Optical Transceiver Market Size

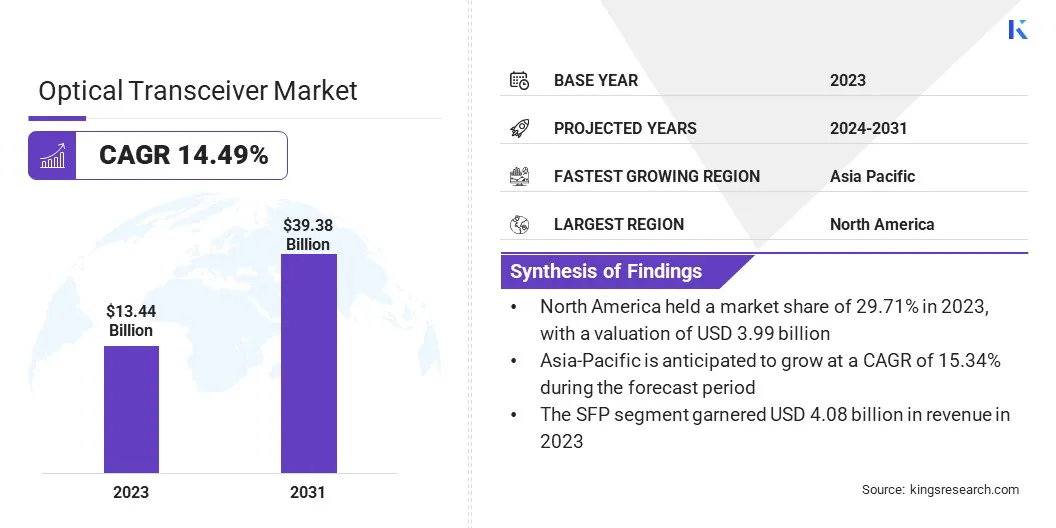

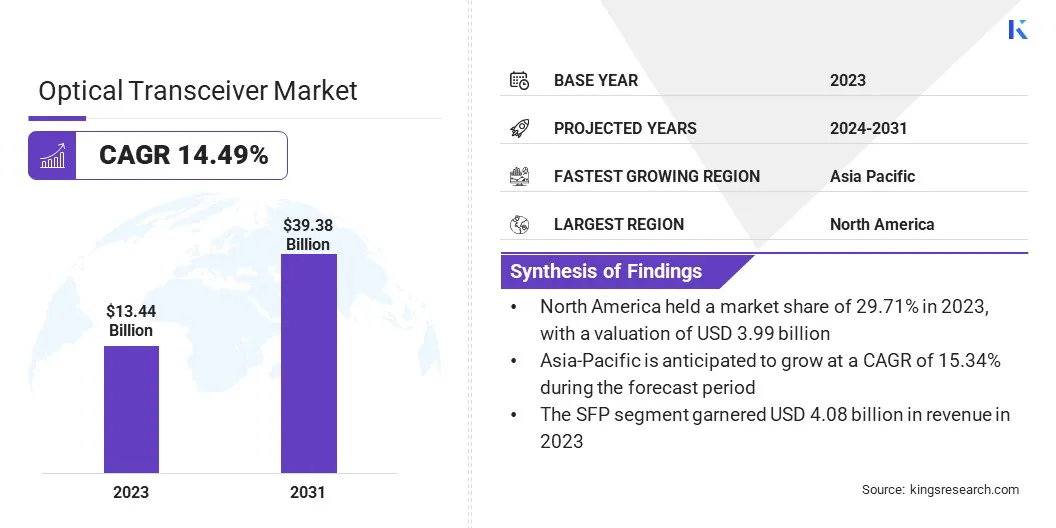

The global Optical Transceiver Market size was valued at USD 13.44 billion in 2023 and is projected to grow from USD 15.27 billion in 2024 to USD 39.38 billion by 2031, exhibiting a CAGR of 14.49% during the forecast period. The market is expanding due to the rising adoption of fiber optic technology in emerging applications and for infrastructure upgrades.

Growing investments in data center modernization and the increasing need for reliable, high-capacity networks are driving the demand. Additionally, advancements in manufacturing techniques are enhancing transceiver performance and cost-efficiency, further fueling market growth.

In the scope of work, the report includes solutions offered by companies such as Coherent Corp., Accelink Technology Co. Ltd, Lumentum Operations LLC, Sumitomo Electric Industries Ltd, Fujitsu Optical Components Limited, Smiths Interconnect, Source Photonics, Huawei Technologies Co. Ltd, Broadcom, HUBER+SUHNER Cube Optics AG, and others.

The surge in global mobile network traffic drives significant demand for optical transceivers market due to their critical role in managing increased data volumes efficiently. These transceivers enable high-speed, reliable, and long-distance data transmission for modern communication networks.

- Ericsson reported a 33% increase in global mobile network traffic from Q2 2022 to Q2 2023. This increase is mirrored by the anticipated rise in average data consumption per smartphone, projected to grow from 21 GB in 2023 to 56 GB by 2029.

Factors such as the expanding smartphone user base, proliferation of data-intensive applications, and growing trend of social media video streaming contribute to this data explosion. Furthermore, innovations in technology, such as silicon photonics, are further driving market expansion by enhancing performance and reducing power consumption.

This shift toward advanced transceiver solutions is supporting the development of more efficient and scalable network infrastructures, contributing to the growth of the optical transceiver market across various industries.

An optical transceiver facilitates the transmission and reception of data over fiber optic networks by converting electrical signals into optical signals and vice versa. It integrates a transmitter, typically using a laser diode or LED to generate light, and a receiver, which uses a photodiode to detect and convert light back into electrical signals.

This dual functionality enables high-speed, long-distance data communication. Optical transceivers are essential in telecommunications, data centers, and networking infrastructure, providing the capability to handle large volumes of data with minimal latency and high reliability.

Analyst’s Review

The market is experiencing accelerated growth due to its fragmented nature, with leading companies focusing on strategic partnerships and acquisitions to bolster their product portfolios and achieve a competitive advantage.

- In December 2023, Coherent Corp. unveiled its latest 800G ZR/ZR+ transceiver, which is now offered in the compact QSFP-DD and OSFP form factors. This innovative transceiver is tailored for optical communications networks, reflecting Coherent Corp.'s dedication to pushing the boundaries of high-speed optical networking technology.

- In October 2023, Source Photonics unveiled 800 Gbps short-reach multimode (MMF) transceivers and active cables at ECOC 2023 in Glasgow, Scotland. The new products are designed to improve connectivity within AI clusters, offering significantly faster speeds for short-reach optical modules and active cables, thereby advancing the infrastructure of AI data centers.

These strategies help key players enhance market growth by driving innovation and broadening their technological capabilities. Through strategic alliances and acquisitions, key players are expanding their product offerings and addressing a wider range of customer requirements. This approach strengthens their market positioning and accelerates the development of advanced transceiver solutions, thereby supporting the market expansion.

Optical Transceiver Market Growth Factors

The surge in data consumption is a major factor driving the growth of the optical transceiver market by increasing the need for faster and more efficient network infrastructure. High-bandwidth applications, such as cloud services, video streaming, and IoT devices, are generating substantial data volumes that require rapid transmission across networks.

Optical transceivers, with their ability to handle large data loads over long distances at low latency, are becoming essential in upgrading data centers and telecommunications networks. This growing demand for enhanced network performance is pushing companies to invest in optical transceiver technology, accelerating market expansion globally.

However, the market is expected to face challenges due to the high cost of advanced optical transceiver technologies and the complexity of integrating these components into existing infrastructure. Additionally, rapid technological advancements require continuous innovation and adaptation, which can strain resources and increase development costs. To address these challenges, key players are investing in research and development to drive cost efficiencies and technological advancements.

- In March 2023, Eoptolink Technology Inc., Ltd. enhanced its product portfolio by launching a Multimode BIDI Transceiver in 100G, 400G, and 800G versions. The 800G transceiver, compatible with a 4+4 fiber MPO-12 connector interface, allows a seamless upgrade from 400G to 800G without the need to replace existing fiber infrastructure.

Companies form strategic partnerships and acquisitions to integrate new technologies seamlessly and remain competitive. These factors are expected to enhance the market growth over the forecast period.

Optical Transceiver Industry Trends

The rising adoption of cloud, AI, and big data is accelerating data center construction, which is significantly driving market growth. As organizations move their operations to the cloud, there is a higher demand for advanced and scalable data center facilities to handle expansive data processing needs.

- In November 2022, Metro Edge Development Partners, a minority business enterprise and commercial real estate developer, finalized agreements with Corgan, Power Construction, Clune Construction, and Ujamaa Construction to design and build a state-of-the-art data center in the Illinois Medical District (IMD). The company partnered with T5 Data Centers for the project. The USD 257 million data center was planned to break ground in 2023 and open in 2024. Metro Edge secured a 75-year ground lease for a 1.97-acre site to build a 19.8 MW, five-story, 184,720-square-foot facility, aimed at serving healthcare, financial, educational, and government sectors.

- April 2024, Microsoft unveiled its plan to invest USD 2.9 billion over the next two years to expand its hyperscale cloud computing and AI capabilities in Japan. The company also intends to extend its digital skilling programs, aiming to train over 3 million people in AI within the next three years. Additionally, Microsoft will establish its first Microsoft Research Asia lab in Japan and strengthen its cybersecurity partnership with the Government of Japan.

Such initiatives reflect a broader trend of investment in high-capacity data centers, which enhances market growth by supporting the growing requirements for robust and efficient data storage and processing capabilities. As businesses upgrade their network infrastructure to support next-generation technologies, the demand for advanced optical transceivers is expanding, largely contributing to the growth of the optical transceiver market.

The integration of silicon photonics technology into optical transceivers is emerging as a key trend, driving advancements in performance, scalability, and cost efficiency. Silicon photonics allows data transmission using light over silicon chips, significantly reducing power consumption compared to traditional transceiver technologies. This efficiency lowers operational costs for data centers and telecom networks, making it an attractive solution for handling the increasing data demand.

Additionally, silicon photonics enables higher bandwidth and faster data transfer, facilitating the development of scalable network infrastructure. As companies seek more energy-efficient and high-performance solutions, the adoption of silicon photonics is accelerating market growth.

- In October 2023, Jabil Inc. announced the acquisition of Intel Corporation's silicon photonics optical modules business. With this deal, Jabil will take over the manufacturing and sales of Intel’s silicon photonics transceivers, while also focusing on the development of future models of these transceivers.

Segmentation Analysis

The global market has been segmented on the basis of form factor, data rate, wavelength, distance, fiber type, connector type, protocol, application, and geography.

By Form Factor

Based on form factor, the optical transceiver market has been categorized into SFP, QSFP, XFP, CFP, SFP+, QSFP-DD, OSFP, and others. The SFP segment held the highest revenue of USD 4.08 billion in 2023. This segment includes SFP, SFP+, and SFP28 transceivers, which are crucial for enabling data transmission in telecommunications, data centers, and enterprise networks.

The shift toward higher bandwidth requirements and the expansion of data center infrastructure are significant factors propelling this growth. Technological advancements, such as higher data rate capabilities and improved power efficiency, are further enhancing the appeal of SFP transceivers.

Additionally, the rising adoption of cloud services and edge computing is boosting the demand for SFP solutions, supporting the overall market expansion and driving innovation within the segment.

By Data Rate

Based on data rate, the market has been categorized into less than 10 Gbps, 10 Gbps to 40 Gbps, 40 Gbps to 100 Gbps, 100 Gbps to 400 Gbps, and more than 400 Gbps. The 40 Gbps to 100 Gbps segment captured the largest optical transceiver market share of 32.13% in 2023.

This segment includes transceivers such as QSFP+ and CFP, which are essential for supporting bandwidth-intensive applications like cloud computing, big data analytics, and high-frequency trading. The demand for faster data rates is driven by the increasing volume of data traffic and the expansion of 5G networks.

Technological innovations, such as enhanced modulation techniques and improved optical components, are further propelling the adoption of 40 Gbps to 100 Gbps transceivers. Enterprises and service providers look to upgrade their infrastructure for higher performance and efficiency, which is expected to drive this segment's growth and innovation over the forecast period.

By Fiber Type

Based on fiber type, the market has been categorized into single-mode fiber and multimode fiber. The single-mode fiber segment is expected to hold the highest revenue of USD 28.40 billion by 2031. Single-mode fibers provide high-speed data transmission in telecommunications, data centers, and metropolitan area networks due to their low attenuation and high signal clarity over long distances.

The expanding demand for faster and more reliable internet connections, along with the deployment of 5G networks and advanced optical networks, is boosting the adoption of SMF. Innovations in fiber optic technology, including enhanced fiber materials and improved connector designs, are further contributing to the growth of this segment.

Optical Transceiver Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America optical transceiver market share stood around 29.71% in 2023 in the global market, with a valuation of USD 3.99 billion, mainly due to its robust technological infrastructure and a high rate of digital adoption. The rapid expansion of communication networks and increasing demand for high-speed data transmission are significant growth factors.

Additionally, the adoption of advanced technologies, such as AI, 5G, IoT, and high-performance computing, is intensifying the need for high-speed data transmission, fueling market expansion. Rising data traffic is spurring the development of numerous data centers to manage the data generated by businesses and consumers.

Additionally, the increasing use of cloud computing services is prompting the construction of large hyper scale data centers across the U.S., further driving the demand for optical transceivers in the region.

Asia-Pacific is anticipated to witness the fastest growth at a CAGR of 15.34% over the forecast period 2024 to 2031, mainly due to a surge in cloud adoption, rapid rollout of 5G technology, and increasing demand for high-speed internet. The region’s dynamic expansion is further supported by a robust increase in data center facilities.

- As of 2022, the Asia-Pacific region boasted over 1.73 billion unique mobile subscribers, as reported by GSMA, with projections indicating an additional USD 130 billion contribution to the region’s economy by 2030.

The region is a frontrunner in 5G deployment, with 11 countries including China, Australia, South Korea, Japan, Malaysia, Indonesia, India, New Zealand, the Philippines, Singapore, and Thailand having successfully launched commercial 5G networks. This early adoption and extensive rollout of 5G technology, coupled with the growing cloud computing sector and escalating data traffic, are driving substantial demand for optical transceivers.

Competitive Landscape

The global optical transceiver market report provides valuable insights which reflects a fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Optical Transceiver Market

Key Industry Developments

- September 2023 (Partnership): Tower Semiconductor teamed up with InnoLight Technology to create the next-generation high-speed optical transceivers using Tower’s Silicon Photonics process platform (PH18). These transceivers are intended to meet the growing requirements of data centers and telecommunications.

- February 2023 (Product Launch): Hamamatsu Photonics K.K. introduced its P16671-01AS optical transceiver, which operates at a data rate of 1.25 Gbps. This device, built using opto-semiconductor technology, is designed for use in scientific research, medical equipment, and semiconductor manufacturing applications.

The global optical transceiver market has been segmented:

By Form Factor

- SFP (Small Form-factor Pluggable)

- QSFP (Quad Small Form-factor Pluggable)

- XFP (10 Gigabit Small Form-factor Pluggable)

- CFP (C Form-factor Pluggable)

- SFP+

- QSFP-DD (Quad Small Form-factor Pluggable - Double Density)

- OSFP (Octal Small Form-factor Pluggable)

- Others (CFP2, CFP4, etc.)

By Data Rate

- Less than 10 Gbps

- 10 Gbps to 40 Gbps

- 40 Gbps to 100 Gbps

- 100 Gbps to 400 Gbps

- More than 400 Gbps

By Wavelength

- 850 nm (Multimode Fiber)

- 1310 nm (Single-mode Fiber for Medium Distance)

- 1550 nm (Single-mode Fiber for Long Distance)

- CWDM (Coarse Wavelength Division Multiplexing)

- DWDM (Dense Wavelength Division Multiplexing)

By Distance

- Short Range (Up to 300 meters)

- Intermediate Range (300 meters to 10 km)

- Long Range (10 km to 40 km)

- Extended Long Range (40 km to 80 km)

- Ultra-Long Range (Above 80 km)

By Fiber Type

- Single-mode Fiber (SMF)

- Multimode Fiber (MMF)

By Connector Type

- LC (Lucent Connector)

- SC (Subscriber Connector)

- MPO/MTP (Multi-fiber Push-On/Pull-off)

- RJ45 (Ethernet)

By Protocol

- Ethernet

- 1GbE

- 10GbE

- 40GbE

- 100GbE

- 400GbE

- Fiber Channel

- InfiniBand

- SONET/SDH

- PON (Passive Optical Network)

- OTN (Optical Transport Network)

By Application

- Data Centers

- Telecommunication

- Enterprise Networks

- Government and Defense

- Healthcare and Education

- Others (Retail, Media, etc.)

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America