Market Definition

The market focuses on the custom production of short DNA or RNA sequences used in biotechnology, pharmaceuticals, diagnostics, and research. These synthetic oligos support applications such as gene editing, molecular diagnostics, and therapeutic development.

The market encompasses suppliers and platforms involved in the design, manufacturing, and distribution of high-quality oligonucleotide products. The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Oligonucleotide Synthesis Market Overview

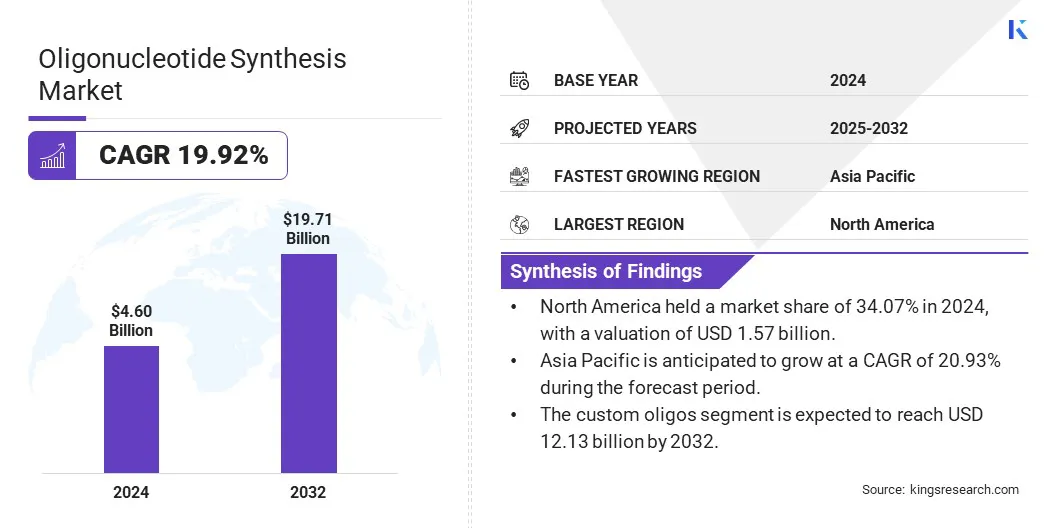

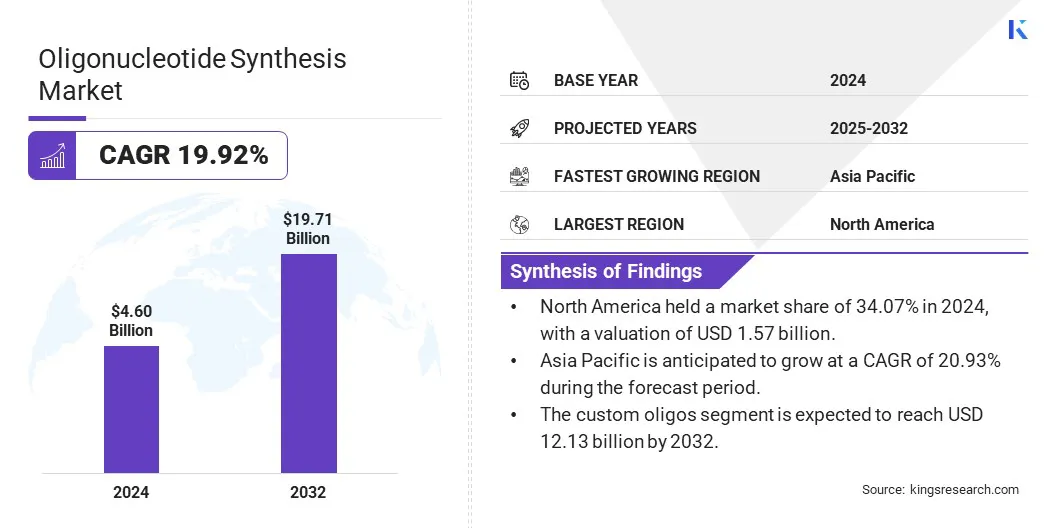

The global oligonucleotide synthesis market size was valued at USD 4.60 billion in 2024 and is projected to grow from USD 5.52 billion in 2025 to USD 19.71 billion by 2032, exhibiting a CAGR of 19.92% during the forecast period.

The market is experiencing growth due to increasing therapeutic applications, particularly in cancer and genetic diseases. Advancements in oligonucleotide-drug conjugates (ODCs) enhance drug targeting and efficacy, driving demand for specialized synthesis solutions, especially in RNAi-based cancer therapies.

Major companies operating in the oligonucleotide synthesis industry are DH Life Sciences, LLC., Eurofins Scientific, KANEKA CORPORATION, Twist Bioscience, Alnylam Pharmaceuticals, Inc., Ionis Pharmaceuticals, Inc., Thermo Fisher Scientific Inc., LGC Biosearch Technologies Maravai LifeSciences, GenScript, Sarepta Therapeutics, Inc, Novartis AG, Merck KGaA, Azenta US Inc., and AstraZeneca.

The market is being driven by the growing demand for personalized medicine. As treatments are increasingly tailored to individual genetic profiles, the need for precise, patient-specific oligonucleotides continues to rise.

Advancements in genomic technologies and the proliferation of gene therapies have further accelerated this demand, opening new opportunities for oligonucleotide-based solutions in previously untapped therapeutic areas. Custom oligo synthesis plays a crucial role in developing these targeted therapies, propelling market growth and boosting innovation in the biopharmaceutical industry.

- In June 2024, GSK plc acquired Elsie Biotechnologies, a San Diego-based biotechnology firm, for approximately USD 50 million, strengthening its oligonucleotide therapeutic capabilities. The acquisition integrates Elsie’s discovery, synthesis, and delivery technologies into GSK's R&D platform. Additionally, it supports GSK’s strategy of advancing novel technologies to accelerate drug development in areas like chronic hepatitis B and liver disease.

Key Highlights:

- The oligonucleotide synthesis market size was recorded at USD 4.60 billion in 2024.

- The market is projected to grow at a CAGR of 19.71% from 2025 to 2032.

- North America held a market share of 34.07% in 2024, with a valuation of USD 1.57 billion.

- The oligonucleotide segment garnered USD 1.94 billion in revenue in 2024.

- The custom oligos segment is expected to reach USD 12.13 billion by 2032.

- The research segment is anticipated to witness a CAGR of 20.27% during the forecast period.

- The hospitals segment is forecasted to have a market share of 26.18% in 2032.

- Asia Pacific is anticipated to grow at a CAGR of 20.93% during the forecast period.

Market Driver

Growing Use of Oligonucleotides in Therapeutics

The market is driven by increasing therapeutic applications of oligonucleotides, which enable targeted modulation of gene expression, splicing, and protein production. Their ability to address previously untreatable genetic targets supports development across indications such as cancer, genetic diseases, and viral infections.

Advances in nucleic acid chemistry and delivery technologies are improving efficacy and safety profiles while growing regulatory support is accelerating clinical adoption. These factors are creating sustained demand for scalable, high-quality oligonucleotide synthesis to support drug development pipelines.

- In April 2024, Asahi Kasei Bioprocess and Axolabs formed a strategic partnership to establish a 59,000 sq. ft. cGMP facility in Berlin for oligonucleotide manufacturing. This collaboration supports the growing use of oligonucleotides in therapeutics by enhancing scalable production capabilities enabling faster development of gene-targeting therapies for conditions such as cancer, genetic disorders, and viral infections.

Market Challenge

Technical Difficulties in Synthesizing Long Oligonucleotides

Synthesizing long oligonucleotides presents a significant challenge in the oligonucleotide synthesis market due to issues such as low yield, increased error rates, and higher costs. The complexity of maintaining high fidelity during the synthesis of longer sequences affects their viability for advanced therapeutic applications, such as gene editing and RNA therapies.

Companies are addressing this by investing in innovative synthesis technologies, like improved solid-phase synthesis methods and error-correction algorithms. Additionally, advancements in automated platforms and continuous flow reactors are improving efficiency and scalability. Market players are also focusing on optimizing chemical modifications to enhance stability and reduce errors in long oligos.

Market Trend

Advancement in Oligonucleotide-Drug Conjugates

The market is witnessing a significant trend in the advancement of Oligonucleotide-Drug Conjugates (ODCs). These innovative therapeutics combine oligonucleotides with small molecules or antibodies, enhancing drug targeting, efficacy, and overcoming resistance.

Recent breakthroughs in ODC platforms have shown strong antitumor activity, including in pancreatic cancer models, by improving potency and reducing toxicity. This trend is fueling the need for specialized oligonucleotide synthesis solutions, particularly in RNAi-based cancer therapies.

- In June 2024, Sirnaomics showcased significant antitumor activity with its novel Oligonucleotide-Chemodrug Conjugate (ODC) across various cancer models, including pancreatic tumors. The company's Antibody-Oligonucleotide-Chemodrug Conjugate (AODC) platform enhances RNAi-based therapies by increasing drug potency, overcoming resistance, and reducing toxicity through targeted oligonucleotide delivery. This breakthrough advances cancer treatment, improving efficacy and minimizing systemic side effects.

Oligonucleotide Synthesis Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Oligonucleotide, Reagents, Equipment

|

|

By Type

|

Custom Oligos, Predesigned Oligos

|

|

By Application

|

Therapeutic, Diagnostics, Research(PCR, Sequencing, Others), Others

|

|

By End-user

|

Hospitals, Academic Research Institutes, Pharmaceutical and Biotechnology Companies, Diagnostic Laboratories, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Oligonucleotide, Reagents, Equipment): The oligonucleotide segment earned USD 1.94 billion in 2024 due to the increasing demand for oligonucleotide-based therapies and advancements in genomic research driving the need for custom oligos in drug development and diagnostics.

- By Type (Custom Oligos, Predesigned Oligos): The custom oligos segment held 62.09% of the market in 2024, due to the growing demand for personalized medicine and targeted therapies, which require tailor-made oligonucleotides for specific genetic targets and therapeutic applications.

- By Application (Therapeutic, Diagnostics, Research, and Others): The therapeutic segment is projected to reach USD 7.12 billion by 2032, due to the expanding pipeline of oligonucleotide-based therapies targeting complex diseases such as genetic disorders, cancer, and viral infections, alongside ongoing advancements in precision medicine.

- By End-user (Hospitals, Academic Research Institutes, Pharmaceutical and Biotechnology Companies, Diagnostic Laboratories, Others): The hospitals segment held 26.18% market in 2032, due to the increasing adoption of oligonucleotide-based treatments in clinical settings for managing complex diseases and improving patient outcomes through targeted therapies.

Oligonucleotide Synthesis Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America oligonucleotide synthesis market share stood at around 34.07% in 2024 in the market, with a valuation of USD 1.57 billion. North America holds a dominant position in the market due to its early adoption of advanced enzymatic synthesis technologies, enabling efficient and scalable production of RNA-based therapeutics.

The region benefits from a strong infrastructure for biotech innovation, extensive clinical research activity, and a high concentration of industry experts. These factors support the rapid integration of novel manufacturing methods, positioning North America at the forefront of oligonucleotide-based drug development and commercialization across various therapeutic applications.

- In May 2024, Codexis, Inc. announced a breakthrough in oligonucleotide synthesis, successfully producing a full-length oligonucleotide via an enzymatic route to support RNA-based therapeutics. Codexis demonstrated the potential of its ECO Synthesis platform as a scalable and sustainable manufacturing method at the TIDES USA event, offering an alternative to traditional approaches for RNAi therapeutics.

Asia Pacific is poised for significant growth at a robust CAGR of 20.93% over the forecast period. The oligonucleotide synthesis industry in Asia Pacific is experiencing growth due to increasing regional investment in local manufacturing capabilities, which enhances self-sufficiency and reduces reliance on imports.

The establishment of advanced synthesis facilities supports domestic production of diagnostic and therapeutic oligonucleotides, aligning with national healthcare initiatives.

This shift is driving market growth by enabling faster regulatory approvals, lowering production costs, and expanding access to advanced molecular diagnostic tools across emerging markets. These developments are strengthening Asia Pacific's position in global biopharmaceutical and diagnostic supply chains.

- In December 2024, Co-Dx and joint venture partner CoSara Diagnostics Pvt. Ltd inaugurated a new oligonucleotide synthesis facility in Ranoli, India. The facility will produce patented Co-Primers chemistry used in existing lab-based Polymerase Chain Reaction (PCR) tests and Co-Dx PCR platform for at-home and point-of-care diagnostic applications.

Regulatory Frameworks

- In India, the Drug Control Center (DCi) oversees the market, ensuring adherence to drug manufacturing regulations and compliance with industry standards to maintain safety and quality in production processes.

- In the U.S., the Food and Drug Administration (FDA) governs the development, manufacturing, and distribution of oligonucleotide-based products, including both diagnostic tools and therapeutic agents, ensuring compliance with regulatory standards for safety and efficacy.

- In Europe, the European Medicines Agency (EMA) regulates oligonucleotide synthesis, especially for pharmaceutical applications. The EMA evaluates these products, often synthesized through solid-phase chemistry with modifications, as new chemical entities, ensuring compliance with regulatory standards for safety and efficacy.

Competitive Landscape

Key players in the oligonucleotide synthesis market are adopting strategies such as mergers and acquisitions, and new product launches to accelerate market growth. Companies are actively acquiring smaller players to enhance their technological capabilities and expand market presence.

Additionally, firms are introducing innovative oligonucleotide-based solutions, focusing on new therapeutic applications and diagnostic tools. These strategic actions are driving competition and enabling key players to capture a larger share of the global market while supporting the broader adoption of these technologies across clinical and research settings.

- In October 2024, Synoligo Biotechnologies Inc. expanded its production capabilities with a new 5,000 sq. ft. facility focused on high-throughput custom oligonucleotide synthesis. This development supports the growing demand for oligonucleotides in therapeutics, enhancing Synoligo’s capacity to deliver critical components used in advanced drug development for precision medicine and targeted therapies.

List of Key Companies in Oligonucleotide Synthesis Market:

- DH Life Sciences, LLC.

- Eurofins Scientific

- KANEKA CORPORATION

- Twist Bioscience

- Alnylam Pharmaceuticals, Inc.

- Ionis Pharmaceuticals, Inc.

- Thermo Fisher Scientific Inc.

- LGC Biosearch Technologies

- Maravai LifeSciences

- GenScript

- Sarepta Therapeutics, Inc

- Novartis AG

- Merck KGaA

- Azenta US Inc.

- AstraZeneca

Recent Developments (New Product Launch)

- In April 2025, Sumitomo Chemical established Sumitomo Chemical Advanced Medical Solutions America LLC (SC-AMSA) in Massachusetts, to strengthen its presence in the oligonucleotide contract development and manufacturing organization (CDMO) sector. SC-AMSA aims to enhance collaboration with local drug discovery startups and meet the growing demand for high-purity guide RNA (gRNA) used in genome editing therapies. The company plans to commence sample production by August 2025, leveraging its proprietary technology capable of producing long-chain gRNAs with high purity and yield.

- In October 2023, Integrated DNA Technologies (IDT) inaugurated its first therapeutic oligonucleotide manufacturing facility in Iowa, U.S. The 41,000-square-foot facility is designed to produce current Good Manufacturing Practice (cGMP) grade cell and gene therapy reagents, including single guide RNAs (sgRNAs) and donor oligonucleotides for homology-directed repair (HDR).