Market Definition

The micro motor market involves the production, distribution, and consumption of small-scale motors, typically ranging from a few millimeters to several centimeters. These low-power motors are integral to applications in electronics, automotive, healthcare, robotics, and consumer products, enabling compact and efficient movement.

Micro Motor Market Overview

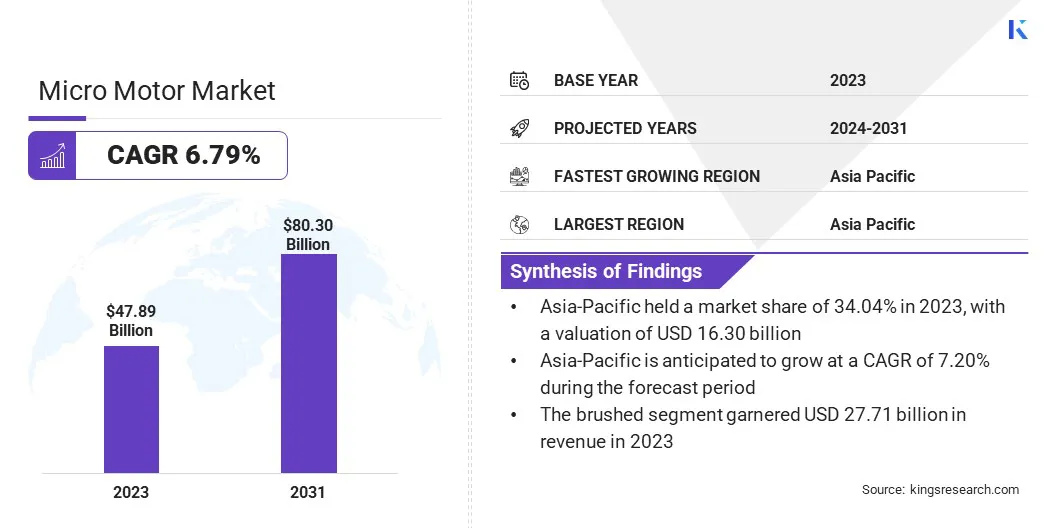

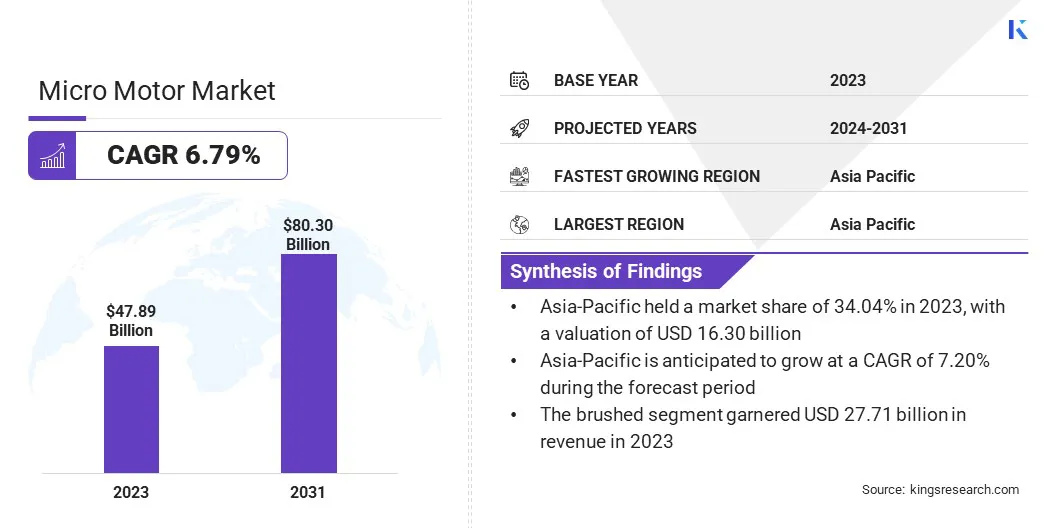

The global micro motor market size was valued at USD 47.89 billion in 2023 and is projected to grow from USD 50.71 billion in 2024 to USD 80.30 billion by 2031, exhibiting a CAGR of 6.79% during the forecast period.

This growth is attributed to a variety of factors, including the rising demand for compact and energy-efficient motors across multiple industries, such as consumer electronics, automotive, healthcare, and robotics. The increasing prevalence of portable devices, wearable technologies, and advancements in automation are driving the expansion of the market.

Major companies operating in the global micro motor industry are Mitsuba Corp, MABUCHI MOTOR CO., LTD., Constar Micromotor Co., Ltd., NIDEC CORPORATION, ABB, FAULHABER GROUP, Johnson Electric Holdings Limited, Ineed Electronics Limited., ARC Systems Inc., Bühler Motor GmbH, DENSO CORPORATION., maxon, Kinetron, Mirmex Motor, and Olimex.

The growing adoption of electric vehicles and innovations in robotics and medical devices are expected to create significant opportunities for micro motor manufacturers. Technological advancements in materials, miniaturization, and integration with smart systems are anticipated to contribute substantially to market growth.

- In February 2024, Microchip Technology launched a new family of dsPIC® Digital Signal Controller (DSC)-based integrated motor drivers, steamlining motor control system design by reducing component count, minimizing PCB size, and lowering complexity.

Key Highlights

- The global micro motor market size was valued at USD 47.89 billion in 2023.

- The market is projected to grow at a CAGR of 6.79% from 2024 to 2031.

- Asia-Pacific held a share of 34.04% in 2023, valued at USD 16.30 billion.

- The DC motor segment garnered USD 27.40 billion in revenue in 2023.

- The brushed segment is expected to reach USD 46.41 billion by 2031.

- The above 48V segment is anticipated to witness the fastest CAGR of 7.00% over the forecast period.

- The automotive segment garnered USD 12.83 billion in revenue in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 7.20% through the projection period.

Market Driver

"Advancements in Technology"

Technological advancements are fueling the growth of the micro motor market, improving motor performance, efficiency, and integration. Innovations in materials, including lightweight composites, and the adoption of brushless motors have improved efficiency, durability, and maintenance requirements.

The integration of advanced control systems and wireless connectivity enhances precision and adaptability across applications, including robotics and medical devices.

Miniaturization and advanced manufacturing techniques, including 3D printing, enable the production of smaller, high-performance motos for modern electronics, automotive systems, and healthcare technologies.

- In November 2023, Portescap introduced the 60ECF brushless DC slotted flat motor, expanding its brushless flat motor portfolio. This 60mm BLDC motor, with a 38.2mm body length and an outer rotor slotted configuration, features an open body design for improved heat management in a compact form.

Market Challenge

"Complexity in Miniaturization"

The complexity in miniaturization poses a significant challenge hampering the growth of the micro motor market as demand for smaller, more efficient motors grows. Balancing size reduction with performance, durability, and efficiency is technically complx.

Smaller components require precise manufacturing and advanced materials to ensure reliability. Additionally, miniaturization increases the risk of overheating and mechanical failure due to limited space for heat dissipation and component protection.

The challenges of miniaturization can be mitigated through the use of advanced materials, precision engineering, and innovative design methods. High-strength, lightweight materials, such as rare-earth magnets, allow for reduced size without compromising performance. Advanced manufacturing techniques such as micro-molding and 3D printing enable the production of smaller, more precise components.

Incorporating enhanced cooling systems and utilizing materials with superior thermal conductivity can effectively manage heat in miniaturized motors. Improvements in power electronics and motor design optimization further ensure that efficiency and torque are maintained despite size reduction.

Market Trend

"Integration with IoT Devices"

The expanding IoT ecosystem is emerging as a notable trend infuelncing the micro motor, as they are increasingly used in connected devices, including smart home systems, wearables , and industrial sensors. These applications require compact, energy-efficient motors that can be seamlessly integrated into devices with wireless capabilities.

The rising demand for high-performance, low-power motors with connectivity features is creating new opportunities for micro motor manufacturers across consumer electronics, healthcare, and industrial automation.

- In November 2024, Faulhaber launched the MC 3602 B and MC 3606 B motion controllers, offering advanced control solutions for precision motion applications. The new MC 3602 B variant is equipped with up to 2 A continuous output current for smaller motors.

Micro Motor Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

AC Motor, DC Motor

|

|

By Technology

|

Brushed, Brushless

|

|

By Power Consumption

|

Less than 11 V, 12–24 V, 25-48 V, Above 48 V

|

|

By Application

|

Automotive, Healthcare, Industrial Automation, Electronics

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (AC Motor and DC Motor): The DC motor segment earned USD 27.40 billion in 2023 due to its widespread adoption in various applications requiring efficient, compact, and reliable power solutions.

- By Technology (Brushed and Brushless): The brushed segment held a substantial share of 57.87% of the market in 2023, fueled by its cost-effectiveness, simplicity in design, and widespread use in low- to mid-range applications.

- By Power Consumption (Less than 11 V, 12–24 V, 25-48 V, and Above 48 V): The 12-24 V segment is projected to reach USD 25.53 billion by 2031, propelled by its versatility and widespread use in consumer electronics, automotive applications, and industrial equipment that require moderate power output.

- By Application (Automotive, Healthcare, Industrial Automation, and Electronics): The electronics segment is anticipated to witness the fastest CAGR of 7.12% over the forecast period, largely attributed to the increasing demand for compact, energy-efficient motors in devices such as smartphones, wearables, and other portable electronic products

Micro Motor Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific micro motor market captured a share of around 34.04% in 2023, valued at USD 16.30 billion. This dominance is reinforced by increasing industrialization, growing automotive sector, and expanding electronics manufacturing in countries such as China, Japan, and South Korea.

Surging demand for consumer electronics, coupled with the rise of electric vehicle production, has further boosted the adoption of micro motors. The increasing focus on automation in manufacturing and robotics is further contributing to regional market growth.

The presence of major micro motor manufacturers, along with favorable government initiatives supporting technological advancements and infrastructure development, strengthens Asia Pacific’s market dominance.

- In January 2025, Hyundai Motor Company and TVS Motor Company began exploring a partnership to analyze and develop last-mile micro mobility solutions for the Indian market. The collaboration aims to address the growing need for efficient, sustainable transportation options in urban areas by leveraging both companies' expertise in mobility innovation.

Europe micro motor industry is likely to grow at a CAGR of 6.81% over the forecast period, supported by increasing demand for advanced automotive technologies, particularly in electric vehicles (EVs) and autonomous driving systems.

The region's strong emphasis on sustainable and energy-efficient solutions is further propelling the adoption of micro motors, particularly in industries like healthcare, robotics, and automation.

The presence of leading automotive manufacturers and a growing focus on smart manufacturing technologies contribute to regional market expansion. Regulatory standards and innovation in renewable energy systems are expected to create new opportunities for micro motor applications, supporting regional market growth.

Regulatory Frameworks

- The RoHS (Restriction of Hazardous Substances) Directive (2011/65/EU), implemented by the European Union, restricts the use of hazardous substances in electrical and electronic equipment to reduce environmental impact and improve recyclability.

- The WEEE Directive (2012/19/EU), implemented by the European Union, regulates the collection, recycling, and disposal of waste electrical and electronic equipment to promote sustainable recycling practices.

- The IEC (International Electrotechnical Commission) sets the IEC 60335-1:2020 standard, which governs the safety of electrical appliances and similar equipment, including small motors used in household appliances and other domestic devices.

- The ISO (International Organization for Standardization) sets the ISO 13485 standard, which outlines the requirements for a quality management system (QMS) specifically for medical device manufacturers.

Competitive Landscape

The global micro motor market is characterized by a number of participants, including both established corporations and emerging players. Large corporations dominate with strong R&D, extensive supply chains, and a focus on high-performance, energy-efficient motors for industries such as automotive, healthcare, and robotics.

Emerging companies are innovating through miniaturization, IoT integration, and cost-effective solutions for niche applications. Strategic partnerships and acquisitions becoming prevalent, as companies seek to expand their product offerings and leverage complementary expertise.

- In July 2023, Nidec Corporation acquired full ownership of TAR, LLC (Houma Armature Works), a privately owned U.S. company. This strategic acquisition is expected to enhance Nidec's capabilities in the motor and armature production sector, strengthening its presence in the North American market.

List of Key Companies in Micro Motor Market:

- Mitsuba Corp

- MABUCHI MOTOR CO., LTD.

- Constar Micromotor Co., Ltd.

- NIDEC CORPORATION

- ABB

- FAULHABER GROUP

- Johnson Electric Holdings Limited

- Ineed Electronics Limited.

- ARC Systems Inc.

- Bühler Motor GmbH

- DENSO CORPORATION.

- maxon

- Kinetron

- Mirmex Motor

- Olimex

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In November 2024, FAULHABER unveiled its new SXR Motor Family, enhancing its DC motor portfolio with higher power output for demanding applications. This advancement sets new standards in performance and versatility for miniature drive systems.

- In July 2024, Micro Motors announced technological enhancem,ents in its DC gearmotors, aimed at enhancing performance and efficiency for a wide range of applications. These innovations include improved gear designs, advanced materials, and enhanced manufacturing processes, resulting inenhance torque, efficiency, and compactness.

- In February 2024, AIR VEV LTD partnered with Nidec Motor Corporation to develop the motor for AIR’s two-seater eVTOL (electric vertical takeoff and landing) aircraft, AIR ONE. This collaboration marks a significant step in advancing consumer eVTOL mass production.