Nerve Conduit, Nerve Protector, Nerve Connector, Nerve Wraps

|

|

By Surgery

|

Direct Nerve Repair, Nerve Grafting, Stem Cell Therapy

|

|

By Application

|

Upper Extremities, Lower Extremities

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Nerve Conduit, Nerve Protector, Nerve Connector, Nerve Wraps): The nerve conduit segment earned USD 4 million in 2023, due to the increasing demand for minimally invasive treatments and nerve regeneration technologies.

- By Surgery (Direct Nerve Repair, Nerve Grafting, Stem Cell Therapy): The direct nerve repair segment held 41.79% share of the market in 2023, due to advancements in surgical techniques and improved patient outcomes in nerve repair.

- By Application (Upper Extremities, Lower Extremities): The upper extremities segment is projected to reach USD 1409.5 million by 2031, owing to the rising prevalence of upper limb nerve injuries and demand for effective treatments.

Peripheral Nerve Injury Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a market share of around 33.24% in 2023, with a valuation of USD 452.3 million. North America remains the dominating region in the peripheral nerve injury market, due to advanced healthcare infrastructure, high adoption of innovative medical technologies, and strong regulatory support.

The market continues to register steady growth, due to the prevalence of a large patient pool suffering from nerve injuries and increased awareness about treatment options.

Regulatory approvals for advanced PNI treatments in the U.S. and Canada further bolster the market's expansion. Additionally, significant research funding, for innovative nerve repair solutions is leading to widespread adoption and market growth.

- In July 2024, the Stevens Institute of Technology received a USD 2 million grant from the U.S. Department of Defense to enhance treatments for PNIs. The research focuses on developing bioactive nerve grafts using 3D printing and electrospinning to improve nerve regeneration and functional recovery.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 9.13% over the forecast period. This growth is fueled by an expanding healthcare infrastructure, increasing medical tourism, and rising demand for advanced nerve repair solutions.

The need for innovative therapies to address nerve damage is growing as countries in the region continue to focus on improving patient care and enhancing surgical outcomes. Additionally, regulatory advancements are supporting the rapid introduction of cutting-edge medical devices, attracting significant investment.

- In March 2025, ReNerve received marketing approval for its NervAlign Nerve Cuff in Thailand and secured an initial stocking order in Hong Kong. These milestones reflect the company's growth in Asia, driven by expanding medical tourism and demand for advanced nerve repair solutions.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates medical devices, including those for PNI treatments, ensuring the safety, efficacy, and security of various healthcare products.

- In the EU, manufacturers must obtain a CE mark to demonstrate compliance with safety, health, and environmental protection requirements, signifying that products meet high safety and performance standards for the European Economic Area.

Competitive Landscape:

Companies in the peripheral nerve injury industry are increasingly investing in research and development to innovate and improve nerve repair treatments.

These investments focus on advancing medical devices, bioelectronic therapies, and regenerative solutions, with funding directed toward clinical trials, product development, and regulatory approvals. This growing financial commitment accelerates the introduction of advanced therapies and enhances patient outcomes globally.

- In November 2024, BioCircuit Technologies received a USD 3M National Institutes of Health (NIH) grant to expand its Nerve Tape product line. This funding will accelerate clinical adoption, supporting further development and evidence gathering for the device, which revolutionizes sutureless nerve repair.

List of Key Companies in Peripheral Nerve Injury Market:

- Axogen Corporation

- Stryker

- BAXTER INTERNATIONAL INC.

- Polyganics

- Integra LifeSciences Corporation

- Renerva

- TOYOBO CO., LTD

- Newrotex

- Orthocell Ltd.

- BioCircuit Technologies

- Neuraptive Therapeutics, Inc.

- Boston Scientific Corporation

- Abbott

- NervGen Pharma Corp.

- Epineuron Technologies Inc.

Recent Developments (Approval)

- In January 2023, Abbott received FDA approval for its Proclaim XR Spinal Cord Stimulation system to treat painful Diabetic Peripheral Neuropathy (DPN). This non-opioid device offers a new, effective alternative for managing chronic pain associated with DPN, enhancing patient quality of life.

- In September 2024, Neuraptive Therapeutics, Inc. announced that its NTX-001 received Breakthrough Therapy Designation from the FDA, expediting its development for PNI repair. Following promising Phase 2 NEUROFUSE results, a Phase 3 pivotal study will begin in early 2025 to assess NTX-001’s efficacy and safety.