Die Casting Market Size

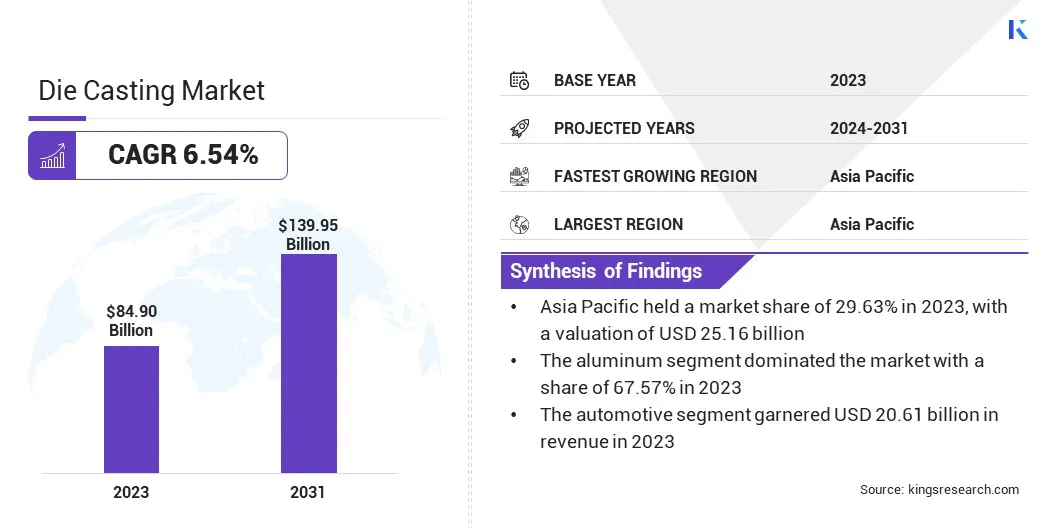

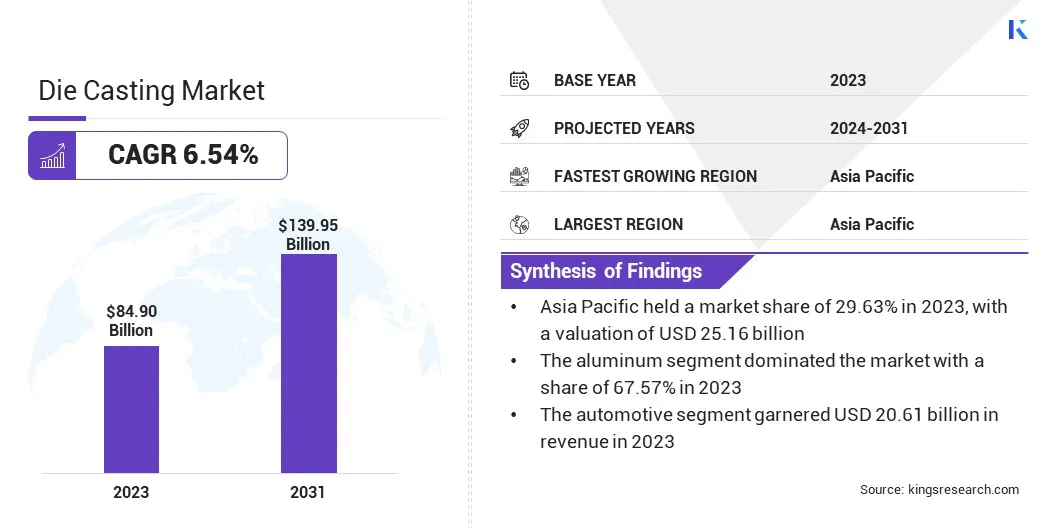

The global Die Casting Market size was valued at USD 84.90 billion in 2023 and is projected to reach USD 139.95 billion by 2031, growing at a CAGR of 6.54% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Linamar Corporation, Sandhar, Alcoa Corporation, Koch Enterprises, Inc., Rheinmetall AG, Dynacast, Foryou Corporation, Endurance Technologies Limited, Aludyne, Oskar Frech GmbH + Co. KG and Others.

The die casting market is currently experiencing significant growth and evolution. With the increasing demand for complex and lightweight metal components across various industries, the market is witnessing a surge in the production and adoption of die casting processes.

Key factors driving this growth include advancements in die casting technology, rising demand for energy-efficient vehicles, and the expanding scope of application of die casting in sectors such as automotive, aerospace, consumer electronics, and industrial machinery.

Furthermore, the market is also influenced by factors like globalization of trade, which has led to the outsourcing of manufacturing activities to regions with lower labor costs, thereby impacting the global landscape of die casting.

Despite challenges such as fluctuating raw material prices and stringent environmental regulations, the die casting market continues to thrive due to its ability to provide high-quality, precise, and cost-effective metal components.

Analyst’s Review

The market is witnessing pivotal growth trends on a substantially increasing utilization of lightweight materials, including aluminum and magnesium, in die casting processes, propelled by the automotive and aerospace industries' increasing focus on fuel efficiency and emissions reduction. This has led to an upsurge in the demand for lightweight components.

Furthermore, advancements in die casting machinery and processes, such as the integration of computer simulations for mold design and optimization, are bolstering the efficiency and precision of die casting operations, thereby contributing to market expansion.

Additionally, the diversification of die casting application areas, extending beyond traditional sectors like medical devices and renewable energy systems, presents major growth prospects for industry players.

Market Definition

Die casting is a metal casting process that involves forcing molten metal into a mold cavity under high pressure. It is commonly used to produce geometrically complex metal parts with high accuracy and surface finish. The key applications of die casting span across various industries, including automotive, aerospace, consumer electronics, industrial machinery, and telecommunications.

In the automotive sector, die casting is utilized for manufacturing engine components, transmission parts, and structural components due to its ability to produce lightweight and durable parts with high tolerances.

Similarly, in the aerospace industry, die casting is employed for producing aircraft components such as engine housings, structural brackets, and interior fittings, where weight reduction and structural integrity are crucial.

What are the major factors affecting the market growth?

The increasing demand for lightweight components in the automotive and aerospace industries is a significant driver shaping the die casting market. In the automotive sector, stringent fuel efficiency regulations and consumer preferences for lighter vehicles have led to a growing demand for lightweight components such as engine blocks, transmission cases, and structural parts.

Die casting, particularly using lightweight materials like aluminum and magnesium, offers a cost-effective solution for producing such components with high strength-to-weight ratios.

Similarly, in the aerospace industry, the emphasis on fuel efficiency and emissions reduction has driven the demand for lightweight components in aircraft design, thereby boosting the adoption of die casting for manufacturing aerospace components like structural frames, brackets, and interior fittings.

This trend towards lightweight in the automotive and aerospace industries is expected to continue driving the growth of the die casting market.

Fluctuating raw material prices impacting profit margins are a significant restraint in the die casting market. The die casting process relies heavily on various metals such as aluminum, zinc, and magnesium as raw materials.

Fluctuations in the prices of these metals, driven by factors such as supply chain disruptions, geopolitical tensions, and changes in demand, can significantly impact the production costs and profit margins of die casting manufacturers.

Moreover, the volatility in raw material prices makes it challenging for manufacturers to accurately forecast production costs and pricing strategies, thereby affecting their competitiveness in the market.

To mitigate the impact of fluctuating raw material prices, die casting companies often employ strategies such as long-term supply contracts, inventory management, and hedging techniques. However, the inherent uncertainty associated with raw material prices remains a key challenge for players in the die casting market.

Segmentation Analysis

The global die casting market is segmented based on raw material, process, end-use, and geography.

What is the market share of Aluminum segment?

Based on raw material, the market is categorized into aluminum, magnesium, and zinc. The aluminum segment dominated the market with a share of 67.57% in 2023 owing to its widespread use in various industries such as automotive, aerospace, consumer electronics, and industrial machinery.

Aluminum die casting offers several advantages, including lightweight, excellent thermal conductivity, and corrosion resistance, making it suitable for a wide range of applications.

Additionally, the growing emphasis on light-weighting in the automotive and aerospace industries has driven the demand for aluminum die casting for producing lightweight components such as engine blocks, transmission cases, structural parts, and aircraft components.

Moreover, technological advancements in aluminum die casting processes, such as vacuum die casting and squeeze casting, have further enhanced the properties and performance of aluminum castings, thereby contributing to the dominance of the aluminum segment in the die casting market.

How fast will the pressure die casting segment grow in this market?

Based on process, the market is segmented into pressure die casting, vacuum die casting, squeeze die casting, and others. The pressure die casting segment is expected to witness the fastest growth, depicting a CAGR of 7.29% over the forecast period owing to its widespread adoption in various industries such as automotive, aerospace, consumer electronics, and industrial machinery.

Pressure die casting offers several advantages, including high production efficiency, excellent dimensional accuracy, and cost-effectiveness, making it suitable for the mass production of complex metal components.

Moreover, advancements in pressure die casting technology, such as the development of high-speed and multi-cavity die casting machines, have further enhanced the capabilities and efficiency of pressure die casting processes, driving its adoption across different industries.

Additionally, the growing demand for lightweight components in the automotive and aerospace industries is expected to fuel the demand for pressure die casting, as it enables the production of lightweight and high-strength metal components with tight tolerances.

How big is the automotive segment in the market?

Based on end-use, the market is divided into automotive, aerospace, electrical and electronics, industrial, and others. The automotive segment garnered the highest valuation of USD 20.61 billion in 2023 owing to the increasing demand for lightweight components and stringent fuel efficiency regulations driving the adoption of die casting in automotive manufacturing.

Die casting offers several advantages for producing automotive components such as engine blocks, transmission cases, structural parts, and chassis components, including lightweight, high strength-to-weight ratio, and cost-effectiveness.

Moreover, advancements in die casting technology, such as vacuum die casting and squeeze casting, have further enhanced the properties and performance of automotive castings, contributing to their widespread adoption in the automotive sector.

Additionally, the growing preference for electric vehicles (EVs) and hybrid vehicles is expected to further drive the demand for die casting in automotive manufacturing, as EVs require lightweight components for improved energy efficiency and range.

What is the market scenario in the Asia-Pacific region?

Based on region, the global die casting market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The Asia Pacific Die Casting Market share stood around 29.63% in 2023 in the global market, with a valuation of USD 25.16 billion, driven by the region's strong manufacturing base, expanding automotive and aerospace industries, and increasing investments in industrial infrastructure.

Countries like China, Japan, and India are major contributors to the growth of the die casting market in Asia Pacific, owing to their large-scale production capabilities, technological advancements, and supportive government policies.

The automotive industry in Asia Pacific, particularly in China and India, is experiencing rapid growth driven by rising disposable incomes, rapid urbanization, and the increasing demand for passenger vehicles.

Similarly, the aerospace industry in countries like Japan and South Korea is witnessing significant investments in research and development, leading to the adoption of advanced manufacturing technologies like die casting for producing aircraft components.

Moreover, the presence of leading die casting manufacturers and suppliers in Asia Pacific is further strengthening the region's dominance in the global die casting market.

Competitive Landscape

The global die casting market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing heavily/extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

Key Companies in Die Casting Market

- Linamar Corporation

- Sandhar

- Alcoa Corporation

- Koch Enterprises, Inc.

- Rheinmetall AG

- Dynacast

- Foryou Corporation

- Endurance Technologies Limited

- Aludyne

- Oskar Frech GmbH + Co. KG

Key Industry Developments

- March 2022 (Acquisition): Linamar Corporation revealed a strategic arrangement with GF Casting Solutions by purchasing 50% stake in their collaborative endeavor, GF Linamar LLC, situated in North Carolina. GF Casting Solutions operates as a division under Georg Fischer AG.

The Global Die Casting Market is Segmented as:

By Raw Material

By Process

- Pressure Die Casting

- Vacuum Die Casting

- Squeeze Die Casting

- Others

By End-Use

- Automotive

- Aerospace

- Electrical and Electronics

- Industrial

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.