Market Definition

Microbiological testing of water detects and quantifies microorganisms, such as bacteria, viruses, and protozoa, to assess water quality and safety. It helps identify contaminants and harmful microorganisms through methods like culture-based techniques, molecular assays (PCR), biochemical tests, and immunological methods (ELISA).

The market involves the development and use of these methods and tools for various applications, including drinking water, recreational water, and industrial water testing.

Microbiological Testing of Water Market Overview

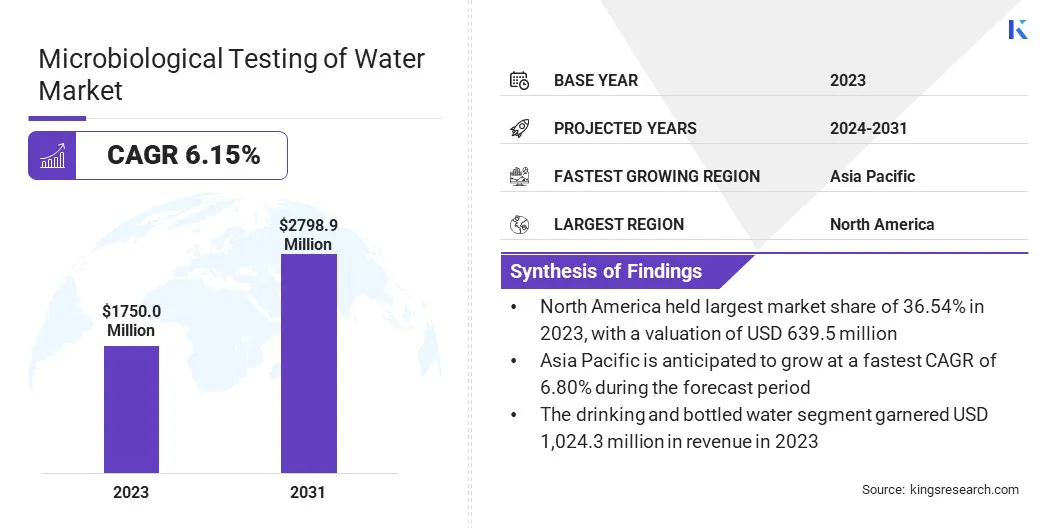

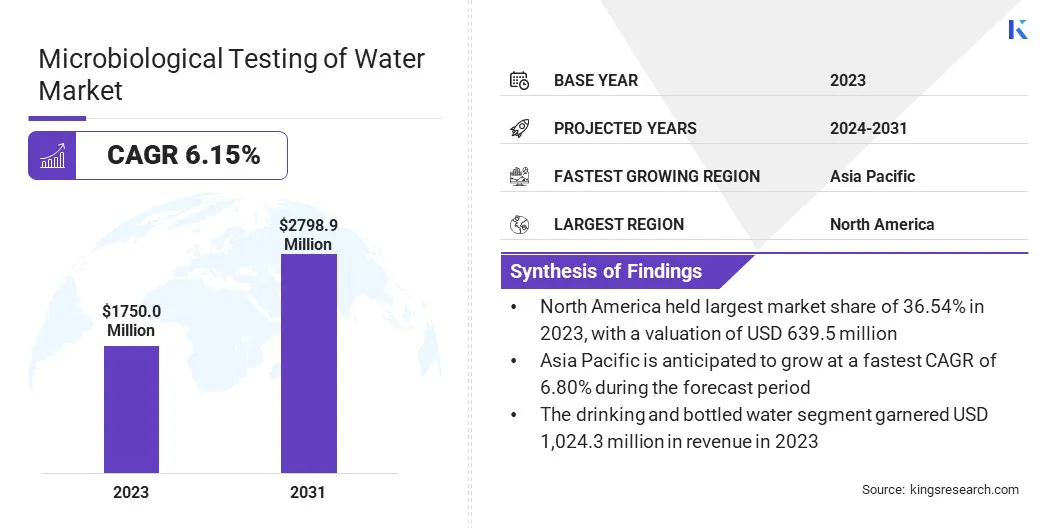

The global microbiological testing of water market size was valued at USD 1,750.0 million in 2023 and is projected to grow from USD 1,843.6 million in 2024 to USD 2,798.9 million by 2031, exhibiting a CAGR of 6.15% during the forecast period.

The market is registering significant growth, due to rising concerns about waterborne diseases and increasing awareness of water quality and safety.

The expansion of industrial and municipal water treatment facilities, along with stringent government regulations and standards for drinking and wastewater quality, is driving the demand for advanced microbiological testing solutions. Technological advancements, such as rapid detection methods and automation in testing procedures, are further accelerating market expansion.

Major companies operating in the microbiological testing of water industry are Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., DH Life Sciences, LLC, Merck KGaA, 3M Company, Döhler GmbH, Agilent Technologies, Inc., SHIMADZU CORPORATION, PerkinElmer Inc., IDEXX, VWR International, LLC, Hardy Diagnostics, rqmicro AG, LaMotte Company, and Accepta Water Treatment.

Additionally, growing investments in environmental monitoring, increasing adoption of point-of-use testing kits, and the rise in water contamination incidents globally are contributing to the market's upward trajectory. The expansion of industries such as food & beverage, pharmaceuticals, and healthcare, which require high-quality water testing, is also fueling the market.

- In August 2024, researchers at the University of Galway developed a portable water testing device that detects Shiga toxigenic E. coli within 40 minutes using isothermal amplification technology. The innovation aims to improve on-site water quality monitoring, especially after extreme weather.

Key Highlights:

- The microbiological testing of water industry size was valued at USD 1,750.0 million in 2023.

- The market is projected to grow at a CAGR of 6.15% from 2024 to 2031.

- North America held a market share of 36.54% in 2023, with a valuation of USD 639.45 million.

- The instruments segment garnered USD 989.3 million in revenue in 2023.

- The bacteria segment is expected to reach USD 1,178.1 million by 2031.

- The drinking and bottled water segment is expected to reach USD 1726.5 million by 2031.

- The Food and Beverage (F&B) segment is expected to reach USD 1,139.1 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.80% during the forecast period.

Market Driver

"Growing Regulatory Standards and Rising Health Concerns"

The microbiological testing of water market is registering significant growth, driven by stringent regulatory standards for water safety and the rising incidences of waterborne diseases. Governments and regulatory bodies have implemented strict guidelines mandating regular testing for microbial contaminants like E. coli, coliform bacteria, and viruses to ensure public health safety.

Compliance with these regulations has led to the increased adoption of advanced microbiological testing solutions across municipal water systems, industries, and healthcare facilities. Additionally, the growing prevalence of waterborne diseases such as cholera, dysentery, and giardiasis has heightened public awareness and demand for frequent water testing.

Contaminated drinking water remains a major global health concern, prompting governments and private organizations to invest in enhanced microbiological monitoring systems to detect pathogens early and prevent outbreaks.

- In 2024, Dubai Central Laboratory, affiliated with Dubai Municipality, implemented AI-based technology to rapidly detect Legionella bacteria in water samples, reducing detection time from 14 days to 48 hours with 99% accuracy, enhancing public health and safety.

Market Challenge

"Cost Barriers and Infrastructure Gaps in Microbiological Water Testing"

The microbiological testing of water market faces several challenges, including high testing costs and limited accessibility to advanced testing methods in remote areas. The cost of sophisticated microbiological testing equipment and laboratory analysis remains a major barrier, particularly for small-scale water treatment plants and municipalities in developing regions.

Advanced testing methods require expensive instruments, skilled personnel, and well-equipped laboratories, making them financially unfeasible for many local water authorities and private well owners. Additionally, the recurring costs of consumables, reagents, and maintenance further strain budgets, limiting the frequency of testing and increasing the risk of undetected microbial contamination.

This challenge can be addressed by promoting cost-effective portable testing kits and increasing government subsidies for water quality monitoring programs.

Another significant challenge is the lack of infrastructure and expertise in remote and underdeveloped areas, which leads to delayed or infrequent water testing, increasing the risk of undetected contamination. Many rural and isolated regions lack properly equipped laboratories, trained personnel, and efficient transportation systems to facilitate timely and accurate microbiological testing.

In such areas, water samples must often be transported over long distances to centralized testing facilities, causing delays in obtaining results and making it difficult to take immediate corrective actions in case of contamination.

Governments and private organizations are investing in mobile testing units and digital solutions such as AI-powered water quality monitoring systems, enabling real-time data collection and faster responses to potential contamination threats.

- In May 2024, UNICEF provided water testing equipment to the Ministry of Health in 13 municipalities of Timor-Leste, enabling faster detection of contaminated water. 28 environmental health officers were trained to use the portable kits, reducing testing time from 1–3 months to 24 hours. Initial tests in Covalima Municipality found high levels of contamination, prompting immediate community awareness efforts.

Market Trend

"Advancements in Technology and Automation in Microbiological Water Testing"

The microbiological testing of water market is evolving with key trends such as the adoption of advanced rapid testing methods and the integration of digital water testing solutions.

Traditional culture-based methods are being replaced by rapid microbial detection technologies, such as polymerase chain reaction (PCR) and enzyme-linked immunosorbent assay (ELISA), which provide faster and more accurate results. This shift is driven by the need for real-time monitoring and early pathogen detection to ensure water safety.

Additionally, the integration of digital solutions, including Internet of Things (IoT)-enabled sensors and cloud-based data management systems, is transforming water quality monitoring. These smart technologies enable continuous tracking, remote access to test results, and automated reporting, enhancing efficiency and compliance with regulatory standards.

The demand for innovative, data-driven microbiological testing solutions is expected to grow significantly as water contamination risks increase.

- In October 2024, METTLER TOLEDO and MACHEREY-NAGEL announced a strategic partnership to enhance water testing by integrating the EasyPlus UV/VIS spectrophotometer with NANOCOLOR test kits, offering precise, user-friendly, and cost-effective water analysis solutions.

Microbiological testing of water Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Instruments, Test Kits and Reagents

|

|

By Pathogen Type

|

Bacteria, Viruses, Protozoa, Fungi

|

|

By Water Type

|

Drinking and bottled water, Industrial water

|

|

By Industry

|

Food and Beverage (F&B), Pharmaceutical and Biotechnology, Hospitals and Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Instruments, Test Kits and Reagents): The instruments segment earned USD 989.3 million in 2023, due to the increasing adoption of advanced analytical devices for accurate and rapid water testing.

- By Pathogen Type (Bacteria, Viruses, Protozoa, Fungi): The bacteria segment held 39.55% share of the market in 2023, due to the high prevalence of bacterial contamination in water sources and stringent regulatory monitoring.

- By Water Type (Drinking and bottled water, Industrial water): The drinking and bottled water segment is projected to reach USD 1,726.5 million by 2031, owing to the rising consumer demand for safe and high-quality drinking water.

- By Industry (Food and Beverage (F&B), Pharmaceutical and Biotechnology, Hospitals and Healthcare, Others): The Food and Beverage (F&B) segment is projected to reach USD 1,139.1 million by 2031, owing to the industry's strict hygiene regulations and the need for contamination-free water in production processes.

Microbiological testing of water Market Regional Analysis

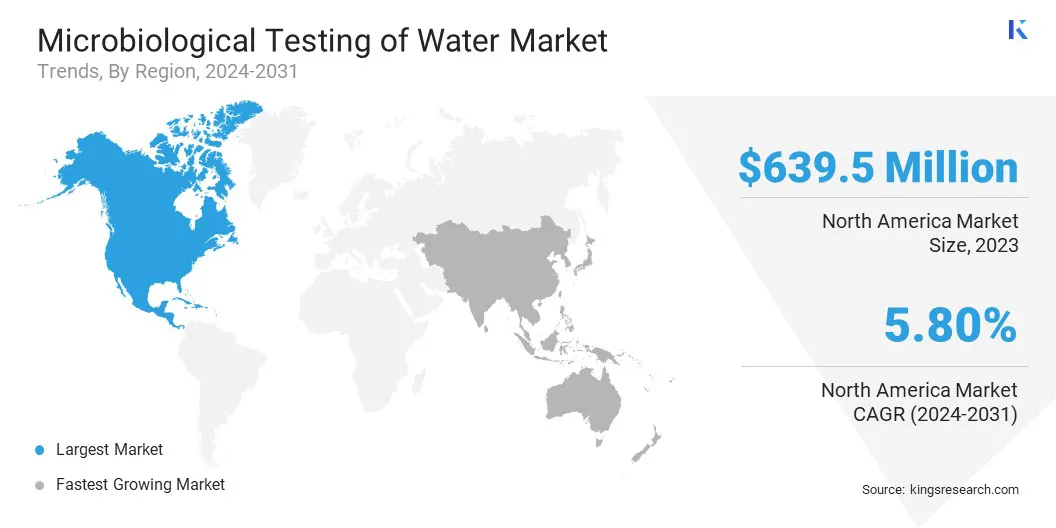

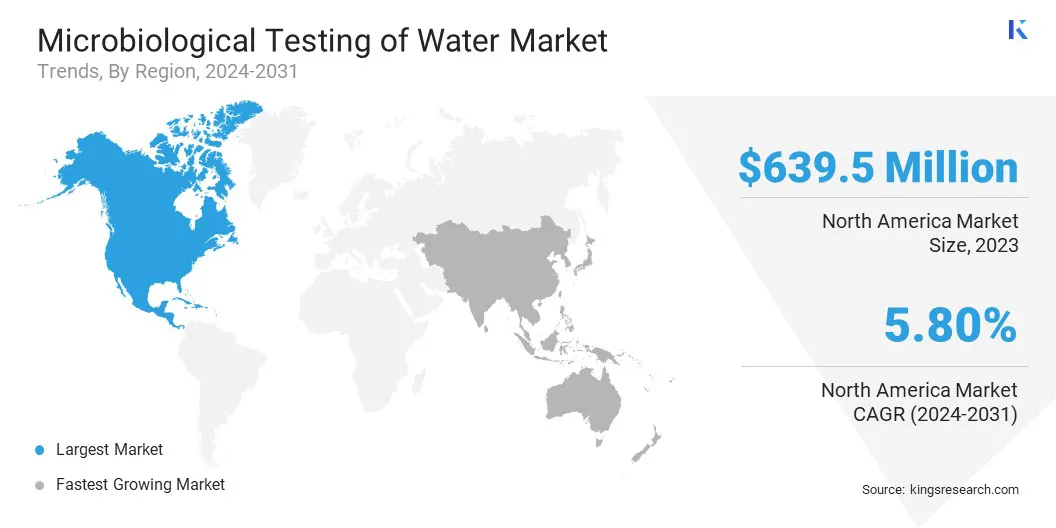

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a substantial share of 36.54% in 2023 in the microbiological testing of water market, with a valuation of USD 639.5 million. The region's dominance is driven by stringent water quality regulations, advanced testing technologies, and the presence of key market players.

The growing emphasis on environmental monitoring, coupled with high awareness regarding waterborne diseases, continues to support market expansion in the region.

The growing concerns over emerging contaminants, such as antibiotic-resistant bacteria and harmful algal blooms, have led to increased funding for research and development in microbiological water testing.

Additionally, significant investments in water treatment infrastructure and the increasing adoption of rapid microbiological testing methods across industries such as food and beverage, healthcare, and pharmaceuticals further contribute to market growth.

- In October 2024, the U.S. Environmental Protection Agency (EPA) deployed mobile water testing laboratories to Western North Carolina to assist communities affected by Hurricane Helene. The initiative, in coordination with state and local agencies, aims to test drinking water for contaminants such as E. coli and total coliform. The mobile labs can process up to 100 samples per day, ensuring rapid assessment of water safety.

Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 6.80% over the forecast period. The rapid expansion of the microbiological testing of water industry in Asia Pacific is also driven by increasing regulatory enforcement and the implementation of stringent water safety guidelines by regional governments.

Organizations such as the World Health Organization (WHO) and local regulatory bodies are actively promoting the adoption of advanced water testing techniques to mitigate risks associated with microbial contamination.

The rising incidence of waterborne diseases, coupled with growing public awareness regarding health and hygiene, has further accelerated the demand for routine water quality testing in both urban and rural areas. Moreover, rapid industrialization has led to increased wastewater discharge, necessitating strict monitoring and treatment to prevent environmental pollution.

In addition, the increasing penetration of multinational companies in the region has facilitated the adoption of high-quality testing equipment and methodologies, aligning with global safety standards.

Regulatory Framework

- In the U.S., the Environmental Protection Agency (EPA) is the regulatory authority for microbiological testing of water. The EPA sets standards and monitors water systems to ensure safe drinking water.

- In Europe, the European Union (EU) Drinking Water Directive and the European Food Safety Authority (EFSA) are the main regulatory authorities for microbiological water testing

- In China, the National Health Commission (NHC) and the Ministry of Ecology and Environment (MEE) enforce microbial water quality standards under Standards for Drinking Water Quality, which mandates regular testing for pathogens.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) sets microbiological water quality standards under the Water Supply Act, requiring strict testing for bacteria, virus, and other microbial contaminants. The Japan Water Works Association (JWWA) provides additional guidelines to maintain safety and hygiene in public water supply systems.

- In India, the regulatory authority responsible for setting standards and overseeing microbiological testing of water is the Bureau of Indian Standards (BIS), which publishes standards that specify the parameters for safe drinking water, including microbiological testing criteria like coliform bacteria levels.

Competitive Landscape

The microbiological testing of water industry is characterized by a large number of participants, including both established corporations and rising organizations . These market players compete based on technological innovation, regulatory compliance, product quality, and pricing strategies.

Established companies leverage their strong brand presence, extensive distribution networks, and advanced research and development capabilities to maintain a competitive edge, while emerging players focus on cost-effective solutions and technological advancements to gain market traction.

The market is registering an influx of new entrants offering rapid and portable testing solutions, intensifying competition and driving further innovation.

Market participants are also engaging in strategic partnerships, mergers, and acquisitions to expand their geographic presence and technological capabilities. Collaborations with government agencies, research institutions, and water treatment facilities are becoming increasingly common, enabling companies to gain a competitive advantage through knowledge-sharing and regulatory alignment.

- In September 2024, LuminUltra acquired Genomadix’s Legionella testing business, expanding its rapid qPCR solutions for water systems. The Genomadix Cube enables on-site Legionella detection within an hour, enhancing LuminUltra’s microbial monitoring capabilities.

List of Key Companies in Microbiological testing of water Market:

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- DH Life Sciences, LLC

- Merck KGaA

- 3M Company

- Döhler GmbH

- Agilent Technologies, Inc.

- SHIMADZU CORPORATION

- PerkinElmer Inc.

- IDEXX

- VWR International, LLC

- Hardy Diagnostics

- rqmicro AG

- LaMotte Company

- Accepta Water Treatment

Recent Developments (Expansion/New Product Launch)

- In January 2025, DIAMIDEX introduced MICA Advance, an innovative microbiological water testing solution designed for rapid and accurate detection of Legionella pneumophila. This advanced system utilizes microbial tagging, optics, and machine learning to identify and quantify all culturable serogroups within 48 hours, significantly reducing the traditional 7-10 day incubation period required by ISO standards.

- In July 2024, Alpha Scientific, a water testing specialist under ADEY Group, relocated its UKAS-accredited microbiological water testing laboratory to Hexagon Tower, Manchester. This expansion enhances its ability to provide high-quality microbiological water testing services across the UK, ensuring fast, reliable, and accurate data for water quality assurance.