Oilfield Casing Spools Market Size

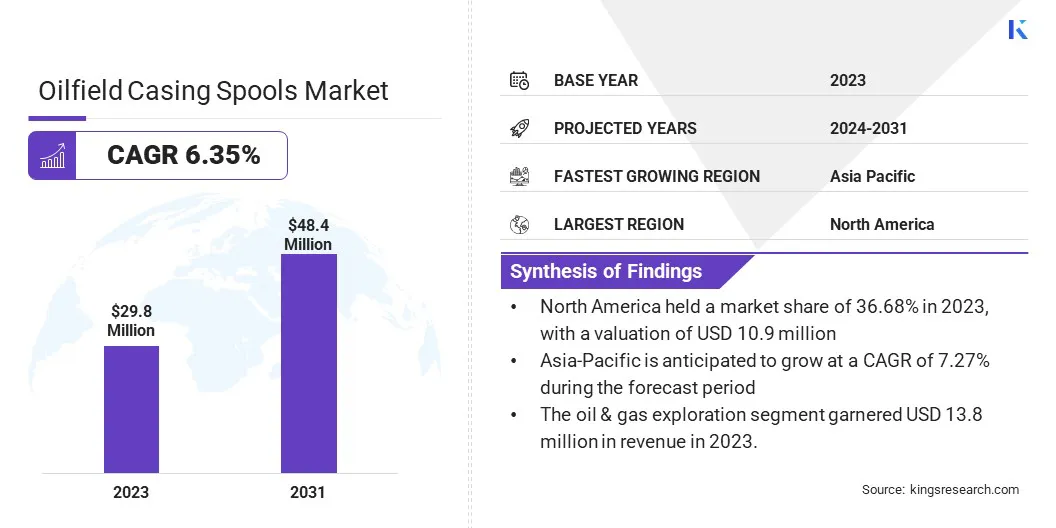

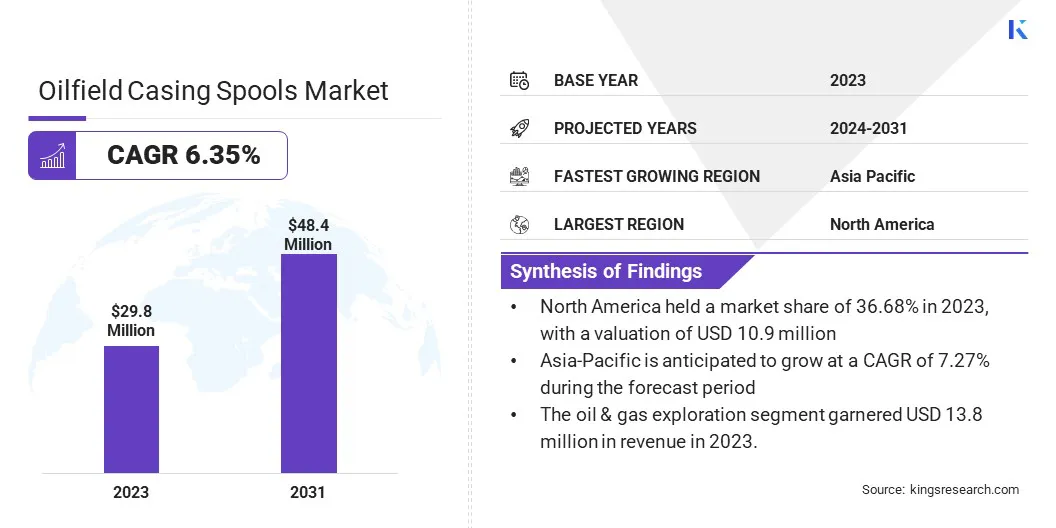

The global Oilfield Casing Spools Market size was valued at USD 29.8 million in 2023 and is projected to grow from USD 31.5 million in 2024 to USD 48.4 million by 2031, exhibiting a CAGR of 6.35% during the forecast period. Increased shale gas exploration is contributing significantly to the development of the market.

In the scope of work, the report includes services offered by companies such as Shaanxi FYPE Rigid Machinery Co.,Ltd, Baker Hughes Company, Delta Corporation, UZTEL S.A., Jiangsu HongFei Petroleum Machinery Manufacturing CO., LTD, Worldwide Oilfield Machine (WOM), Jereh Group, Sentry Wellhead Systems, Parveen Industries Pvt. Ltd. , CCSC Petroleum Equipment LTD CO and others.

The surge in shale gas exploration is significantly driving the demand for oilfield casing spools market. Shale gas, trapped within fine-grained sedimentary rocks, requires advanced drilling techniques such as hydraulic fracturing and horizontal drilling. These techniques necessitate robust and reliable casing spools to ensure the integrity of the wellbore throughout the drilling process.

Casing spools play a critical role in maintaining well control and preventing blowouts by securely housing and supporting the well casing. As countries including the United States, Canada, and China continue to explore and exploit their shale gas reserves, the need for high-quality casing spools has surged.

The increased exploration activities demand more casing spools, requiring innovations in spool design and materials to handle the high pressures and temperatures associated with shale gas extraction.

This trend underscores the importance of continuous advancements in casing spool technology to meet the evolving needs of the oil and gas industry, thereby ensuring the safety and efficiency of extraction processes.

Oilfield casing spools are crucial components in the drilling and completion phases of oil and gas wells. They are part of the wellhead assembly, which is installed at the surface of an oil or gas well. Casing spools serve to provide a connection point for the casing strings, which are large diameter pipes lowered into the well to stabilize it and prevent the walls from caving in.

These spools are typically made from high-strength materials such as carbon steel or stainless steel to withstand the extreme pressures and corrosive environments encountered during drilling operations. The primary application of casing spools is to support and suspend the casing strings, facilitate well control, and provide access for wellbore operations.

They are equipped with flanges and threaded connections that allow for the secure attachment of additional wellhead equipment. Moreover, casing spools play a vital role in ensuring the safe and efficient flow of hydrocarbons from the well to the surface, making them indispensable in the oil and gas industry.

Analyst’s Review

In the highly competitive oilfield casing spools market, key players are adopting several strategic imperatives to maintain and enhance their market position. One of the primary strategies involves investing heavily in research and development to innovate and improve the durability and performance of casing spools.

This includes exploring new materials and manufacturing techniques capable of withstanding higher pressures, temperatures, and corrosive environments.

Furthermore, these companies are focusing on expanding their product portfolios to offer a wider range of customized solutions tailored to the specific operational needs of various oilfield projects. Another critical strategy is forming strategic partnerships and alliances with oilfield service providers and operators.

These collaborations aim to integrate advanced casing spool technologies into broader drilling and completion solutions, thereby enhancing operational efficiency and safety.

Additionally, there is a significant emphasis on digitalization and the incorporation of automation technologies to streamline installation and maintenance processes, reduce operational downtime, and improve accuracy. The key players continue to prioritize sustainability by developing environmentally friendly products and practices, thereby meeting increasing regulatory requirements and market demands.

Oilfield Casing Spools Market Growth Factors

The integration of digital technologies and automation in oilfield operations is revolutionizing the industry, significantly impacting the demand for advanced oilfield casing spools. By leveraging cutting-edge technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML), oilfield operators are aiming to achieve greater precision and efficiency in their operations.

Automated systems enhance real-time monitoring and predictive maintenance capabilities, thereby reducing the risk of equipment failure and operational downtime. For casing spools, digital integration means improved design and manufacturing processes, ensuring that these components meet the rigorous demands of modern drilling activities.

Furthermore, automation facilitates more accurate placement and secure installation of casing spools, thus enhancing well integrity and safety.

This technological shift is bolstered by the industry's need to maximize production efficiency, minimize costs, and ensure the safety of operations. As digitalization continues to advance, smart casing spools equipped with sensors and data analytics capabilities are poised to play vital role in optimizing their drilling strategies.

The volatility of oil prices poses a significant challenge to the development of the oilfield casing spools market, creating an environment of uncertainty and cautious investment. Fluctuating oil prices impact the budget allocations for exploration and production activities, leading to variability in demand for casing spools.

Conversely, during periods of high oil prices, there is a notable surge in exploration activities, resulting in increased demand for high-quality casing spools. Managing production and inventory levels to adapt to these fluctuating market conditions while maintaining product quality and fostering innovation presents a major challenge to the industry players.

Additionally, the unpredictable nature of oil prices complicates strategic planning and investment in research and development for new technologies, thereby underscoring the need for agile business strategies to mitigate the risks associated with market volatility.

Oilfield Casing Spools Industry Trends

The rising demand for customized solutions in the oilfield casing spools market reflects the industry's notable shift toward tailored and specific operational needs. Oilfield operations vary significantly based on geological formations, environmental conditions, and specific project requirements, thereby necessitating customized casing spool designs.

Customization allows operators to optimize well integrity, enhance performance, and ensure safety by using spools that are specifically engineered to address the unique challenges posed by each individual well. This trend is further fueled by the increasing complexity of drilling projects, including deeper wells and more challenging environments such as deepwater and ultra-deepwater drilling.

Manufacturers are responding to this demand by offering a broader range of customizable options, ranging from material selection and spool size to advanced features such as integrated sensors for real-time monitoring.

The ability to provide tailored solutions that address the immediate operational needs of oilfield companies positions manufacturers as valuable partners in achieving long-term efficiency and cost-effectiveness over the long run.

Segmentation Analysis

The global market is segmented based on material, application, end user, and geography.

By Material

Based on material, the market is categorized into stainless steel and low alloy steel. The low alloy steel segment captured the largest oilfield casing spools market share of 53.15% in 2023, largely attributed to its superior mechanical properties and cost-effectiveness.

Low alloy steels are renowned for their high strength, toughness, and resistance to wear and corrosion, making them ideal for use in harsh drilling environments. These steels typically contain small amounts of alloying elements such as chromium, molybdenum, and nickel, which enhance their performance under extreme conditions.

Additionally, low alloy steel casing spools are easier to manufacture and process, leading to lower production costs compared to high alloy steels or other advanced materials. The widespread availability and versatility of low alloy steels further contribute to their increased popularity, allowing manufacturers to meet the diverse requirements of various oilfield operations.

By Application

Based on application, the market is classified into onshore and offshore. The onshore segment is poised to record a staggering CAGR of 7.04% through the forecast period. Onshore oil and gas exploration and production activities are witnessing a resurgence, particularly in regions with abundant untapped reserves.

Technological advancements in drilling techniques, such as hydraulic fracturing and horizontal drilling, have significantly enhanced the feasibility and cost-effectiveness of onshore operations.

Additionally, onshore projects typically involve lower capital expenditure and operational risks compared to offshore ventures, making them more attractive to investors and operators, especially in a volatile oil price environment. The growing demand for energy and the pressing need to bolster domestic production in numerous countries support the expansion of onshore drilling activities.

Regulatory support and favorable government policies aimed at increasing onshore production play a crucial role in bolstering segmental growth.

By End User

Based on end user, the market is divided into oil & gas exploration companies, oilfield service providers, and others. The oil & gas exploration companies garnered the highest revenue of USD 13.8 million in 2023, mainly propelled by increased exploration activities and significant investments in advanced drilling technologies. The surge in global energy demand, coupled with the discovery of new oil and gas reserves, has led to a substantial rise in exploration projects.

These companies are at the forefront of utilizing cutting-edge technologies such as 3D seismic imaging, enhanced oil recovery techniques, and real-time data analytics to optimize exploration efficiency and success rates. Additionally, the strategic focus on expanding operations into untapped and emerging markets has opened new revenue streams.

Increased investments in innovative drilling equipment, including high-performance casing spools, have played a pivotal role in improving operational efficiency and safety, thereby fueling the expansion of the segment. Furthermore, a notable shift toward achieving energy independence in various regions has led governments to support and incentivize exploration activities, thereby boosting the growth of the segment.

Oilfield Casing Spools Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America oilfield casing spools market accounted for a considerable share of 36.68% and was valued at USD 10.9 million in 2023. This significant market share is mainly stimulated by the extensive shale gas exploration and production activities, particularly in the United States, which is home to vast shale reserves.

The technological advancements in hydraulic fracturing and horizontal drilling have propelled the region to the forefront of unconventional oil and gas extraction.

Additionally, North America's well-established infrastructure, favorable regulatory environment, and substantial investments in oilfield technologies have further solidified its leading position. Major oil companies and service providers in the region continue to drive demand for high-quality casing spools, thereby enhancing operational efficiency and safety in challenging drilling conditions.

Furthermore, the strategic focus on increasing domestic energy production to achieve energy independence has spurred continuous exploration and drilling activities, fostering regional market growth.

Asia-Pacific is poised to grow at a robust CAGR of 7.27% in the forthcoming years, propelled by several factors such as rising energy demand, increasing investments in oil and gas exploration, and significant economic growth in the region.

Countries such as China, India, and Indonesia are at the forefront of this growth, undertaking extensive efforts to develop their domestic oil and gas resources to meet their burgeoning energy needs.

The region's rapid industrialization and urbanization are key factors contributing to the surge in energy consumption, highlighting the need for enhanced exploration and production activities. Furthermore, supportive government policies and incentives aimed at boosting energy security are prompting both domestic and international companies to invest in Asia-Pacific's oil and gas sector.

The establishment of new oilfields and the expansion of existing ones are creating substantial opportunities for the deployment of advanced oilfield casing spools in the region. The widespread adoption of cutting-edge technologies and innovations in drilling and well-completion processes is expected to foster domestic market growth.

Competitive Landscape

The global oilfield casing spools market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Oilfield Casing Spools Market

- Shaanxi FYPE Rigid Machinery Co.,Ltd

- Baker Hughes Company

- Delta Corporation

- UZTEL S.A.

- Jiangsu HongFei Petroleum Machinery Manufacturing CO., LTD

- Worldwide Oilfield Machine (WOM)

- Jereh Group

- Sentry Wellhead Systems

- Parveen Industries Pvt. Ltd.

- CCSC Petroleum Equipment LTD CO

The global oilfield casing spools market is segmented as:

By Material

- Stainless Steel

- Low alloy steel

By Application

By End User

- Oil & Gas Exploration Companies

- Oilfield Service Providers

- Others

By Region

- North America

- Europe

- France

- U,K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America