Market Definition

The market refers to the global industry involved in the design, manufacturing, and integration of sensors that detect physical movement in a defined space. The report outlines the major driving factors, along with the competitive landscape shaping the growth trajectory over the forecast period.

Motion Sensor Market Overview

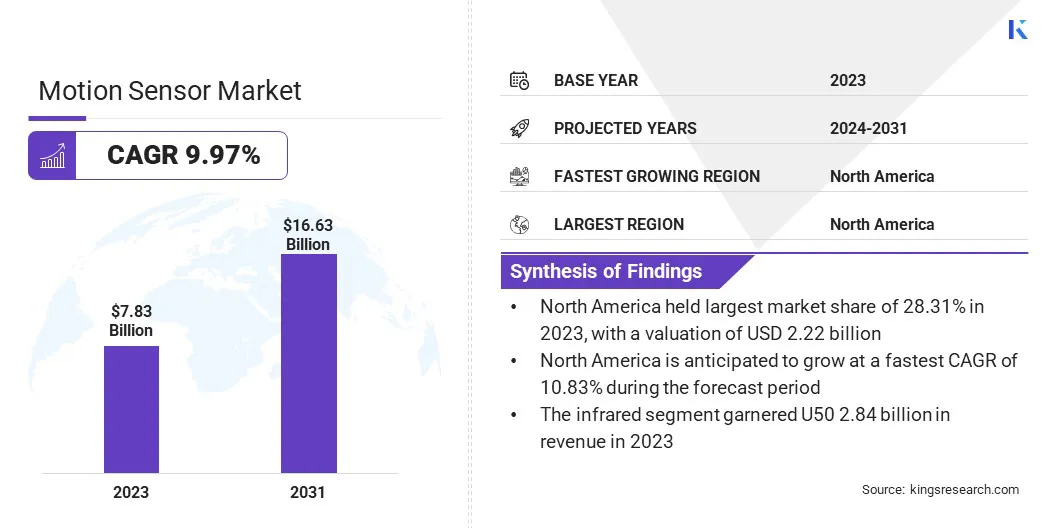

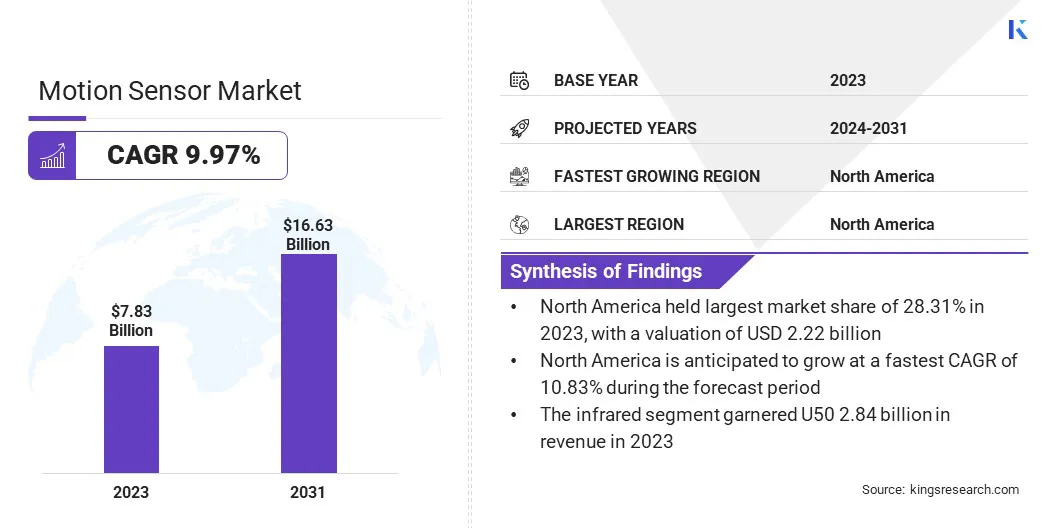

Global motion sensor market size was valued at USD 7.83 billion in 2023, which is estimated to be valued at USD 8.55 billion in 2024 and reach USD 16.63 billion by 2031, growing at a CAGR of 9.97% from 2024 to 2031.

The rise of IoT is driving motion sensor integration into connected devices such as smart homes and wearables. This growth is fueling the demand for sensors that enable automation, security, and energy management applications.

Major companies operating in the global motion sensor industry are STMicroelectronics, Murata Manufacturing Co., Ltd., Honeywell International Inc., Analog Devices, Inc., Microchip Technology Inc. , InvenSense, Robert Bosch GmbH, MEMSIC Semiconductor Co., Ltd., TE Connectivity , ifm electronic gmbh, Movella Inc. , Seiko Epson Corporation, Panasonic Corporation, Sensinova, KEMET Corporation., and others.

The smart home market is experiencing significant growth, propelled by increasing consumer demand for home automation systems that incorporate motion sensors for enhanced lighting, security, and energy efficiency. Motion sensors enable smart homes to automatically adjust lighting, heating, and cooling systems based on occupancy, reducing energy consumption.

Additionally, motion detection is essential in security systems, activating alarms and surveillance cameras upon detecting unauthorized movement. This growing demand for connected, intelligent solutions is fueling market expansion.

- In April 2024, Aqara launched the Motion and Light Sensor P2, integrating ultra-wide PIR motion detection with Matter and Thread connectivity. Compatible with platforms like Amazon Alexa, Apple Home, and Google Home, it offers energy-efficient automation, a 7-meter detection range, and two years of battery life.

Key Highlights:

- The global motion sensor industry size was recorded at USD 8.55 billion in 2023.

- The market is projected to grow at a CAGR of 9.97% from 2024 to 2031.

- North America held a share of 28.31% in 2023, valued at USD 2.22 billion.

- The infrared segment garnered USD 2.84 billion in revenue in 2023.

- The consumer electronics segment is expected to reach USD 5.78 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 10.83% over the forecast period.

Market Driver

Surging Adoption of Smart Devices and IoT

The growing adoption of smart devices and the growth of the Internet of Things (IoT) is propelling the expansion of the the market. As more devices become interconnected, the need for intelligent motion detection has increased.

Smart homes, smart clocks, wearables, and other connected devices are leveraging motion sensors for functions such as security, automation, and energy management. IoT expansion across various industries, including healthcare, automotive, and retail continues to fuel demand, fostering innovation and market growth.

- In October 2024, Nintendo launched the Sound Clock: Alarmo, featuring motion-sensing technology for an interactive alarm experience that enables the users to snooze the alarm or stop the alarm through movement. This aligns with the growing IoT trend, showcasing motion sensor integration in smart devices for enhanced automation and user engagement.

Market Challenge

Sensor Accuracy and Reliability

Sensor accuracy and reliability present a major challenge to thedevelopment of the motion sensor market, particularly in complex environments where factors such as lighting, temperature, and obstructions affect performance. False positives and negatives can lead to inefficiency and security risks, impacting user trust.

To address this, manufacturers are incorporating advanced algorithms, multi-sensor fusion, and AI-based processing to enhance detection accuracy and adapt to varying conditions. Additionally, ongoing improvements in sensor technology, such as higher sensitivity and better calibration, are enhancing reliability.

Market Trend

AI and Sensor Integration

AI and sensor integration is emerging as a key trend in the market, where advanced AI algorithms are being paired with motion sensors to enhance defect detection, condition monitoring, and safety assurance.

This combination allows for real-time data analysis, improving the accuracy and efficiency of sensor systems in various applications, including industrial monitoring, smart homes, and healthcare. As AI advances, it fuels the development of intelligent, autonomous sensor systems essential for predictive maintenance, security, and optimized performance across industries.

- In April 2025, MultiSensor AI Holdings, Inc. (MSAI) collaborated with FOTRIC U.S.A. Inc. to integrate FOTRIC's advanced camera solutions into MSAI's product channels. This partnership enhances MSAI Connect, improving defect detection, condition monitoring, and safety assurance across industries such as manufacturing, chemical processing, metallurgy, Li-ion battery storage, waste management, electric utilities, oil & gas, and building infrastructure.

Motion Sensor Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Infrared, Ultrasonic, Microwave, Dual Technology, Tomographic, Others

|

|

By Application

|

Consumer Electronics, Automotive, Aerospace & Defense, Healthcare, Industrial, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (Infrared, Ultrasonic, Microwave, Dual Technology, Tomographic, and Others): The infrared segment earned USD 2.84 billion in 2023 due to the growing adoption of infrared sensors in security systems, automotive, and consumer electronics, ensuring efficient motion detection.

- By Application (Consumer Electronics, Automotive, Aerospace & Defense, Healthcare, Industrial, and Others): The consumer electronics segment held a share of 34.17% in 2023, largely attributed to the increasing integration of motion sensors in smart devices, wearables, and home automation products, enhancing user experience and convenience.

Motion Sensor Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America motion sensor market share stood at around 28.31% in 2023, vaued at USD 2.22 billion. This dominance is reinforced by the region's well-established technology infrastructure and strong adoption of advanced technologies. The strong presence of key players in the automotive, healthcare, and consumer electronics sectors generates the demand for motion sensors.

Additionally, the widespread integration of IoT devices and smart home technologies boosts regional market growth. The United States, in particular, benefits from significant investments in research and development, along with supportive government policies promoting innovation.

Asia Pacific motion sensor industry is estimated to grow at a robust CAGR of 10.83% over the forecast period. This growth is propelled by rapid technological advancements and increasing demand for smart devices. The region's expanding industrial sectors, particularly in automotive, healthcare, and consumer electronics, are leading to more efficient motion sensing solutions.

Additionally, countries such as China, Japan, and India are investing heavily in IoT, smart home technologies, and automation, highlighting the need for motion sensors. Government initiatives supporitng innovation and technological development significantly contribute to this growth .

- In February 2024, IIT Guwahati researchers unveiled a cost-effective gel-based wearable motion sensor for healthcare applications. This innovative organohydrogel sensor offers high stretchability, self-healing properties, and enables wireless monitoring of subtle body movements wirelessly, providing valuable insights into patient conditions for improved healthcare interventions.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) enforces regulations ensuring motion sensors comply with federal energy efficiency and environmental standards.

- In India, the Bureau of Indian Standards (BIS) mandates compliance with safety, performance, and environmental norms to ensure quality and reliability of of motion sensors.

- In the EU, motion sensors require CE marking, indicating conformity with health, safety, and environmental protection standards for products sold within the EEA.

Competitive Landscape

Companies in the motion sensor industry are focusing on expanding their product offerings through innovation and strategic acquisitions. They are integrating advanced technologies such as AI and multi-sensor fusion, enhancing sensor sensitivity and accuracy. Additionally, businesses are developing cost-effective solutions to cater to diverse industries, including healthcare, automotive, and industrial automation, fostering technological advancements and improving performance across various applications.

- In March 2024, Sentech, Inc. acquired the assets of Xensor, LLC, a leading provider of motion sensors, to expand its industrial portfolio. The acquisition strengthens Sentech’s capabilities in position measurement technologies and enhance its global sensor solutions for industrial and aerospace markets.

List of Key Companies in Motion Sensor Market:

- STMicroelectronics

- Murata Manufacturing Co., Ltd.

- Honeywell International Inc.

- Analog Devices, Inc.

- Microchip Technology Inc.

- InvenSense

- Robert Bosch GmbH

- MEMSIC Semiconductor Co., Ltd.

- TE Connectivity

- ifm electronic gmbh

- Movella Inc.

- Seiko Epson Corporation

- Panasonic Corporation

- Sensinova

- KEMET Corporation.

Recent Developments (Product Launch)

- In January 2025, Logitech introduced the Logitech Spot, a radar-based occupancy and environmental sensor designed to improve workplace efficiency. It automates meeting room reservations, monitors air quality, and provides actionable insights to reduce energy consumption and enhance employee well-being, contributing to smarter, healthier office environments with lower operational costs.

- In December 2024, ESYSENSE launched a smart home ecosystem feacturing motion sensors, sensor lights, and smart lighting solutions. Designed to work in tandem, these products automate home functions based on motion, enhancing security, energy efficiency, and user comfort.