Market Definition

The optometry equipment comprises devices used for diagnosing, monitoring, and treating vision-related disorders. It includes autorefractors, slit lamps, fundus cameras, optical coherence tomography scanners, and tonometers. These instruments support optometrists in assessing refractive errors, detecting ocular diseases, and ensuring effective eye care across hospitals, clinics, and specialized diagnostic centers.

Optometry Equipment Market Overview

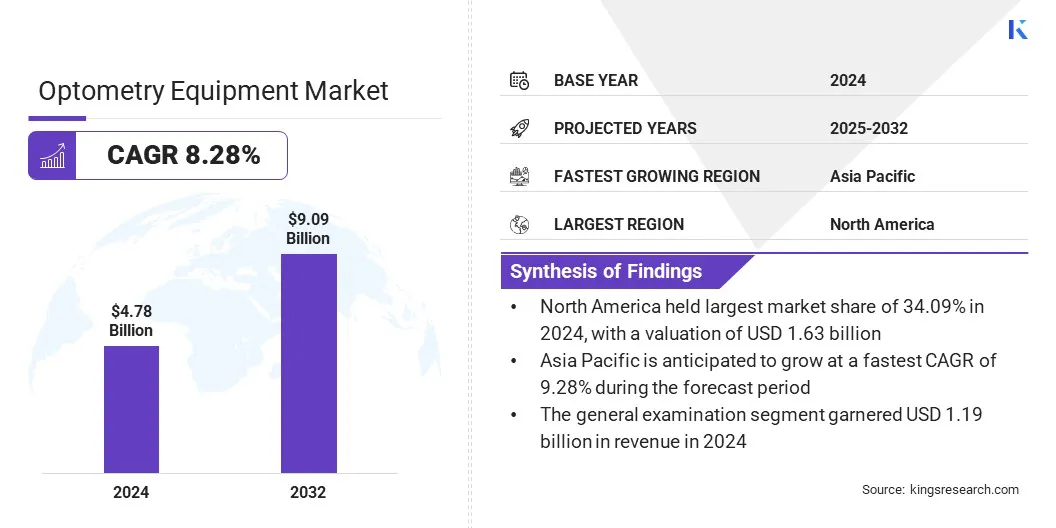

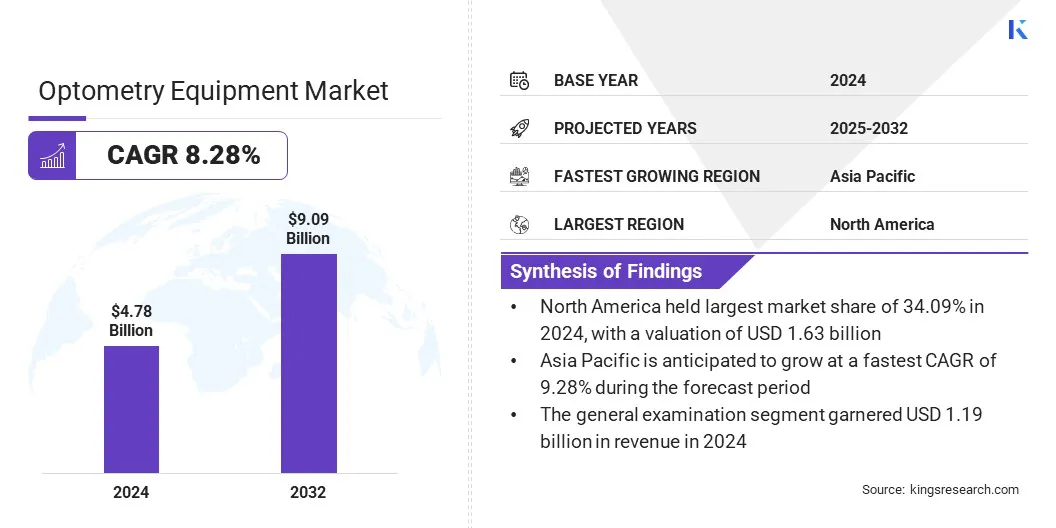

The global optometry equipment market size was valued at USD 4.78 billion in 2024 and is projected to grow from USD 5.16 billion in 2025 to USD 9.09 billion by 2032, exhibiting a CAGR of 8.28% over the forecast period.

This growth is driven by the increasing demand for remote consultations, improved access to eye care, and technological advancements such as AI, virtual reality (VR), telemedicine, and computer simulations enabling accurate virtual diagnostics. The tele-optometry is further supporting early disease detection, reduces patient travel, and strengthens healthcare delivery efficiency worldwide.

Key Highlights:

- The optometry equipment industry was valued at USD 4.78 billion in 2024.

- The market is projected to grow at a CAGR of 8.28% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, valued at USD 1.63 billion.

- The refraction & vision testing segment garnered USD 1.84 billion in revenue in 2024.

- The general examination segment is expected to reach USD 2.27 billion by 2032.

- The specialty clinics segment is anticipated to witness the fastest CAGR of 8.40% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 9.28% through the projection period.

Major companies operating in the optometry equipment market are ZEISS Group, Alcon Vision LLC, Topcon Corporation, NIDEK CO., LTD., EssilorLuxottica, Haag-Streit Group, Bausch + Lomb Incorporated, Johnson & Johnson, Revenio Group Oyj, Canon Medical Systems, Kowa Company, Ltd., OCULUS Optikgeräte GmbH, Visionix Ltd., Reichert Technologies, and Ziemer Ophthalmic Systems AG.

The expansion of telehealth and remote eye testing is propelling the growth in the market. The increasing deployment of digital platforms in hospitals and clinics allows accurate vision assessments and consultations in remote and underserved areas.

Furthermore, the development of portable diagnostic devices and mobile-based instruments is facilitating early detection of ocular diseases, while integration with telemedicine platforms is enhancing workflow efficiency. These factors are improving accessibility to eye care services and addressing the growing demand for cost-effective, advanced diagnostic solutions across hospitals, clinics, and specialized care centers.

- In April 2024, DigitalOptometrics surpassed 2 million remote comprehensive eye tests, with an aim to expand access to quality eye care. The platform allows optometrists to perform full eye exams remotely, combining video conferencing with advanced operation of ophthalmic equipment.

Market Driver

Growing Prevalence of Eye Disorders

The growing prevalence of eye disorders is driving the expansion of the optometry equipment market. The rising incidence of cataracts, glaucoma, diabetic retinopathy, and myopia is increasing the demand for advanced diagnostic and monitoring devices. The aging population and lifestyle changes are further contributing to higher rates of vision impairment.

Clinics and hospitals are adopting advanced optometry equipment, including fundus cameras, OCT scanners, and tonometers, to support accurate diagnosis and effective treatment. Additionally, early detection and continuous monitoring have become critical in managing chronic ocular conditions, fostering innovations in precise optometry solutions globally.

- In August 2023, the World Health Organization reported that 2.2 billion people experienced near or distance vision impairment. Globally, 36% with refractive errors and 17% with cataract-related impairment received appropriate interventions.

Market Challenge

High Cost of Advanced Diagnostic Equipment

The high cost of advanced diagnostic equipment poses a significant challenge to the expansion the optometry equipment market. Premium devices, including OCT scanners, fundus cameras, and autorefractors, require substantial capital investment, limiting adoption among smaller clinics and practices.

Moreover, ongoing maintenance, software updates, and training add to the financial expense. Price sensitivity in emerging markets further constrains widespread deployment, restricting access to advanced diagnostic capabilities and impacting market growth.

To address this challenge, companies are offering flexible financing options, leasing programs, and modular equipment designs. Manufacturers are reducing entry barriers through cost-effective and scalable solutions, enabling broader adoption of advanced diagnostic tools in diverse clinical settings.

Market Trend

Integration of AI in Diagnostic Imaging

A key trend influencing the optometry equipment market is the integration of artificial intelligence (AI) in diagnostic imaging. AI-enabled devices are improving accuracy in detecting ocular conditions, including diabetic retinopathy, glaucoma, and macular degeneration.

Additionally, these devices are able to streamline image analysis, reduce diagnostic time, and enhance decision-making for clinicians. Furthermore, the adoption of AI-integrated imaging platforms increased efficiency in clinics and hospitals by optimizing patient workflow and reinforcing diagnostic capabilities.

- In October 2024, ZEISS Medical Technology expanded its ophthalmic portfolio with ZEISS VisioGen. The solution uses AI to enhance cataract, corneal, retina, and glaucoma workflows, enabling digitally connected patient management and treatment.

Optometry Equipment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Refraction & Vision Testing, Diagnostic & Imaging, Surgical & Treatment

|

|

By Application

|

General Examination, Cataract, Glucoma, Refractive Errors, Age related macular degeneration, Others

|

|

By End User

|

Hospital, Specialty clinics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Refraction & Vision Testing, Diagnostic & Imaging, and Surgical & Treatment): The refraction and vision testing segment captured 38.45% in 2024, mainly due to high demand for accurate vision assessments, widespread adoption of autorefractors and phoropters, and increasing prevalence of refractive errors globally.

- By Application (General Examination, Cataract, Glucoma, Refractive Errors, Age related macular degeneration, and Others): The cataract segment is poised to record a CAGR of 8.32% through the forecast period, owing to the rising incidence of cataract, aging population, advancements in surgical equipment, and increasing adoption of minimally invasive procedures.

- By End User (Hospital, Specialty clinics, and Others): The hospital segment is expected to reach USD 3.79 billion by 2032, propelled by growing patient inflow, advanced diagnostic infrastructure, integrated ophthalmic solutions, and increased investment in comprehensive eye care services.

Optometry Equipment Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America optometry equipment market share stood at 34.09% in 2024, with a valuation of USD 1.63 billion. This dominance is reinforced by the adoption of advanced diagnostic and imaging devices, driven by a well-established healthcare infrastructure and high awareness of eye care.

Increasing prevalence of ocular disorders and rising geriatric population in the region are further contributing to this growth. Moreover, market players in the region are focusing on technologically advanced optometry solutions and integrating them with digital platforms. These efforts are improving service efficiency and contributing to regional market growth.

- In May 2024, Reichert Technologies, part of AMETEK, Inc, launched the Tono-Vera Tonometer with ActiView Positioning System in the U.S. The handheld tonometer offers fast, automated, and accurate intraocular pressure measurements using rebound technology, eliminating the need for topical anesthetics.

Asia Pacific is set to grow at a robust CAGR of 9.28% over the forecast period. This growth is attributed with the expansion of healthcare access, rising awareness of eye care, and government as well as private sector initiatives to strengthen diagnostic infrastructure.

Additionally, the adoption of portable and tele-optometry devices in hospitals are improving accessibility in urban and rural areas. Moreover, technological advancements in imaging and AI-based diagnostics are further supporting domestic market expansion.

- In July 2025, Topcon Healthcare, Inc acquired Intelligent Retinal Imaging Systems (IRIS), a cloud-based retinal screening technology. The acquisition broadened Topcon Healthcare’s primary care presence in and enhanced its focus on early disease detection with connected, data-driven solutions.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) 21 CFR Part 820 regulates medical devices. It establishes quality requirements for the design, manufacture, and distribution of optometry equipment, ensuring safety and effectiveness.

- In the EU, Medical Device Regulation (MDR) 2017/745 sets compliance standards for safety, performance, and clinical evaluation of optometry equipment sold in the EU.

- In Japan, the Pharmaceutical and Medical Device Act (PMD Act) regulates medical devices. It ensures approval, safety, and performance standards for optometry equipment before market entry.

- In Australia, the Therapeutic Goods Administration (TGA) Regulations regulate medical devices. It requires registration, conformity assessment, and ongoing monitoring of optometry equipment to protect patient safety.

Competitive Landscape

Key players in the market are focusing on strategic initiatives to sustain growth and maintain competitive advantage. Companies are actively investing in research and development to enhance diagnostic accuracy and expand product portfolios.

They are further adopting digital integration, AI-enabled imaging, and tele-optometry solutions, while also engaging in collaborations, mergers, and acquisitions to expand market presence and gain access to advanced technologies.

- In April 2025, ZEISS, in collaboration with Boehringer Ingelheim, launched the AI-powered Research Data Platform. The cloud-based, AI-driven solution integrated clinical and research data, streamlined ophthalmic research workflows, and enabled clinicians and scientists to accelerate discoveries through efficient, data-driven processes.

Key Companies in Optometry Equipment Market:

- ZEISS Group

- Alcon Vision LLC

- Topcon Corporation

- NIDEK CO., LTD.

- EssilorLuxottica

- Haag-Streit Group

- Bausch + Lomb Incorporated

- Johnson & Johnson

- Revenio Group Oyj

- Canon Medical Systems

- Kowa Company, Ltd.

- OCULUS Optikgeräte GmbH

- Visionix Ltd.

- Reichert Technologies

- Ziemer Ophthalmic Systems AG

Recent Developments (Acquisition/Product Launch)

- In September 2025, ZEISS introduced CIRRUS PathFinder, an AI-integrated clinical support tool that received CE mark approval. It improves management of comorbid cataract and glaucoma patients, supports surgical planning for high-volume clinics, and advances ZEISS’s cataract and corneal refractive workflow solutions across diagnostics, planning, and treatment.

- In August 2025, EssilorLuxottica acquired Automation & Robotics (A&R), a manufacturer of automated optical lens quality systems for mass production and prescription laboratories. This acquisition aims to enhance the company’s capabilities in vision care quality and performance.

- In January 2025, AI Optics Inc. obtained FDA 510(k) clearance for the Sentinel Camera, a handheld retinal imaging device that capture high-quality images and improve accessibility in retinal disease screening.