Market Definition

Nitric acid is a strong, highly corrosive mineral acid composed of hydrogen, nitrogen, and oxygen. It appears as a colorless or yellowish liquid that decomposes into nitrogen oxides when exposed to light. It is widely used in the production of fertilizers, explosives, dyes, and pharmaceuticals, as well as in metal refining and chemical synthesis.

Nitric Acid Market Overview

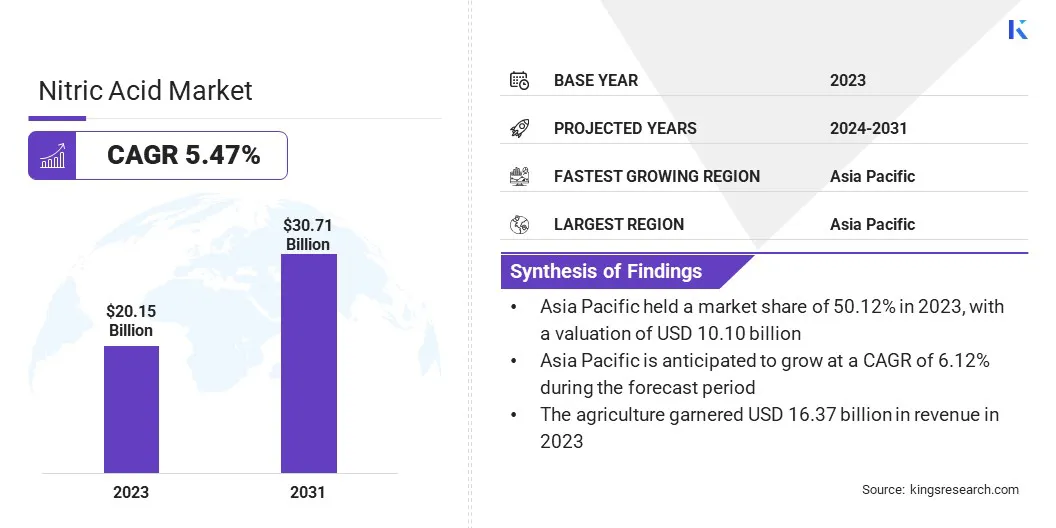

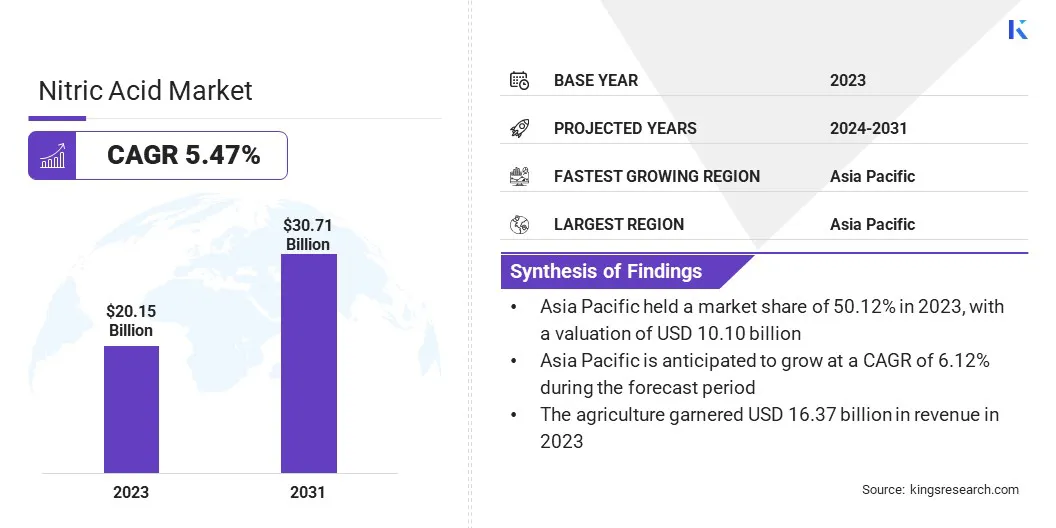

Global nitric acid market size was valued at USD 20.15 billion in 2023 and is projected to grow from USD 21.16 billion in 2024 to USD 30.71 billion by 2031, exhibiting a CAGR of 5.47% during the forecast period.

The market is experiencing steady growth, driven by its growing use across diverse industries such as fertilizers, explosives, chemicals, and metal processing. A significant portion of nitric acid is used in producing ammonium nitrate fertilizers, supporting the agricultural sector’s need for higher crop yields.

Major companies operating in the nitric acid market are BASF, Apache Nitrogen Products, Inc., CF Industries Holdings, Inc., Yara International ASA, LSB Industries, Sasol Limited, Deepak Fertilisers and Petrochemicals Corporation Ltd., Nutrien, EuroChem Group, Omnia Nutriology, Casale SA, Trammo, Inc., DuPont de Nemours, Inc., INEOS AG, and Hanwha Group.

Nitric acid is crucial in manufacturing explosives such as TNT and nitroglycerin for mining, construction, and defense applications. Furthermore, the chemical industry relies on nitric acid for producing adipic acid precursor to nylon, dyes, and pharmaceuticals.

- For instance, in April 2024, Tata Projects Limited (TPL) collaborated with Deepak Fertilizers and Petrochemicals Corporation Ltd. for the Nitric Acid Expansion Project in Gujarat. The project aims to enhance production capacity while ensuring energy efficiency and sustainability.

Key Highlights:

- The nitric acid industry size was recorded at USD 20.15 billion in 2023.

- The market is projected to grow at a CAGR of 5.47% from 2024 to 2031.

- Asia Pacific held a share of 50.12% in 2023, with a valuation of USD 10.10 billion, and is anticipated to grow at a CAGR of 6.12% over the forecast period.

- The powder segment garnered USD 13.70 billion in revenue in 2023.

- The fertilizers segment is expected to reach USD 25.01 billion by 2031.

- The agriculture segment is projected to generate USD 25.20 billion by 2031.

Market Driver

"Rising Need for Fertilizers and Advancements in N₂O Abatement Technologies"

The rising need for fertilizers is a significant factor influencing the nitric acid market, as it is essential for producing ammonium nitrate and other nitrogen-based fertilizers. With a growing global population and increasing food demand, agricultural productivity relies on nitrogen-rich fertilizers to enhance crop yields.

Additionally, the expansion of the chemical and explosives industries is boosting demand, given nitric acid’s crucial role in manufacturing explosives.

Furthermore, strict environmental regulations and the adoption of green technologies are shaping the market, with governments and industries investing heavily in low-emission production processes and N₂O abatement technologies to meet climate goals and reduce greenhouse gas emissions. The focus on sustainability and cleaner manufacturing is driving innovation in nitric acid production.

- For instance, in December 2024, Clariant announced the successful deployment of its EnviCat N2O-S catalyst at Sichuan Lutianhua's nitric acid plant to reduce N₂O emissions by an estimated 275 kilotons of CO₂eq annually. The initiative focuses on supporting industrial decarbonization efforts with advanced emission reduction technology, strengthening sustainability in nitric acid production.

Market Challenge

"Environmental Impact and Volatility in Raw Material Prices"

Nitric acid production generates significant emissions of nitrogen oxides (NOx) and nitrous oxide (N₂O), which are potent greenhouse gases contributing to air pollution and climate change.

NOx emissions can lead to the formation of smog and acid rain, while N₂O is a highly effective greenhouse gas. To mitigate this challenge, industries are increasingly adopting advanced emission control technologies such as catalytic reduction and EnviNOx systems.

Ammonia, a key raw material in the production of nitric acid, is subject to price fluctuations due to supply-demand imbalances, geopolitical tensions, and other factors. When ammonia prices rise, production costs also increase, leading to reduced profitability for producers.

Companies are addressing this barrier by exploring alternative feedstocks and improving energy efficiency to reduce dependency on fluctuating raw material markets. Additionally, regulations governing industrial emissions, waste management, and sustainability are becoming increasingly strict.

Compliance with these regulations demands continuous investment in cleaner processes, waste treatment systems, and operational changes. To navigate this, firms are leveraging innovative process optimizations and sustainable certifications to meet regulatory standards while maintaining operational efficiency.

Market Trend

"Growing Emphasis on Sustainability and Specialty Chemicals Expansion"

There is a growing focus on sustainable production methods, with companies increasingly adopting low-emission and energy-efficient technologies to reduce the environmental impact of nitric acid manufacturing.

Additionally, the expansion of specialty chemicals production is contributing significantly to the expansion of the nitric acid market, as it serves as a key ingredient in various chemical synthesis processes, including dyes, pigments, and explosives.

Another notable trend is the increasing use of nitric acid in biopharmaceuticals, where it plays a crucial role in equipment cleaning, pH regulation, and pharmaceutical synthesis, ensuring compliance with stringent industry standards and high-purity production requirements.

- For instance, in April 2024, Ligand Pharmaceuticals introduced Pelthos Therapeutics, a biopharmaceutical company. The initiative focuses on commercializing ZELSUVMI topical gel, the first FDA-approved at-home treatment for molluscum contagiosum, developed using Pelthos’ nitric oxide-based technology platform, NITRICIL.

Nitric Acid Market Report Snapshot

|

Segmentation

|

Details

|

|

By Form

|

Powder, Liquid

|

|

By Application

|

Fertilizers, Adipic Acid, Nitrobenzene, Toluene Di-isocyanate, Nitrochlorobenzene, Others

|

|

By End-Use Industry

|

Agriculture, Chemical Manufacturing, Mining, Pharmaceuticals, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Form (Powder and Liquid): The powder segment earned USD 13.70 billion in 2023, mainly due to its high stability, ease of storage, and widespread use in fertilizers and industrial applications.

- By Application (Fertilizers, Adipic Acid, Nitrobenzene, Toluene Di-isocyanate, Nitrochlorobenzene, and Others): The fertilizers segment held a share of 80.09% in 2023, largely attributed to the rising global demand for high-yield crops, increasing agricultural activities, and the extensive use of ammonium nitrate and urea-based fertilizers.

- By End-Use Industry (Agriculture, Chemical Manufacturing, Mining, Pharmaceuticals, and Others): The agriculture segment is projected to reach USD 25.20 billion by 2031, fueled by the growing global population, increasing food demand, and the widespread adoption of nitrogen-based fertilizers.

Nitric Acid Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific nitric acid market accounted for a notable share stood around 50.12% in 2023, valued at USD 10.10 billion. This dominance is primarily reinforced by high fertilizer consumption, rapid industrialization, and expanding chemical manufacturing activities in countries such as China, India, and Japan.

The increasing demand for ammonium nitrate-based fertilizers to support agricultural productivity, coupled with government initiatives promoting food security, is fueling regional market growth. Additionally, rising investments in chemical processing, explosives for mining and infrastructure projects, and expanding automotive and textile industries are boosting the demand for nitric acid across the region.

Europe nitric acid industry is poised to grow at a CAGR of 4.99% over the forecast period. The region is a key producer of adipic acid, nitrobenzene, and toluene di-isocyanate, which are essential raw materials for the automotive, textile, and construction industries.

The rising demand for explosives in mining and infrastructure projects is further contributing to this expansion. Additionally, the increasing demand for explosives in mining, construction, and defence sectors is fueling the use of nitric acid.

- In July 2024, Stamicarbon (MAIRE) partnered with FertigHy through a feasibility study and pre-FEED contract to provide NX Stami Green Ammonia and NX Stami Nitric Acid technologies for a low-carbon fertilizer plant in France. The initiative aims to enhance sustainable fertilizer production using renewable hydrogen, strengthening low-carbon solutions in agriculture.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) regulate nitric acid. The New Source Performance Standards (NSPS) for Nitric Acid Plants oversee nitrogen oxide (NOx) emissions from new, modified, or reconstructed Nitric Acid Production Units.

- In Europe, the European Chemicals Agency (ECHA) monitors the regulation od nitric acid under the REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) framework, ensuring its safe production and use within the European Union

- In China, the Ministry of Public Security (MPS) regulates nitric acid production and usage, listing it in Catalogue of Controlled Explosives Precursors, particularly at concentrations above 70%, due to its potential in explosives. Manufacturers and distributors are subject to strict regulations and monitoring by the MPS to prevent misuse.

- In Japan, the Ministry of Economy, Trade and Industry (METI) regulates the production, handling, and trade of chemicals under the Industrial Safety and Health Act (ISHA) and the Chemical Substances Control Law (CSCL) to ensure workplace safety and prevent environmental pollution.

- In India, the Ministry of Environment, Forests and Climate Change regulates the manufacturing, storage, and use of nitric acid under the Manufacture, Storage and Import of Hazardous Chemical Rules, which outlines specific regulations for handling hazardous chemicals such as nitric acid. The Bureau of Indian Standards (BIS) sets standards for nitric acid quality, with the "IS 264" code defining its specifications.

Competitive Landscape

The nitric acid industry is characterized by a large number of participants, including both established corporations and established players. Market participants are prioritizing capacity expansion, strategic partnerships, and technological advancements to strengthen their market position.

Innovation remains key, with manufacturers developing low-emission nitric acid production technologies and exploring alternative feedstocks to reduce environmental impact.

Fluctuations in raw material prices, particularly ammonia, drives pricing pressures, making cost optimization a key focus for market players. Additionally, companies are increasingly investing in R&D for process efficiency and safety improvements, while mergers and acquisitions are reshaping the competitive dynamics, allowing firms to gain technological expertise and expand their geographical footprint.

- In November 2024, UBE Corporation announced the expansion of its high-purity nitric acid production capacity at the UBE Chemical Factory to meet the increasing demand for semiconductor applications. The initiative focused on enhancing production by approximately 30% to support the growing semiconductor market.

List of Key Companies in Nitric Acid Market:

- BASF

- Apache Nitrogen Products, Inc.

- CF Industries Holdings, Inc.

- Yara International ASA

- LSB Industries

- Sasol Limited

- Deepak Fertilisers and Petrochemicals Corporation Ltd.

- Nutrien

- EuroChem Group

- Omnia Nutriology

- Casale SA

- Trammo, Inc.

- DuPont de Nemours, Inc.

- INEOS AG

- Hanwha Group

Recent Developments (Partnerships/Agreements/Expansion)

- In December 2024, Grupa Azoty Puławy announced the commissioning of the fifth nitric acid production line as part of a PLN 300 million modernization project. The initiative aims to enhance production efficiency, expand fertilizer output, and significantly reduce NOx and N₂O emissions, strengthening sustainable nitric acid manufacturing.

- In September 2024, Bilfinger secured a project management and consultancy contract from Egyptian Chemical Industries for a new chemical and fertilizer plant in Aswan, Egypt. The plant is expected to produce 600 tons of nitric acid per day, which will be converted into 800 tons of granulated ammonium nitrate for fertilizer use.

- In July 2024, thyssenkrupp Uhde and Genesis Fertilizers signed a Pre-FEED contract for the conceptual design of a reduced-emission fertilizer plant in Canada, incorporating nitric acid production. The initiative aims to minimize emissions using EnviNOx technology and renewable-based hydrogen.