Navigation Lighting Market Size

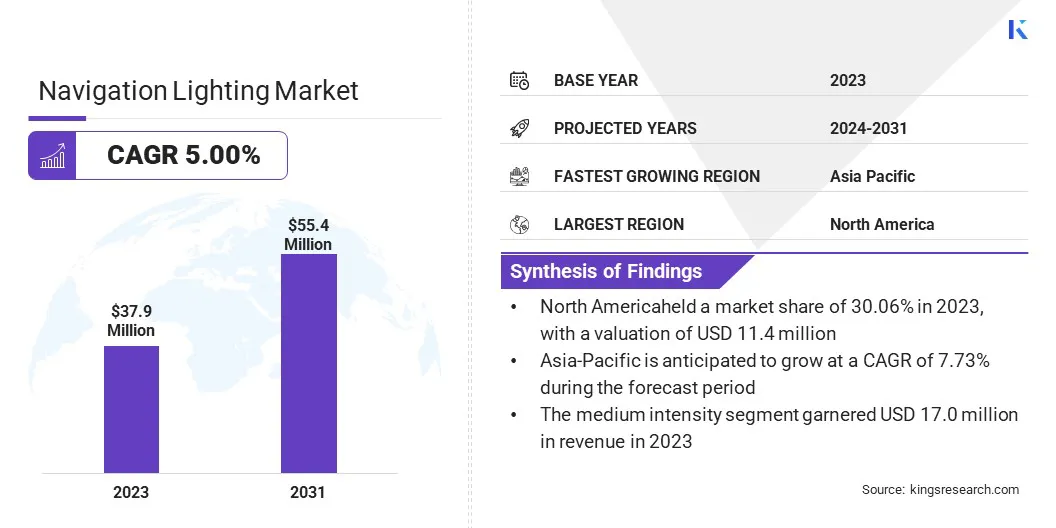

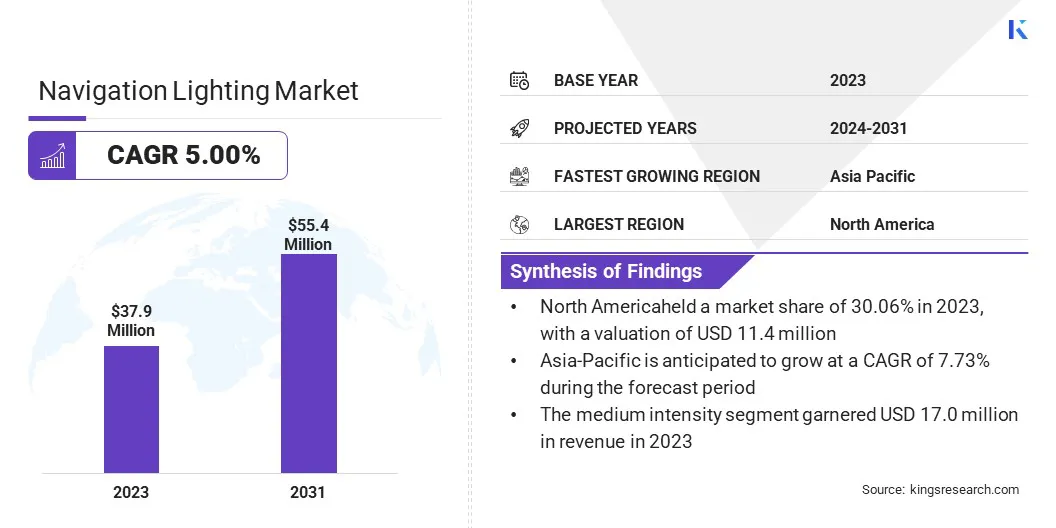

The global Navigation Lighting Market size was valued at USD 37.9 million in 2023 and is projected to grow from USD 39.4 million in 2024 to USD 55.4 million by 2031, exhibiting a CAGR of 5.00% during the forecast period.

The growth of the market is driven by increased maritime and aviation activities, regulatory requirements for safety, ongoing technological advancements in lighting, and the growing demand for energy-efficient solutions.

In the scope of work, the report includes solutions offered by companies such as Aveo Engineering Group, s.r.o., Aviolights, Den Haan Rotterdam, Glamox, Hella Marine, Oxley Group, Perko Inc., Phoenix Products LLC, Sealite, R. STAHL TRANBERG AS, and others.

The expansion of the navigation lighting market is propelled by increasing maritime and aviation activities globally. The expansion of the global shipping industry, mainly due to rising international trade, necessitates the implementation of enhanced safety measures, including advanced lighting systems.

Regulatory requirements from organizations such as the International Maritime Organization (IMO) and the Federal Aviation Administration (FAA), mandate the use of specific navigation lighting, thereby propelling market growth.

- For instance, in September 2023, Perko announced the launch of new vertical and horizontal mount Stern Lights its range of C5 compliant navigation lights. These 2 nautical mile lights were designed to replace older models and comply with updated visibility standards and European regulations. Featuring classic styling and advanced LED modules, these lights are suited for both power and sail boats under 20 meters,. They are equipped with stainless steel covers and black polymer bases. The new products have received positive feedback from OEM engineers, distributors, and end users.

Additionally, technological advancements, such as LED lighting, offer energy efficiency and durability, leading to their widespread adoption. Furthermore, growing investments in infrastructure, particularly in developing regions, contribute significantly to market expansion the ongoing development of additional ports and airports.

The market is experiencing steady growth, characterized by increasing demand across maritime and aviation sectors. This market encompasses a variety of lighting systems designed for vessels, aircraft, and related infrastructure. The market includes products such as LED, incandescent, and halogen lighting.

The market is witnessing increased competition among key players, thereby fostering innovation and price competitiveness. Regulatory compliance and technological advancements remain pivotal in shaping market dynamics.

The market refers to the industry involved in the production, distribution, and maintenance of lighting systems used for navigation purposes in maritime and aviation sectors. These systems are essential for ensuring safety and compliance with international regulations.

Navigation lighting includes various types of lights, such as running lights, anchor lights, and obstruction lights, each serving specific functions to prevent collisions and ensure visibility. The market covers both hardware (lighting systems) and software (control systems) components.

Analyst’s Review

Manufacturers in the navigation lighting market are increasingly focusing on innovation and sustainability, with key efforts directed toward developing energy-efficient LED systems and smart lighting solutions.

New products, such as solar-powered navigation lights and integrated control systems, are gaining immense traction as they offer enhanced reliability and reduced operational costs. Moreover, the rising emphasis on compliance with international safety standards is driving advancements in product quality and performance.

- In 2023, the International Association of Marine Aids to Navigation and Lighthouse Authorities (IALA) set specific installation requirements for solar-powered navigation lights on boats. These guidelines included proper light positioning for maximum visibility, using high-quality and certified equipment, and regular maintenance. IALA's standards were designed to ensure reliable performance of the lights and adhered to standardized signaling patterns.

Manufacturers are recommended to continue investing in R&D to maintain a competitive edge, particularly in emerging markets. Additionally, forming strategic partnerships and expanding after-sales services are projected to improve customer satisfaction and increase market penetration, thereby ensuring long-term growth in this evolving industry.

What are the major factors affecting the market growth?

The increasing adoption of LED technology is propelling the growth of the market since LED lights offer significant advantages over traditional lighting solutions, including lower energy consumption, longer lifespan, and enhanced durability.

These benefits are particularly appealing in maritime and aviation sectors, where reliability and efficiency are crucial. As environmental concerns and regulations are becoming more stringent, the shift toward energy-efficient solutions is gaining momentum.

Moreover, the declining costs of LED technology are making it more accessible, promoting wider adoption across various applications, including commercial vessels and aircraft. This trend is steadily reshaping the market landscape, positioning LED lighting as the preferred choice.

A significant challenge hampering the development of the navigation lighting market is the high initial investment required for advanced lighting systems, particularly LED solutions. While the long-term benefits of energy savings and reduced maintenance are evident, the upfront costs are often prohibitive for smaller operators and developing regions.

This challenge is being addressed through government incentives and subsidies aimed at promoting energy-efficient technologies.

Additionally, manufacturers are developing more cost-effective LED solutions to reduce the financial burden on end-users. Emerging leasing models and financing options are allowing operators to upgrade their systems without substantial upfront costs, thus facilitating broader market penetration.

What are the major trends in this market?

The increasing integration of smart lighting systems is a key trend reshaping the landscape of the market. These systems incorporate advanced sensors and automation features, allowing for real-time monitoring and control. In maritime and aviation sectors, smart lighting systems are enhancing safety by automatically adjusting to changing environmental conditions, such as fog or darkness.

Additionally, these systems improve energy efficiency by dimming or switching off lights when they are not needed. The growing emphasis on digitalization and the Internet of Things (IoT) is supporting this trend, as operators increasingly seek to leverage data for improved operational efficiency and safety compliance.

Another significant trend influencing the navigation lighting market is the growing focus on sustainability. As environmental regulations are becoming more stringent, there is an increased demand for eco-friendly lighting solutions. Manufacturers are responding to this surging demand by developing lighting systems that are energy-efficient, made from recyclable materials, and compliant with environmental standards.

The notable shift toward LED technology is further fueling this trend, given its lower energy consumption and longer lifespan compared to traditional lighting. Additionally, there is an increasing use of solar-powered navigation lights, particularly in remote and off-grid locations, which contributes to reducing the carbon footprint of maritime and aviation operations.

Segmentation Analysis

The global market is segmented based on type, end user, and geography.

How big is the medium intensity segment in the market?

Based on type, the market is categorized into low intensity, medium intensity, and high intensity. The medium intensity segment led the navigation lighting market in 2023, reaching a valuation of USD 17.0 million. This notable growth is largely stimulated by its versatility and broad applicability across various sectors.

Medium intensity lights are increasingly preferred in both maritime and aviation sectors as they provide an optimal balance between visibility and energy efficiency. They are particularly suitable for a wide range of applications, including navigation and signaling, without the excessive power consumption associated with high-intensity lights.

Moreover, regulatory standards often mandate medium intensity lighting for many critical applications, thereby increasing demand. The growth of the segment is further supported by technological advancements aimed at enhancing the performance and durability of these lights.

How fast will the aerospace segment grow in this market?

Based on end user, the navigation lighting market is classified into marine and aerospace. The aerospace segment is poised to witness significant growth at a CAGR of 5.93% through the forecast period (2024-2031). This growth is propelled by the rise in air travel and the expansion of global aviation infrastructure.

As new airports are being developed and existing ones are upgraded, there is a growing demand for advanced navigation lighting systems to ensure safety and compliance with stringent aviation regulations. The aerospace sector is increasingly adopting technological innovations, such as smart lighting and energy-efficient LEDs, to enhance operational efficiency.

Furthermore, rising investments in aerospace, particularly in emerging markets, are fueling the demand for state-of-the-art navigation lighting solutions, thereby contributing to the expansion of the segment.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

North America navigation lighting market captured a substantial share of around 30.06% in 2023, with a valuation of USD 11.4 million. This dominance is attributed to the region's well-established maritime and aviation industries, supported by robust infrastructure and stringent regulatory standards.

The presence of key market players and the early adoption of advanced technologies, such as LED lighting and smart systems, are further contributing to the growth of the regional market.

Additionally, stringent safety regulations enforced by authorities such as the Federal Aviation Administration (FAA) and the U.S. Coast Guard are driving continuous demand for upgraded navigation lighting systems, solidifying North America's prominent position in the global market.

Asia-Pacific is poised to experience significant growth at a CAGR of 7.73% over the forecast period. This rapid expansion is bolstered by the region's burgeoning maritime and aviation sectors due to increasing trade activities and rising air travel demand.

The region's emerging economies, particularly China and India, are investing heavily in infrastructure development, including new airports and seaports, which is creating demand for advanced navigation lighting systems.

Additionally, the region's focus on modernizing existing infrastructure and adopting energy-efficient technologies is contributing to this growth. Government initiatives that promote industrialization and international trade are playing a crucial role in this remarkable growth.

Competitive Landscape

The global navigation lighting market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

Key Companies in Navigation Lighting Market

- Aveo Engineering Group, s.r.o.

- Aviolights

- Den Haan Rotterdam

- Glamox

- Hella Marine

- Oxley Group

- Perko Inc.

- Phoenix Products LLC

- Sealite

- STAHL TRANBERG AS

Key Industry Developments

- April 2024 (Partnership): Perko, a marine lighting and hardware manufacturer, and DuraBrite, a technology company specializing in high-reliability lighting solutions, announced a collaboration to advance LED technology for commercial and recreational boats. This partnership aimed to improve marine lighting standards by integrating DuraBrite's energy efficient, advanced thermal management, and optical control technologies into new and upgraded Perko products. The collaboration aims to deliver enhanced lighting solutions for various marine applications.

- May 2023 (Launch): Apelo A3 Underwater Light was introduced, featuring advanced capabilities such as a high-intensity 6000-lumen output and RGBW functionality. The model included dedicated white LEDs for enhanced brightness and a “Fish mode” with a strobe function. Designed for larger boats, the Apelo A3's marine-grade bronze housing and precision optical distribution system made it ideal for submerged installations, offering both superior performance and durability.

The global navigation lighting market is segmented as:

By Type

- Low Intensity

- Medium Intensity

- High Intensity

By End User

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America