Optical Metrology Market Size

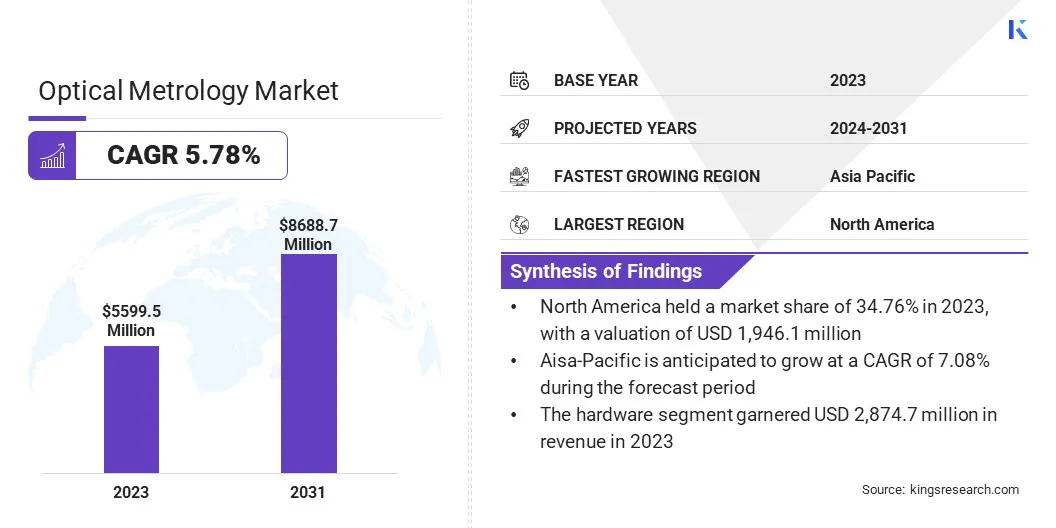

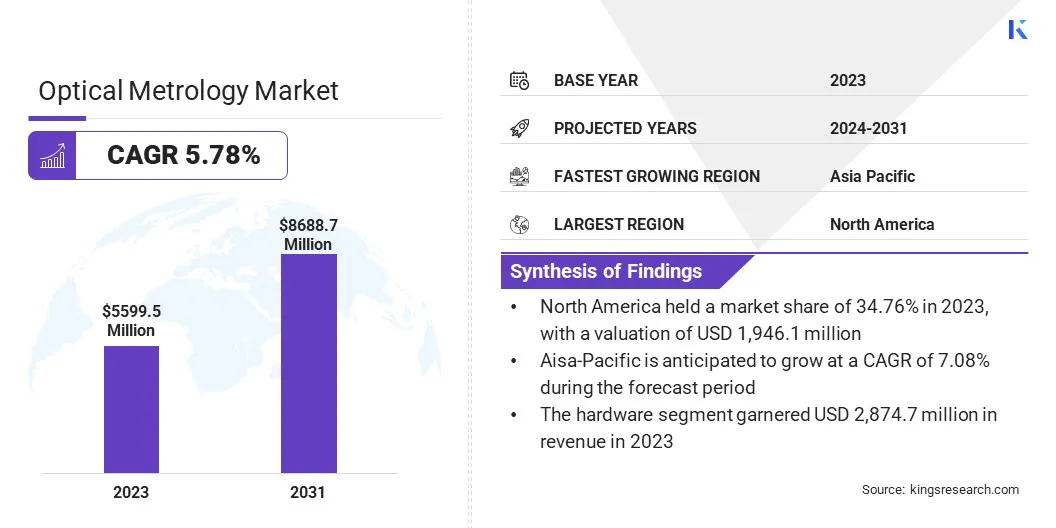

The global Optical Metrology Market size was valued at USD 5,599.5 million in 2023 and is projected to grow from USD 5,861.5 million in 2024 to USD 8,688.7 million by 2031, exhibiting a CAGR of 5.78% during the forecast period. The market is expanding rapidly, driven by the increasing demand for precise measurement solutions across diverse industries such as manufacturing, semiconductor, and healthcare.

Advancements in optical technologies, including lasers and imaging systems, enhance measurement accuracy and efficiency. As industries prioritize quality control and process optimization, optical metrology plays a crucial role in ensuring dimensional accuracy and surface integrity of components. This growth is further fueled by the widespread adoption of 3D printing and additive manufacturing technologies worldwide.

In the scope of work, the report includes solutions offered by companies such as Carl Zeiss Industrial Metrology LLC, Creaform Inc (Ametek Inc.), FARO, Hexagon AB, KLA Corporation, Micro-Vu, Mitutoyo America Corporation, Nikon Corporation Industrial Metrology, Nova Ltd., Quality Vision International Inc., and others.

The optical metrology market is poised to witness robust growth, mainly fostered by the increasing demand for high-precision measurement solutions across various industries. With a rising focus on quality assurance and process optimization, industries such as semiconductors, automotive, aerospace, and healthcare are increasingly adopting optical metrology due to its non-destructive and accurate measurement capabilities.

Technological advancements in optics and imaging, coupled with the rise of 3D printing and additive manufacturing, further propel market expansion. As manufacturers prioritize stringent quality control and seek to enhance product reliability, optical metrology systems are crucial in ensuring dimensional accuracy and surface quality, positioning the market for continued growth and innovation.

- In August 2022, LMI Technologies (LMI), a leading developer of 3D scanning and inspection solutions, officially launched its new Gocator 2600 Series of 4K+ resolution smart 3D laser line profile sensors. These factory pre-calibrated sensors are equipped with custom optics and a powerful 9-megapixel imager, capable of delivering 4,200 data points per profile. This enables high-resolution 3D scanning and inspection across wide fields of view in various applications, including battery inspection, building materials, automotive, rubber and tire production, and general factory automation.

Optical metrology encompasses the measurement and inspection techniques that utilize optical principles and technologies for assessing the dimensional characteristics, surface properties, and defects of objects or materials. It involves the use of light-based methods such as lasers, interferometry, and advanced imaging systems to achieve precise and non-contact measurements.

Optical metrology is widely employed across various industries, including manufacturing, semiconductor, automotive, aerospace, and healthcare, where accurate and detailed analysis of components and materials is essential for quality control, process optimization, and ensuring product reliability.

Analyst’s Review

Rising demand for high-precision manufacturing and quality assurance across various industries is propelling the growth of the optical metrology market.

- For instance, the introduction of Scantech's AM-CELL C200 represents a significant advancement in optical automated 3D measurement systems, particularly tailored for medium-sized parts.

This innovative system is designed to enhance automated measurement capabilities, offering precision and efficiency in assessing complex geometries and dimensions. As companies within manufacturing sectors seek to enhance productivity and quality assurance through automated technologies, products such as the AM-CELL C200 play a pivotal role.

These advancements address the growing demands for accuracy and reliability while also fostering market growth by setting new standards for performance and versatility in optical metrology solutions.

Optical Metrology Market Growth Factors

The optical metrology market is experiencing significant growth, mainly due to the increasing demand for high-precision components across various industries such as semiconductors, MEMS, and photonics. These sectors require precise measurement capabilities to ensure minimal dimensional variations that impact device performance.

Optical metrology systems address this requirement by offering non-destructive and highly accurate measurement solutions for critical dimensions, surface profiles, and defect detection. As industries emphasize stringent quality control and process optimization, the market for optical metrology is expanding.

This expansion is supported by ongoing technological advancements and the integration of advanced features such as AI and automation. This trend underscores optical metrology's pivotal role in enabling quality-driven manufacturing practices globally.

The complexity and cost associated with implementing advanced optical metrology technologies present significant barriers to the growth of the market. These factors deter smaller companies from investing in high-end systems, thereby limiting market penetration and adoption rates. Moreover, the upfront expenses associated with purchasing and integrating optical metrology systems place a significant strain on budgets, particularly in industries with tight financial constraints.

However, product launches and innovations by key players in the optical metrology market are aiding market growth by introducing advanced capabilities and addressing evolving industry needs. New product introductions, such as enhanced 3D scanners with higher resolution and faster scanning speeds, cater to the increasing demand for precision measurement in manufacturing and quality control processes.

These innovations enable industries to achieve higher levels of accuracy, efficiency, and reliability in their operations, thereby fostering adoption and expanding market opportunities.

Optical Metrology Market Trends

The rising adoption of 3D printing and additive manufacturing technologies is boosting the demand for optical metrology solutions. These innovative manufacturing techniques necessitate precise measurement capabilities both during the printing process and in the post-processing stages to ensure the dimensional accuracy and quality of printed parts.

Optical metrology plays a crucial role by offering fast, non-destructive, and highly accurate measurement techniques. It allows manufacturers to monitor and control the entire 3D printing process effectively, allowing for the detection of deviations and ensuring that the final components meet rigorous standards. As 3D printing advances across various industries, the role of optical metrology in supporting quality assurance and process optimization is becoming increasingly indispensable. This growing significance is contributing to the optical metrology market growth and widespread adoption of optical metrology.

- In August 2022, LK Metrology, a manufacturer of Coordinate Measuring Machines (CMMs), metrology software, and related CMM accessory products, announced its participation in Booth No. 135230 in Chicago, where it exhibited various new products. The company demonstrated four different CMMs, including the LK ALTERA M SCANTEK 5, equipped with a Renishaw REVO-2 5-axis scanning system; the LK Multi-Sensor ALTERAC, featuring LK's new blue line laser scanner and a surface roughness probe; the new ALTO 65 Bench Top CMM; and the new COORD 3 UNIVERSAL CMM.

The growing trend toward miniaturization and lightweight designs across various industries is leading to increased demand for optical metrology solutions. As components become increasingly intricate and compact, traditional measurement techniques often encounter difficulties in providing accurate assessments. Optical metrology addresses this challenge by offering non-invasive, high-resolution measurement capabilities tailored for intricate geometries and delicate structures.

By utilizing advanced optics and imaging technologies, these systems capture detailed surface profiles and dimensions without physical contact, ensuring precision and maintaining component integrity. This capability makes optical metrology indispensable for industries striving to meet stringent quality standards and enhance manufacturing efficiency, particularly in the context of miniaturized and lightweight components.

Segmentation Analysis

The global market is segmented based on component, technology, end-user, and geography.

By Component

Based on component, the optical metrology market is categorized into hardware, software, and services. The hardware segment garnered the highest revenue of USD 2,874.7 million in 2023. This growth is mainly propelled by increasing adoption across diverse industries such as automotive, aerospace, and electronics, where accurate dimensional analysis and quality control are critical.

Technological advancements in hardware, such as improved sensor resolutions and faster data processing capabilities, enhance measurement accuracy and efficiency. As industries continue to prioritize stringent quality standards and operational efficiency, there is a sustained demand for advanced hardware solutions in optical metrology.

By Technology

Based on technology, the market is divided into autocollimators, measuring microscope, profile projector, optical digitizing system, coordinate measuring machine, and vision measuring machine. The coordinate measuring machine segment captured the largest optical metrology market share of 22.78% in 2023. CMMs are instrumental in accurately determining the geometric features of complex parts and components through precise probing and scanning techniques.

This growth is further fueled by the increasing demand for high-precision manufacturing and quality assurance across industries such as automotive, aerospace, and medical devices. Technological advancements, including multi-sensor integration and software enhancements for data analysis, further propel segmental expansion. CMMs enable efficient production processes, ensure compliance with stringent tolerances, and support continuous improvement in manufacturing operations, making them indispensable tools in modern industrial settings.

By End-User

Based on end-user, the market is categorized into aerospace, automotive, semiconductor & electronics, healthcare, research & development, and others. The automotive segment is expected to garner the highest revenue of USD 1,747.3 million by 2031. Optical metrology technologies such as 3D scanners and coordinate measuring machines (CMMs) are pivotal for dimensional inspection, surface analysis, and defect detection in automotive manufacturing.

These tools enable manufacturers to meet stringent industry standards, optimize production processes, and support innovations such as lightweight design and advanced driver-assistance systems (ADAS). Additionally, the integration of optical metrology with smart manufacturing practices enhances efficiency and quality control, thereby driving continuous advancements in automotive technology.

Optical Metrology Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America optical metrology market share stood around 34.76% in 2023 in the global market, with a valuation of USD 1,946.1 million. The region's strong presence in the automotive, aerospace, and semiconductor sectors, where precise measurement and inspection capabilities are crucial for quality assurance and innovation, is supporting regional market growth.

The adoption of advanced optical technologies, such as 3D scanning and interferometry, is increasing, supported by substantial investments in research and development. Moreover, stringent regulatory standards and a growing focus on quality control further stimulate regional market growth. North America's proactive approach towards integrating optical metrology into smart manufacturing practices reinforces its position as a leading market for optical metrology solutions.

Aisa-Pacific is anticipated to witness significant growth at a CAGR of 7.08% over the forecast period. This notable expansion is stimulated by expanding industrialization, technological advancements, and increasing adoption across diverse sectors. Countries such as China, Japan, South Korea, and India are at the forefront of this growth, with robust demand from the automotive, electronics, and semiconductor industries.

The region's rapid manufacturing expansion, coupled with stringent quality requirements, fuels the demand for high-precision measurement solutions. Moreover, increased investments in research and development, along with the integration of optical metrology in smart manufacturing initiatives, foster regional market expansion.

Competitive Landscape

The global optical metrology market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Optical Metrology Market

- Carl Zeiss Industrial Metrology LLC

- Creaform Inc (Ametek Inc.)

- FARO

- Hexagon AB

- KLA Corporation

- Micro-Vu

- Mitutoyo America Corporation

- Nikon Corporation Industrial Metrology

- Nova Ltd.

- Quality Vision International Inc.

Key Industry Development

- May 2024 (Product Launch): OptoFidelity launched Production IQ, an advanced and easy-to-use test system specifically designed for AR waveguide volume manufacturing. With its highly advanced metrology, OptoFidelity Production IQ ensured that waveguides were precisely tested at each phase of the manufacturing process, providing consistent quality control, and supporting cost-effective scalability and operational efficiency of waveguide production. It has been recognized as the optimal solution for high-standard testing and is considered essential for streamlining the waveguide manufacturing process.

The global optical metrology market is segmented as:

By Component

- Hardware

- Software

- Services

By Technology

- Autocollimators

- Measuring Microscope

- Profile Projector

- Optical Digitizing System

- Coordinate Measuring Machine

- Vision Measuring Machine

By End User

- Aerospace

- Automotive

- Semiconductor & Electronics

- Healthcare

- Research & Development

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America