Offshore Energy Storage Market Size

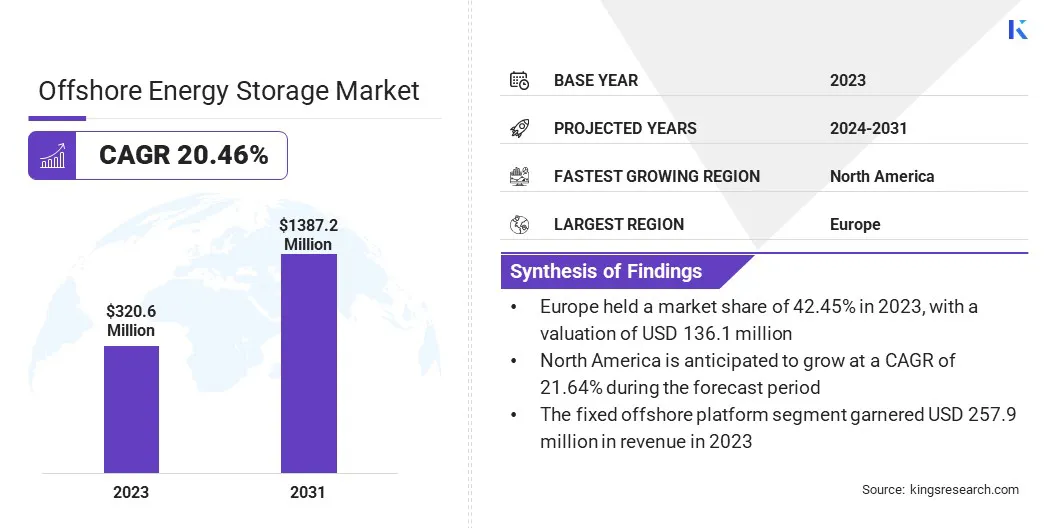

The global Offshore Energy Storage Market size was valued at USD 320.6 million in 2023 and is projected to grow from USD 376.9 million in 2024 to USD 1,387.2 million by 2031, exhibiting a CAGR of 20.46% during the forecast period. Several factors driving the growth of the market include the increasing adoption of renewable energy sources, technological advancements in storage systems, and regulatory support for carbon reduction initiatives.

In the scope of work, the report includes products and solutions offered by companies such as GE VERNOVA, Siemens Energy, ABB, Ørsted A/S, Corvus Energy, LG Chem, Ltd., Duke Energy Corporation., SolarEdge, Johnson Controls Inc., FLASC B.V. and others.

The market is growing due to the increasing demand for renewable energy sources, particularly wind and solar power. These energy sources are intermittent, requiring efficient storage solutions to ensure a stable supply. Technological advancements in battery storage systems, coupled with decreasing costs, further propel market growth.

Government policies and incentives that promote clean energy and carbon reduction support this growth. Additionally, the growing need for grid stability and energy security in remote offshore locations boosts the adoption of advanced storage solutions. Increased investment from major energy companies and collaboration between public and private sectors contribute significantly to market expansion.

- The Ministry of New and Renewable Energy (MNRE) under the Government of India approved the first phase of the National Bioenergy Programme with a budgetary allocation of USD 102.6 million. This program, notified by MNRE on November 2, 2022, extends the National Bioenergy Programme from FY 2021-22 to 2025-26.

The offshore energy storage market is experiencing robust growth, spurred by the rising adoption of renewable energy and the growing need for efficient energy management. This market encompasses various storage technologies, including batteries, compressed air energy storage, and flywheels, designed specifically to store energy generated from offshore wind and solar farms.

The focus is on enhancing grid stability, reducing carbon emissions, and ensuring a reliable energy supply. Europe holds a significant share of the market, characterized by key projects and investments, while North America shows promising potential due to increasing renewable energy initiatives.

The offshore energy storage refers to the deployment and utilization of energy storage systems located in offshore environments. These systems are designed to store energy generated from renewable sources, such as offshore wind and solar farms, and release it when as needed to maintain grid stability and ensure energy security.

These systems are essential for managing the intermittent nature of renewable energy and ensuring a continuous and reliable power supply. The market is characterized by innovation, regulatory support, and significant investments aimed at enhancing storage capabilities and reducing costs.

Analyst’s Review

The offshore energy storage market is witnessing significant advancements, with manufacturers focusing on developing more efficient and cost-effective storage solutions. There is an increasing investment in research and development to enhance battery technologies and explore innovative storage methods, such as solid-state and flow batteries.

New product launches are aimed at increasing storage capacity and improving energy management. Manufacturers are further forming strategic partnerships to foster innovation and deployment. Manufacturers are advised to continue to invest in R&D to overcome current technological limitations and further cost reductions.

Additionally, the public sector's interventions, which include supportive regulations and incentives, are boosting the adoption of offshore energy storage. Strengthening collaborations between public and private entities is anticipated to fuel market growth and ensure a sustainable energy future.

- Nissan has unveiled its pilot line for the production of all-solid-state batteries pilot line, under construction at the Yokohama Plant in Kanagawa Prefecture. The company is aiming to advance development and manufacturing technologies associated with these batteries. Under its Nissan Ambition 2030 vision, the company planned to launch EVs with all-solid-state batteries by fiscal year 2028. These batteries are designed to contain twice the energy density, shorter charging times, and lower costs compared to conventional lithium-ion batteries.

Offshore Energy Storage Market Growth Factors

The increasing integration of renewable energy sources into the energy grid has a significant impact on the market. Offshore wind and solar farms are growing rapidly and generating substantial amounts of energy. However, these sources are intermittent, creating a need for the implementation of efficient storage solutions.

Energy storage systems, such as advanced batteries and compressed air energy storage, are playing a crucial role in balancing supply and demand. By storing excess energy generated during peak production times and releasing it during low production periods, these systems contribute to maintaining grid stability and reliability. This integration is essential for achieving carbon reduction goals and enhancing energy security.

- In 2021, the U.S. administration set a target to achieve an offshore wind energy capacity of 30 gigawatts by 2030. The Wind Vision Report by the U.S. Department of Energy (DoE) anticipated the potential benefits of installing up to 22 gigawatts of offshore wind capacity by 2030 and 86 gigawatts by 2050. The report suggested that by 2050, offshore wind energy could be accessible nationwide, thereby promoting substantial growth and expanding both the domestic supply chain and workforce.

A key challenge impeding the development of the offshore energy storage market is the high cost associated with storage technologies. Advanced battery systems and other storage solutions require a significant upfront investment, which often acts as a barrier to widespread adoption. Overcoming this challenge involves continuous technological advancements and economies of scale. As technology advancements continue, production costs are decreasing, thereby making storage solutions more affordable.

Additionally, government incentives and subsidies are leading to increased investments in energy storage projects. Collaborative efforts between the public and private sectors are crucial for reducing costs. Investing in research and development, coupled with the implementation of supportive policies, plays a crucial role in significantly mitigating the financial barriers associated with energy storage technologies.

Offshore Energy Storage Market Trends

The increasing adoption of hybrid energy storage systems is resulting in companies combining multiple storage technologies, such as batteries and flywheels, to optimize performance and efficiency. This hybrid approach is enhancing the overall reliability and flexibility of energy storage solutions. By leveraging the strengths of different technologies, these systems provide better energy management and longer storage durations.

The integration of hybrid systems is particularly beneficial for offshore applications, where maintaining a continuous energy supply is crucial. This trend is further fueled by the growing need to improve energy efficiency and reduce costs, making offshore energy storage more viable and sustainable.

There is rising investment in research and development of offshore energy storage technologies. Governments and private companies are dedicating substantial resources to innovate and improve storage technologies. This investment is leading to advancements in battery chemistry, energy density, and storage capacity.

Emerging technologies, such as solid-state batteries and advanced flow batteries, are showing promising potential for offshore applications. There is a growing focus on increasing the lifespan and reducing the environmental impact of storage systems. Continuous R&D efforts are essential for overcoming existing limitations and ensuring the long-term success of offshore energy storage solutions. This trend is contributing to the market's growth and technological evolution.

Segmentation Analysis

The global market is segmented based on deployment mode, technology, end-use industry, and geography.

By Deployment Mode

Based on deployment mode, the market is categorized into fixed offshore platforms and floating platforms. The fixed offshore platform segment led the offshore energy storage market in 2023, reaching a valuation of USD 257.9 million. This expansion is attributable to its established infrastructure and reliability. These platforms offer stable and secure foundations, which is essential for energy storage systems in harsh offshore environments.

The technology for fixed platforms is mature, ensuring both efficient deployment and maintenance. Additionally, fixed platforms support large-scale storage solutions, making them ideal for substantial energy projects. Investments in upgrading existing infrastructure and integrating advanced storage technologies are further propelling the expansion of this segment, meeting the increasing demand for offshore energy storage.

By Technology

Based on technology, the market is classified into pumped hydro power, battery storage, thermal energy storage, and others. The pumped hydro power segment is poised to witness significant growth at a robust CAGR of 23.82% through the forecast period (2024-2031). This notable growth is augmented by its high efficiency and capacity for large-scale energy storage.

This segment is benefiting from advancements in hydroelectric technology and the increasing need for reliable, long-duration storage solutions. Pumped hydro power systems are ideal for balancing supply and demand, particularly in regions with abundant water resources. The scalability and long operational life of these systems render them attractive investment opportunities.

Favorable government support and environmental regulations that promote renewable energy storage are further contributing to the rapid expansion of the pumped hydro power segment.

By End-Use Industry

Based on end-use industry, the market is segmented into oil & gas, renewable energy providers, utilities, military & defense, and others. The utilities segment secured the largest offshore energy storage market share of 32.56% in 2023. Significant investments are being directed toward the offshore energy storage within the utility sector to enhance grid stability, integrate renewable energy sources, and improve energy security.

The pressing need to meet regulatory requirements for carbon reduction and renewable energy integration is leading to the widespread adoption of advanced storage solutions. Collaboration with technology providers and government incentives are further supporting this expansion. The sector's focus on modernizing the grid and ensuring a reliable energy supply is essential for sustaining the growing demand for offshore energy storage systems.

Offshore Energy Storage Market Regional Analysis

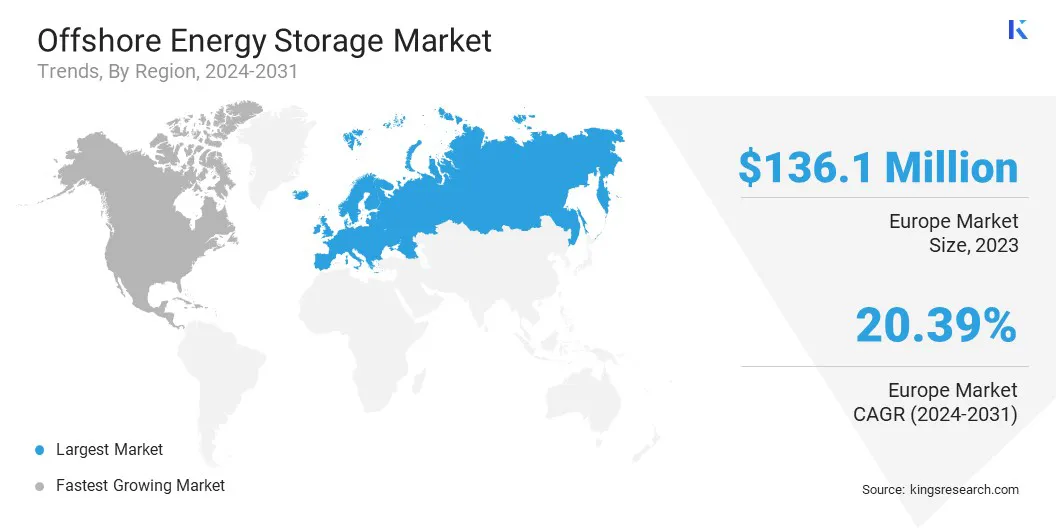

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Europe offshore energy storage market share stood around 42.45% in 2023 in the global market, with a valuation of USD 136.1 million. This dominance is attributed to the region's strong commitment to renewable energy and stringent environmental regulations. European countries are investing heavily in offshore wind farms and innovative energy storage solutions to meet ambitious carbon reduction targets.

The region's well-established infrastructure and supportive government policies are fostering the growth of the Europe market. Additionally, significant R&D activities and collaborations among key industry players are propelling technological advancements. Growing implementation of sustainable energy practices and proactive approach to addressing climate change in the region are crucial factors contributing to its market dominance.

North America is poised to experience significant growth at a CAGR of 21.64% through the projection period. This rapid growth is stimulated by increasing investments in renewable energy projects, particularly offshore wind farms. The United States and Canada are focusing on enhancing their energy infrastructure and grid stability through advanced storage technologies. Government incentives and regulatory support are promoting the adoption of clean energy solutions.

Furthermore, North America's strong innovation ecosystem and the presence of major technology companies are contributing to advancements in energy storage. The region's commitment to reducing greenhouse gas emissions and ensuring energy security is further propelling domestic market expansion.

Competitive Landscape

The global offshore energy storage market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Offshore Energy Storage Market

- GE VERNOVA

- Siemens Energy

- ABB

- Ørsted A/S

- Corvus Energy

- LG Chem, Ltd.

- Duke Energy Corporation.

- SolarEdge

- Johnson Controls Inc.

- FLASC B.V.

Key Industry Development

- March 2023 (Expansion): Duke Energy expanded its battery storage capabilities in North Carolina and completed its 11-MW project in Onslow County. The battery, featuring lithium iron phosphate chemistry and an 11-MW/11-MWh capacity on a one-acre footprint, was developed in partnership with Black & Veatch and OCI, who provided engineering and construction services.

The global offshore energy storage market is segmented as:

By Deployment Mode

- Fixed Offshore Platforms

- Floating Platforms

By Technology

- Pumped Hydro Power

- Battery Storage

- Thermal Energy Storage

- Others

By End-Use Industry

- Oil & Gas

- Renewable Energy Providers

- Utilities

- Military & Defense

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America