Market Definition

The market comprises equipment designed for on-site concrete production, offering flexibility in formulation and real-time mixing. These mixers integrate precise control systems for proportioning cement, aggregates, water, and additives, enabling consistent quality across varied projects.

Their portable nature suits remote or small-scale construction, where traditional batching plants are impractical. Mobile mixers are widely used in infrastructure repair, road construction, urban development, and precast applications. The market covers a range of designs, including truck-mounted, trailer-mounted, and self-loading units.

The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Mobile Concrete Mixer Market Overview

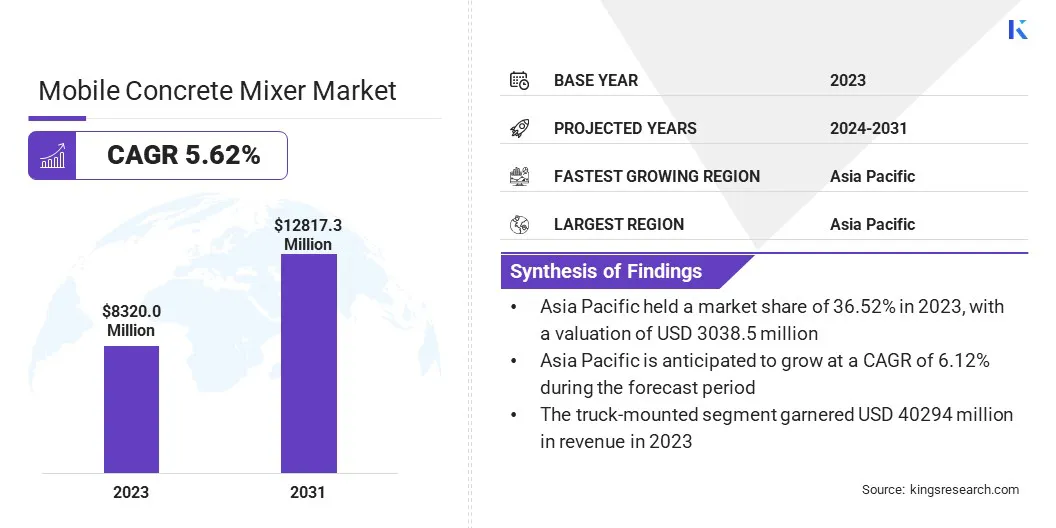

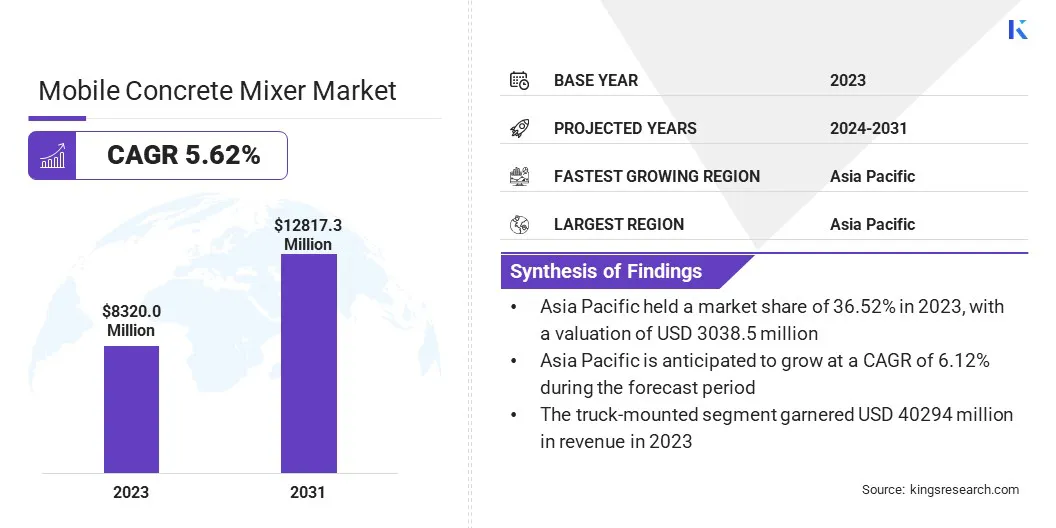

The global mobile concrete mixer market size was valued at USD 8,320.0 million in 2023 and is projected to grow from USD 8,739.4 million in 2024 to USD 12,817.3 million by 2031, exhibiting a CAGR of 5.62% during the forecast period.

The market is driven by the development of self-loading mobile mixer units, which streamline loading, mixing, and discharge operations, improving on-site efficiency. Additionally, advancements in mixer design and automation are enhancing precision, reducing labor dependency, and lowering operational costs.

Major companies operating in the mobile concrete mixer industry are Cemen Tech Inc., Zimmerman Industries, Inc., Utranazz, Terex Corporation, Bay Lynx Manufacturing Inc., Omega Concrete Mixers, SCHWING GmbH, Sany Heavy Industry Co., Ltd., XCMG Group, Schwing GmbH, Acme Concrete Mixers Pvt Ltd., Terex Corporation, Liebherr Group, McNeilus Truck and Manufacturing, and Volumetric Mixers by Strong Inc.

The growth of the market is strongly linked to the rising number of infrastructure projects in developing countries. Governments and private players are investing in roads, bridges, airports, and residential developments, which require efficient and mobile concrete solutions.

Mobile concrete mixers provide on-site production capabilities, reducing dependence on central batching plants and minimizing delays. Their adaptability makes them suitable for regions with limited access to conventional mixing facilities.

Key Highlights:

- The mobile concrete mixer industry size was valued at USD 8,320.0 million in 2023.

- The market is projected to grow at a CAGR of 5.62% from 2024 to 2031.

- Asia Pacific held a market share of 36.52% in 2023, with a valuation of USD 3,038.5 million.

- The truck-mounted segment garnered USD 4,029.4 million in revenue in 2023.

- The 4-6 cubic meters segment is expected to reach USD 6,007.4 million by 2031.

- The construction sites segment secured the largest revenue share of 37.52% in 2023.

- The market in Europe is anticipated to grow at a CAGR of 5.86% during the forecast period.

Market Driver

Development of Self-loading Mobile Mixer Units

The emergence of self-loading mobile concrete mixers is transforming on-site concrete production. These units integrate loading, mixing, and transport functions into a single system, improving job-site efficiency and reducing labor needs.

Their ability to prepare consistent concrete without external support systems is enhancing their appeal in diverse construction settings. The market is gaining traction from this innovation, which offers a scalable solution for both large infrastructure and smaller private projects.

- In February 2023, Shanqi Group introduced the world’s smallest self-loading concrete mixer. This compact, 3.5-cubic-meter automatic loading mixer truck is designed to perform both concrete mixing and on-site spreading simultaneously. It offers high flexibility and automation, making it especially effective for use in confined or remote construction sites. The advanced design enhances operational efficiency and reflects a significant innovation in mobile concrete mixing technology.

Market Challenge

High Initial Investment and Operational Costs

A key challenge impacting the growth of the mobile concrete mixer market is the high upfront cost of advanced mixer units, coupled with expenses related to maintenance, fuel, and skilled operation. These financial barriers can deter small and mid-sized contractors from adopting mobile solutions.

Companies are offering financing options, leasing models, and modular designs to reduce capital burden. Additionally, manufacturers are integrating energy-efficient systems, predictive maintenance technologies, and automation features to lower long-term operational costs, making ownership more feasible and appealing across a broader customer base.

Market Trend

Technological Advancements in Mixer Design and Automation

Technology integration is playing a key role in the growth of the market. Innovations such as digital controls, real-time monitoring, and automated loading systems are enhancing the accuracy and speed of concrete production.

These advancements improve machine reliability, reduce labor dependency, and provide better oversight of mix consistency. Contractors are increasingly adopting these high-performance units to streamline operations and gain a competitive edge in large-scale and specialized construction work.

- In January 2025, Cemen Tech released the latest version of its ACCU-POUR fleet management software, introducing new features that enable users to request quotes, track orders, and access invoices through a dedicated digital portal. As a cloud-based productivity tool, it seamlessly connects the office, dispatch operations, and the volumetric mixer fleet. This integration allows for near real-time schedule adjustments, helping users maintain a continuous workflow and improve overall operational efficiency.

Mobile Concrete Mixer Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Truck-mounted, Trailer-mounted, Self-loading

|

|

By Capacity

|

Less than 4 cubic meters, 4-6 cubic meters, 7-9 cubic meters, More than 9 cubic meters

|

|

By Application

|

Construction Sites, Roads & Bridge Projects, Industrial, Mining, Agriculture

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Truck-mounted, Trailer-mounted, Self-loading): The truck-mounted segment earned USD 4,029.4 million in 2023, due to its high mobility, on-site mixing efficiency, and suitability for large-scale infrastructure and commercial construction projects.

- By Capacity (Less than 4 cubic meters, 4-6 cubic meters, 7-9 cubic meters, and More than 9 cubic meters): The 4-6 cubic meters segment held 43.32% share of the market in 2023, due to its optimal balance between load efficiency and maneuverability, making it ideal for urban infrastructure, mid-sized construction projects, and frequent job-site mobility.

- By Application (Construction Sites, Roads & Bridge Projects, Industrial, Mining, Agriculture): The construction sites segment is projected to reach USD 4,819.9 million by 2031, owing to the rising demand for on-site, flexible concrete production that reduces transportation costs and improves project efficiency across diverse and remote job locations.

Mobile Concrete Mixer Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for 36.52% share of the mobile concrete mixer market in 2023, with a valuation of USD 3,038.5 million. The rapid expansion of national highway networks, rural road connectivity programs, and high-speed rail corridors, particularly in India, Indonesia, and Vietnam is fueling the demand for on-site concrete solutions.

Mobile concrete mixers support faster deployment in scattered and remote project zones, where fixed batching infrastructure is limited or absent. Their ability to deliver consistent quality in high-volume, linear infrastructure projects leads to the growth of the market in this region.

- In January 2025, the National Highways Authority of India (NHAI) unveiled plans for a 380-kilometre greenfield expressway connecting Ghaziabad to Kanpur under the Green Highway Policy. Slated for completion by 2026, this major infrastructure initiative will span nine key districts in Uttar Pradesh, significantly boosting regional connectivity and transport efficiency. Large-scale infrastructure projects like this are expected to accelerate the demand for mobile concrete mixers, given their capability to deliver high-quality concrete directly to remote construction stretches. Their flexibility and on-site batching efficiency make them ideal for maintaining consistent supply across expansive, time-sensitive roadway developments.

Additionally, government-backed rural housing schemes such as India’s PMAY-G and similar initiatives in Southeast Asia are driving localized construction activities. Mobile concrete mixers are instrumental in supporting these decentralized projects by enabling quality-controlled concrete production close to the construction site.

The market in Europe is poised for significant growth at a robust CAGR of 5.86% over the forecast period. European construction standards demand high-quality concrete production with strict compliance to environmental regulations. Mobile concrete mixers allow contractors to meet EN 206 requirements for mix precision while minimizing waste and reducing emissions from transportation.

The ability to produce concrete on-site ensures better control over water-cement ratios and admixture usage, aligning with EU sustainability targets and carbon neutrality goals. Furthermore, EU-backed transport corridors and cross-border infrastructure projects, including rail and highway expansion across Eastern Europe, are boosting the market.

Regulatory Frameworks

- The UK's Department for Transport (DfT) has implemented regulations to align volumetric concrete mixers (VCMs) with standard heavy goods vehicle (HGV) requirements. As of 2018, VCM operators must obtain operator licenses, and drivers are subject to EU drivers' hours and working time rules. Temporary weight limits were established, allowing certain VCMs to operate at higher weights until 2028, facilitating a transition to standard weight limits.

- China's regulations for mobile concrete mixers are encapsulated in standards such as GB/T 26408-2011, which outlines technical requirements and testing methods for truck-mounted concrete mixers. Compliance with these national standards ensures product quality and safety.

- Japan mandates that mobile concrete mixers comply with the Road Transport Vehicle Act, which sets standards for vehicle safety, dimensions, and emissions. The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) oversees these regulations, ensuring that construction vehicles meet national safety and environmental criteria.

- In India, the Bureau of Indian Standards (BIS) has established IS 4926:2003, a code of practice for ready-mixed concrete, detailing production and supply requirements. The BIS also offers certification for RMC plants to ensure adherence to quality standards.

Competitive Landscape:

Market players are increasingly focusing on the development of compact and highly maneuverable mobile concrete mixers to address evolving job-site requirements. This strategic shift aligns with the growing demand for equipment that can operate efficiently in space-constrained environments such as residential zones and urban infrastructure projects.

Manufacturers are enhancing operational flexibility, fuel efficiency, and ease of access by prioritizing reduced vehicle footprints without compromising performance. These advancements are directly contributing to the growth of the mobile concrete mixer market, particularly in regions where construction activity is intensifying in densely populated or developing areas.

- In January 2025, ADVANCE unveiled its latest Challenger front discharge mixer at World of Concrete 2025. Designed to offer a compact, highly maneuverable solution for contractors and ready-mix producers, the Challenger delivers strong performance in a smaller footprint. This streamlined design enhances fuel efficiency, reduces wear on roads and streets, and operates with significantly lower noise levels. Tailored for work in residential areas, developing sites, and dense urban settings, the Challenger sets a new standard for concrete delivery efficient, quiet, and built for challenging environments.

List of Key Companies in Mobile Concrete Mixer Market:

- Cemen Tech Inc.

- Zimmerman Industries, Inc.

- Utranazz

- Terex Corporation

- Bay Lynx Manufacturing Inc.

- Omega Concrete Mixers

- SCHWING GmbH

- Sany Heavy Industry Co., Ltd.

- XCMG Group

- Schwing GmbH

- Acme Concrete Mixers Pvt Ltd.

- Liebherr Group

- McNeilus Truck and Manufacturing

- Volumetric Mixers by Strong Inc.

Recent Developments (Expansion/Product Launch)

- In January 2025 2024, Bay-Lynx expanded its UK operations with the launch of a second facility in Basingstoke, aimed at meeting the rising demand across southern England. The new location is equipped to provide faster turnaround for parts, repairs, and maintenance support. Bay-Lynx Manufacturing UK has built a strong reputation for delivering high-quality volumetric concrete mixers along with reliable parts and service solutions.

- In October 2024, Cemex expanded its global fleet with the addition of new electric concrete mixers. Engineered for full-load capacity and capable of operating throughout an entire workday, these mixers highlight a design that is both efficient and scalable, supporting Cemex’s broader sustainability and innovation goals in concrete delivery.

- In April 2024, SCHWING Group introduced a hybrid system for electric concrete placement, showcasing the innovation through its well-known S 43 SX truck-mounted concrete pump. The SCHWING hybrid concept places a strong emphasis on operational efficiency. Featuring an entirely redesigned drive architecture and a reengineered vehicle body structure, the S 43 SX hybrid integrates advanced electric drive technology, marking a significant step toward sustainable and energy-efficient concrete pumping solutions.