Market Definition

Omnichannel order management systems refer to integrated software platforms that centralize and coordinate order processing across multiple sales channels, including online, in-store, mobile, and third-party marketplaces. These systems enable real-time inventory visibility, order routing, and fulfillment optimization to ensure a seamless and consistent customer experience.

The market focuses on the development, deployment, and integration of omnichannel order management solutions that streamline operations for retailers, logistics providers, and e-commerce platforms.

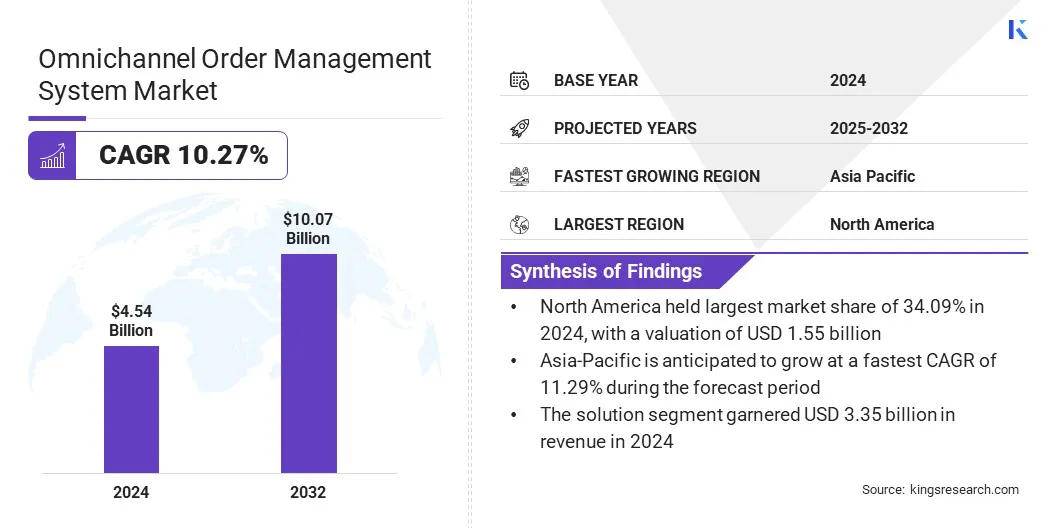

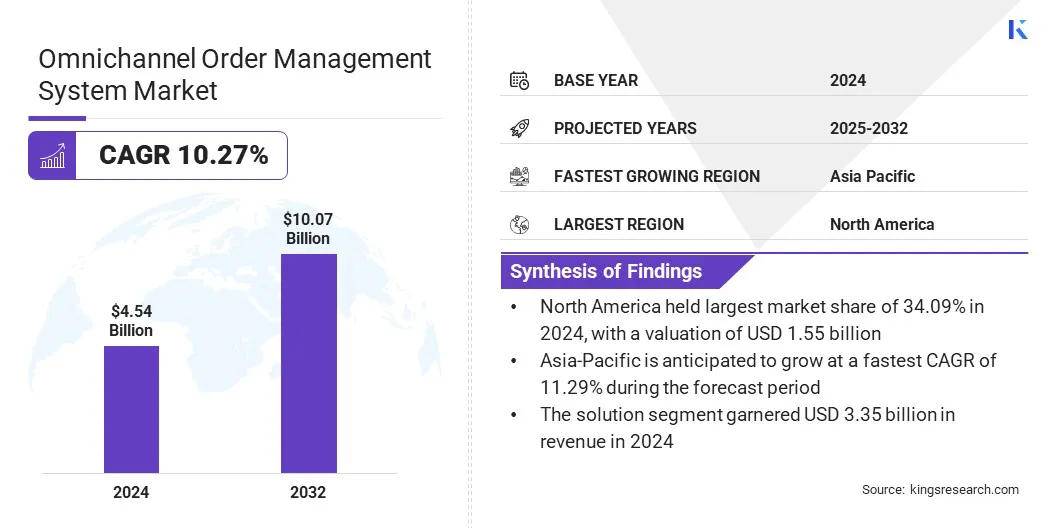

The omnichannel order management system market size was valued at USD 4.54 billion in 2024 and is projected to grow from USD 4.96 billion in 2025 to USD 10.07 billion by 2032, exhibiting a CAGR of 10.27% during the forecast period.

The market growth is fueled by the increasing need for seamless order fulfillment across diverse retail channels and rising consumer expectations for real-time visibility and delivery flexibility. The shift toward unified commerce is prompting retailers and e-commerce platforms to adopt omnichannel order management systems that integrate inventory, order processing, and customer engagement into a single platform.

Key Market Highlights:

- The omnichannel order management system industry size was valued at USD 4.54 billion in 2024.

- The market is projected to grow at a CAGR of 10.27% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 1.55 billion.

- The solution segment garnered USD 3.35 billion in revenue in 2024.

- The on-premises segment is expected to reach USD 6.09 billion by 2032.

- The small and medium enterprises segment is anticipated to witness the fastest CAGR of 10.84% over the forecast period.

- The food & beverages segment garnered USD 1.36 billion in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 11.29% through the projection period.

Major companies operating in the omnichannel order management system industry are Deck Commerce, IBM, Aptean, Manhattan Associates, SkuNexus LLC, Kibo Software, Inc., Veeqo Ltd, Fluent Commerce, Oracle, Cart.com, Inc., Blue Yonder Group, Inc., Baozun Inc., Deposco, Inc., SAP SE, and Salesforce.com, Inc.

Omnichannel Order Management System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solution, and Services

|

|

By Deployment

|

On-premises, and Cloud-based

|

|

By Organization

|

Small and Medium Enterprises, and Large Enterprises

|

|

By Vertical

|

Healthcare, Manufacturing, Food & Beverages, Automotive, Retail & E-commerce, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Omnichannel Order Management System Market Regional Analysis

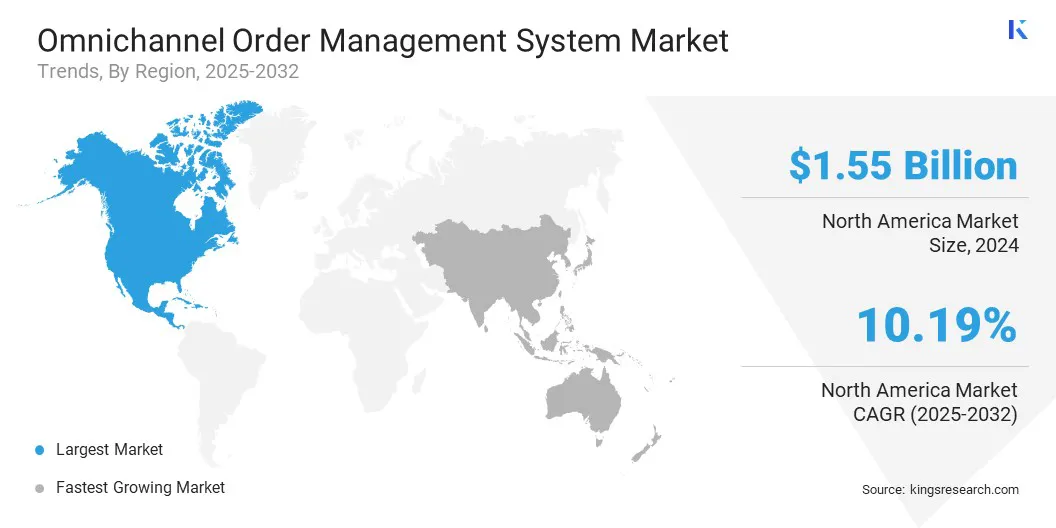

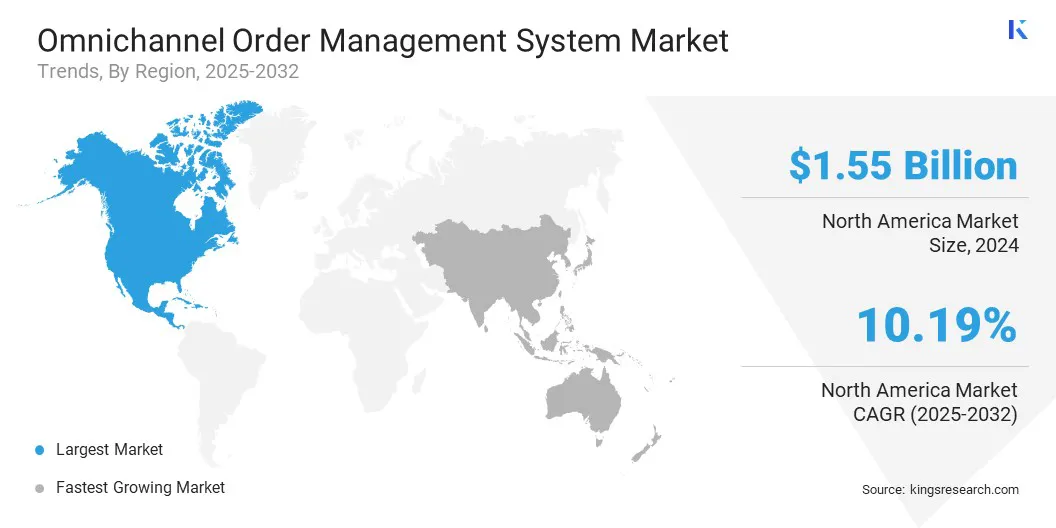

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America omnichannel order management system market share stood at 34.09% in 2024, valued at USD 1.55 billion. This dominance is attributed to the region’s mature retail ecosystem, early adoption of digital commerce platforms, and the presence of technology providers offering advanced omnichannel solutions.

Furthermore, growing investment in retail automation, cloud infrastructure, and data-driven customer engagement strategies continues to support the widespread implementation of omnichannel order management systems across diverse industries. The region’s focus on improving customer experience and streamlining operations supports its strong position in the market.

Rising consumer expectations for seamless multichannel interactions along with continuous advancements in artificial intelligence, analytics, and fulfillment technologies further strengthen the market in North America.

- In June 2024, U.S.-based OneRail acquired Canada-based Orderbot Software Inc. to enhance its end-to-end omnichannel fulfillment platform. The integration combines Orderbot’s distributed order management with OneRail’s last-mile delivery network, enabling smarter order routing, reduced costs, and improved delivery speed and accuracy across channels.

The Asia-Pacific omnichannel order management system industry is set to grow at a CAGR of 11.29% over the forecast period. Growth is propelled by the rapid expansion of digital commerce, rising internet penetration, and changing consumer expectations for seamless multichannel shopping experiences.

The region’s growing base of tech-savvy consumers and the increasing presence of regional and global e-commerce players are driving the demand for efficient and scalable order management solutions. Government support for digital infrastructure development and favorable regulatory environments are further accelerating market adoption.

Moreover, the shift toward direct-to-consumer models and a heightened focus on operational efficiency and customer engagement are encouraging businesses to invest in advanced omnichannel order management platforms across the Asia-Pacific region.

Omnichannel Order Management System Market Overview

Advancements in cloud computing, artificial intelligence, and automation technologies are enhancing the scalability, accuracy, and responsiveness of these systems supporting their broader deployment across retail, logistics, and distribution sectors. Businesses are leveraging omnichannel order management to streamline operations, reduce fulfillment costs, and improve customer satisfaction accelerating adoption across both mature and emerging markets.

- In March 2025, IBM’s Sterling Order Management System (OMS) is transforming retail operations with AI-driven tools that improve efficiency across fulfillment, inventory, and customer service. Advance Auto Parts reported a 98% on-time delivery rate, reduced transportation costs by 12%, and a 27% increase in sales for its 30-minute delivery segment using IBM solutions.

Market Driver

Rising Demand for Seamless Customer Experience

The growth of the omnichannel order management system market is propelled by the increasing demand for a smooth and consistent customer experience across all retail channels.Consumers increasingly expect a seamless and consistent experience across all channels-whether browsing, purchasing, or returning products through online platforms, physical stores, mobile applications, or third-party marketplaces.

This shift is fueled by rising digital literacy, widespread smartphone adoption, and the influence of e-commerce platforms that offer flexible and convenient shopping options. Omnichannel order management systems help businesses meet these expectations by synchronizing inventory, automating order processing, and ensuring timely fulfillment across all touchpoints.

As retailers aim to enhance customer satisfaction and build long-term loyalty, the adoption of integrated order management solutions is becoming essential, contributing to sustained market growth.

- In October 2024, Nextuple enhanced its Order Management Studio (NOMS) for grocery and convenience retailers, adding AI-powered features for real-time order promising, inventory forecasting, and efficient in-store fulfillment. The update supports same-day delivery, express pickup, substitutions, and weight-based items, and marks the company's expansion.

Market Challenge

Integration Complexity Across Channels

Integration complexity across channels presents a significant barrier to the effective implementation of omnichannel order management systems for businesses with diverse and legacy infrastructures. Retailers often operate across multiple platforms including e-commerce websites, mobile apps, physical stores and third-party marketplaces each with its own backend systems for inventory, order processing and customer management.

This creates challenges in achieving real-time synchronization and consistent data flow across all touchpoints. System incompatibilities, outdated technologies and inconsistent data formats can lead to inventory discrepancies, order delays and fragmented customer experiences.

As a result, market players are enhancing their platforms through pre-built connectors, middleware tools, and modular architectures to reduce integration complexity. They are also investing in IT modernization and aligning internal processes to enable smoother data exchange. These efforts support the full functionality of omnichannel systems across dynamic and multi-platform retail environments.

Market Trend

Adoption of Cloud-Based and SaaS Platforms

The adoption of cloud-based and Software-as-a-Service (SaaS) platforms is reshaping the omnichannel order management system market by offering scalable, flexible and cost-efficient deployment models. Cloud-based systems eliminate the need for extensive on premise infrastructure and enable real-time access to data, ensuring that inventory, orders, and customer information are synchronized across all sales channels.

SaaS platforms further simplify implementation and maintenance by providing subscription-based access to continuously updated software, reducing the demand on internal IT teams. These solutions support rapid onboarding, easy integration with third-party systems and on-demand scalability making them ideal for businesses seeking agility in fast-changing retail environments.

Moreover, cloud-native architectures enhance system reliability, enable remote access and support advanced functionalities such as AI-driven analytics and automated order orchestration.

- In May 2025, Thalia, a leading bookseller in German-speaking countries partnered with OC Fulfillment GmbH to strengthen its omnichannel operations. The cloud-based order management system enhances inventory visibility, lowers stock levels, and supports future ship-from-store functionality, offering fast integration and improved supply chain efficiency.

Market Segmentation

- By Component (Solution, and Services): The solution segment earned USD 3.35 billion in 2024 due to increasing demand for centralized platforms that streamline order processing, inventory management, and multichannel fulfillment.

- By Deployment (On-premises, and Cloud-based): The on-premises segment held a share of 61.77% in 2024, attributed to greater control over data security, system customization, and compliance with enterprise-specific IT policies.

- By Organization (Small and Medium Enterprises, and Large Enterprises): The large enterprises segment is projected to reach USD 6.05 billion by 2032, owing to high order volumes, complex supply chain operations, and increased investment in scalable, integrated order management solutions.

- By Vertical (Healthcare, Manufacturing, Food & Beverages, Automotive, Retail & E-commerce, and Others): The retail & e-commerce segment is anticipated to grow at a CAGR of 10.58% through the projection period due to rising consumer demand for omnichannel shopping experiences, rapid digitalization of retail operations, and the need for real-time order visibility and flexible fulfillment options.

Regulatory Frameworks

- In the U.S., the California Consumer Privacy Act regulates the collection, storage, and management of consumer data by companies. It impacts omnichannel order management system platforms by requiring clear data handling policies and robust security measures for customer order and transaction information.

- In the European Union, the General Data Protection Regulation governs the processing of personal data across all digital platforms. Omnichannel order management system vendors must ensure data privacy, user consent, and the right to data access and deletion, especially when handling cross-border orders and customer profiles.

- In India, the Digital Personal Data Protection Act, 2023 regulates the handling of digital personal data. Omnichannel order management systems must comply with requirements related to data storage, user consent, and secure processing of customer and order information across retail and e-commerce operations.

Competitive Landscape

The omnichannel order management system industry is characterized by the presence of several well-established technology providers and emerging vendors competing on the basis of platform scalability, integration capabilities, and user experience.

Key market participants are focusing on strategies such as enhancing real-time order visibility, incorporating artificial intelligence for demand forecasting, and streamlining multi-channel fulfillment processes. Companies are also investing in research and development to offer modular, cloud-native solutions that cater to specific industry verticals and enterprise sizes.

Furthermore, strategic partnerships with e-commerce platforms, logistics providers, and cloud service companies along with mergers and acquisitions are being pursued to expand global reach, improve implementation services, and deliver end-to-end order management solutions tailored to evolving business needs.

- In May 2025, Manhattan Associates and Shopify launched a connector app integrating Manhattan Active Order Management with Shopify, enabling real-time inventory visibility and unified omnichannel fulfillment, including buy online, pick up in store (BOPIS), same-day delivery, and ship-from-store. The collaboration aims to enhance checkout speed, order accuracy, and customer experience.

List of Key Companies in Omnichannel Order Management System Market:

- Deck Commerce

- IBM

- Aptean

- Manhattan Associates

- SkuNexus LLC

- Kibo Software, Inc.

- Veeqo Ltd

- Fluent Commerce

- Oracle

- Cart.com, Inc.

- Blue Yonder Group, Inc.

- Baozun Inc.

- Deposco, Inc.

- SAP SE

- Salesforce.com, Inc.

Recent Developments (Partnerships/Investments/Launch)

- In April 2025, Nextuple Inc. and 910 Advisors announced a strategic partnership to boost omnichannel fulfillment and supply chain efficiency. The collaboration combines Nextuple’s micro services-based order management solutions with 910 Advisors’ expertise in supply chain and technology integration, enabling faster, more agile, and seamless fulfillment across retail channels.

- In May 2024, OneStock received a USD 72 million investment from Summit Partners to accelerate global expansion and advance its AI-powered order management capabilities. Through the investment, the company aims to expand its footprint in the U.S. market and drive innovation in B2B solutions and circular commerce models.

- In February 2024, Cart.com introduced the Constellation Order Management System (OMS), designed to streamline order and inventory management across multiple channels. Powered by artificial intelligence, the platform improves demand forecasting accuracy by over 40%. It also enables features like buy online pick up in store (BOPIS), ship-from-store, real-time tracking, and easy integration with existing systems.

- In October 2023, Deck Commerce partnered with Klaviyo to integrate omnichannel order management with intelligent email and SMS marketing automation. The collaboration enables real-time customer engagement across order lifecycle touchpoints, leveraging Klaviyo’s communication platform to enhance personalization and drive growth.