Market Definition

The market focuses on developing and selling advanced electric drive systems for electric vehicles (EVs). These systems integrate smart technologies, including sensors and AI, to improve energy efficiency, performance, and driving experience. Market growth is driven by the growing demand for electric vehicles and the need for sustainable, high-performance mobility solutions.

Smart E Drive Market Overview

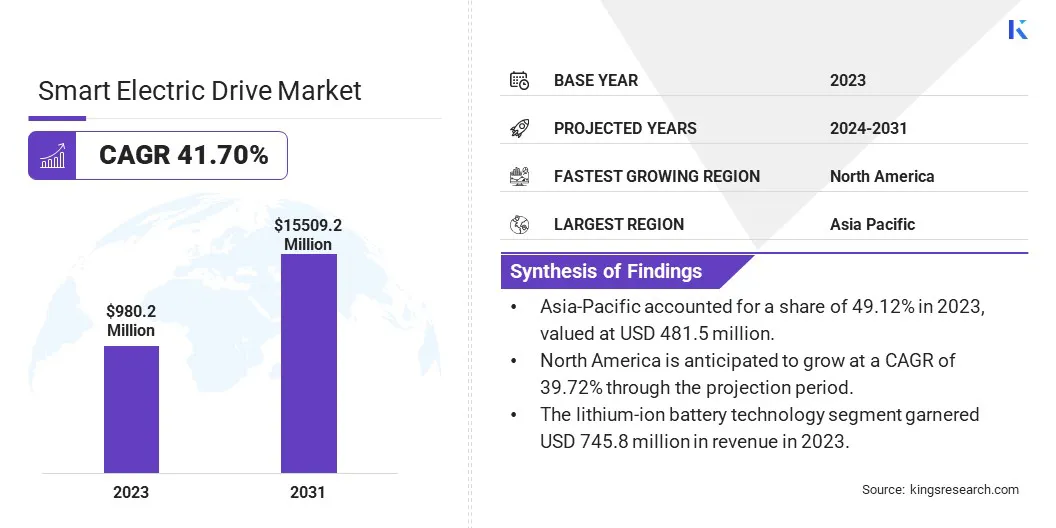

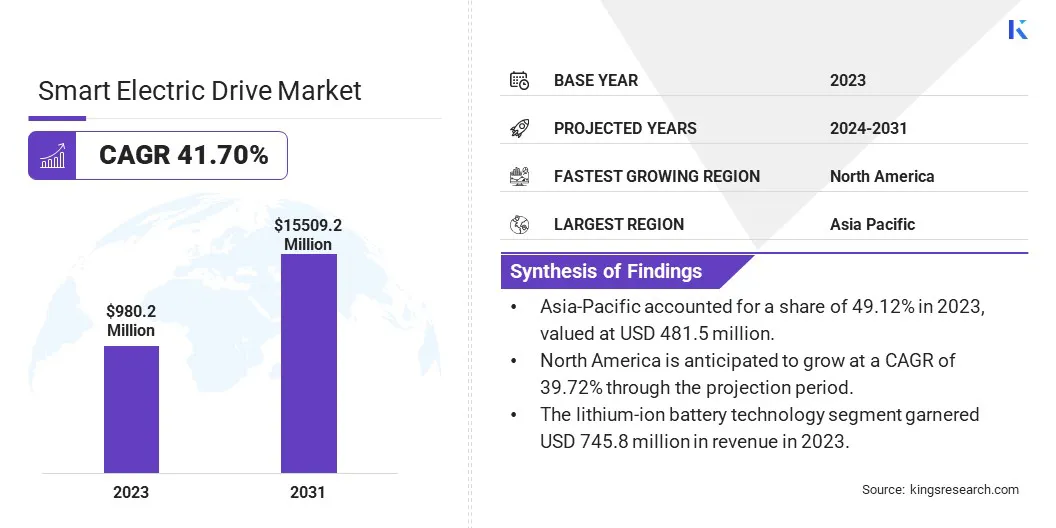

Global smart e drive market size was USD 980.2 million in 2023, which is estimated to be valued at USD 1,351.8 million in 2024 and reach USD 15,509.2 million by 2031, growing at a CAGR of 41.70% from 2024 to 2031. This growth is mainly fueled by the increasing demand for electric vehicles (EVs).

As more consumers and governments prioritize sustainability and lower emissions, automakers are investing in advanced, energy-efficient electric drive systems to meet these demands.

Major companies operating in the smart e drive industry are NIDEC CORPORATION, AISIN CORPORATION, BorgWarner Inc., Robert Bosch GmbH, ZF Friedrichshafen AG, Allison Transmission, Inc., Dana Limited, GKN Automotive Limited, SAMSUNG SDI, LG Magna e-Powertrain Co., Ltd, Magna International Inc., MAHLE GmbH, MEIDENSHA CORPORATION, Cummins Inc., Smesh B.V, and others.

The market is evolving rapidly, supported by advancements in electric vehicle technology. It encompasses a variety of innovative solutions that integrate electric motors, inverters, and intelligent software to improve vehicle efficiency, performance, and sustainability.

With increasing demand for environmentally friendly transportation, companies are investing in more compact, energy-efficient drive systems. Intense competition among global players reflects the growing consumer and regulatory focus on smarter, greener mobility solutions.

- In January 2024, Magna International unveiled its next-generation 800V eDrive solution at CES, showcasing a lightweight and compact design that enhances efficiency and power. The eDrive offers a 20% reduction in height compared to previous generations and features a unique 90-degree rotation capability for better system integration. With a peak power of 250 kW and an efficiency of up to 93%, it advances sustainability and innovation in the automotive sector.

Key Highlights:

- The smart e drive industry size was recorded at USD 980.2 million in 2023.

- The market is projected to grow at a CAGR of 41.70% from 2024 to 2031.

- Asia-Pacific accounted for a share of 49.12% in 2023, valued at USD 481.5 million.

- The lithium-ion battery technology segment garnered USD 745.8 million in revenue in 2023.

- The battery segment is expected to reach USD 7,109.8 million by 2031.

- The front-wheel drive (FWD) segment held a share of 44.09% in 2023.

- The off-highway vehicles segment is anticipated to witness a CAGR of 43.46% over the forecast period.

- North America is anticipated to grow at a CAGR of 39.72% through the projection period.

Market Driver

“Rising demand for Electric Vehicles (EVs)”

The rising demand for electric vehicles (EVs) is contributing significantly to the growth of the smart e drive market.

- According to the International Energy Agency (IEA), electric vehicle (EV) sales reached nearly 14 million units in 2023, accounting for approximately 18.5% of total global vehicle sales.

As consumers place greater emphasis on sustainability and reducing their carbon footprint, there is a significant shift toward eco-friendly transportation options. This growing interest in EVs is prompting automakers to invest in advanced electric drive systems that offer higher efficiency, enhanced performance, and extended driving ranges, fueling the demand for smarter, more efficient e-drive solutions in the automotive industry.

- In November 2024, XPENG unveiled its P7+, the world’s first AI-defined vehicle, highlighting advancements in smart driving, energy efficiency, and safety. With superior energy efficiency and a focus on sustainability, the P7+ reflects the growing consumer demand for eco-friendly, high-performance electric vehicles, supporting the adoption of smart e-drive solutions.

Market Challenge

“High Production Costs”

A key challenge hindering the growth of the smart e drive market is the high production cost, driven by the use of expensive materials and complex manufacturing processes. This results in higher overall vehicle prices.

To address this, manufacturers are working on optimizing designs, reducing dependence on costly materials, and improving production efficiency. These efforts aim to lower costs, making advanced e-drive systems more cost-effective, which in turn encourages broader adoption of electric vehicles and enhances market growth potential.

Market Trend

“Integration of AI and Machine Learning”

A key trend influencing the smart e drive market is the integration of AI and machine learning to enhance the performance and efficiency of electric drive systems. AI algorithms are used to optimize energy consumption, adjust driving behavior in real-time, and improve vehicle adaptability to varying road conditions.

This enables smarter decision-making within the system, enhancing the driving experience and extending the vehicle’s range. AI-driven e-drives offer more personalized and efficient mobility solutions, meeting the growing demand for advanced EV technologies.

- In November 2024, XPENG unveiled the Kunpeng Super Electric System and Turing AI Intelligent Driving System, marking a major advancement in AI-driven mobility. These innovations enhance energy efficiency, accelerate charging, and improve driving capabilities, supporting the trend of AI adoption in smart e-drives for improved performance and adaptability.

Smart E Drive Market Report Snapshot

|

Segmentation

|

Details

|

|

By Battery Type

|

Lithium-Ion Battery, Nickel-Based Battery, Solid-State Battery, Other

|

|

By Component

|

Battery, Electric Motor, Inverter, E-Brake Booster, Power Electronics

|

|

By Drive Type

|

Front-Wheel Drive (FWD), Rear-Wheel Drive (RWD), All-Wheel Drive (AWD)

|

|

By Application

|

Passenger Vehicles, Commercial Vehicles, Off-Highway Vehicles

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Battery Type (Lithium-Ion Battery, Nickel-Based Battery, Solid-State Battery, and Other): The lithium-ion battery segment earned USD 745.8 million in 2023, mainly due to its high energy density, cost-effectiveness, and widespread adoption in electric vehicles.

- By Component (Battery, Electric Motor, Inverter, E-Brake Booster, and Power Electronics): The battery segment held a share of 44.00% in 2023, largely attributed to its critical role in energy storage, range, and overall vehicle performance.

- By Drive Type [Front-Wheel Drive (FWD), Rear-Wheel Drive (RWD), and All-Wheel Drive (AWD)]: The front-wheel drive (FWD) segment is projected to reach USD 7,000.1 million by 2031, owing to its cost-efficiency, better traction, and suitability for urban electric vehicles.

- By Application (Passenger Vehicles, Commercial Vehicles, and Off-Highway Vehicles): The off-highway vehicles segment is anticipated to grow at a staggering CAGR of 43.46% over the forecast period, largely fueled by increased demand for electric-powered machinery and vehicles in construction and agriculture.

Smart E Drive Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific smart e drive market captured a substantial share of around 49.12% in 2023, valued at USD 481.5 million. This dominance is reinforced by continual advancements in electric vehicle (EV) technology, particularly in countries such as China, Japan, and South Korea, where strong government support, large-scale production facilities, and a growing consumer base accelerate EV adoption.

Additionally, the presence of major manufacturers enhances the availability of advanced e-drive solutions.

- In December 2024, Honeywell was selected by Exide Energy to provide building automation solutions for its lithium-ion gigafactory in India. This collaboration aims to enhance operational efficiency, safety, and energy savings at the facility, supporting the country’s electric mobility growth.

North America smart e drive industry is set to grow at a robust CAGR of 39.72% over the forecast period. This rapid expansion is fueled by increasing adoption of electric vehicles and supportive regulatory policies.

The U.S. and Canada are investing heavily in EV infrastructure, manufacturing, and technology development. With rising consumer demand for eco-friendly vehicles and stricter emissions regulations, automakers in North America are shifting toward smart e-drive solutions. This shift is expected to contribute significantly to regional market growth in the foreseeable future.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates environmental policies, conducts research, and mitigates health risks.

- In the EU, the revised Clean Vehicles Directive mandates clean mobility solutions in public procurement, boosting demand for low- and zero-emission vehicles.

- The FAME II Scheme (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) in India provides financial incentives for electric vehicle adoption to reduce pollution and promote clean energy in transportation.

Competitive Landscape

In the smart e drive market, companies are increasingly forming strategic partnerships to enhance their technological capabilities and market reach. These collaborations often focus on advancing electric powertrains, improving battery efficiency, and integrating innovative features such as AI-driven systems.

By combining expertise in various areas, these partnerships enable faster development, greater innovation, and stronger market positioning within the growing electric vehicle industry.

- In October 2024, Yamaha Motor partnered with Caterham EVo Limited to develop the 'Project V' electric sports coupe. Yamaha will provide the e-axle for the prototype, leveraging its expertise in lightweight electric powertrains. This collaboration aligns with Yamaha's goal to achieve carbon neutrality by 2050.

List of Key Companies in Smart E Drive Market:

- NIDEC CORPORATION

- AISIN CORPORATION

- BorgWarner Inc.

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Allison Transmission, Inc.

- Dana Limited

- GKN Automotive Limited

- SAMSUNG SDI

- LG Magna e-Powertrain Co., Ltd

- Magna International Inc.

- MAHLE GmbH

- MEIDENSHA CORPORATION

- Cummins Inc.,

- Smesh B.V

Recent Developments (Partnership)

- In Oct 2024, Ashok Leyland partnered with Nidec to develop innovative e drive motors for India's commercial vehicle market. This collaboration focuses on advanced motor technologies, power electronics systems, and building a strong local supply chain for electric vehicles, driving sustainable mobility solutions.

- In August 2023, BorgWarner commences the supply of its integrated drive module (iDM220) to Li Auto for new energy vehicles. This marks BorgWarner's first iDM business in China, equipping Li Auto's L8 and L9 models with advanced electric drive systems to enhance performance and sustainability.