Market Definition

ModelOps (Model Operations) is a growing market focused on the governance, deployment, monitoring, and lifecycle management of Artificial Intelligence (AI) and Machine Learning (ML) models in production.

It enables enterprises to scale AI initiatives efficiently by ensuring compliance, reliability, and performance. The market spans industries like finance, healthcare, and retail, integrating AI into business workflows seamlessly.

ModelOps Market Overview

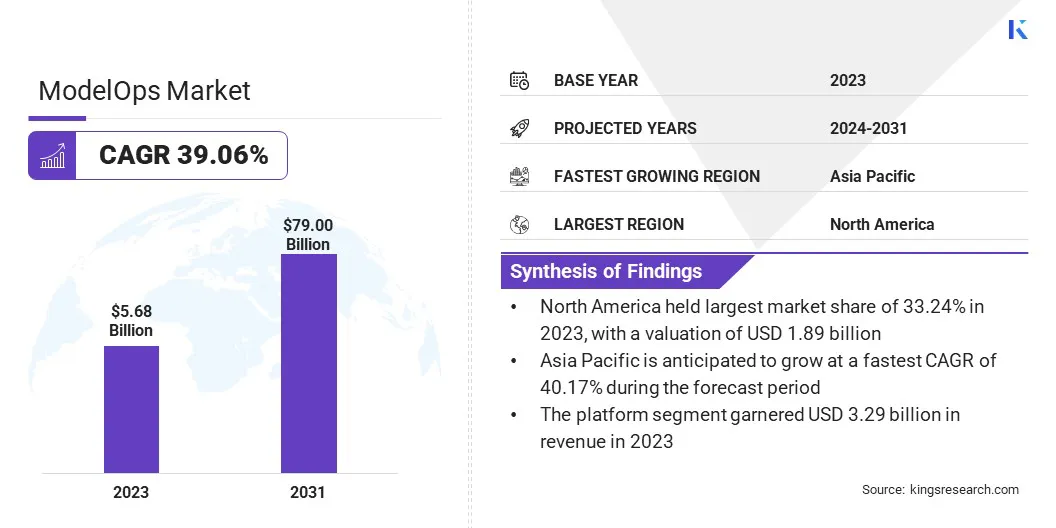

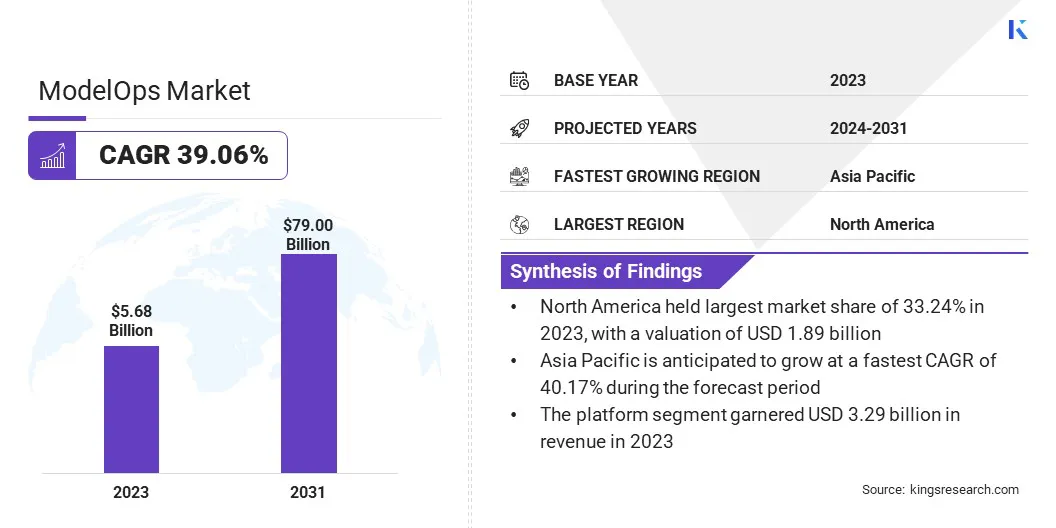

The global ModelOps market size was valued at USD 5.68 billion in 2023 and is projected to grow from USD 7.86 billion in 2024 to USD 79.00 billion by 2031, exhibiting a CAGR of 39.06% during the forecast period.

This market is evolving as organizations recognize the need for streamlined AI model management, ensuring that models remain accurate, explainable, and aligned with business objectives. The expansion of edge computing and IoT is further driving the demand for efficient model deployment across decentralized environments.

The increasing reliance on real-time data processing and predictive analytics fuels investments in ModelOps solutions that support continuous integration and delivery of AI models.

Major companies operating in the ModelOps industry are IBM, SAS Institute Inc., Databricks, C3.ai, Inc., Domino Data Lab, Inc., ModelOp, DataKitchen, Inc., Teradata, Datatron, iFusion, Azilen Technologies, Giggso, Domo, Inc., The MathWorks, Inc., and Cloud Software Group, Inc.

Additionally, the proliferation of industry-specific AI applications, such as personalized healthcare, fraud detection in finance, and intelligent automation in manufacturing, is boosting the market.

Strategic collaborations between cloud providers, AI startups, and enterprises are fostering innovation in ModelOps platforms, enhancing model governance, version control, and scalability. The market will continue to expand with new capabilities, integrations, and enterprise-wide adoption as businesses seek to maximize the value of their AI initiatives.

- In August 2024, ModelOp announced a USD 10 million Series B funding round led by Baird Capital to accelerate AI governance software innovation. The investment supports ModelOp’s expansion, product advancements, and go-to-market efforts. ModelOp introduced the world’s first AI Governance Score and was recognized as the Best AI Governance Platform in the 2024 AI Breakthrough Awards.

Key Highlights:

- The ModelOps industry size was valued at USD 5.68 billion in 2023.

- The market is projected to grow at a CAGR of 39.06% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 1.89 billion.

- The platform segment garnered USD 3.29 billion in revenue in 2023.

- The machine learning segment is expected to reach USD 21.17 billion by 2031.

- The continuous integration/continuous deployment segment is expected to reach USD 19.40 billion by 2031.

- The BFSI segment is expected to reach USD 17.70 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 40.17% during the forecast period.

Market Driver

"Evolving AI Governance and Scaling AI Operations"

The ModelOps market is expanding as enterprises seek structured AI oversight and streamlined operational processes. Additionally, the market is driven by evolving AI governance and compliance standards, where businesses are proactively implementing governance frameworks to enhance trust, transparency, and ethical AI usage.

This includes integrating bias detection, explainability, and performance monitoring into AI workflows to ensure consistent decision-making. Organizations can mitigate risks while maximizing AI-driven business outcomes by standardizing auditing and oversight mechanisms.

Another significant driver of the market is operationalizing AI at scale, as companies move from experimental AI models to enterprise-wide AI deployment. Effective AI implementation requires continuous monitoring, version control, and automated retraining to maintain accuracy and performance.

Businesses face challenges like fragmented workflows and inefficient model updates without a robust ModelOps framework. ModelOps ensures that AI models remain adaptive, unbiased, and aligned with business objectives by automating lifecycle management, driving seamless integration across industries.

- In September 2023, Teradata announced new enhancements to its ModelOps capabilities in ClearScape Analytics to simplify AI model deployment and governance. The updates include no-code model deployment, automated monitoring, and advanced explainability controls to ensure trusted AI. These capabilities help organizations accelerate AI adoption, reduce deployment time, and enhance model lifecycle management, enabling businesses to scale AI initiatives efficiently.

Market Challenge

"AI Model Degradation"

One of the major challenges in the ModelOps market is AI model drift and performance degradation, where AI and ML models gradually lose their predictive accuracy as real-world data distributions shift over time. This issue arises, due to evolving user behavior, changing market trends, seasonal variations, and external disruptions such as economic shifts or regulatory updates.

Model drift can take various forms, including concept drift, where the relationship between input features and target outcomes changes, and data drift, where the statistical properties of input data shift away from the original training dataset.

The consequences of model drift are significant, as outdated AI models can produce biased predictions, inaccurate forecasts, and suboptimal business decisions. A drop in model performance can lead to financial losses, reputational damage, and compliance risks in industries like finance, healthcare, and e-commerce, where AI is used for fraud detection, medical diagnoses, or personalized recommendations.

Organizations that fail to address model drift in a timely manner may also face increased operational costs, due to manual interventions and frequent model re-deployments. Enterprises are integrating continuous model monitoring, automated drift detection, and proactive retraining mechanisms into their ModelOps workflows.

AI-driven monitoring tools track model accuracy in real time, flagging deviations from expected performance thresholds. When drift is detected, automated retraining pipelines can trigger updates using fresh, relevant data to restore model accuracy without requiring extensive manual intervention.

Market Trend

"AI-driven Automation and Multi-cloud Expansion"

The ModelOps market is advancing as businesses prioritize automation and infrastructure flexibility. A key trend in the market is embedded AI for automated model monitoring, where AI-driven automation is enhancing real-time performance tracking, drift detection, and continuous retraining.

Traditional manual monitoring is resource-intensive and prone to delays, leading to model degradation. Organizations can proactively detect deviations, optimize AI performance, and improve operational efficiency without extensive human intervention by embedding automation within ModelOps.

Another significant trend is the expansion of multi-cloud and edge deployments, as businesses seek scalable and flexible AI infrastructures. AI workloads are increasingly distributed across hybrid, multi-cloud, and edge environments to optimize processing speed and resource allocation.

ModelOps solutions supporting these deployments enable organizations to process data closer to its source, reducing latency and enhancing real-time decision-making. This is particularly critical in industries like telecommunications, healthcare, and manufacturing, where AI-driven insights must be immediate and reliable.

- In July 2024, Comviva unveiled its next-generation AI Workbench for MobiLytix Marketing Studio, empowering telecom operators with a self-managed, no-code AI platform for customer value management. The workbench includes over a hundred ready-to-use AI model frameworks and an inbuilt MLOps platform for seamless AI/ML model deployment. Designed to maximize customer lifetime value in B2C and B2B sectors, the solution accelerates real-time customer campaign delivery, enhances automation, and supports ModelOps/AIOps.

ModelOps Market Report Snapshot

|

Segmentation

|

Details

|

|

By Offering

|

Platform, Services

|

|

By Model

|

Agent-based, Graph-based, Linguistic, Machine Learning, Others

|

|

By Application

|

Batch Scoring, Continuous Integration/Continuous Deployment, Dashboard & Reporting, Governance, Risk and Compliance, Monitoring & Alerting, Parallelization & Distributed Computing, Others

|

|

By Vertical

|

BFSI, Government & Defense, Healthcare, Manufacturing, IT & Telecommunications, Transportation & Logistics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Offering (Platform, Services): The platform segment earned USD 3.29 billion in 2023, due to the growing adoption of end-to-end ModelOps solutions that streamline AI model lifecycle management.

- By Model (Agent-based, Graph-based, Linguistic, and Machine Learning): The graph-based segment held 22.20% share of the market in 2023, due to its effectiveness in handling complex relationships and dependencies in AI-driven applications.

- By Application (Batch Scoring, Continuous Integration/Continuous Deployment, Dashboard & Reporting, Governance, Risk and Compliance, Monitoring & Alerting, Parallelization & Distributed Computing, and Others): The continuous integration/continuous deployment segment is projected to reach USD 19.40 billion by 2031, owing to the increasing demand for automated and scalable AI model deployment workflows.

- By Vertical (BFSI, Government & Defense, Healthcare, Manufacturing, IT & Telecommunications, Transportation & Logistics, Others): The BFSI segment is projected to reach USD 17.70 billion by 2031, owing to the growing reliance on AI for fraud detection, risk management, and personalized financial services in the BFSI sector.

ModelOps Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America ModelOps market accounted for a substantial market share of 33.24% in 2023, with a valuation of USD 1.89 billion, driven by its mature AI ecosystem, early technology adoption, and strong regulatory frameworks.

The region has a high concentration of AI-driven enterprises, leading cloud service providers, and established ModelOps vendors, particularly in the U.S. and Canada. The demand for AI governance, compliance, and automation is surging, due to the increasing complexity of AI models and the need for explainability in decision-making processes.

The financial services, healthcare, and IT & telecommunications sectors in North America are at the forefront of AI adoption, leveraging ModelOps solutions for real-time monitoring, risk mitigation, and AI scalability. Additionally, the region has strong venture capital support and government-backed AI research programs, further accelerating the expansion of the market.

The market in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 40.17% over the forecast period. This growth is fueled by rapid AI adoption, expanding cloud infrastructure, and rising enterprise investments in AI/ML.

Countries like China, India, Japan, and South Korea are leading the charge, with governments and private sector players heavily funding AI research and development. Additionally, the region’s rapid digital transformation across BFSI, healthcare, retail, and telecommunications has intensified the need for scalable and automated AI model management.

The rise of 5G networks and edge computing is further boosting the demand for multi-cloud and edge-compatible ModelOps solutions, allowing enterprises to deploy and manage AI models seamlessly across diverse environments.

The expansion of AI regulations in Asia Pacific, while still in its early stages, is also expected to accelerate the adoption of ModelOps for governance and compliance purposes.

Regulatory Frameworks

- In the U.S., ModelOps is influenced by the National Institute of Standards and Technology (NIST) AI Risk Management Framework, which provides guidelines for AI reliability, safety, and bias mitigation. The Federal Financial Institutions Examination Council (FFIEC) guidelines regulate AI/ML use in financial institutions to ensure security and risk management, while the Health Insurance Portability and Accountability Act (HIPAA) governs AI models handling healthcare data to ensure compliance and patient privacy.

- In Europe, the European Union (EU) Artificial Intelligence Act (AI Act) establishes a risk-based regulatory framework for AI systems, emphasizing transparency, accountability, and compliance. Additionally, the General Data Protection Regulation (GDPR) regulates AI-driven data processing, ensuring privacy, fairness, and explainability. The International Organization for Standardization/International Electrotechnical Commission (ISO/IEC) also provides guidelines for AI governance, risk management, and ethical AI deployment across industries.

Competitive Landscape

The ModelOps industry is characterized by rapid innovation, strategic partnerships, and the continuous evolution of AI model lifecycle management solutions. Key players in the market focus on expanding their platform capabilities by integrating automation, real-time monitoring, and compliance features to meet enterprise demands.

Many companies are investing in AI-driven orchestration tools that streamline model deployment across hybrid and multi-cloud environments. Solution providers emphasize interoperability by offering integrations with existing Machine Learning Operations (MLOps), Development Operations (DevOps), and data management solutions to strengthen their market position.

Strategic acquisitions of AI startups and partnerships with cloud service providers are common approaches to enhancing technological capabilities and expanding customer reach. Additionally, players are prioritizing low-code and no-code functionalities to enable broader adoption among business users and non-technical stakeholders.

Competitive differentiation is also driven by AI governance and explainability features, ensuring compliance with evolving regulations. Many organizations provide managed services and AI model auditability to help enterprises maintain transparency and accountability in AI decision-making.

Companies continue to invest in R&D, open-source contributions, and ecosystem expansion to solidify their foothold in the market as the demand for scalable AI solutions grows.

- In November 2024, KNIME secured a USD 30 million investment from Invus to enhance its AI governance and ModelOps capabilities, bringing its total funding to USD 50 million. The investment will support enterprise-scale AI deployment, automation, and governance. KNIME introduced K-AI, an AI assistant, and enhanced its Business Hub to improve AI model operationalization.

List of Key Companies in ModelOps Market:

- IBM

- SAS Institute Inc.

- Databricks

- C3.ai, Inc.

- Domino Data Lab, Inc.

- ModelOp

- DataKitchen, Inc.

- Teradata

- Datatron

- iFusion

- Azilen Technologies

- Giggso

- Domo, Inc.

- The MathWorks, Inc.

- Cloud Software Group, Inc.

Recent Developments (Collaboration/Product Launch)

- In May 2024, ModelOp launched Version 3.3, introducing the world’s first AI Governance Score to help enterprises assess AI risks and ensure compliance with evolving regulations. The update enhances AI governance inventory, automated compliance controls, and reporting, enabling real-time monitoring and risk management across all AI initiatives.

- In May 2024, Teradata expanded its Strategic Collaboration Agreement (SCA) with Amazon Web Services (AWS) to support enterprises in their cloud modernization and AI-driven analytics initiatives. The collaboration enhances the integration of Teradata VantageCloud with Amazon SageMaker and Amazon Bedrock, enabling organizations to scale AI/ML models, streamline ModelOps, and accelerate generative AI use cases while ensuring secure and efficient data management in the cloud.