Market Definition

The market encompasses the global industry focused on the tools, technologies, products, and services used in molecular cloning. Molecular cloning is a core technique used in molecular biology, which involves replicating DNA fragments and inserting them into host organisms to analyze gene function.

The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth during the forecast period.

Molecular Cloning Market Overview

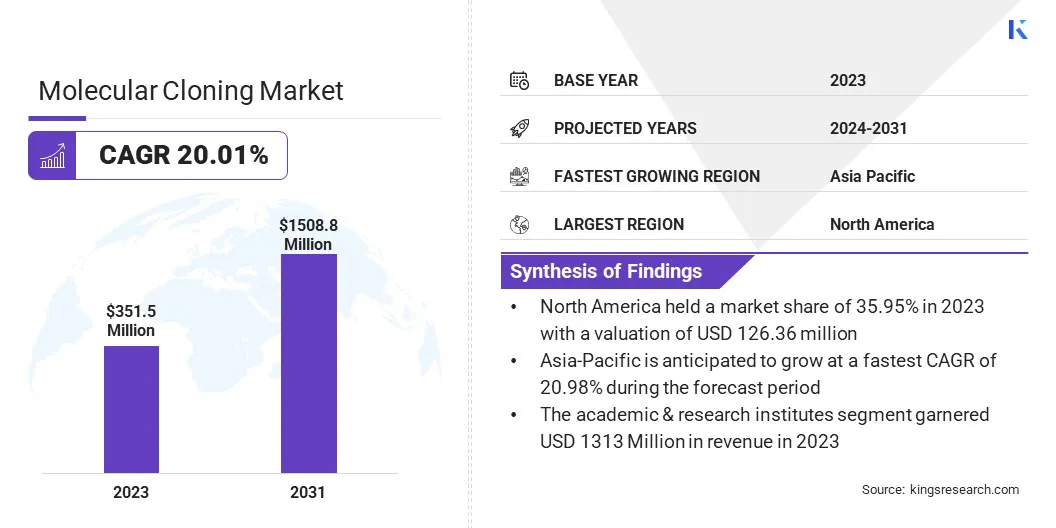

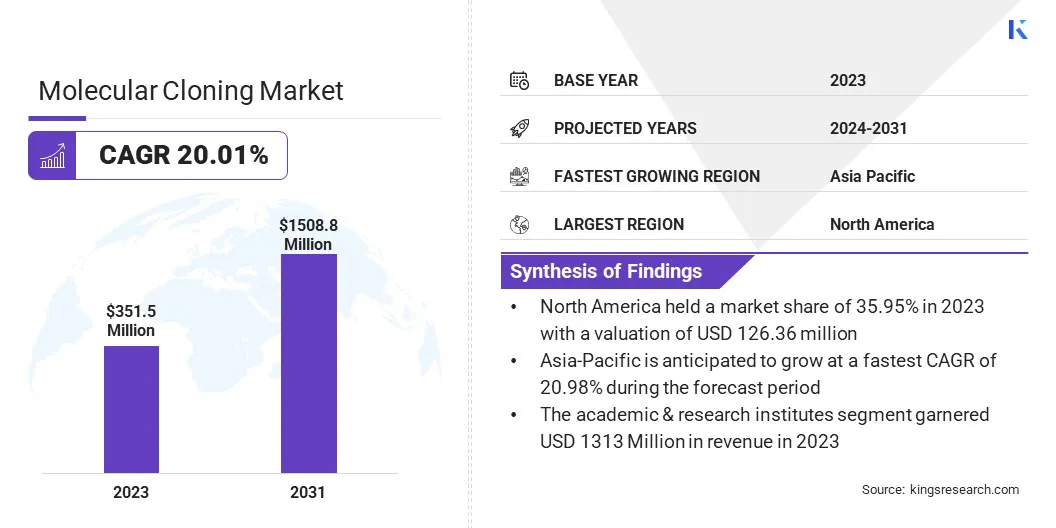

The global molecular cloning market size was valued at USD 351.5 million in 2023 and is projected to grow from USD 420.7 million in 2024 to USD 1508.8 million by 2031, exhibiting a CAGR of 20.01% during the forecast period.

The growing demand for precise genetic research and personalized medicine is driving the market. Advancements in cloning technologies are improving efficiency, accuracy, and scalability, enabling faster and more reliable results. This is essential for drug development, gene therapy, and genetic modifications in various industries, such as biotechnology and pharmaceuticals.

Major companies operating in the molecular cloning industry are Thermo Fisher Scientific, Agilent Technologies, New England Biolabs, TAKARA BIO INC., GenScript, TransGen Biotech Co., Ltd., Twist Bioscience, Integrated DNA Technologies, Promega Corporation, Bio-Rad Laboratories, F. Hoffmann-La Roche Ltd, Illumina Inc, OriGene Technologies, ProMab Biotechnologies, Inc., and Qiagen.

Advancements in next-generation technologies are driving the market by improving imaging precision and capabilities. These innovations enable a more detailed analysis of cellular processes and gene functions, accelerating research in genomics and gene therapy.

- In November 2024, Nikon Corporation and the European Molecular Biology Laboratory (EMBL) announced a partnership to advance next-generation microscopy technologies. This partnership aims to address complex challenges in life sciences by combining Nikon’s imaging expertise with EMBL’s advanced molecular biology research.

Key Highlights:

- The molecular cloning industry size was valued at USD 351.5 million in 2023.

- The market is projected to grow at a CAGR of 20.01% from 2024 to 2031.

- North America held a market share of 35.95% in 2023, with a valuation of USD 126.4 million.

- The blunt end cloning segment garnered USD 105.1 million in revenue in 2023.

- The academic & research institutes segment is expected to reach USD 558.5 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 20.98% during the forecast period.

Market Driver

"Rising Demand for Biopharmaceuticals"

The rising demand for biopharmaceuticals is driving the molecular cloning market. Biologics such as monoclonal antibodies, recombinant proteins and gene therapies require precise gene manipulation techniques, making molecular cloning essential in their development. The need for efficient cloning technologies to produce high-yield and targeted therapies continues to grow as the biopharma industry expands.

- According to the Pharmaceutical Research and Manufacturers Association (PhRMA), biopharmaceutical firms in the U.S. spent approximately USD 96 billion on research and development in 2023. In 2023, R&D accounted for over 20% of total sales in Biopharmaceuticals sector . Additionally, foreign direct investment (FDI) in pharmaceuticals and medicines reached USD 503.4 billion, reflecting strong global confidence in the U.S. biopharmaceutical industry.

Market Challenge

"Efficiency and Reproducibility Challenge"

A major challenge in the molecular cloning market is the low efficiency and reproducibility of the traditional cloning method, which involves multiple manual steps and is prone to errors. These inefficiencies can lead to delays in research and increased costs when working with complex or large gene constructs.

Companies operating in the market can increasingly adopt advanced technological solutions, such as high-fidelity cloning enzymes, automation technologies, and integrated all-in-one cloning kits.

High-fidelity enzymes significantly enhance the precision of DNA replication and assembly, thereby minimizing the risk of mutations or errors during the cloning process.

Market Trend

"Automation in Single-cell Cloning Technology"

The trend of automation in single-cell cloning is growing, as companies are seeking more efficient solutions for single-cell isolation, culture, and transfer. This shift reflects the increasing demand for technologies that enhance throughput, precision, and traceability in cloning workflows, reducing the need for manual intervention.

Additionally, laboratories are adopting automated platforms, such as the integration of proprietary fluid-shaping technology and Single-Cell Automated Identification (SCAI), to improve reproducibility and accelerate research, especially in gene therapy and cell biology applications.

- In November 2024, iotaSciences launched its Single-Cell Cloning Platform XT at the Cell 2024 event in London. The platform, based on iotaSciences’ proprietary fluid-shaping technology, offers enhanced automation for single-cell isolation, culture, and verified monoclonal transfer into 96-well plates. The integration of the newly developed SCAI technology, along with a documented monoclonality report, boosts throughput, precision, and traceability in single-cell cloning workflows.

Molecular Cloning Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Blunt End Cloning, Ligase Independent Cloning, PCR Cloning, Seamless Cloning, TA Cloning, Others

|

|

By End-Use Industry

|

Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Hospitals & Clinics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Blunt End Cloning, Ligase Independent Cloning, PCR Cloning, Seamless Cloning, TA Cloning and Others): The blunt end cloning segment earned USD 105.1 million in 2023, fueled by its widespread use in fundamental gene function studies and its compatibility with various vector systems.

- By End-Use Industry (Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Hospitals & Clinics and Others): The academic & research institutes segment held 37.37% share of the market in 2023, propelled by increased government funding and growing demand for genetic research & training programs.

Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America molecular cloning market share stood at around 35.95% in 2023, with a valuation of USD 126.4 million. This market dominance is strengthened by the region's strong biotechnology and pharmaceutical industries, which drive the demand for advanced molecular cloning techniques.

Additionally, strategic initiatives such as market expansion, partnerships, and acquisitions are enabling key players to broaden their technological capabilities, enhance their product offerings, and expand their presence in new markets, further fueling the market.

- In June 2024, Bionova Scientific announced its plans to expand into plasmid DNA (pDNA) production, with the establishment of a new facility in The Woodlands, Texas. This expansion is part of a strategic initiative to meet the growing demand for high-quality pDNA, particularly from the developers of cell and gene therapies.

The molecular cloning industry in Asia Pacific is poised for significant growth at a robust CAGR of 20.98% over the forecast period. This growth is attributed to several factors, including the rapid expansion of biotechnology and pharmaceutical industries in the region, which are increasingly adopting advanced molecular cloning technologies for research and drug development.

Additionally, the growing focus on improving healthcare infrastructure and scientific research capabilities is driving the demand for innovative molecular cloning solutions.

Regulatory Frameworks

- In Europe, the European Medicines Agency (EMA) and the European Commission (EC), oversee the regulation of molecular cloning in gene therapy and emerging biotechnologies. The European Commission governs areas such as genetically modified organisms (GMOs) and animal cloning to ensure that ethical standards and public safety are maintained.

- In the U.S., the Food and Drug Administration (FDA), regulates the use of molecular cloning in therapeutic and biomedical applications. It oversees the development of drugs, biological products, and medical devices that utilize cloning techniques. Through the Investigational New Drug (IND) application process, the FDA ensures that these technologies meet stringent safety, efficacy, and ethical standards before advancing to clinical trials or market approval.

- In India, the Review Committee on Genetic Manipulation (RCGM), operating under the Department of Biotechnology (DBT), is responsible for overseeing the safety of research activities, which involve genetically engineered organisms and hazardous microorganisms. It plays a critical role in evaluating and monitoring projects that present higher biosafety risks, ensuring that such research complies with national guidelines and maintains public & environmental safety.

Competitive Landscape

The molecular cloning industry is characterized by a moderately consolidated competitive landscape, which comprises established multinational corporations and specialized regional players. Market participants are focusing on strategic partnerships and expanding their market reach.

By entering into collaborations with healthcare companies in emerging regions like the Middle East & Africa, players are aiming to enter markets with high demand for advanced diagnostic solutions.

Additionally, these partnerships allow companies to integrate advanced technologies, such as precision diagnostics and molecular profiling, improving their ability to deliver accurate, faster and more reliable results.

- In June 2024, Juniper Biologics, a Singapore-based healthcare company, partnered with Caris Life Sciences, a leader in precision medicine. Juniper granted distribution rights for Caris’ advanced solid tumor molecular profiling services across the Middle East & Africa.

List of Key Companies in Molecular Cloning Market:

- Thermo Fisher Scientific

- Agilent Technologies

- New England Biolabs

- TAKARA BIO INC.

- GenScript

- TransGen Biotech Co.,Ltd.

- Twist Bioscience

- Integrated DNA Technologies

- Promega Corporation

- Bio-Rad Laboratories

- Hoffmann-La Roche Ltd

- Illumina Inc

- OriGene Technologies

- ProMab Biotechnologies, Inc.

- Qiagen

Recent Developments (M&A/Partnerships/Agreements/Product Launches)

- In September 2024, Molecular Designs, a leading provider of PCR assays, reagents, and equipment, acquired Lamda Biotech, a specialized provider of research products for molecular biology, functional genomics, proteomics, and gene therapy. This acquisition expands the product portfolio of Molecular Designs, enhances its reach into academic research and pharmaceutical sectors, and grows its talent base. Lamda Biotech, known for its advanced PCR products, RT-PCR reagents, RT-qPCR kits, and Direct-PCR genotyping kits, will benefit from the manufacturing expertise of Molecular Designs, enhancing R&D and distribution.

- In May 2024, Integrated DNA Technologies (IDT) expanded its synthetic biology operations by opening a new 25,000 square-foot facility in Coralville, Iowa. The new site doubles IDT’s synthetic biology footprint, enabling the company to enhance its gene synthesis portfolio and improve its offerings in synthetic biology product manufacturing.

- In November 2023, New England Biolabs launched the NEBNext UltraExpress DNA and RNA Library Prep Kits for next-generation sequencing (NGS) on Illumina platforms. These kits reduce library prep time, enabling RNA library preparation in one day and DNA library prep in less than two hours. The kits are automation-friendly and accommodate a wide range of input amounts.

- In October 2023, Aragen, a leading Contract Research, Development, and Manufacturing Organization (CRDMO) for small molecules and biologics, announced the opening of a new biologics manufacturing facility in Bangalore. Backed by a USD 30 million investment, the facility spans nearly 160,000 sqm and includes process development labs, GMP manufacturing suites, and quality control labs.

- In May 2023, QIAGEN introduced its high-quality enzymes as individual products, allowing researchers and industrial customers to customize assays and workflows. This move positions QIAGEN as a comprehensive provider for research needs, from enzymes and sample preparation solutions to automation and bioinformatics.

- In March 2023, Vector Laboratories acquired Click Chemistry Tools and Fluoroprobes to expand its bioconjugation and manufacturing capabilities. This acquisition strengthened Vector’s portfolio of cross-linking and labeling reagents, along with fluorescent dyes, enabling greater support for drug discovery, bioconjugation, and research. The acquisition also provides increased security of supply along with U.S.-based manufacturing.