Market Definition

Natural fiber composites (NFCs) are materials combining a polymer matrix with natural fibers such as jute, flax, hemp, sisal, coir, or bamboo. They offer the strength and stiffness of natural fibers alongside the durability and processability of polymers. The NFCs market encompasses the production, processing, and application of these composites across industries such as automotive, construction, consumer goods, and aerospace.

Natural Fiber Composites Market Overview

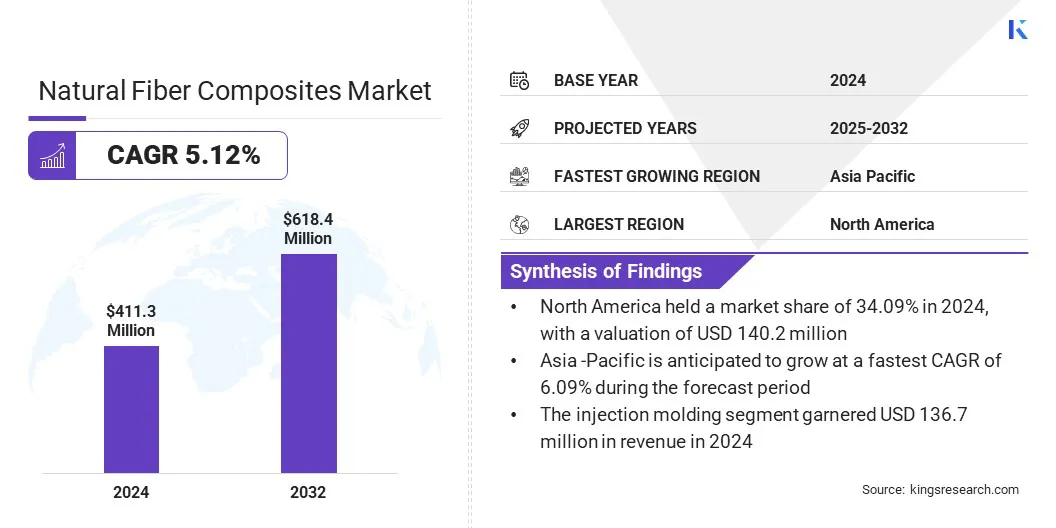

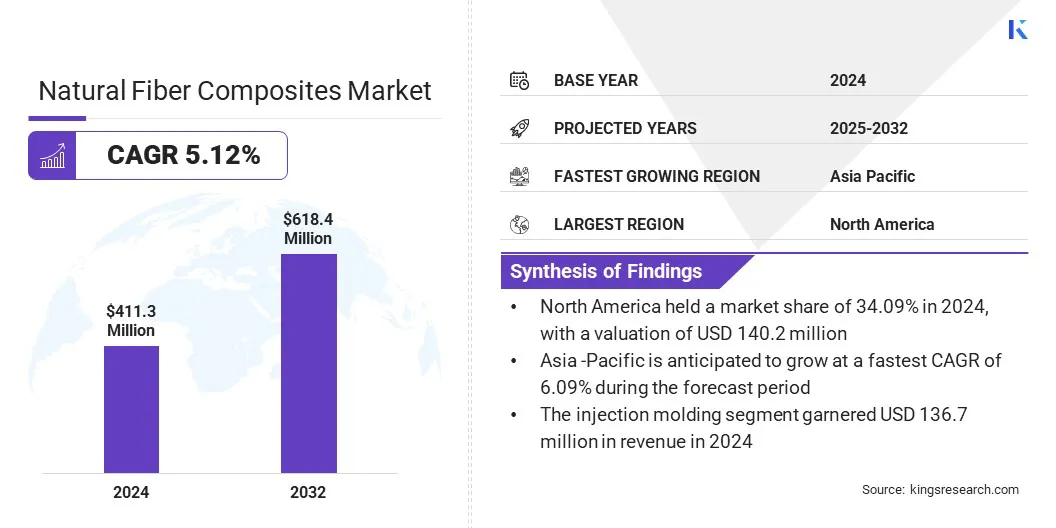

The global natural fiber composites market size was valued at USD 411.3 million in 2024 and is projected to grow from USD 430.5 million in 2025 to USD 618.4 million by 2032, exhibiting a CAGR of 5.12% over the forecast period.

This growth is driven by the growing emphasis on sustainable and biodegradable materials, fueled by stricter environmental regulations and increased consumer demand for eco-friendly products. Additionally, the expansion of the construction and packaging sectors is fueling the adoption of natural fiber composites across industrial and commercial applications.

Key Highlights:

- The natural fiber composites industry size was recorded at USD 411.3 million in 2024.

- The market is projected to grow at a CAGR of 5.12% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 140.2 million.

- The wood segment garnered USD 107.9 million in revenue in 2024.

- The injection molding segment is expected to reach USD 203.6 million by 2032.

- The construction segment is anticipated to witness the fastest CAGR of 5.64% over the forecast period.

- Asia Pacific is estimated to grow at a CAGR of 6.09% through the projection period.

Major companies operating in the natural fiber composites market are Bcomp Ltd, Tecnaro GmbH, UPM-Kymmene Oyj, FlexForm Technologies, Green Dot Bioplastics Inc, Polyvlies Franz Beyer GmbH, Procotex Corporation nv, NPSP BV, Lingrove, Inc, JELU-WERK J. Ehrler GmbH & Co. KG, GODAVARI BIOREFINERIES LTD, Plasthill Oy, Weifang Yunding Holding Group Co., Ltd, BUSS AG, and Procotex.

Rising light vehicle production is boosting demand for lightweight and sustainable materials in the automotive sector. Automakers are increasingly adopting natural fiber composites to reduce vehicle weight, improve fuel efficiency, and meet stricter environmental regulations. This shift toward eco-friendly materials is accelerating the adoption of bio-based composites, fostering market expansion.

- In April 2025, the American Composites Manufacturers Association reported that U.S. light vehicle sales reached 1,463,379 units, up 11.1% from 1,317,480 units in April 2024.

Market Driver

Rising Consumer Preference for Eco-Friendly Products

A key factor propelling the growth of the natural fiber composites market is the rising consumer preference for eco-friendly products that reduce environmental impact and dependence on non-renewable materials.

Consumers are increasingly favoring products that incorporate bio-based fibers such as flax, jute, hemp, and kenaf, valued for their strength, lightweight properties, and recyclability. This shift is driving industries including automotive, construction, and packaging to adopt natural fiber composites. The growing awareness of carbon footprint reduction is further creating demand for sustainable materials that support regulatory compliance and corporate sustainability goals.

- In February 2025, Bcomp collaborated with SFG Composites to scale the use of flax fibre composites for the automotive industry. This partnership aims to provide automakers with high-performance, lightweight, and sustainable materials, reducing CO₂ emissions and supporting eco-friendly vehicle production.

Market Challenge

Inconsistent Quality and Variability of Natural Fibers

A key challenge impeding the growth of the natural fiber composites market is the inconsistent quality and variability of natural fibers. Their properties are highly dependent on environmental factors such as soil conditions, climate, and cultivation practices, resulting in fluctuations in strength, moisture absorption, and fiber length. These inconsistencies make it difficult for manufacturers to achieve uniform performance in the large-scale production of composite components.

To address this challenge, market players are increasingly investing in advanced fiber treatment and surface modification techniques to improve strength, durability, and moisture resistance.

They are also collaborating with agricultural partners to establish standardized cultivation practices and ensure a more uniform raw material supply. Additionally, integrating hybrid composites with synthetic reinforcements is improving performance consistency while maintaining sustainability benefits.

Market Trend

Expansion of NFC in Electric Vehicles

A key trend influencing the natural fiber composites market is their expanding use in electric vehicles. Automakers are integrating NFCs into interiors, body panels, and structural components to reduce weight, improve energy efficiency, and lower carbon emissions. This integration is enhancing vehicle range, supporting compliance with environmental regulations, and driving broader adoption of bio-based composites across the automotive sector.

- In April 2024, Kia Europe collaborated with Bcomp to integrate ampliTex flax fibre composites into the interiors of Concept EV3 and EV4 vehicles. This partnership enables sustainable, lightweight interiors using natural fiber composites, reducing CO₂ emissions by up to 85%

Natural Fiber Composites Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Wood, Hemp, Flax, Jute, Others

|

|

By Process

|

Injection Molding, Compression Molding, Pultrusion, Others

|

|

By End Use

|

Automotive, Construction, Consumer Goods, Aerospace, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Wood, Hemp, Flax, Jute, and Others): The wood segment earned USD 107.9 million in 2024, mainly driven by its high strength-to-weight ratio and widespread use in construction and automotive applications.

- By Process (Injection Molding, Compression Molding, Pultrusion, and Others): The injection molding segment held a share of 33.24% in 2024, owing to its efficiency, scalability, and ability to produce complex shapes with consistent quality.

- By End Use (Automotive, Construction, Consumer Goods, Aerospace, and Others): The automotive segment is projected to reach USD 173.8 million by 2032, supported by growing adoption of lightweight, sustainable materials in vehicles to improve fuel efficiency and reduce emissions.

Natural Fiber Composites Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America natural fiber composites market share stood at 34.09% in 2024, valued at USD 140.2 million. This dominance is reinforced by the increasing demand for lightweight materials in the automotive and transportation sectors across the region.

Stringent environmental regulations, including the U.S. Corporate Average Fuel Economy (CAFE) standards and California's Low-Emission Vehicle (LEV) regulations, are compelling manufacturers to adopt sustainable materials to meet fuel efficiency and emission targets. Rising consumer awareness and preference for eco-friendly products are prompting industries to replace conventional plastics with bio-based alternatives.

Technological advancements by regional players in fiber treatment and composite processing are enhancing material performance and consistency of natural fiber composite components. Additionally, the growth of electric and alternative energy vehicles is creating a strong demand for sustainable, high-performance components that reduce vehicle weight, thus aiding regional market expansion.

- In July 2024, NASCAR launched a battery-electric vehicle (BEV) prototype at Chicago, Illinois, featuring flax-based composite bodywork developed by Bcomp. The vehicle incorporates ampliTex fabrics and powerRibs to provide lightweight, sustainable body structures.

The Asia-Pacific natural fiber composites industry is set to grow at a robust CAGR of 6.09% over the forecast period. This growth is propelled by the increasing automotive production and rapid urbanization, generating demand for lightweight and sustainable materials.

Government initiatives, including China’s green building codes and India’s sustainable manufacturing incentives, are fostering the adoption of natural fiber composites in the automotive and construction sectors. The region’s abundant natural fibers, including jute, hemp, and coir, provide cost-effective raw materials. Additionally, rising investments by local manufacturers in advanced fiber processing are enhancing material quality and expanding industrial applications.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates environmental compliance for natural fiber composites. It oversees emissions, chemical usage, waste management, and lifecycle impacts, including recyclability and end-of-life disposal. The EPA ensures manufacturers follow federal environmental laws and promotes sustainable production practices.

- In the UK, the British Standards Institution (BSI) governs product standards, quality, and environmental compliance for natural fiber composites. It oversees testing, certification, emissions, recyclability, and material safety. It ensures manufacturers adopt responsible production practices and promote the use of sustainable bio-based composites across automotive, construction, and industrial applications.

- In China, the Ministry of Ecology and Environment (MEE) oversees environmental protection for industrial materials, including natural fiber composites. It monitors pollutant emissions, chemical safety, waste disposal, and enforces resource efficiency standards.

- In India, the Bureau of Indian Standards (BIS) sets quality, safety, and sustainability standards for natural fiber composites. It oversees chemical safety, structural integrity, and durability compliance.

Competitive Landscape

Major players operating in the natural fiber composites industry are expanding production capabilities to meet growing demand for lightweight and sustainable materials.

They are focusing on strategic partnerships to scale the manufacturing of natural fiber composite components for automotive and specialty vehicles to enable efficient integration of eco-friendly materials. Additionally, players are investing in advanced fiber processing and surface treatment techniques to improve the strength, durability, and consistency of composite panels.

- In June 2025, Greenlander partnered with Boxmanufaktur to scale production of the Sherpa camper using natural fiber composite panels. This partnership enables lightweight, sustainable bodyshells for customized vehicles.

Top Key Companies in Natural Fiber Composites Market:

- Bcomp Ltd

- Tecnaro GmbH

- UPM-Kymmene Oyj

- FlexForm Technologies

- Green Dot Bioplastics Inc

- Polyvlies Franz Beyer GmbH

- Procotex Corporation nv

- NPSP BV

- Lingrove, Inc

- JELU-WERK J. Ehrler GmbH & Co. KG

- GODAVARI BIOREFINERIES LTD

- Plasthill Oy

- Weifang Yunding Holding Group Co., Ltd

- BUSS AG

- Procotex

Recent Developments

- In June 2025, BMW Group integrated Bcomp’s natural fiber composites into exterior and interior components of future series vehicles, including the BMW M3. This integration reduces CO₂ emissions during production by up to 40% and promotes sustainability through flax-based materials.