Market Definition

Medical packaging films are specialized materials used to package medical devices, pharmaceuticals, and healthcare products, ensuring sterility, protection, and integrity during storage and transportation. These films provide barrier properties against moisture, oxygen, light, and contaminants while maintaining durability and ease of sealing.

Common types of medical packaging films include polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), polyethylene terephthalate (PET), and multi-layer laminates, often incorporating sterilizable and tamper-evident features.

Medical Packaging Films Market Overview

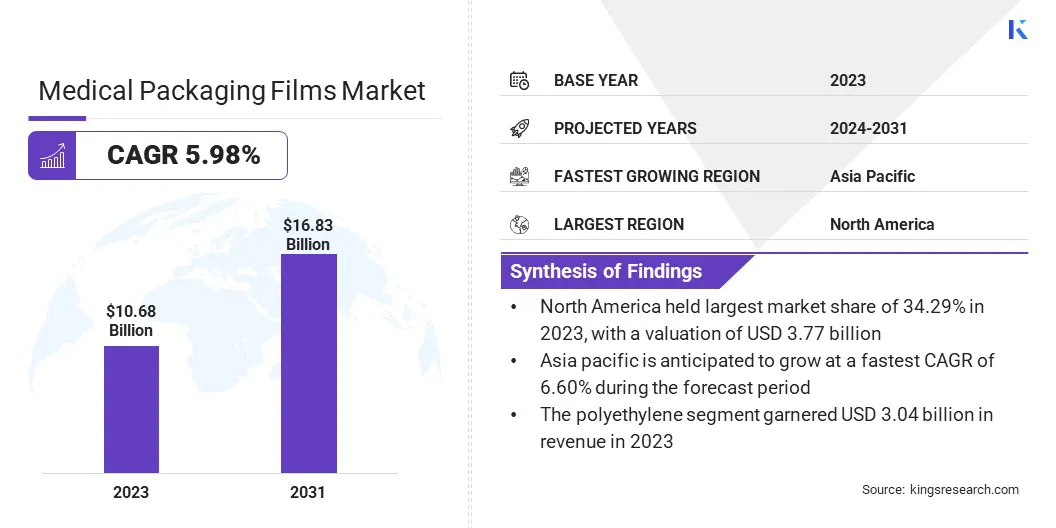

The global medical packaging films market size was valued at USD 10.68 billion in 2023 and is projected to grow from USD 11.21 billion in 2024 to USD 16.83 billion by 2031, exhibiting a CAGR of 5.98% during the forecast period. Market growth is driven by increasing demand for high-barrier, sterile packaging to ensure product safety and extend shelf life.

Stringent regulatory requirements mandate the use of high-quality materials that comply with safety and sustainability standards. Additionally, the rising adoption of eco-friendly and recyclable packaging solutions, supported by rising environmental concerns and favorable corporate sustainability initiatives, accelerates market expansion.

Major companies operating in the global medical packaging films industry are Amcor plc, Berry Global, Inc., Klöckner Pentaplast, UFP Technologies, Inc., Gerresheimer AG, Avery Dennison Corporation, SIG Combibloc Group AG, Bemis Company, Inc., Sealed Air Corporation, Wipak Oy, AptarGroup, Inc., Sonoco Products Company, Tekni-Plex, Inc., Placon Corporation, Printpack, Inc., and others.

The market benefits from the continuous expansion of the pharmaceutical industry. The growing prevalence of chronic diseases, an aging population, and advancements in drug formulations require secure and high-quality packaging solutions.

Increased pharmaceutical production leads to a higher demand for specialized films that preserve drug efficacy, extend shelf life, and provide tamper resistance. Biopharmaceutical developments, including vaccines and biologics, require advanced barrier films that support temperature-sensitive products.

The rising global healthcare expenditures and expanding pharmaceutical supply chains are creating a robust demand for high-performance medical packaging films, fostering innovations in material composition and sustainability.

- According to the 2024 report by the Centers for Medicare & Medicaid Services, U.S. healthcare spending increased by 7.5% in 2023, totaling USD 4.9 trillion (USD 14,570 per person) and accounting for 17.6% of the nation's Gross Domestic Product (GDP).

Key Highlights:

- The global medical packaging films market size was recorded at USD 10.68 billion in 2023.

- The market is projected to grow at a CAGR of 5.98% from 2024 to 2031.

- North America held a share of 35.29% in 2023, valued at USD 3.77 billion.

- The high barrier films segment secured the largest revenue share of 36.84% in 2023.

- The polyethylene segment garnered USD 3.04 billion in revenue in 2023.

- The bags & pouches segment is expected to reach USD 5.17 billion by 2031.

- The medical devices is poised for a robust CAGR of 5.99% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 6.60% during the forecast period.

Market Driver

"Rising Demand for Sustainable and Eco-Friendly Packaging Solutions"

Sustainability initiatives are fueling the growth of the medical packaging films market. The industry is shifting toward recyclable, biodegradable, and low-carbon-footprint packaging materials to reduce environmental impact.

Regulatory policies promote the development of eco-friendly medical packaging films that maintain performance without compromising product safety. Advances in bio-based polymers, solvent-free coatings, and energy-efficient manufacturing processes support this transition.

Healthcare providers and pharmaceutical companies prioritize sustainable solutions, generating a demand for medical packaging films that meet both environmental and regulatory standards. Companies are investing in innovative materials that enusre both sustainability and high-barrier, sterile packaging.

- In April 2024, Horus Pharma, a French ophthalmology laboratory specializing in preservative-free products for eye and eyelid health, expanded its partnership with Plastic Bank to reduce its plastic footprint and combat pollution in the Mediterranean. The company aims to offset 65% of its plastic distribution and recycle 400 metric tons of plastic from late 2022 to late 2025.

Market Challenge

"Supply Chain Disruptions"

A significant challenge hindering the growth of the medical packaging films market is supply chain disruptions due to raw material fluctuations, shipping delays, and cost volatility. These disruptions can hamper production schedules and elevate operational costs, affecting market profitability and expansion.

Companies are addressing these issues by investing in advanced supply chain management systems and diversifying their supplier networks. They are further adopting digital technologies for real-time monitoring and forecasting, enabling swift responses to potential disruptions. Strategic inventory management and robust supplier partnerships further ensure production stability.

Market Trend

"Increasing Surgical Procedures and Hospitalization Rates"

The rising number of surgical procedures and hospital admissions is stimulating the expansion of the medical packaging films market. Healthcare institutions require sterile and high-barrier packaging solutions for medical instruments, surgical kits, and wound care products.

The shift toward minimally invasive surgeries increases the use of disposable medical devices, necessitating high-performance films that ensure sterility and durability. The demand for IV bags, blood bags, and diagnostic kits grows with increasing hospitalization rates.

The expansion of healthcare infrastructure worldwide leads to the increased consumption of medical packaging films, reinforcing the need for innovative, reliable, and compliant packaging solutions.

- In September 2023, the American Society of Plastic Surgeons reported that 26.2 billion surgical and minimally invasive cosmetic and reconstructive procedures were performed in the United States. Notably, cosmetic surgery procedures saw a 19% increase compared to 2019.

Medical Packaging Films Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

High Barrier Films (Metallized Films, Coated Films), Co-extruded Films, Formed Films (Thermoformed Films, Cold-formed Films)

|

|

By Material

|

Polyethylene, Polypropylene, Polyvinyl Chloride, Polystyrene, Polyamide, Aluminum, Oxides, Others

|

|

By Application

|

Blister Packs, Bags & Pouches, Lidding, Sachets, Wraps, Labels, Others

|

|

By End-Use

|

Pharmaceutical, Medical devices

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (High Barrier Films, Co-extruded Films, and Formed Films): The high barrier films segment earned USD 3.93 billion in 2023 due to its superior protective properties, which ensure product sterility, extend shelf life, and compliance with stringent regulatory standards, making it widely adopted in pharmaceutical and medical device packaging.

- By Material (Polyethylene, Polypropylene, Polyvinyl Chloride, Polystyrene, Polyamide, Aluminum, Oxides, and Others): The polyethylene segment held a share of 28.45% of the market, fueled by its superior durability, cost-effectiveness, chemical resistance, and compatibility with sterilization processes, making it the preferred choice for medical packaging applications.

- By Application (Blister Packs, Bags & Pouches, Lidding, Sachets, Wraps, Labels, and Others): The bags & pouches segment is projected to reach USD 5.17 billion by 2031, propelled by its widespread use in sterile packaging, cost-effectiveness, high barrier properties, and ability to protect medical devices and pharmaceuticals from contamination, ensuring compliance with stringent regulatory standards.

- By End-Use (Pharmaceutical and Medical devices): The medical devices segment is likely to grow at a CAGR of 5.99% through the forecast period, largely attributed to the rising demand for sterile and high-barrier packaging solutions that ensure product safety, regulatory compliance, and extended shelf life, supported by the increasing production and adoption of medical devices worldwide.

Medical Packaging Films Market Regional Analysis

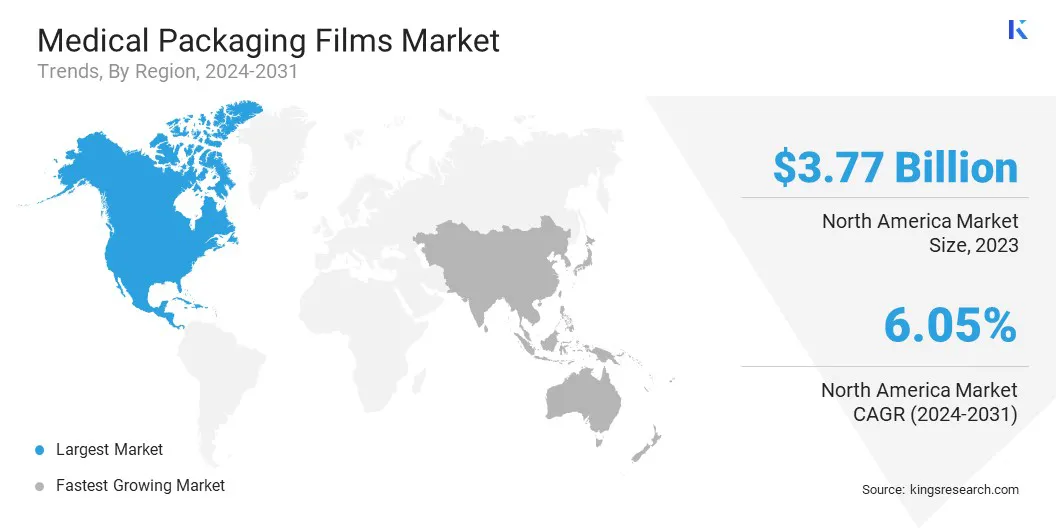

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America medical packaging films market captured a notable share of around 35.29% in 2023, valued at USD 3.77 billion. North America's stringent regulatory environment for medical and pharmaceutical packaging is fostering this growth.

Organizations such as the U.S. Food and Drug Administration (FDA), Health Canada, and the United States Pharmacopeia (USP) enforce strict guidelines on packaging materials to ensure safety, sterility, and compliance.

Medical packaging films must meet regulations related to tamper resistance, barrier protection, and sustainability. The need for FDA-approved and ISO-certified packaging materials promotes continuous innovation, leading to increased investments in high-performance films that comply with evolving regulatory standards.

Additionally, sustainability is reshaping market landscape. Regulatory policies, corporate sustainability initiatives, and consumer preferences boost the adoption of recyclable, biodegradable, and low-carbon-footprint packaging materials.

Companies invest in bio-based polymers, solvent-free coatings, and recyclable medical films to reduce environmental impact. The transition to eco-friendly alternatives that maintain product integrity and regulatory compliance fuels the demand for innovative, sustainable packaging solutions.

- In February 2024, Sanofi Consumer Healthcare joined the Blister Pack Collective, an initiative led by PA Consulting and PulPac to develop recyclable fiber-based blister packs and minimize plastic waste in pharmaceutical packaging. The project focuses on replacing problematic plastics, such as PVC, which contribute significantly to the 100,000 tonnes of plastic used annually in medical packaging. Utilizing PulPac's Dry Molded Fiber technology, the initiative seeks a sustainable alternative with an 80% lower CO₂ footprint than conventional packaging materials.

Asia Pacific medical packaging films industry is estimated to grow at a CAGR of 6.60% over the forecast period. This rapid growth is attributed to the expansion of the pharmaceutical and healthcare sectors. The region is a major hub for pharmaceutical production, with countries such as China, India, and Japan leading in drug manufacturing and exports.

Increased demand for prescription and over-the-counter (OTC) medicines, along with government initiatives promoting local drug production, highlights the need for high-quality medical packaging films that ensure product safety and longevity.

Furthermore, the medical device and diagnostics industry in Asia-Pacific is expanding due to increased investment in technological advancements and domestic manufacturing. Countries such as China, India, and Singapore are emerging as key players in medical device production.

The rising demand for diagnostic kits, surgical instruments, wound care products, and IV bags requires high-quality sterile and flexible packaging films to maintain product integrity. Growth in point-of-care testing and home diagnostics further accelerates the demand for specialized medical packaging solutions.

Regulatory Frameworks

- The U.S. Food and Drug Administration (FDA) regulates medical packaging materials under Title 21 of the Code of Federal Regulations (CFR). Specifically, Part 820 outlines the Quality System Regulation (QSR), which includes requirements for the design, manufacturing, packaging, labeling, storage, and distribution of medical devices. Manufacturers must establish and maintain procedures to ensure that packaging materials do not adversely affect the device's quality and are suitable for their intended use.

- The European Medicines Agency (EMA) enforces Good Manufacturing Practice (GMP) guidelines for medicinal products, ensuring packaging materials are suitable for their intended purpose and do not compromise product quality. Manufacturers must conduct thorough testing to verify the materials' compatibility with the product.

- In China, the National Medical Products Administration (NMPA) regulates medical packaging materials, requiring them to be non-toxic, compatible with the medical product, and protective against contamination and damage. Manufacturers must conduct rigorous testing and obtain approval from the NMPA before introducing new materials.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates medical packaging materials. The CDSCO mandates that packaging materials must comply with prescribed standards to ensure they do not react with the product and provide sufficient protection against environmental factors. Manufacturers must adhere to the Drugs and Cosmetics Act and Rules, which outline the requirements for the packaging and labeling of medical products.

Competitive Landscape

The global medical packaging films market is characterized by a number of participants, including both established corporations and emerging players. Market participants are implementing strategies that involve collaborating with organizations and healthcare institutions to facilitate plastic recycling.

These initiatives reduce medical waste, promote sustainability, and align with regulatory requirements, supporting market expansion. By partnering with hospitals, research centers, and recycling firms, companies are enhancing their environmental responsibility while strengthening their market position.

- In July 2023, Berry Global Inc. partnered with Deaconess Midtown Hospital, Nexus Circular, and Evansville Packaging Supply to recycle non-hazardous, sterile plastic packaging and nonwoven fabric from the hospital’s surgical suite, pharmaceutical, laboratory, and warehouse operations.

List of Key Companies in Medical Packaging Films Market:

- Amcor plc

- Berry Global, Inc.

- Klöckner Pentaplast

- UFP Technologies, Inc.

- Gerresheimer AG

- Avery Dennison Corporation

- SIG Combibloc Group AG

- Bemis Company, Inc.

- Sealed Air Corporation

- Wipak Oy

- AptarGroup, Inc.

- Sonoco Products Company

- Tekni-Plex, Inc.

- Placon Corporation

- Printpack, Inc.

Recent Developments (M&A/New Product Launch)

- In February 2025, Berry Global’s Flexible Films division introduced the newest addition to its Bontite Sustane Stretch Film portfolio at Packaging Innovations in Birmingham, now incorporating 30% certified post-consumer recycled (PCR) content.

- In November 2024, Amcor introduced the next generation of its Medical Laminates solutions. This latest innovation enables the creation of fully recyclable all-film packaging within the polyethylene stream. This innovation lowers the package's carbon footprint while maintaining performance standards for medical device applications.

- In November 2024, Berry Global completed the merger of its Health, Hygiene, and Specialties Global Nonwovens and Films business with Glatfelter Corporation. This merger led to the formation of Magnera Corporation, now the world's largest nonwovens company, offering a comprehensive range of solutions for the specialty materials industry.