Market Definition

Adipic acid is a white, transparent, fine particulate material. This organic compound is a significant synthetic dicarboxylic acid and a key component in nylon production.

It serves as a crucial raw material in the chemical industry for manufacturing polymers, coatings, plasticizers, and detergents. While predominantly derived from cyclohexane, a smaller portion is produced from phenol.

Adipic Acid Market Overview

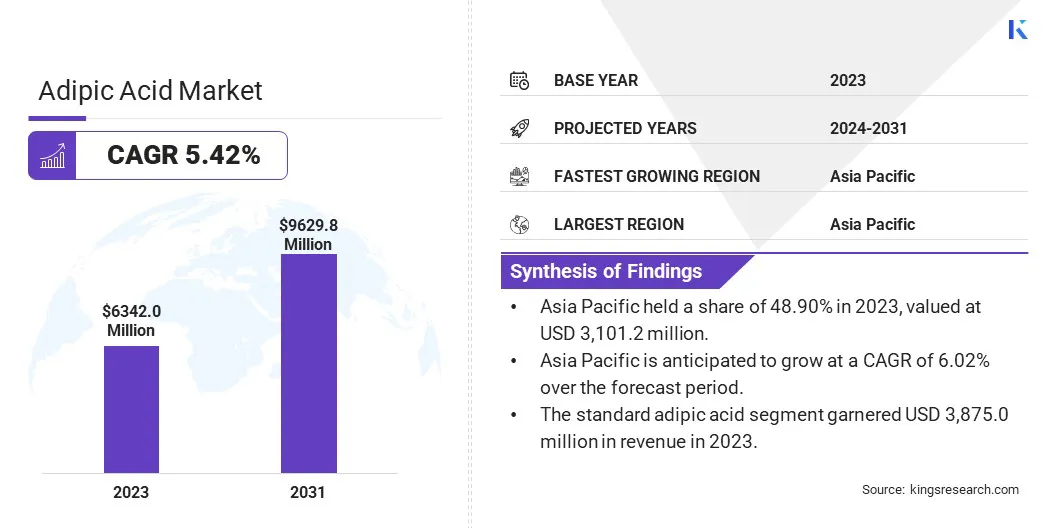

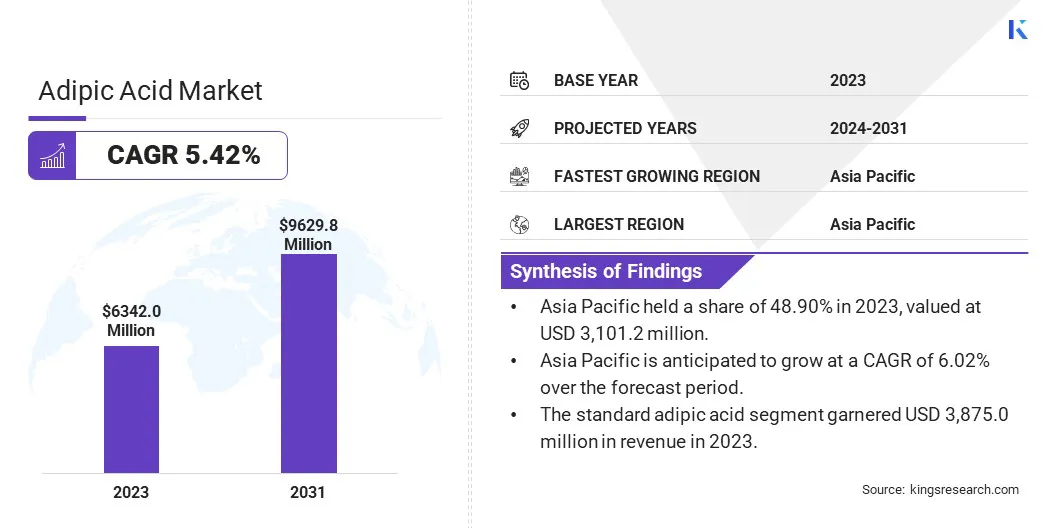

Global adipic acid market size was at USD 6,342.0 million in 2023, which is estimated to be valued at USD 6,656.4 million in 2024 and reach USD 9,629.8 million by 2031, growing at a CAGR of 5.42% from 2024 to 2031.

The market is witnessing notable growth, mainly due to rising automotive production and expanding construction industry. Increased demand for engineered plastics in automotive applications and the growing use of nylon 6,6 in insulation materials and carpets further propel market expansion.

Major companies operating in the global adipic acid market are Ascend Performance Materials, Asahi Kasei Corporation, BASF SE, Domo Chemicals, INVISTA, LANXESS, Radici Partecipazioni SpA, Solvay, UBE Corporation, Tokyo Chemical Industry Co., Ltd., Graham Chemical, Otto Chemie Pvt. Ltd., Tangshan Zhonghao Chemical Co. Ltd., Tian Li High & New Tech. Co., Ltd, and Sumitomo Chemical Co., Ltd.

Adipic acid is recognized for its ability to enhance durability, flexibility, and overall performance across a wide range of applications. It is widely used across diverse sectors such as automotive, textiles, packaging, and construction.

Increasing focus on sustainability, in response to growing environmental concerns, is prompting manufacturers to develop bio-based adipic acid production methods to minimize carbon emissions and reliance on fossil fuels. Advances in fermentation and bio-catalysis technologies are accelerating this transition.

- In November 2024, BASF's Monomers Division obtained ISCC PLUS certification for its Polyamide 6 (PA6) plant in Shanghai. This certification enables the facility to supply biomass-balanced and Ccycled PA6, along with PA6/6.6 copolymer, reinforcing BASF's commitment to sustainable and innovative solutions in the polymer industry.

Furthermore, the use of adipic acid in the production of lightweight materials for automotive applications supports global initiatives aimed at improving energy efficiency and reducing fuel consumption.

Key Highlights:

- The adipic acid industry size was recorded at USD 6,342.0 million in 2023.

- The market is projected to grow at a CAGR of 5.42% from 2024 to 2031.

- Asia Pacific held a share of 48.90% in 2023, valued at USD 3,101.2 million.

- The standard adipic acid segment garnered USD 3,875.0 million in revenue in 2023.

- The nylon 6,6 fiber segment is expected to reach USD 5,237.2 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 6.02% over the forecast period.

Market Driver

"Expansion of Packaging Industry"

The expansion of the packaging industry is fostering the growth of the adipic acid market, given its essential role in manufacturing high-performance materials such as nylon 6,6 and polyurethane.

The growing demand for durable, lightweight, and flexible packaging solutions in sectors such as food and beverage, pharmaceuticals, and consumer goods is highlighting the rising need for raw materials, including adipic acid. Its application in creating robust packaging materials that ensure product safety and longevity aligns with the evolving requirements of modern supply chains.

Furthermore, the increasing focus on sustainable and recyclable packaging is supporting market growth, positioning adipic acid as a critical component in the development of innovative and eco-friendly packaging solutions.

- India's paper and pulp industry attracted USD 1.73 billion in Foreign Direct Investment (FDI) from April 2000 to June 2024, reflecting strong investor confidence in the packaging sector.

Market Challenge

"Stringent Environmental Regulations"

Stringent environmental regulations pose a significant challenge to the growth of the adipic acid market due to the chemical's association with greenhouse gas emissions and environmental concerns during production. These regulations impose strict limits on emissions, waste management, and production practices, increasing compliance costs and hindering operational flexibility for manufacturers.

To mitigate this challenge, companies are adopting advanced production technologies, such as bio-based or low-emission manufacturing processes, to minimize environmental impact.

Additionally, they are integrating carbon capture and utilization (CCU) technologies into operations and aligning business strategies with sustainability objectives, further strengthening regulatory compliance and supports market leadership.

Market Trend

"Increasing Shift Toward Sustainable Production Methods and Bio-Based Alternatives"

The growing shift toward sustainable production methods and bio-based alternatives is leading to increased consumption of adipic acid. Manufacturers are emphasizing sustainability by developing eco-friendly and bio-based production processes, contributing significantly to the growth of the adipic acid market.

- For instance, in November 2024, Toray Industries, signed a memorandum of understanding (MOU) with PTT Global Chemical Public Company Limited (GC), a leading Thai petrochemicals producer, to jointly explore mass production technology for adipic acid derived from non-edible biomass.

Adipic acid, traditionally produced through a petrochemical process, is increasingly facing surging demand for cleaner, eco-friendly production methods due to environmental concern and the shift toward reduced carbon emissions led to a demand for cleaner and eco-friendly production techniques.

Bio-based adipic acid, sourced from renewable materials such as plant sugars, offers a viable alternative to traditional petroleum-derived adipic acid. This transition supports global sustainability objectives and meets the growing consumer demand for eco-friendly products.

Leading industry stakeholders are actively investing in research and development to enhance bio-based production processes, increase yield, and reduce production costs, ensuring the scalability and economic feasibility of sustainable adipic acid production.

Adipic Acid Market Report Snapshot

| Segmentation |

Details |

| By Type |

High Purity Adipic Acid, Standard Adipic Acid |

| By Application |

Nylon 6,6 Fiber, Nylon 6,6 Resin, Polyurethane, Adipate Esters, Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (High Purity Adipic Acid and Standard Adipic Acid): The standard adipic acid segment earned USD 3,875.0 million in 2023 due to its extensive use in nylon 6,6 production, polyurethane applications, and as a plasticizers in flexible PVC, which enhances the flexibility coatings, polymers, and fillers.

- By Application (Nylon 6,6 Fiber, Nylon 6,6 Resin, Polyurethane, Adipate Esters, and Others): The nylon 6,6 fiber segment held a substantial share of 56.24% 2023, as they are widely utilized in the aerospace and automotive industries owing to their durability and high strength-to-weight ratio. These fibers are also used in industrial applications such as nets, ropes, and conveyor belts.

Adipic Acid Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific adipic acid market accounted for a significant share of around 48.90% in 2023, valued at USD 3,101.2 million. This growth is primarily fueled by rapid industrialization in developing economies. Industrialization has significantly boosted manufacturing activities across multiple sectors, positioning the region as a global manufacturing hub.

Key factors include reduced production costs, a skilled labor force, and favorable government policies that support industrial growth. Governments in region are offering incentives to promote the adoption of green technologies and industrial biotechnology, further aiding regional market expansion

This robust manufacturing capability is expected to drive the demand for key raw materials used in the production of nylon 6,6 and engineering plastics. Additionally, the growing textile and apparel industries in India, China, Bangladesh, and Vietnam further boosted the demand for nylon fibers, accelerating product consumption.

Europe adipic acid market is anticipated to grow at the fastest growth CAGR of 5.63% through the projection period. The expanding automotive industry, coupled with a strong emphasis on sustainability, is fostering this growth. Key industry players are utilizing advanced technologies to enhance production processes.

Moreover, advancements in green technologies, along with the growth of the packaging sector focusing on recyclable materials, are supporting this trend. Ongoing investments in research and development (R&D) for bio-based adipic acid are further shaping the regional market landscape.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The U.S. EPA regulates greenhouse gas (GHG) emissions from major stationary sources under the Clean Air Act (CAA). 17) through the “Tailoring Rule.” This rule mandate that all existing stationary sources emitting more than 100,000 tons (approximately 90,719 metric tons, “t”) of CO2e annually obtain Title V operating permits for GHG emissions.

- Regulation (EC) No. 1907/2006 (REACH) governs the Registration, Evaluation, Authorisation, and Restriction of Chemicals, establishing the European Chemicals Agency. It amends Directive 1999/45/EC and repeals multiple prior regulations. Additionally, Regulation (EC) No. 1272/2008 and Commission Regulation (EU) 2020/878 amend REACH, with the latter updating Annex II on chemical registration and compliance.

- In China, the National Health Commission of the People's Republic of China (NHC) regulates the use of adipic acid in food contact materials. NHC notice No. 5 of 2022 approves the use of one food contact additive with expanded scope, two new food contact resins, and one resin with extended scope.

Competitive Landscape:

The adipic acid market is characterized by a number of participants, including both established corporations and rising organisations. Companies in the market investing in research and development to expand their production capacity.

To gain a competitive edge in this evolving industry, companies are implementing various strategic initiatives. Major strategies include new product launches, collaborations and alliances, corporate expansions, and mergers and acquisitions.

Several key market players are adopting bio-based process technologies to enhance the sustainability and performance of extensively used chemicals derived from alternative feedstocks. They are further investing in eco-friendly and sustainable production methods to cater the rising demand.

- In March 2023, BASF SE achieved ISCC+ certification for its Onsan and Yeosu facilities in Korea. The Onsan site received certification for the production of adipic acid and polyamide 6.6, while the Yeosu site was certified for the production of methylene diphenyl diisocyanate (MDI) and toluene diisocyanate (TDI). This certification underscores BASF's commitment to sustainable chemical manufacturing practices .

List of Key Companies in Adipic Acid Market:

- Ascend Performance Materials

- Asahi Kasei Corporation

- BASF SE

- Domo Chemicals

- INVISTA

- LANXESS

- Radici Partecipazioni SpA

- Solvay

- UBE Corporation

- Tokyo Chemical Industry Co., Ltd.

- Graham Chemical

- Otto Chemie Pvt. Ltd.

- Tangshan Zhonghao Chemical Co. Ltd.

- Tian Li High & New Tech. Co., Ltd

- Sumitomo Chemical Co., Ltd.

Recent Developments (Expansion/Investment)

- In December 2023, Ascend Performance Materials launched a new thermal reduction unit at its Pensacola, Florida facility. This initiative is aimed at reducing approximately 98% of greenhouse gas emissions from adipic acid production at the site. The development aligns with the company’s 2030 Vision initiative, which emphasizes sustainable chemical production practices.

- In April 2023, LANXESS announced plans to invest in innovative adipic acid production technologies to enhance sustainability and improve production efficiency.