Market Definition

The market involves hardware and software systems used to monitor, control, and automate physical processes across various industries, including manufacturing, energy, and transportation.

These systems enable real-time management of industrial operations, offering increased efficiency, enhanced safety, and reduced downtime. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Operational Technology Market Overview

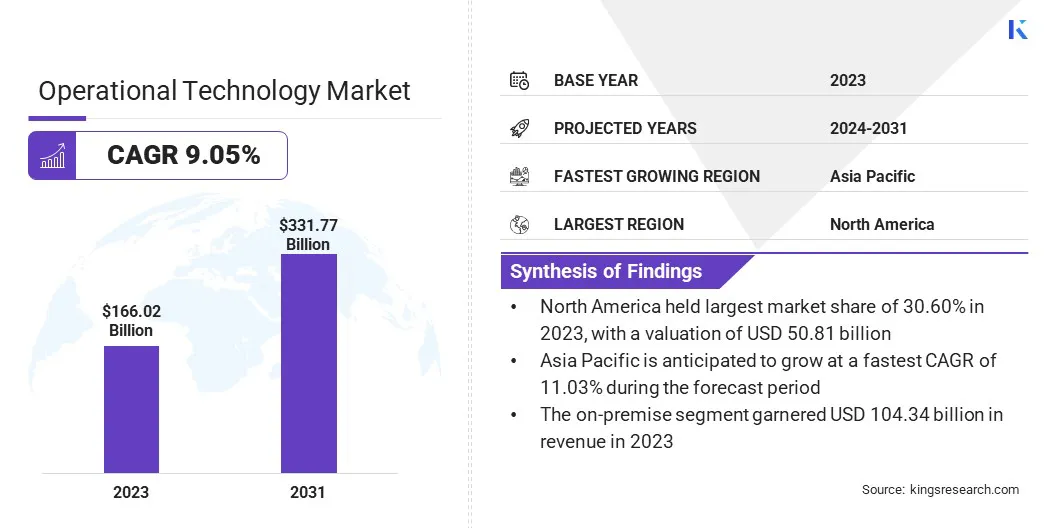

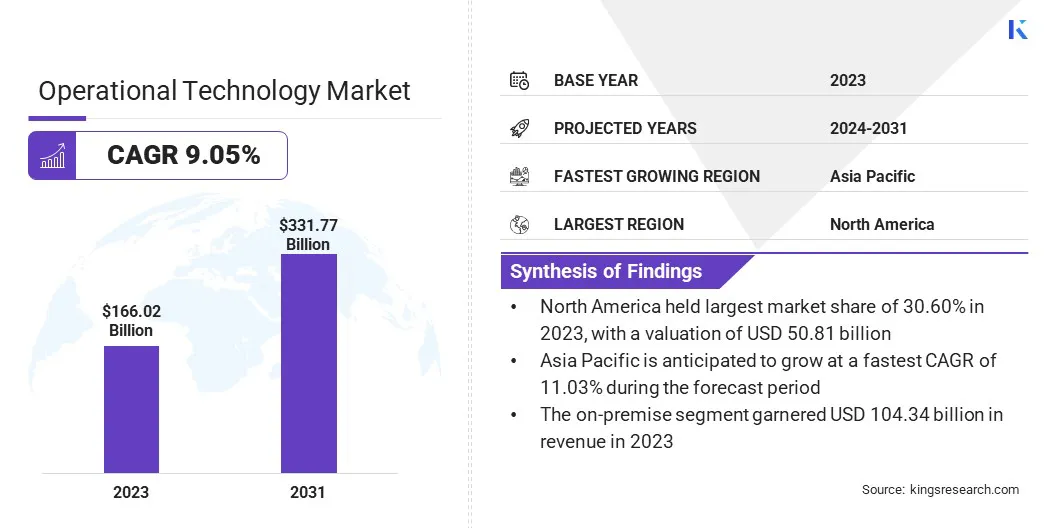

The global operational technology market size was valued at USD 166.02 billion in 2023 and is projected to grow from USD 180.91 billion in 2024 to USD 331.77 billion by 2031, exhibiting a CAGR of 9.05% during the forecast period.

Market growth is driven by increased connectivity, digital transformation, and the integration of AI and machine learning (ML) in OT security, which enhances operational efficiency, enables real-time monitoring, and strengthens the protection of critical infrastructure.

Major companies operating in the operational technology industry are ABB, Siemens, Schneider Electric, Rockwell Automation, Honeywell International Inc., Emerson Electric Co., IBM, General Electric, Fortinet, Inc., Mitsubishi Electric, Yokogawa Electric Corporation, Oracle, Cisco Systems Inc., Kaspersky Lab, Phoenix Contact and others .

The adoption of advanced data integration technologies is transforming the Operational Technology (OT) market by enabling seamless connectivity between operational and IT systems. These technologies improve data flow and decision-making in real-time, enhancing operational efficiency and predictive maintenance. Integration of disparate data sources also increases system reliability and supports improved productivity.

- In February 2025, Yokogawa Electric Corporation launched an enhanced version of its OpreX Collaborative Information Server, aimed at strengthening IT/OT integration and optimizing production management. Key additions include the CI Gateway component and support for RESTful APIs, enabling seamless data integration and improved operational efficiency across industries.

Key Highlights

- The operational technology market size was recorded at USD 166.02 billion in 2023.

- The market is projected to grow at a CAGR of 9.05% from 2024 to 2031.

- North America held a share of 30.60% in 2023, valued at USD 50.81 billion.

- The hardware segment garnered USD 90.92 billion in revenue in 2023.

- The Industrial Internet of Things (IIoT) segment is expected to reach USD 129.55 billion by 2031.

- The cloud-based segment is anticipated to witness the fastest CAGR of 11.31% through the projection period.

- The Process Industry segment is projected to secure the largest revenue share of 58.79% in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 11.03% over the forecast period.

Market Driver

Rapid Digital Transformation

The market is experiencing rapid digital transformation, fueled by increased industrial connectivity, advancements in the Internet of Things, and automation technologies. As more OT systems are integrated with IT networks, they offer greater opportunities for operational efficiency, real-time data analysis, and enhanced decision-making.

The transition to digital transformation is prompting companies to adopt innovative solutions that balance connectivity with robust cybersecurity.

- In October 2024, Palo Alto Networks introduced new OT security solutions, addressing the increasing cybersecurity threats to industrial operations. These innovations, including AI-powered virtual patching and ruggedized firewalls, cater to the growing demand for advanced security in critical OT environments, helping businesses protect their infrastructure while supporting digital transformation efforts.

Market Challenge

Rising Risk of CybersecurityThreats

A significant challenge hampering the progress of the the operational technology market is the increasing risk of cybersecurity threats. As OT systems become more interconnected, they are increasingly susceptible to cyberattacks that can compromise critical infrastructure, disruot operations, and lead to financial losses.

To address these risks, companies are proactively investing in advanced security solutions, adopting a defense-in-depth strategy, and regularly updating systems to strengthen defenses and cater to evolving cyber threats.

Market Trend

Increasing Integration of AI and Machine Learning (ML) in OT Security

The integration of artificial intelligence (AI) and machine learning (ML) technologies is emerging as a key trend in the market. These advanced technologies enhance threat detection by analyzing vast amounts of data in real-time, identifying patterns, and detecting anomalies that could indicate potential cyberattacks.

By automating threat identification and response, AI and ML improve the efficiency and accuracy of OT security measures, allowing for faster mitigation of risks. Organizations are better equipped to protect critical infrastructure from evolving cyber threats, while also reducing manual intervention and resource requirements.

- In May 2023, Nozomi Networks launched Vantage IQ, an AI-powered cybersecurity engine for critical infrastructure. The solution uses AI and machine learning to automate threat detection, correlate alerts, and enable predictive monitoring, targeting the growing need for advanced cybersecurity in OT and IoT systems.

Operational Technology Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware (Industrial Controllers (PLCs, DCS), Sensors, Industrial Networks & Gateways, Human-Machine Interface (HMI), Software (SCADA Systems, Manufacturing Execution Systems (MES), Asset Performance Management (APM), Industrial Cybersecurity Software), Services (Integration & Implementation, Support & Maintenance, Consulting & Training)

|

|

By Technology

|

Distributed Control System (DCS), Programmable Logic Controller (PLC), Machine Execution Systems (MES), Safety Instrumented Systems (SIS), Industrial Automation and Control Systems (IACS), Industrial Internet of Things (IIoT)

|

|

By Deployment Mode

|

On-premise, Cloud-based, Hybrid

|

|

By End-use Industry

|

Process Industry (Oil & Gas, Food & Beverages, Pharmaceuticals, Chemicals, Energy & Power, Metals & Mining, Pulp & Paper, Others), Discrete Industry (Automotive, Aerospace & Defense, Semiconductor & Electronics, Medical Devices, Machine Manufacturing, Others)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software, and Services): The hardware segment earned USD 89.10 billion in 2023 due to the growing demand for advanced sensors, control systems, and industrial devices that enable efficient monitoring and automation of operational processes.

- By Technology (Distributed Control System (DCS), Programmable Logic Controller (PLC), Machine Execution Systems (MES), Safety Instrumented Systems (SIS), Industrial Automation and Control Systems (IACS), and Industrial Internet of Things (IIoT)): The industrial internet of things (IIoT) segment captured a share of 34.73% in 2023, fueled by its essential role in providing real-time monitoring, control, and data analysis for critical industrial operations.

- By Deployment Mode (On-premise, Cloud-based, and Hybrid): The on-premise segment is projected to reach USD 189.50 billion by 2031, owing to the increasing need for greater data security, control over critical operations, and compliance with industry-specific regulations.

- By End-use Industry (Process Industry and Discrete Industry): The discrete industry segment is likely to grow at a CAGR of 10.04% through the forecast period, largely attributed to the rising adoption of advanced OT systems for improving patient care, operational efficiency, and medical equipment management.

Operational Technology Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America operational technology market share stood at around 30.60% in 2023 valued at USD 50.81 billion. This domianace is reinforced by the region’s advanced industrial base across manufacturing, energy, oil & gas, and utilities, which rely heavily on OT systems for automation and control. The presence of leading OT vendors, early adoption of Industry 4.0, and significant investments in upgrading legacy systems further fuel this growth.

- In March 2025, Dragos Inc. introduced its Community Defense Program in Canada, offering free OT cybersecurity software to small water, electric, and gas utilities. The initiative aims to strengthen threat detection, vulnerability management, and cyber resilience under-resourced critical infrastructure.

Asia Pacific operational technology industry is estimated to grow at a robust CAGR of 11.03% over the forecast period. This growth is mainly fueled by rapid industrialization, urbanization, and substantial government initiatives promoting smart manufacturing and infrastructure development.

Programs such as China’s “Made in China 2025” and India’s “Make in India” are spurring demand for OT solutions across sectors such as energy, transportation, and utilities. Additionally, the increasing focus on cybersecurity, the integration of OT with IT systems, and the modernization of critical industries such as energy, pharmaceuticals, and water treatment are propelling regional market growth.

- In August 2024, Singapore released the updated Operational Technology Cybersecurity Masterplan, aiming to strengthen the security and resilience of industrial control systems. This updated plan promotes secure-by-deployment principles, enhances talent development, and improves information sharing to safeguard OT systems across various sectors.

Regulatory Frameworks

- The U.S. National Institute of Standards and Technology (NIST) has introduced a comprehensive set of guidelines to enhance cybersecurity across critical infrastructure sectors, including operational technology . It enables organizations to manage and reduce cybersecurity risks to OT systems.

- The Europe implemented the General Data Protection Regulation (GDPR) to enhance personal data protection and privacy across member states. This regulation promotes transparency, accountability, and user control in the collection and processing of personal data by organizations.

Competitive Landscape

In the operational technology market, key players are leveraging strategic partnerships and collaborations to expand their market presence and enhance product offerings.

By forming alliances with technology firms, they are integrating advanced solutions such as Industrial IoT (IIoT) and edge computing into their OT systems, enabling improved automation and real-time data analytics. These collaborations help companies optimize operational processes across industries such as manufacturing, energy, and utilities.

- In March 2024, Mitsubishi Electric partnered with Nozomi Networks to enhance OT security, addressing the increasing demand for robust cybersecurity solutions in critical infrastructure. This collaboration combines Mitsubishi Electric’s factory automation expertise with Nozomi Networks’ intrusion detection and network visualization technologies, targeting industries seeking secure and continuous OT system operation.

List of Key Companies in Operational Technology Market:

• ABB

• Siemens

• Schneider Electric

• Rockwell Automation

• Honeywell International Inc.

• Emerson Electric Co.

• IBM

• General Electric

• Fortinet, Inc.

• Mitsubishi Electric

• Yokogawa Electric Corporation

• Oracle

• Cisco Systems Inc.

• Kaspersky Lab

• Phoenix Contact

Recent Developments (Product Launch)

- In March 2025, Siemens announced an extended collaboration with Microsoft to integrate Siemens Industrial Edge with Microsoft Azure IoT Operations, supporting the growing demand for IT-OT convergence in manufacturing. This partnership enables seamless edge-to-cloud data integration, allowing industrial customers to leverage AI, digital twins, and advanced analytics to improve machine performance, reduce maintenance, and optimize production.

- In March 2025, Orro launched its Digital Asset Discovery service, the first in Australia to offer managed OT asset visibility. This new service provides continuous monitoring and risk assessment, helping businesses in industries such as energy, mining, and healthcare ensure security and compliance with evolving regulations.

- In March 2025, Fortinet enhanced its OT Security Platform to address the growing need for improved cybersecurity in critical infrastructure. The updated platform features improved visibility, segmentation, and secure connectivity, aiming to protect industries such as energy and manufacturing from evolving cyber threats.

- In February 2025, Schneider Electric enhanced the cybersecurity functionality of its SCADAPack 470i and 474i Remote Terminal Units, addressing the growing need for OT security in critical infrastructure. This new offering integrates IT security tools such as Active Directory and role-based access control, allowing customers manage RTU access securely in harsh environments, particularly in water and energy sectors.

- In August 2024, Rockwell Automation launched the Industrial Data Center Gen 5.0, enhancing industrial data centers with scalable compute solutions for medium-to-large businesses. This new generation features on-cloud backup, reduced server footprint, and improved security, addressing the evolving needs of OT environments and enabling manufacturers to securely collect and store critical data.