Market Definition

Metal casting is a manufacturing process in which molten metal is poured into a mold cavity and allowed to solidify into a specific shape. The mold, typically made from sand, metal, or ceramic, defines the final form of the cast object. Once the metal cools and hardens, the mold is removed to reveal the finished product.

Metal casting is widely used in industries such as automotive, aerospace, and construction to produce components with complex geometries, high strength, and durability. Common casting methods include sand casting, investment casting, die casting, and centrifugal casting.

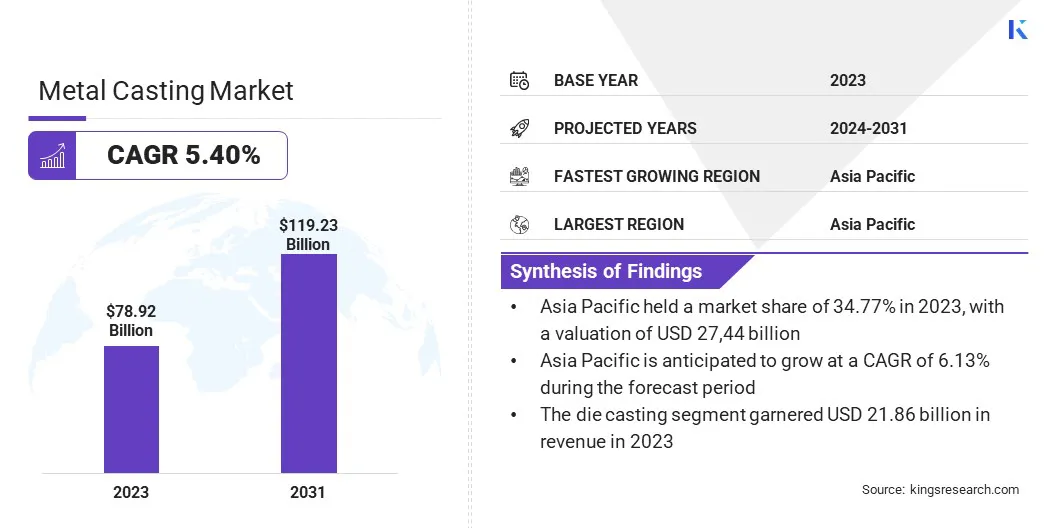

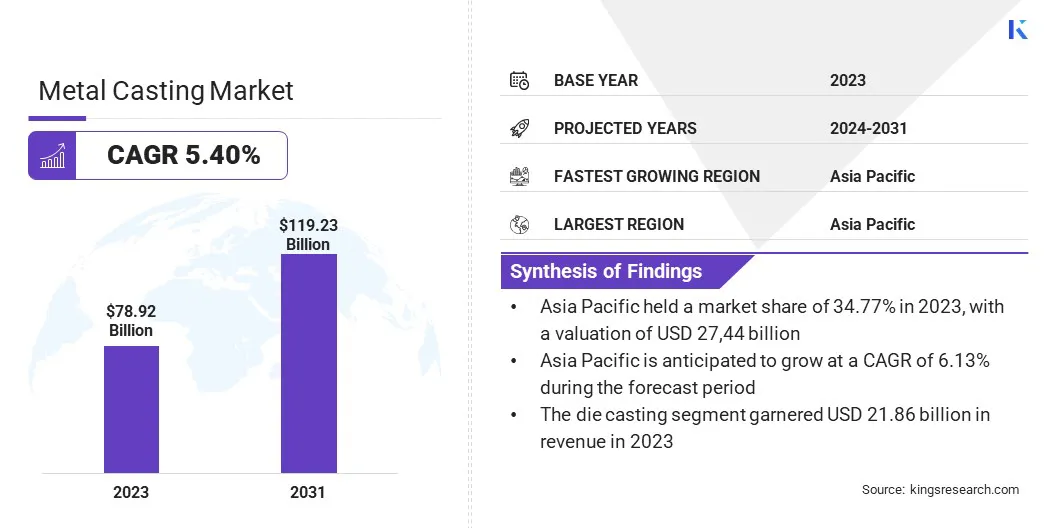

The global metal casting market size was valued at USD 78.92 billion in 2023 and is projected to grow from USD 82.49 billion in 2024 to USD 119.23 billion by 2031, exhibiting a CAGR of 5.40% during the forecast period.

The growth of the market is primarily driven by the increasing demand for lightweight materials in automotive manufacturing, particularly for electric vehicles (EVs). The shift toward EVs requires advanced casting technologies for structural components, prompting investments in facilities and production capacity.

Additionally, the growing infrastructure development in emerging markets, particularly in Asia-Pacific, is fueling demand for high-quality cast products used in construction and industrial applications.

Major companies operating in the metal casting industry are Dynacast, Nemak, Aisin World Corp. of America, Omnidex, MINO Industry USA, Inc, Endurance Technologies Limited, Rheinmetall AG, Ryobi Die Casting (USA), Inc., Arconic, Alcast Technologies Ltd, UNI Abex, GF Casting Solutions, Gibbs, MES, Inc., POSCO, and others.

Rapid urbanization and ongoing infrastructure projects in emerging markets are fueling the demand for metal casting products. Cast metal components are essential in the construction of buildings, bridges, transportation systems, and other infrastructure projects that require durable and high-performance materials.

The ongoing expansion of infrastructure in developing economies, coupled with a growing emphasis on modernizing aging infrastructure in developed regions, is fueling market growth.

- The 2023 National Action Plans (NAPs) on Business and Human Rights report projects the global construction industry to expand by USD 4.5 trillion, reaching USD 15.2 trillion within the next decade. China, India, the US, and Indonesia are expected to account for 58.3% of this projected growth.

Key Highlights:

- The metal casting industry size was recorded at USD 78.92 billion in 2023.

- The market is projected to grow at a CAGR of 5.40% from 2024 to 2031.

- Asia Pacific held a share of 34.77% in 2023, valued at USD 27.44 billion.

- The aluminum segment garnered USD 30.14 billion in revenue in 2023.

- The sand casting is set to grow at a CAGR of 5.87% through the forecast period.

- The manufacturing segment is expected to reach USD 38.37 billion by 2031.

- Europe is anticipated to grow at a CAGR of 5.33% through the projection period.

Market Driver

"Rising Demand in Automotive and Aerospace Industries"

The automotive and aerospace industries are among the largest consumers of metal casting products. The need for lightweight and durable components in these sectors is significantly boosting the growth of the metal casting market.

- The Environmental Defense Fund's report, released in August 2024, projects that by 2027, U.S. electric vehicle manufacturing facilities will reach around 5.8 million units annually, representing 36% of total U.S. vehicles in 2023.

Components such as engine blocks, transmission parts, and turbine blades require precise casting methods to meet strict performance standards. With the increasing focus on fuel efficiency, safety, and reduced emissions, the demand for high-performance cast parts in these industries continues to rise, boosting the growth of the market.

- The U.S. Department of Energy report highlights the significant potential of lightweight materials in enhancing vehicle efficiency. A 10% reduction in vehicle weight can lead to a 6%-8% improvement in fuel economy. By substituting cast iron and conventional steel parts with lightweight materials, the weight of a vehicle's body and chassis could be reduced by up to 50%, thus lowering fuel consumption. Implementing lightweight components and high-efficiency engines, made possible by advanced materials, in just one-quarter of the U.S. fleet could save over 5 billion gallons of fuel annually by 2030.

Market Challenge

"Rising Raw Material Costs and Supply Chain Disruptions"

A significant challenge hindering the growth of the metal casting market is the rising cost of raw materials, particularly metals such as aluminum, steel, and cast iron. These costs are driven by global supply chain disruptions, fluctuating commodity prices, and trade policies.

Key players are adopting various strategies to address this challenge, including diversifying their supply sources, investing in advanced recycling technologies to reduce dependency on raw materials, and optimizing production processes to enhance efficiency.

Additionally, collaboration with suppliers and leveraging digital tools for inventory management helping stabalize cost and ensure a reliable material supply.

Market Trend

"Expansion in Renewable Energy Sector"

The global transition to renewable energy sources is contributing significantly to the growth of the metal casting market. Renewable energy technologies, such as wind turbines and solar energy systems, require high-quality, durable metal components for optimal performance.

For instance, turbine housings, wind tower components, and support structures are commonly produced through metal casting. As countries invest in renewable energy infrastructure to reduce carbon emissions and meet sustainability goals, the demand for cast components in the renewable energy sector is expected to expand.

- The Global Wind Energy Council's 2024 report reveals that the global wind industry reached a significant milestone in 2023, adding a record-breaking 117 GW of new capacity, the highest to date. To align with COP28 targets, the industry is expected to dramatically increase its growth, with annual installations projected to rise from 117 GW in 2023 to a minimum of 320 GW by 2030.

|

Segmentation

|

Details

|

|

By Material

|

Iron, Steel, Aluminum, Others

|

|

By Process

|

Sand Casting, Investment Casting, Die Casting, Gravity Casting, Others

|

|

By Application

|

Automotive & Transportation, Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (Iron, Steel, Aluminum, and Others): The aluminum segment earned USD 30.14 billion in 2023 due to its lightweight properties, cost-effectiveness, and superior strength-to-weight ratio, making it the preferred material for industries such as automotive and aerospace that prioritize efficiency and performance.

- By Process (Sand Casting, Investment Casting, Die Casting, Gravity Casting, and Others): The die casting segment held a share of 27.70% in 2023, largely attributed to its ability to produce high-precision, complex parts at a faster rate and lower cost, making it ideal for high-volume production in industries such as automotive and consumer electronics.

- By Application (Automotive & Transportation, Manufacturing, Building & Construction, and Others): The manufacturing segment is projected to reach USD 38.37 billion by 2031, mainly fueled by its extensive use in producing essential components for industries such as automotive, aerospace, and construction, creating consistent demand and innovation in casting technologies.

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific metal casting market captured a substantial share of around 34.77% in 2023, valued at USD 27.44 billion. The Asia-Pacific region is experiencing rapid industrialization and urbanization, particulalry in countries such as China, India, and Southeast Asia.

This surge in infrastructure development, including the construction of roads, buildings, and transportation networks, significantly boosts the demand for metal casting products. These developments require durable, high-performance metal components, thereby contributing to the expansion of the regional market.

- According to the United Nations Human Settlements Programme, Asia currently houses over 54% of the global urban population, exceeding 2.2 billion people. By 2050, tthis figure is expected to grow by 1.2 billion, representing a 50% increase.

Additionally, Asia-Pacific is the largest producer and consumer of automobiles, with major automotive hubs in China, India, Japan, and South Korea.

The increasing demand for vehicles, particularly electric vehicles (EVs), is highlighting the need for high-quality cast components such as engine blocks, chassis, and transmission parts. As the automotive industry continues to grow in the region, it contributes significantly to market expansion.

Europe metal casting industry is set to grow at a CAGR of 5.33% over the forecast period. Europe is at the forefront of environmental sustainability initiatives, with a strong regulatory framework designed to reduce carbon emissions and promote circular economy practices.

The European Green Deal and carbon neutrality goals have made sustainability a primary focus for the region’s manufacturing industries, including metal casting. The push for energy-efficient production, the adoption of recyclable metal materials, and the use of environmentally friendly casting technologies are becoming integral parts of the industry’s strategy.

As companies strive to meet stringent environmental standards, demand for metal casting solutions that reduce waste, improve energy consumption, and promote sustainable practices is surging.

Regulatory Frameworks:

- In the U.S., the Environmental Protection Agency (EPA) oversees emissions from metal casting facilities, enforcing standards for air quality and hazardous waste management. The Occupational Safety and Health Administration (OSHA) sets workplace safety standards, including those for foundry operations. Additionally, the American Foundry Society (AFS) provides industry-specific guidelines and best practices.

- In Europe, the Industrial Emissions Directive (IED) sets limits on emissions from industrial installations, including foundries. The REACH Regulation addresses the production and use of chemical substances, impacting materials used in casting. The European Agency for Safety and Health at Work (EU-OSHA) provides guidelines for workplace safety.

- In China, the Ministry of Ecology and Environment enforces environmental standards, including emissions from metal casting. The State Administration of Work Safety oversees occupational health and safety regulations in the industry. Moreover, the Air Pollution Prevention and Control Action Plan sets industry-wide emission standards, while the Work Safety Law governs workplace safety.

- In Japan, the Air Pollution Control Act sets emission limits for industries, including the metal casting sector, with an emphasis on reducing particulate emissions and harmful gases. The Industrial Safety and Health Act governs the safety and health of workers in the foundry and metalworking industries. It covers aspects such as personal protective equipment (PPE), ventilation systems, and safe material handling protocols.

- The Environment Protection Act (EPA) regulates industrial emissions in India, including those from foundries and metal casting operations. It mandates the adoption of best practices to reduce environmental impact. The Factories Act governs worker safety in India’s metal casting industry, requiring adequate safety measures, regular training, and access to protective equipment for all workers.

Competitive Landscape

The metal casting industry is characterized by a large number of participants, including both established corporations and emerging players. To accelerate growth and expand market share, leading companies are adopting strategies such as the expansion of operations and significant investments in their facilities.

These strategies enable companies to boost their production capacity, improve efficiency, and meet the increasing demand for high-quality metal cast products.

By expanding their manufacturing plants and upgrading technology, companies can optimize production processes, reduce costs, and enhance product offerings. These initiatives further enable players to cater to new market segments and geographical regions.

This investment in facilities and infrastructure is vital for companies aiming to strengthen their competitive edge and position themselves as industry leaders in a growing market.

- In May 2024, Ryobi Die Casting announced a USD 50 million capital investment program at its aluminum die-casting facility in Irapuato, Mexico. This investment aims to increase capacity in preparation for the growing demand for electric vehicle components. The expansion, slated for completion by April 2025, will add 91,500 square feet of production space, featuring the installation of five new large high-pressure die-casting machines.

List of Key Companies in Metal Casting Market:

- Dynacast

- Nemak

- Aisin World Corp. of America

- Omnidex

- MINO Industry USA, Inc

- Endurance Technologies Limited

- Rheinmetall AG

- Ryobi Die Casting (USA), Inc.

- Arconic

- Alcast Technologies Ltd

- UNI Abex

- GF Casting Solutions

- Gibbs

- MES, Inc.

- POSCO

Recent Developments (Expansion/Agreements)

- In January 2024, Nemak made a USD 18 million investment to expand its Sheboygan facility by 49,500 square feet, emphasizing advancements in lightweight die-casting. As part of this expansion, 35,300 square feet were dedicated to aluminum die-casting, housing two 4,500-ton machines along with their associated equipment.

- In August 2023, Rheinmetall secured a new order in the internal combustion engine sector, validating its "last man standing" strategy. The order involves a 4-cylinder engine block manufactured through a high-pressure die-casting process. Production and pre-machining of the cast parts commenced in autumn 2023 at Rheinmetall’s Neckarsulm plant and will continue for four years.

- In May 2024, GF Casting Solutions committed USD 184 million to its Augusta plant to supply p aluminum structural components for U.S. electric vehicle manufacturers.