Water Treatment Chemicals Market Size

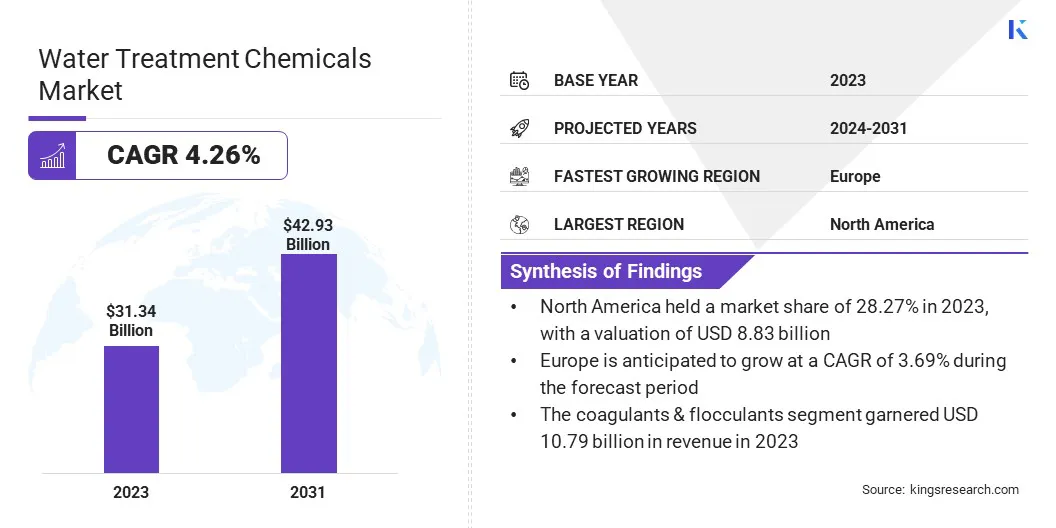

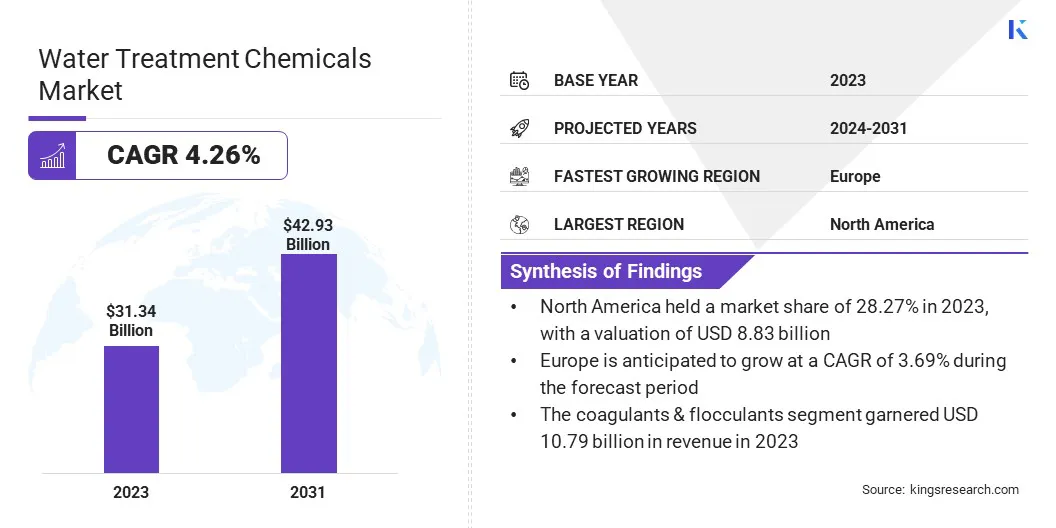

The global Water Treatment Chemicals Market size was valued at USD 31.24 billion in 2023 and is projected to reach USD 42.93 billion by 2031, growing at a CAGR of 4.26% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Dow, Ecolab, Veolia, Evoqua Water Technologies LLC, Buckman, Kemira, Solenis, LANXESS, BASF SE, SUEZ, and others.

The market has experienced significant growth, mainly propelled by advancements in water treatment technologies and an increasing focus on recycling of water. Technological innovations have enabled the development of more efficient and sustainable water treatment solutions, thus fostering the adoption of water treatment chemicals across various industries and regions.

Factors such as increasing water pollution levels, stringent government regulations regarding wastewater treatment, and growing awareness of the importance of clean water have spurred the demand for advanced water treatment chemicals. Moreover, the emergence of novel treatment processes, such as membrane filtration, UV disinfection, and advanced oxidation, has created new opportunities for chemical manufacturers to introduce specialized products tailored to specific applications.

- Furthermore, the integration of digitalization and automation in water treatment systems has enhanced operational efficiency and reduced chemical consumption, thereby driving market growth.

Key players in the industry are investing heavily in research and development to introduce innovative formulations with improved efficacy and environmental sustainability, thus reshaping the competitive landscape. As governments and industries worldwide prioritize water conservation and environmental protection, the market for water treatment chemicals is poised to experience robust expansion, fueled by ongoing technological advancements and regulatory initiatives.

The water treatment chemicals market encompasses the production, distribution, and sale of chemical compounds used to treat and purify water for various industrial, municipal, and residential applications. These chemicals are essential for maintaining water quality, ensuring compliance with regulatory standards, and mitigating the adverse effects of contaminants.

The market includes a diverse range of products, such as coagulants, flocculants, biocides, corrosion inhibitors, and pH adjusters, tailored to specific treatment processes and water quality requirements.

Analyst’s Review

Increasing industrialization, stringent environmental regulations, and escalating water scarcity, are propelling the demand for water treatment facilities, thereby propelling market growth. Key players in the market are implementing various strategic initiatives including investments in R&D to develop eco-friendly formulations, strategic collaborations for technology transfer, and geographical expansion to capitalize on emerging markets.

Moreover, key players are emphasizing on product differentiation through innovation and customization, coupled with efforts to enhance operational efficiency and reduce production costs.

Water Treatment Chemicals Market Growth Factors

The scarcity of freshwater resources, intensified by climate change and population growth, emphasizes the critical importance of efficient water treatment technologies. This has fueled demand for chemicals such as coagulants and flocculants, which are essential for enhancing water recovery and facilitating reuse.

- For instance, advanced coagulant formulations facilitate the removal of suspended particles and contaminants from water, thereby improving its quality for reuse in various industrial and municipal applications.

Additionally, stringent regulations and the imperative of water conservation have prompted industries to implement water reuse practices. This has led to a growing demand for specialized chemicals tailored to industrial wastewater treatment, enabling industries to minimize their reliance on freshwater sources while ensuring compliance with environmental standards. As industries increasingly prioritize sustainability and resource efficiency, the demand for innovative water treatment chemicals is expected to continue to grow.

However, managing byproducts generated by certain water treatment chemicals is presenting a significant challenge to the water treatment chemicals market growth. It is necessitating the development of sustainable and cost-effective solutions for disposal or conversion. Key players are mitigating effective byproduct management strategies to reduce environmental risks and ensure compliance with regulatory standards.

Innovations in waste treatment technologies and the adoption of circular economy principles are offering viable solutions to overcome this challenge, which is facilitating the transformation of hazardous byproducts into valuable resources or non-hazardous materials.

Water Treatment Chemicals Market Trends

A notable shift toward sustainability and efficiency in water treatment practices is increasing the demand for water treatment facilities, thereby propelling market expansion. Environmental regulations and consumer preferences are driving the adoption of green chemistry solutions. This trend is mainly fueled by the increasing demand for bio-based flocculants, biodegradable disinfectants, and low-toxicity corrosion inhibitors.

- For instance, the rising popularity of bio-based flocculants, including chitosan, derived from renewable sources such as crustacean shells, emphasizes the market's commitment to eco-friendly alternatives.

Furthermore, automation and remote monitoring technologies are revolutionizing water treatment processes, leading to greater efficiency and resource optimization. This has spurred the demand for automated chemical dosing systems and real-time data analysis tools, enabling operators to make informed decisions and minimize chemical wastage.

Moreover, the growing adoption of membrane bioreactor (MBR) technology signifies a paradigm shift in wastewater treatment, characterized by higher efficiency and smaller residual footprint on the environment. This trend has created a niche market for specialized chemicals aimed at enhancing membrane performance and prolonging lifespan, thereby optimizing the operation of MBR systems.

Segmentation Analysis

The global market is segmented based on product, end use, and geography.

By Product

Based on product, the water treatment chemicals market is categorized into coagulants & flocculants, biocide & disinfectant, defoamer & defoaming agent, pH adjuster & softener, scale & corrosion inhibitor, and others. The coagulants & flocculants segment garnered the highest revenue of USD 10.79 billion in 2023. This prominence can be attributed to its crucial role in water clarification and solids removal processes across various industries. Coagulants aid in destabilizing colloidal particles, thereby facilitating their aggregation, while flocculants enhance particle settling by promoting larger floc formation.

Additionally, stringent regulations regarding water quality standards worldwide have propelled the demand for effective coagulants and flocculants. Moreover, advancements in polymer chemistry have led to the development of highly efficient and cost-effective coagulant and flocculants formulations, thereby driving the growth of the segment.

By End Use

Based on end use, the market is divided into municipal, power, oil & gas, chemical manufacturing, mining & mineral processing, pulp & paper, food & beverages, and others. The municipal segment captured the largest water treatment chemicals market share of 36.57% in 2023. The pivotal role of municipalities in providing safe and potable water to burgeoning urban populations worldwide is mainly contributing to the dominance of the segment.

Municipalities heavily rely on water treatment chemicals to ensure compliance with stringent regulatory standards and address diverse water quality challenges, including microbial contamination, suspended solids, and chemical pollutants.

Additionally, the growing global urbanization trend and expanding municipal infrastructure projects are fueling the demand for water treatment chemicals. Moreover, the increasing awareness among both authorities and communities regarding the importance of ensuring a clean water supply is underscoring the significance of water treatment chemicals in municipal water treatment processes.

Water Treatment Chemicals Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Water Treatment Chemicals Market share stood around 28.27% in 2023 in the global market, with a valuation of USD 8.83 billion. With aging infrastructure in the U.S., there is a pressing need for rehabilitation solutions. The shale oil and gas boom in North America is driving the demand for water treatment chemicals used in hydraulic fracturing, necessitating environmentally friendly solutions such as biodegradable fracturing fluids to comply with stringent regulations.

Additionally, the growing focus on disinfection byproducts, spurred by EPA regulations, is fostering the demand for alternative disinfection methods such as chlorine dioxide and UV disinfection systems. This is fueling the need for specialized chemicals such as stabilizers for chlorine dioxide and lamp maintenance chemicals for UV systems, reflecting a shift toward sustainable and regulatory-compliant water treatment practices in the region.

Europe is anticipated to witness steady growth at a CAGR of 3.69% over 2024-2031. Stringent water quality regulations set by the European Union (EU) are driving the demand for high-performance water treatment chemicals across municipalities and industries in European countries. Compliance with regulations such as the Urban Wastewater Treatment Directive necessitates the implementation of advanced treatment processes, which is creating a demand for chemicals specifically tailored to facilitate efficient tertiary treatment and water reuse in industrial and agricultural sectors.

Moreover, rising water scarcity concerns in certain regions are fueling the adoption of decentralized water treatment solutions, thereby creating opportunities for compact, pre-filled cartridge-based units with specific chemical formulations. For instance, Southern European regions experiencing water scarcity are witnessing a rise in the adoption of domestic reverse osmosis systems. These systems utilize pre-filled cartridges containing membranes and antiscalants.

Additionally, addressing eutrophication remains a priority, with regulations mandating stricter nutrient removal targets. This is resulting in a strong demand for specialized coagulants and flocculants optimized for efficient nutrient removal, reflecting Europe's commitment to environmental sustainability and water resource management.

Competitive Landscape

The water treatment chemicals market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding service offerings, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Water Treatment Chemicals Market

- Dow

- Ecolab

- Veolia

- Evoqua Water Technologies LLC

- Buckman

- Kemira

- Solenis

- LANXESS

- BASF SE

- SUEZ

Key Industry Development

- November 2023 (Acquisition): Kymera International, a prominent global specialist materials firm, signed an agreement with KDF Fluid Treatment Inc., securing a significant portion of their assets. KDF, headquartered in Three Rivers, Michigan, specializes in delivering sustainable media designed for water and industrial treatment applications. Renowned for its advanced technology in fluid treatment, KDF offers cost-effective solutions with the goal of ensuring the supply of clean water.

The Global Water Treatment Chemicals Market is Segmented as:

By Product

- Coagulants & Flocculants

- Biocide & Disinfectant

- Defoamer & Defoaming Agent

- pH Adjuster & Softener

- Scale & Corrosion Inhibitor

- Others

By End Use

- Municipal

- Power

- Oil & Gas

- Chemical Manufacturing

- Mining & Mineral Processing

- Pulp & Paper

- Food & Beverages

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America