Market Definition

The market involves the development and production of systems and components that regulate machine movement. As a sub-field of automation, motion control ensures precise motion regulation through open-loop (without feedback) or closed-loop (with feedback) configurations.

These systems are integral to industries such as robotics, CNC machines, packaging, and semiconductor manufacturing. The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Motion Control Market Size Overview

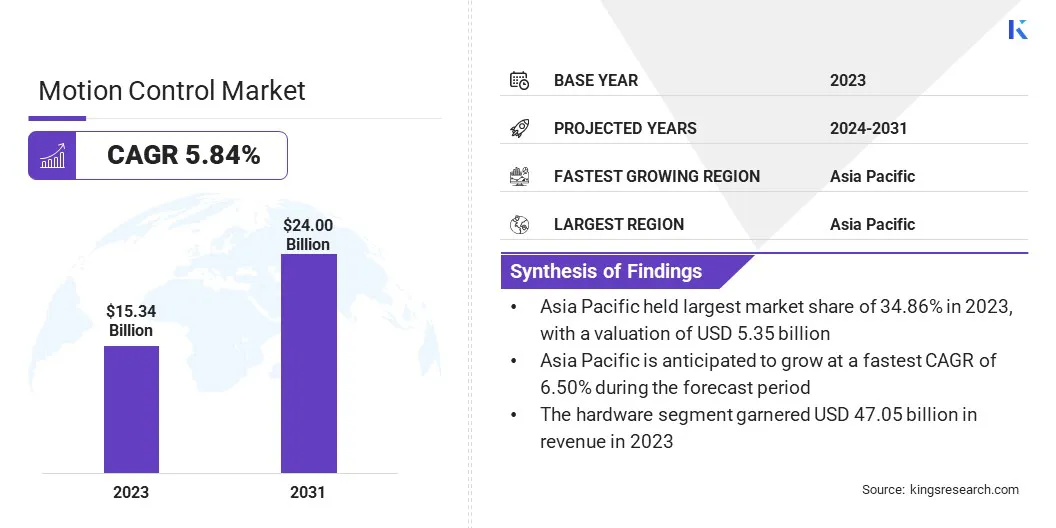

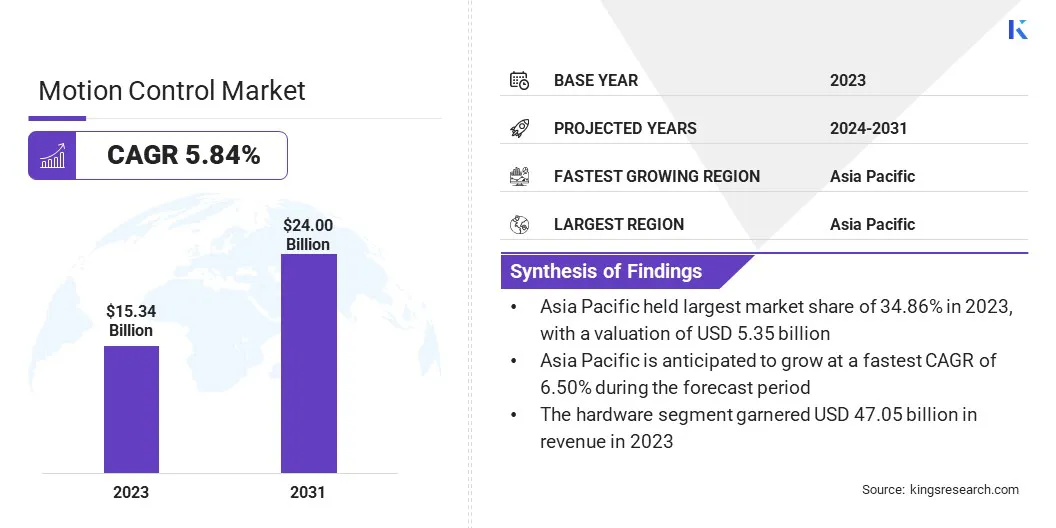

According to Kings Research, the global motion control market size was valued at USD 15.34 billion in 2023 and is projected to grow from USD 16.13 billion in 2024 to USD 24.00 billion by 2031, exhibiting a CAGR of 5.84% during the forecast period.

Market growth is fueled by the increasing adoption of automation across industries, which demands precise and reliable motion control systems to enhance efficiency, reduce human error, and improve overall production capabilities.

Major companies operating in the motion control industry are ABB, Rockwell Automation, Parker Hannifin Corp, Siemens, OMRON Corporation, Yaskawa Europe GmbH, Mitsubishi Electric Corporation, Dover Motion, FANUC America Corporation, Schneider Electric, Robert Bosch GmbH, Novanta Inc., Altra Industrial Motion Corp., AMETEK Inc., Delta Electronics Inc. and others.

Key Market Highlights:

- The motion control market size was recorded at USD 15.34 billion in 2023.

- The market is projected to grow at a CAGR of 5.84% from 2024 to 2031.

- Asia-Pacific held a market share of 34.86% in 2023, with a valuation of USD 5.35 billion.

- The closed-loop system segment garnered USD 8.86 billion in revenue in 2023.

- The motors segment is expected to reach USD 5.49 billion by 2031.

- The metal cutting segment secured the largest revenue share of 25.02% in 2023

- The electronics & semiconductor segment is poised for a robust CAGR of 7.26% through the forecast period.

- North America is anticipated to grow at a CAGR of 5.96% during the forecast period.

Market expansion is fueled by advancements in automation, robotics, and industrial IoT technologies. As industries strive for increased efficiency and precision, the demand for motion control systems, including motors, drives, and controllers, is rising.

The market is witnessing increased competition as key players focus on innovation, strategic collaborations, and geographic expansion to strengthen their market position. Additionally, the growing adoption of smart manufacturing practices and Industry 4.0 technologies is reshaping market landscape.

- In September 2024, Applied Motion Products (AMP) launched the CPBD-A-C remote control module, enhancing the functionality of its CSM34 Smart Motor. This new module allows operators to remotely configure motion profiles, monitor system status, and adjust settings, catering to industries seeking more flexible and efficient motion control solutions for transport systems.

Analyst View on Motion Control Market:

The motion control market is structurally positioned for sustained growth, expanding from USD 15.34 billion (2023) toward USD 24.00 billion by 2031, driven by deepening automation, robotics, and Industry 4.0 adoption.

Closed-loop systems dominate adoption due to superior precision and real-time feedback, accounting for USD 8.86 billion in 2023, reinforcing their critical role in high-accuracy manufacturing environments.

Asia-Pacific remains the primary growth engine with 34.86% market share, supported by semiconductor and electronics manufacturing scale, while North America shows stable momentum at a 5.96% CAGR.

Integration of AI, machine learning, and advanced sensors is elevating motion control from deterministic systems to intelligent, predictive platforms, improving uptime and energy efficiency. Competitive differentiation increasingly hinges on software intelligence, retrofit-friendly architectures, and regulatory compliance (CE, UL), strengthening long-term market credibility and buyer trust.

- In March 2024, FANUC introduced the Power Motion i-MODEL A Plus, enabling simultaneous control of up to 32 axes, targeting complex automated applications.

- In June 2024, ABB expanded its portfolio with high-performance motors designed for harsh and hygienic environments, improving efficiency and digital integration. (Source: abb.com)

Motion Control Market Growth Factors

Surging Adoption of Robotics and Smart Machinery

The rising adoption of robotics and smart machinery in industries such as automotive, electronics, and healthcare is propelling the expansion of the market.

These technologies rely on precise, coordinated, and real-time movement, which is enabled by advanced motion control systems. Additionally, motion control systems become smarter and more capable when paired with AI, making them crucial for the next generation of advanced automation

- In June 2024, ABB launched the OmniCore robotics control platform, catering to the growing demand for automation solutions that enhance productivity and lower operating costs. This new system delivers faster throughput, reduces energy consumption, and streamlines integration, supporting industries in achieving sustainable and scalable motion control.

Motion Control Market Challenge

Integration Challenges with Legacy Systems

A major challenge impeding the progress of the motion control market is the complexity involved in integrating advanced motion control systems with existing legacy machinery.

Many manufacturing facilities operate with outdated equipment that may not be compatible with modern motion controllers, drives, or communication protocols. This often requires significant customization, including software reconfiguration and hardware modifications, which can increase both implementation time and cost.

This challenge can be addressed through offering flexible, retrofit-friendly solutions that allow for easy integration with older equipment. Manufacturers are adopting standardized communication protocols, modular components, and custom integration services to ensure smooth transitions.

These innovations enable manufacturers to modernize their systems efficiently, reducing costs, downtime, and disruption, while enhancing overall productivity and performance.

Motion Control Market Trends

Integration of Machine Learning and Advanced Sensors in Motion Control

The market is increasingly integrating machine learning (ML) and advanced sensors as part of evolving motion control market trends to improve precision, adaptability, and operational efficiency. ML algorithms analyze real-time sensor data to predict equipment failures, optimize system performance, and dynamically respond to changing operating conditions.

Advanced sensors, including force, position, and velocity sensors, provide critical inputs that enable accurate motion control and enhanced system performance. In automotive manufacturing, AI-driven robotic arms leverage these technologies to increase assembly line efficiency and support predictive maintenance, significantly reducing downtime and operational costs.

This convergence of ML and sensor technologies is transforming motion control into an intelligent, autonomous system capable of executing complex tasks with minimal human intervention.

- In April 2025, Elmo Motion Control launched the Titanium Maestro, catering to the growing demand for high-performance motion control solutions. This new controller is designed to enhance system efficiency and flexibility, empowering industries to develop faster, more accurate, and reliable automation systems for complex applications. (Source: elmomc.com)

Motion Control Market Report Snapshot

|

Segmentation

|

Details

|

|

By System

|

Open-loop System, Closed-loop System

|

|

By Offerings

|

Actuators & Mechanical Systems, Drives, Motors, Motion Controllers,

|

|

By Application

|

Metal Cutting, Metal Forming, Material Handling, Packaging, Robotics, Others

|

|

By Industry Vertical

|

Electronics & Semiconductor, Logistics, Automotive, Healthcare, Food & Beverage, Paper & Printing, Aerospace & Defense, Others

|

|

By Region

|

North America: US, Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By System(Open-loop System and Closed-loop System): The closed-loop system segment earned USD 8.86 billion in 2023 due to its high precision, real-time feedback capabilities, and growing demand in automation-intensive industries.

- By Offerings (Actuators & Mechanical Systems, Drives, Motors, and Motion Controllers): The motors segment held a share of 23.07% in 2023, due to increasing demand for high-performance and energy-efficient solutions across various industries..

- By Application (Metal Cutting, Metal Forming, Material Handling, Packaging, Robotics, and Others): The metal cutting segment is projected to reach USD 5.83 billion by 2031, owing to the increasing adoption of precision machining across the automotive, aerospace, and industrial manufacturing sectors.

- By Industry Vertical (Electronics & Semiconductor, Logistics, Automotive, Healthcare, Food & Beverage, Paper & Printing, Aerospace & Defense, and Others): The electronics & semiconductor segment is estimated to grow at a CAGR of 7.26% through the forecast period, fueled by the increasing demand for high-precision automation in microelectronics and chip manufacturing processes.

Motion Control Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific motion control market share stood at around 34.86% in 2023, valued at USD 5.35 billion. China, Japan, South Korea, and Taiwan are major global manufacturing hubs for the automotive, electronics, and semiconductor industries, all of which require high-precision automation through motion control systems.

The region is experiencing rapid industrial automation, leading to the increased adoption of smart factory technologies. The widespread availability of locally produced components such as servo motors, drives, and controllers reduces manufacturing costs and enhances the accessibility of motion control systems across various industrial applications.

- In August 2024, Elmo Motion Control showcased its latest innovations at Automation Expo, catering to the growing demand for advanced motion control solutions. The showcased products, including the Platinum Line of servo drives and a next-generation, AI-ready motion controller, target industries seeking efficient, high-performance, and intelligent automation solutions to enhance safety and productivity.

The North America motion control industry is estimated to grow at a CAGR of 5.96% over the forecast period. This expansion is bolstered by the rising adoption of Industry 4.0 technologies across key sectors such as automotive, electronics, and aerospace, which increasingly rely on advanced motion control systems to achieve automation and precision.

Furthermore, ongoing upgrades in manufacturing facilities, breakthroughs in robotics innovation, and the growing demand from the defense and aerospace sectors are fueling this growth. Strong investments in R&D and consistent government support for technological advancement are boosting regional market expansion.

- In March 2024, FANUC America showcased its Power Motion i‑MODEL A Plus at MODEX. This advanced PLC/CNC motion controller integrates motion control for up to 32 axes simultaneously and is designed to offer flexible control for automated applications such as filling, winding, packaging, and stamping.

Regulatory Frameworks

- In the EU, the market is governed by CE marking requirements, ensuring compliance with product safety, electromagnetic compatibility, and environmental standards. Components such as servo motors, drives, and controllers must adhere to directives such as the Low Voltage Directive, the Electromagnetic Compatibility (EMC) Directive, and the Machinery Directive to be legally marketed within the European Economic Area.

- In the U.S., the market is primarily regulated by UL (Underwriters Laboratories), which sets standards for product safety, electrical integrity, and performance. Motion control components like servo motors, drives, and controllers must meet UL Listed or UL Recognized certifications to ensure compliance with national safety codes and to gain customer trust in industrial applications.

Competitive Landscape

In the motion control market, companies are prioritizing strategic collaborations, investments in research and development, and expanding into emerging markets. Key players are partnering with technology providers to integrate advanced solutions such as AI and IoT, enhancing the efficiency of motion control systems.

Additionally, companies are investing heavily in smart manufacturing technologies, such as predictive maintenance and Industry 4.0, to optimize operations and reduce costs. These initiatives, along with a focus on sustainability, are fostering innovation and supporting market expansion.

- In April 2024, Performance Motion Devices (PMD) partnered with DigiKey to expand the global distribution of its motion control solutions. This collaboration makes PMD's advanced ICs, modules, and developer kits more accessible to industries such as robotics, medical devices, and industrial automation, catering to the increasing demand for high-quality and reliable motion control products.

Key Companies in Motion Control Market:

- ABB

- Rockwell Automation

- Parker Hannifin Corp

- Siemens

- OMRON Corporation

- Yaskawa Europe GmbH

- Mitsubishi Electric Corporation.

- Dover Motion

- FANUC America Corporation

- Schneider Electric

- Robert Bosch GmbH.

- Novanta Inc.

- Altra Industrial Motion Corp.

- Inc.

- Delta Electronics, Inc.

Recent Developments (Launches)

- In December 2024, Yaskawa launched the LA700 AC drive, a dedicated motion control solution for elevators. It features improved auto-tuning, a guided setup tool and wireless monitoring via Bluetooth for easier configuration and real-time adjustments. The drive enhances ride comfort, simplifies installation, reduces setup time, and improves reliability.

- In August 2024, Inovance Technology developed advanced motion control solutions integrating automation, robotics, and IoT to enhance manufacturing efficiency. Its systems, including AC drives, servos, and robots, improve precision, flexibility, and productivity, enabling businesses to optimize production, reduce costs, and maintain competitiveness.

- In June 2024, ABB launched high-performance motors such as the DP200 Crush+, Food Safe SP5+, and RXT Series, designed for harsh and hygienic environments. These motors offer enhanced efficiency, durability, and digital integration for improved motion control.

- In April 2024, Siemens launched the Simatic S7‑1200 G2 controller at Hannover Messe, catering to the growing demand for automation solutions that deliver efficient motion control and flexible machine safety. This new generation enables higher production output, seamless OT/IT integration, and scalable system expansion, empowering industries seeking productivity, flexibility, and cost‑effective automation.