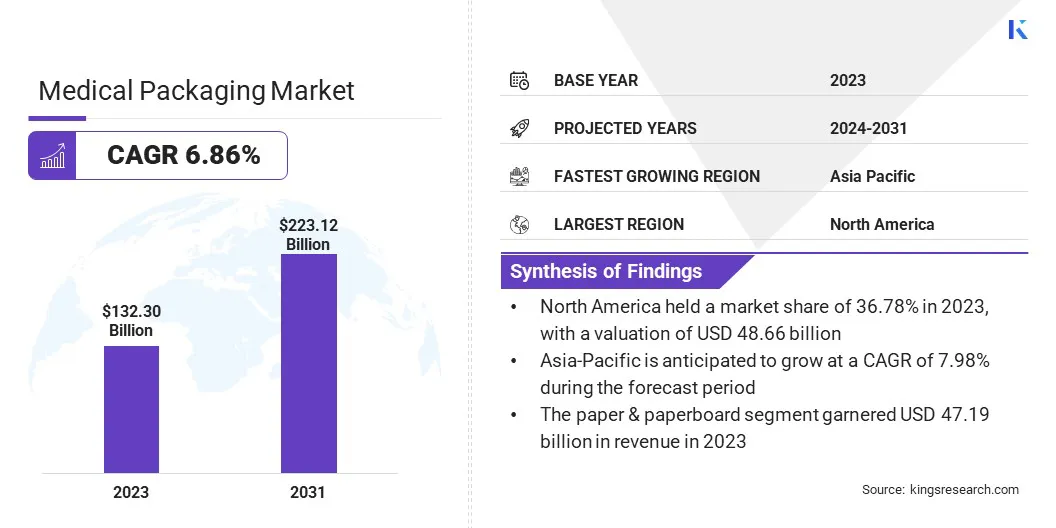

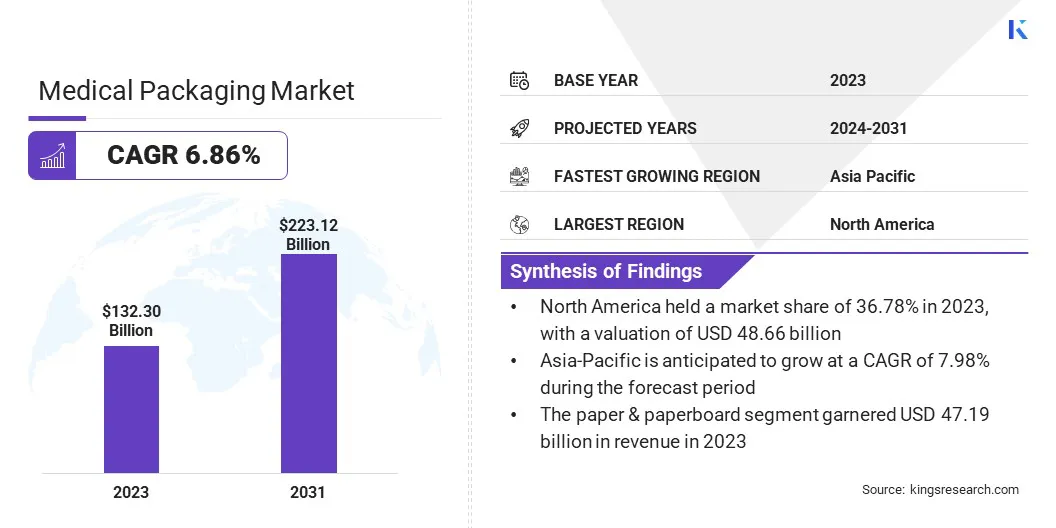

Medical Packaging Market Size

The global Medical Packaging Market size was valued at USD 132.30 billion in 2023 and is projected to grow from USD 140.22 billion in 2024 to USD 223.12 billion by 2031, exhibiting a CAGR of 6.86% during the forecast period. The growth of the market is driven by ongoing advancements in smart packaging technologies and the increasing demand for tamper-evident features.

Companies are investing heavily in innovative materials and designs to enhance packaging durability and meet rigorous compliance standards. The rising global health concerns are further boosting the demand for reliable and user-friendly packaging solutions. Additionally, ongoing developments in packaging design are addressing the growing need for improved convenience and usability, thereby supporting market growth and expanding its applications.

In the scope of work, the report includes solutions offered by companies such as Amcor plc, Gerresheimer AG., DS Smith Plc, Huhtamäki Oyj, Berry Global Inc., Sealed Air Corporation, Constantia Flexibles, Winpak Ltd., CCL Industries Inc., 3M Company, and others.

The medical packaging market is experiencing robust growth, fueled by the increasing demand for safety, sterility, and adherence to regulatory standards. With a rising focus on sustainability, companies are increasingly adopting eco-friendly and recyclable materials to meet stringent environmental regulations. Technological advancements, such as digital systems, IoT, and blockchain, are enhancing packaging efficiency and traceability.

- Further, as of May 2022, the Food & Drug Administration’s Title II of the Drug Supply Chain Security Act (DSCSA) outlines steps for the interoperable, electronic tracing of prescription drugs. These measures aim to enhance the FDA’s ability to prevent exposure to counterfeit or harmful drugs. This regulation is prompting companies to develop sustainable packaging solutions and improve drug traceability.

Medical packaging refers to the specialized packaging solutions specifically designed to protect, preserve, and ensure the safety and efficacy of medical products. This category includes pharmaceuticals, medical devices, and biologics, all of which require stringent packaging standards to prevent contamination, tampering, and degradation.

Medical packaging encompasses a range of materials and technologies, such as sterile barriers, tamper-evident seals, and child-resistant features, tailored to meet regulatory requirements and maintain product integrity throughout the supply chain. It further involves innovative solutions such as smart packaging, which integrates technologies for enhanced traceability and real-time monitoring, ensuring optimal safety and compliance in the healthcare industry.

Analyst’s Review

Advancements in plastic materials are significantly driving the growth of the medical packaging market. Plastics have become indispensable in the production of medical devices, personal protective equipment, and critical production processes. These materials are crucial for the packaging and distribution of pharmaceuticals and medical supplies. Companies in the pharmaceutical and medical device sectors are continually enhancing their product offerings by developing improved sterile packaging solutions.

- In January 2024, Cherwell, a global leader in microbiology solutions, unveiled the Redipor Beta Bag. This advanced plastic bag is designed to mitigate risks, reduce costs, and save time in environmental monitoring procedures while supporting the continuous production of sterile medicinal products. These new transfer bags, have been validated for compatibility with 190mm Getinge Alpha Ports used in isolators and RABS systems, ensuring contamination-free transfers of media, while enhancing production efficiency and reducing risk.

Advancements in plastic materials and innovative packaging solutions are resulting in increased efficiency, safety, and cost-effectiveness in the medical packaging sector, thereby supporting its ongoing growth and development.

Medical Packaging Market Growth Factors

The increasing demand for safe and sterile packaging solutions is propelling the growth of the market. As the global healthcare sector expands, the need for advanced packaging that ensures product sterility and integrity becomes increasingly critical. This increased focus on patient safety fosters innovations and investments in packaging technologies that meet stringent regulatory standards.

The growing emphasis on preventing contamination and ensuring the efficacy of medical products results in higher demand for specialized packaging solutions, thereby aiding market growth. The development of the medical packaging market is hampered by the rising raw material costs, including advanced polymers and sterile barrier films, which places pressure on manufacturers to manage both quality and affordability. These increased costs hinder innovation and market expansion.

Additionally, stringent regulatory requirements add to the financial strain. Key players are mitigating these challenges by investing in research and development to optimize material use and reduce costs. They are exploring alternative materials and manufacturing techniques to enhance efficiency. Strategic collaborations with suppliers and advancements in technology are helping companies manage cost pressures while maintaining high standards of product quality and compliance, which is likely to boost market growth.

Medical Packaging Market Trends

Healthcare companies are investing heavily in advanced machinery to boost packaging speed and efficiency. By leveraging digital technology, IoT, and blockchain, these investments significantly enhance operational performance and reliability. Digital systems automate and streamline packaging processes, while IoT connects machinery to smart devices for real-time monitoring, troubleshooting, and data analysis.

This integration improves efficiency and reduces downtime. Blockchain technology records data across the supply chain, thereby ensuring both transparency and traceability. These advancements enable improved operational insights, enhanced product safety, and compliance, thereby fostering substantial growth and innovation in the medical packaging market.

A significant trend in the market is the increasing emphasis on sustainability due to evolving regulatory pressures.

- According to Amcor PLC, as of May 2022, legislation focused on sustainability is reshaping the industry, with companies facing potential Extended Producer Responsibility (EPR) taxes and penalties if their packaging is determined to be non-recyclable.

This regulatory shift is compelling medical packaging providers to adopt eco-friendly materials and practices to comply with new standards. For instance, packaging solutions that fail to meet recycling criteria are encountering financial penalties, prompting industry players to innovate and enhance their sustainability efforts to avoid compliance costs and improve environmental impact.

Segmentation Analysis

The global market is segmented based on material, type, and geography.

By Material

Based on material, the medical packaging market is categorized into plastic, paper & paperboard, glass, metal, and others. The paper & paperboard segment garnered the highest revenue of USD 47.19 billion in 2023. Innovations in barrier coatings and treatment processes are enhancing the performance of paper-based packaging, making it highly suitable for various medical applications.

Regulatory pressures to reduce plastic use and rising consumer preference for environmentally friendly options are further boosting this growth. Consequently, the segment is advancing with improved durability and compliance, which is contributing to its significant expansion.

By Type

Based on type, the market is categorized into primary, secondary, and tertiary. The primary segment captured the largest medical packaging market share of 55.34% in 2023. Primary medical packaging, which includes materials that come into direct contact with medical products such as bottles, vials, blisters, and syringes, is critical for maintaining product integrity, sterility, and safety. Innovations in packaging technologies, such as smart packaging and tamper-evident features, are enhancing functionality and compliance with stringent regulatory standards.

Additionally, the increasing focus on patient safety and the rising shift toward single-use and disposable packaging is fueling segmental expansion. These trends are leading to significant advancements in primary packaging solutions, improving product protection and aligning with evolving healthcare needs and regulatory requirements.

Medical Packaging Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America medical packaging market share stood around 36.78% in 2023 in the global market, with a valuation of USD 48.66 billion. This notable growth is attributed to recent regulatory developments and increasing investments in the sector. The U.S. government has initiated a pilot project permitting wholesalers and pharmacists to import FDA-approved drug versions from Canada.

This initiative is designed to reduce prescription drug costs for American consumers while ensuring the preservation of public health and safety. This regulatory change is resulting in the increased demand for healthcare packaging solutions due to higher import volumes. Additionally, companies are expanding their operations to increase their market share.

- For instance, in June 2022, Guardian Medical USA secured over USD 2.0 million in private funding to support the development of sterile barrier packaging for orthopedic medical devices. This investment is anticipated to bolster the company’s efforts to meet the rising demand for rigid tube packaging used in orthopedic implants and devices.

Asia-Pacific is anticipated to witness substantial growth at a robust CAGR of 7.98% over the forecast period. This growth is primarily propelled by the expanding healthcare sector and increased demand for medical devices and surgical instruments. This surge is largely attributed to ongoing advancements in sterilization technologies and innovative packaging designs.

The region's growing healthcare needs, spurred by an aging population, rising prevalence of chronic diseases, and advancements in medical technology, are boosting the demand for sterile packaging solutions. The growing focus on infection control and patient safety is prompting manufacturers to prioritize sterile packaging to ensure product integrity and sterility. The Asia-Pacific market is witnessing robust growth as it adapts to these evolving requirements and continues to expand its healthcare infrastructure.

Competitive Landscape

The global medical packaging market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Medical Packaging Market

- Amcor plc

- Gerresheimer AG.

- DS Smith Plc

- Huhtamäki Oyj

- Berry Global Inc.

- Sealed Air Corporation

- Constantia Flexibles

- Winpak Ltd.

- CCL Industries Inc.

- 3M Company

Key Industry Development

- April 2024 (Product Launch): DuPont launched its new roofing underlayment product, the Tyvek Protec PSU peel-and-stick underlayment. This product has been designed to offer high performance with high-temperature and UV resistance, a slip-resistant walking surface, and a split liner for easy installation. Additionally, iIt has received an ICC-ES code report and achieved the prestigious FL/Miami-Dade certification.

The global medical packaging market is segmented as:

By Material

- Plastic

- Paper & Paperboard

- Glass

- Metal

- Others

By Type

- Primary

- Secondary

- Tertiary

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America