Medical Foods Market Size

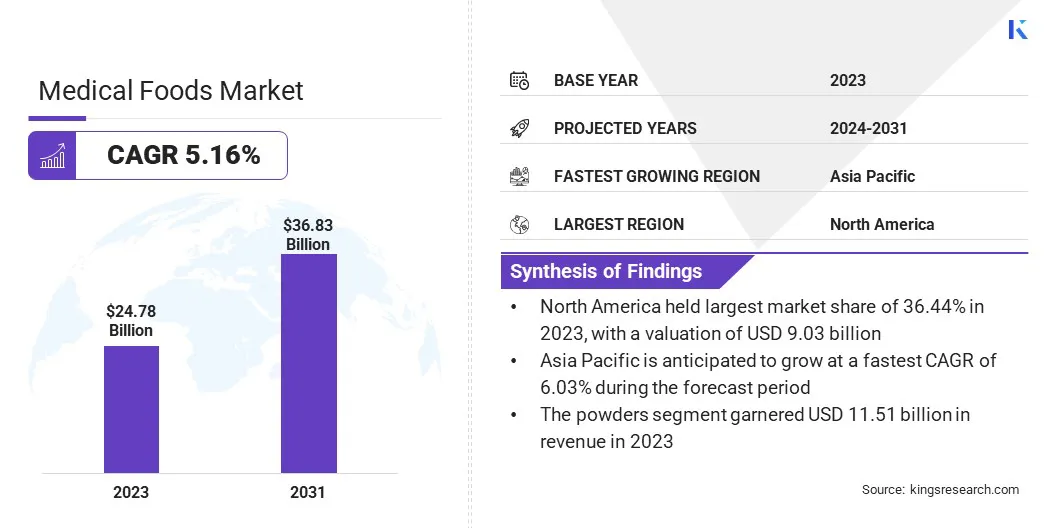

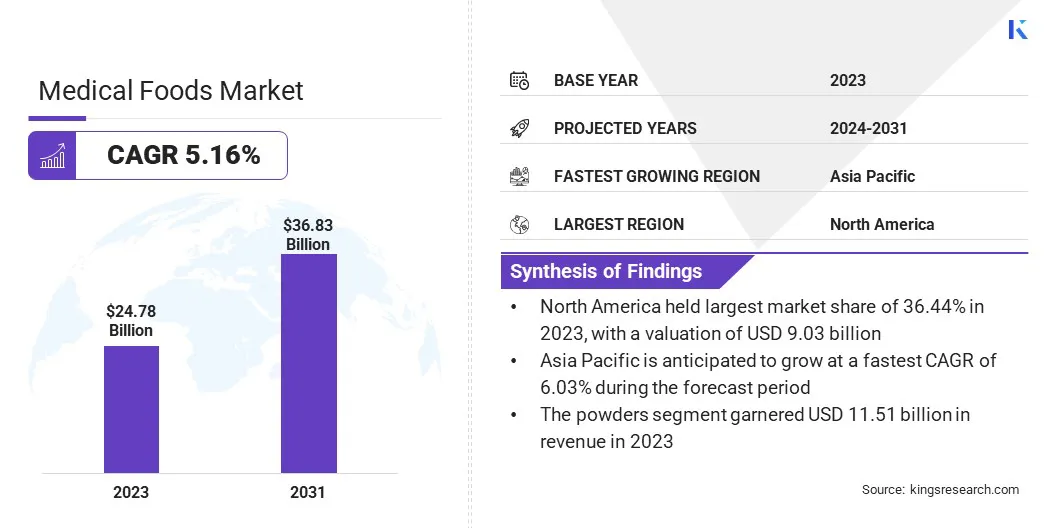

The Global Medical Foods Market size was valued at USD 24.78 billion in 2023 and is projected to grow from USD 25.90 billion in 2024 to USD 36.83 billion by 2031, exhibiting a CAGR of 5.16% during the forecast period. The increasing prevalence of chronic illnesses highlights the critical role of medical foods in therapeutic regimens, fueling global demand for innovative medical food solutions.

In the scope of work, the report includes products offered by companies such as Nestlé, Danone, Abbott, Mead Johnson & Company, LLC., Medtrition, Inc., Meiji Co., Ltd., Primus Pharmaceuticals Inc., Fresenius Kabi AG, B. Braun, Bausch Health Companies Inc., and others.

Rising disposable incomes and increased consumer willingness to invest in specialized healthcare products have bolstered market expansion. Strategic partnerships and funding initiatives are further boosting medical foods industry's expansion across developed and emerging markets.

- In September 2023, Danone announced a USD 53.50 million expansion of its production facility in Opole, Poland. This investment aims to enhance the its medical nutrition capabilities, support its growth strategy in the adult medical nutrition market.

Medical foods are specially formulated products designed for the dietary management of diseases or conditions requiring distinctive nutritional requirements unmet by standard diets. Developed based on medical and nutritional science, they address specific metabolic or physiological needs associated with chronic illnesses, genetic disorders, or post-surgical recovery.

These products, distinct from conventional foods or dietary supplements, are used under the supervision of a healthcare professional. They often include essential nutrients, vitamins, minerals, or bioactive compounds tailored to support targeted therapeutic outcomes and improve patient health.

Analyst’s Review

Governments across the globe are implementing targeted strategies to support the growth of the medical foods market, recognizing its role in addressing complex nutritional needs associated with chronic illnesses and aging populations.

Regulatory bodies are streamlining approval processes and establishing guidelines for classification, labeling, and marketing of medical foods. These initiatives ensure adherence to stringent quality standards to enhance transparency and trust among consumers and healthcare providers.

- Packaged foods in the U.S. must comply with updated FDA regulations to qualify as "healthy,". These guidelines require products to contain specified amounts of recognized food groups, such as fruits, vegetables, grains, dairy, or proteins and introduce limits on added sugars for the first time.

Furthermore, Modern techniques such as biofortification, microencapsulation, and targeted delivery systems have enabled the development of specialized products with enhanced bioavailability and efficacy. Companies are leveraging advanced technologyieso streamline production processes and expand their product portfolios, offering solutions for complex medical conditions and addressing disease-specific needs.

- In September 2024, Nourish, a food-as-medicine platform, revealed a strategic partnership with ModifyHealth to enhance its program. The collaboration allows individuals to order medically tailored meals prescribed by registered dietitians (RDs) directly through the Nourish platform.

Such advancements ehnance product quality, foster consumer trust, and accelerate the adoption of medical foods into global healthcare systems.

Medical Foods Market Growth Factors

The increasing prevalence of chronic diseases such as diabetes, gastrointestinal disorders, and cancer is contributing significantly to the growth of the market.

- A September 2023 report by the World Health Organization reveals that cardiovascular diseases remain the leading cause of death, accounting for 17.9 million fatalities annually. This is followed by cancers at 9.3 million deaths, chronic respiratory diseases at 4.1 million, and diabetes, including kidney disease related to diabetes, which collectively result in 2 million deaths each year.

Patients with these conditions often require specialized nutrition solutions to meet their specific medical needs. Medical foods offer scientifically formulated products that address nutrient deficiencies, aid in symptom management, and improve overall quality of life.

Rising healthcare spending and investments in nutritional solutions are fueling the growth of the medical foods market. Governments and private entities are allocating resources to enhance healthcare infrastructure and promote innovative treatments, including medical foods. Additionally, increasing disposable incomes and consumers' willingness to invest in specialized healthcare products further foster market growth.

However, high cost associated with these specialized products presents a significant challenge to the expansion of the market, which limits accessibility, particularly in developing regions of Asia-Pacific. To address this challenge, companies are focusing on cost-reduction strategies such as improving manufacturing efficiency and sourcing raw materials locally.

Additionally, partnerships with healthcare providers and governments are being established to offer subsidized prices or reimbursement options, improving affordability and accessibility.

Medical Foods Industry Trends

Ongoing advancements in medical research are propelling the growth of the medical foods market through the development of innovative formulations.Insights into disease-specific nutritional requirements have targeting conditions such as metabolic disorders, diabetes, epilepsy, and inflammatory diseases.

The market benefits from collaborations between academic institutions, healthcare organizations, and industry players, further accelerating product innovation.

- In September 2023, a study by the Public Health Institute's Center for Wellness and Nutrition (PHI CWN) evaluated Abbott's Healthy Food Rx program, which delivers home-based medical prescriptions of healthy meals to support diabetes management, demonstrated significant benefits for individuals with diabetes. Conducted over 12 months at acommunity clinic, the study found that participants experienced reduced A1C levels, enhanced diabetes self-management, better diet quality, and increased food security.

This dynamic ecosystem fosters the development of advanced medical food products that address unmet medical needs, positioning the industry for sustained growth.

The growing prevalence of metabolic disorders, including obesity, hypercholesterolemia, and metabolic syndrome, has fueled the expansion of the medical foods market. These conditions often require dietary modifications to support treatment and metabolic health.

Medical foods offer disease-specific formulations that support clinical interventions, improving symptom management and reducing complications, thereby contributing to market growth and innovation.

Segmentation Analysis

The global market has been segmented based on route of administration, form, application, distribution channel, and geography.

By Route of Administration

Based on route of administration, the market has been segmented into oral and enteral. The oral segment led the medical foods market in 2023, reaching a valuation of USD 14.47 billion. Oral medical foods, such as ready-to-drink formulas and powders, enable patients to manage conditions such as diabetes, malnutrition, and gastrointestinal disorders independently, without healthcare professional involvement.

Additionally, the rising demand for non-invasive treatments boosts the preference for oral administration. The expanding availability of diverse oral medical food products catering to various health conditions is further contributing to the dominance of the segment, making it a preferred option for both patients and healthcare providers.

By Form

Based on form, the market has been classified into powders, liquids, capsules/tablets, and others. The powders segment secured the largest revenue share of 46.44% in 2023.

Powdered medical foods offer easy customization, allowing healthcare providers to adjust dosage and nutrient content according to individual patient needs. This flexibility is particularly beneficial for managing complex medical conditions such as malnutrition, diabetes, and gastrointestinal disorders.

Additionally, they are more cost-effective, have a longer shelf life, and are easier to store compared to liquid or solid alternatives. Their portability and ease of consumption further lead to their widespread adoption, particularly in homecare settings.

By Application

Based on application, the market has been divided into metabolic disorders, neurological disorders, digestive disorders, oncology, pediatric nutrition, and others. The neurological disorders segment is set to witness significant growth, registering a CAGR of 7.23% through the forecast period.

The global aging population grows has resulted in an increase in neurological conditions, particularly in developed regions such as North America and parts of Asia-Pacific. This has created a strong demand for medical foods designed to support brain health, enhance cognitive function, and manage symptoms.

The focus on personalized nutrition and the role of specific nutrients in brain health has propelled the expansion of the segment. Additionally, growing awareness among healthcare professionals and patients about the potential of medical foods in managing these conditions has further bolstered this growth.

Medical Foods Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America medical foods market held a notable share of around 36.44% in 2023, valued at USD 9.03 billion. This growth is largely attributed to the high prevalence of preterm births in North America, with approximately 1 in 10 infants born prematurely in the U.S.. This has led to increased demand for specialized nutritional support tailored to the needs of preterm infants.

- According to the 2024 March of Dimes report, the United States recorded 373,902 preterm births in 2023, representing 10.4% of all live births.

Additionally, the regulatory environment in North America plays a critical role in the growth of the regional market. The Food and Drug Administration's (FDA) clear guidelines for medical foods provide a structured framework for product development, manufacturing, and marketing.

This regulatory clarity has improved consumer confidence in medical foods and streamlined the approval process, fostering innovation and propelling domestic market growth.

The Asia-Pacific medical foods market is projected to grow at a CAGR of 6.03% over the forecast period. This notable growth is primarily stimulated by rapidly growing aging populations, which is generating the demand for medical foods. Older adults often face specific nutritional challenges, such as malnutrition, weakened immune systems, and chronic conditions.

As this demographic grows, the market for specialized nutrition products to improve health outcomes and quality of life for older adults is expanding rapidly.

Furthermore, child malnutrition remains a significant issue in several countries, contributing to the growth of the Asia-Pacific market. Limited access to proper nutrition, particularly in developing areas, has led to high malnutrition rates among children, causing stunted growth, weakened immunity, and developmental delays.

Medical foods addressing these nutritional deficiencies are being increasingly adopted through government and healthcare initiatives to combat malnutrition. As awareness rises, the demand for specialized medical foods to meet children's nutritional needs is expanding, fostering regional market expansion.

Competitive Landscape

The global medical foods market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Medical Foods Market

- Nestlé

- Danone

- Abbott

- Mead Johnson & Company, LLC.

- Medtrition, Inc.

- Meiji Co., Ltd.

- Primus Pharmaceuticals Inc.

- Fresenius Kabi AG

- Braun

- Bausch Health Companies Inc.

Key Industry Developments

- September 2024 (Acquisition): Nestlé Health Science acquired the VOWST business, the first orally administered microbiota-based therapeutic for preventing recurrent Clostridioides difficile infection (CDI) in adults. This acquisition provides Nestlé Health Science full control over VOWST's development, commercialization, and manufacturing in the U.S. and globally.

- May 2024 (Expansion): Danone announced plans to invest USD 74.9 million in its Steenvoorde, France facility to expand production of medical nutrition products. A majority of the, investment USD 64.2 million, will be used to install a new medical nutrition production line for nearly 30 different formulas of Danone's oral nutritional supplements formulas under the Nutricia brand.

The global medical foods market has been segmented as:

By Route of Administration

By Form

- Powders

- Liquids

- Capsules/Tablets

- Others

By Application

- Metabolic Disorders

- Neurological Disorders

- Digestive Disorders

- Oncology

- Pediatric Nutrition

- Others

By Distribution Channel

- Hospitals

- Pharmacies

- Online Retailers

- Others

By Region

- North America

- Europe

- France

- UK.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America