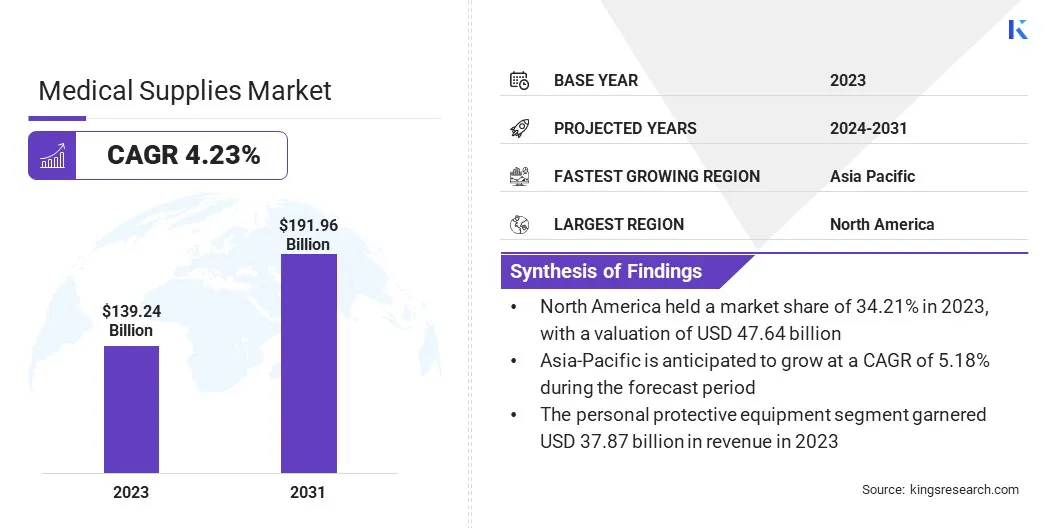

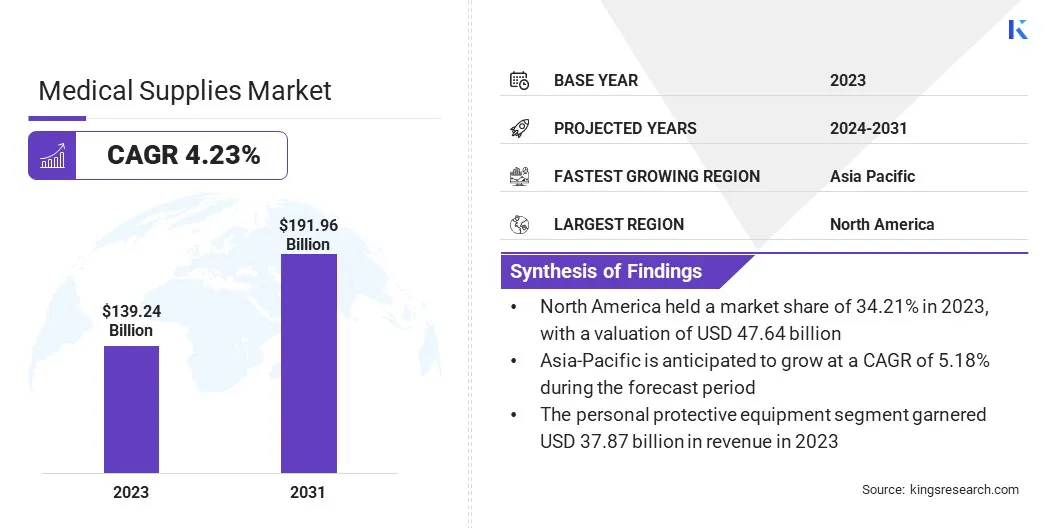

Medical Supplies Market Size

Global Medical Supplies Market size was valued at USD 139.24 billion in 2023 and is projected to grow from USD 143.60 billion in 2024 to USD 191.96 billion by 2031, exhibiting a CAGR of 4.23% during the forecast period. The market is growing rapidly due to an aging population, technological advancements, and the rising prevalence of chronic diseases.

Increased demand for home healthcare, along with innovations in medical devices and eco-friendly products, is driving market expansion. The market's dynamic landscape is characterized by continuous innovation and regulatory support, which address evolving healthcare needs and enhance patient outcomes.

In the scope of work, the report includes products offered by companies such Medtronic plc, Cardinal Health, Becton, Dickinson and Company, Johnson & Johnson Services, Inc., B. Braun Melsungen AG, Boston Scientific Corporation, Thermo Fisher Scientific, Inc., Baxter, 3M Company, Abbott, and others.

The medical supplies market is experiencing significant growth, mainly fueled by an aging global population and continuous technological advancements. Increasing prevalence of chronic diseases and the rising demand for home healthcare solutions further propel market expansion. Innovations in medical devices, such as minimally invasive surgical tools and advanced wound care products, enhance treatment efficiency and patient outcomes.

Moreover, the market is witnessing a notable shift toward sustainability, with eco-friendly products gaining significant traction. These factors, combined with growing healthcare needs and regulatory support, are contributing to market expansion.

- According to the Population Reference Bureau (PRB), the number of Americans aged 65 and older has increased significantly over the past decades. From 58 million in 2022, this demographic is expected to grow to 82 million by 2050, marking a 47% increase. This highlights the growing requirement for medical supplies worldwide.

Medical supplies refers to a broad range of products and equipment used in healthcare settings for the diagnosis, treatment, and management of medical conditions. These supplies include consumables such as bandages, syringes, gloves, and surgical instruments, as well as durable medical equipment such as diagnostic machines, infusion pumps, and mobility aids.

They are essential for effective patient care in hospitals, clinics, and home healthcare environments. Medical supplies enable healthcare professionals to provide accurate diagnoses, perform necessary treatments, and support patients' recovery and overall well-being. The continuous demand for these supplies is fueled by ongoing healthcare needs and advancements in medical technology.

Analyst’s Review

The rising expenditure by the government on healthcare is expected to aid the growth of the market.

- According to the 2023-24 budget released by Hong Kong, substantial resources were allocated to healthcare, with an estimated allocation of USD 104.4 billion for 2023-24, constituting approximately 19% of the government's recurrent expenditure.

This commitment underscored ongoing efforts to enhance public healthcare services, thereby creating growth opportunities in the medical supplies market.

- Furthermore, according to the India Brand Equity Foundation (IBEF), in November 2023, six strategies were formulated as part of the National Medical Policy to maximize the sector's potential, accompanied by a detailed action plan for their execution. Additionally, India allows 100% Foreign Direct Investment (FDI) in the medical devices sector, thereby generating growth opportunities in the industry.

Key players in the medical supplies market are capitalizing on the government's increased expenditure on healthcare by strategically aligning their offerings with the evolving needs of public healthcare services. By focusing on innovation and quality, companies are developing advanced medical devices and supplies that meet regulatory standards and enhance patient outcomes. Moreover, investing in research and development to create cost-effective solutions could position them favorably in competitive bidding processes for government contracts.

Medical Supplies Market Growth Factors

The global aging population is fostering market growth by significantly increasing the demand for a wide range of medical supplies. As individuals age, the incidence of chronic diseases such as diabetes, cardiovascular conditions, and arthritis rises, necessitating more frequent use of diagnostic equipment, surgical tools, and everyday healthcare products.

This increased demand is further amplified by the need for advanced medical supplies to effectively manage these complex health conditions and enhance the quality of life for the elderly. Moreover, manufacturers are investing heavily in innovations and expanding their product offerings, which is boosting market growth.

- The National Cancer Institute of the United States projects that 2,001,140 new cancer cases to be diagnosed in the country by the end of 2024, with 611,720 individuals expected to succumb to the disease.

A major challenge hampering the development of the medical supplies market is the stringent regulatory requirements and lengthy approval processes, which are delaying product launches and increasing costs. Additionally, the competitive landscape and price sensitivity among healthcare providers are exerting pressure on profit margins, making it difficult for companies to invest in innovation and increase their market share.

Key players are mitigating these challenges by investing in robust regulatory compliance programs and accelerating their research and development efforts to streamline approval processes. Moreover, they are adopting innovative pricing strategies, enhancing operational efficiencies, and focusing on value-added services to differentiate their products. By continuously improving their offerings and maintaining compliance, they are striving to lead the market.

Medical Supplies Market Trends

Continuous innovations and advancements in medical technology are key factors contributing notably to the growth of the medical supplies market. Enhanced medical devices, such as innovative diagnostic equipment and minimally invasive surgical tools, significantly improve the quality of care by enabling more precise and effective treatments.

These technological advancements reduce recovery times, minimize patient discomfort, and lower the risk of complications, making healthcare more efficient and effective. Furthermore, the development of advanced wound care products accelerates healing processes and improves patient outcomes, which is bolstering market growth.

There is a growing trend toward home healthcare, mainly fueled by its convenience and cost-effectiveness. Patients increasingly use medical supplies at home for chronic disease management, post-operative care, and elderly care. Portable and user-friendly devices such as home dialysis machines, glucose monitors, and telemedicine tools support this trend by enabling effective health monitoring and treatment outside traditional settings.

Home healthcare reduces hospital visits and empowers patients to manage their own care. Advances in telemedicine further enhance remote consultations and continuous monitoring, thereby increasing the demand for home healthcare solutions and augmenting the growth of the market.

Segmentation Analysis

The global market is segmented based on product type, application, and geography.

By Product Type

Based on product type, the medical supplies market is categorized into personal protective equipment, wound care products, diagnostic supplies, infusion & injection supplies, surgical instruments, and others. The personal protective equipment segment garnered the highest revenue of USD 37.87 billion in 2023. Increased awareness of the importance of PPE in preventing infection spread has led to higher demand across the healthcare industry and other sectors.

Regulatory mandates established by governments and health organizations require the consistent use of PPE, thereby ensuring steady demand. Technological advancements have improved the effectiveness and comfort of PPE, making it more appealing.

Additionally, the use of PPE has expanded beyond healthcare to include industries such as manufacturing and construction. Substantial investments from both governments and private sectors are fueling production and innovation, thereby propelling the growth of the PPE segment.

By Application

Based on application, the market is divided into cardiology, neurology, orthopedics, respiratory care, wound management, and others. The cardiology segment captured the largest medical supplies market share of 25.84% in 2023. The increasing prevalence of cardiovascular diseases, coupled with the aging population, is spurring thr demand for advanced diagnostic and treatment solutions.

- According to the WHO, cardiovascular diseases (CVDs) are responsible for approximately 17.9 million deaths each year worldwide, establishing them the leading cause of death globally.

Innovations in cardiology-related medical devices, such as stents, pacemakers, and imaging systems, are enhancing patient outcomes and leading to higher adoption rates. Furthermore, supportive government initiatives and increased funding for cardiovascular health programs are boosting market growth.

Medical Supplies Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America medical supplies market share stood around 34.21% in 2023 in the global market, with a valuation of USD 47.64 billion. The region boasts a highly developed healthcare infrastructure, with advanced hospitals, clinics, and research institutions that demand advanced medical supplies. Government initiatives and favorable reimbursement policies are further propelling regional market growth.

The U.S. and Canada have made significant investments in healthcare technology and innovation, bolstering the development and adoption of new medical products. Moreover, North America's strong regulatory framework ensures the quality and safety of medical supplies, thereby fostering trust and reliability among healthcare providers and patients.

Asia-Pacific is anticipated to witness robust growth at a CAGR of 5.18% over the forecast period. The rising government initiatives and product launches by key players are estimated to boost regional market growth in the foreseeable future. Local market players across the region are investing heavily in product development and launches to enhance medical device manufacturing, which is projected to aid Asia-Pacific market expansion.

- For instance, in April 2022, Wipro GE Healthcare, a global medical technology and digital solutions innovator, launched its next-generation Revolution Aspire CT (Computed Tomography) scanner. Revolution Aspire is designed and manufactured end-to-end in India at the newly launched Wipro GE Medical Devices Manufacturing plant, in line with the Atma Nirbhar Bharat initiative.

These developments are projected to offer a more cost-effective solution for hospitals, which is contributing significantly to regional market growth.

Competitive Landscape

The global medical supplies market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Medical Supplies Market

- Medtronic plc

- Cardinal Health

- Becton, Dickinson and Company

- Johnson & Johnson Services, Inc.

- Braun Melsungen AG

- Boston Scientific Corporation

- Thermo Fisher Scientific, Inc.

- Baxter

- 3M Company

- Abbott

Key Industry Development

- January 2024 (Product Launch): GE HealthCare entered into an agreement to acquire MIM Software, a global provider of medical imaging analysis and artificial intelligence (AI) solutions. MIM Software specializes in radiation oncology, molecular radiotherapy, diagnostic imaging, and urology, serving imaging centers, hospitals, specialty clinics, and research organizations worldwide. GE HealthCare intends to leverage MIM Software’s imaging analytics and digital workflow capabilities across various care areas to foster innovation and enhance its medical supplies portfolio. This strategic acquisition aims to differentiate GE HealthCare’s solutions, thereby benefiting patients and healthcare systems globally by providing more advanced, integrated medical supplies and technologies.

The global medical supplies market is segmented as:

By Product Type

- Personal Protective Equipment (PPE)

- Wound Care Products

- Diagnostic Supplies

- Infusion & Injection Supplies

- Surgical Instruments

- Others

By Application

- Cardiology

- Neurology

- Orthopedics

- Respiratory Care

- Wound Management

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America